GMI Edge is a forex broker that is registered and regulated in Vanuatu, there isn’t much information on their website about them, no about ‘About Us’ page or outline of their goals. So we will be going into this review blind, looking at all aspects of their service and site to see if they stand up to the competition and so you can decide if they are the right broker for your trading needs.

Account Types

There are four different accounts available to choose from, each with its own features, so let’s outline what they are.

Standard Account:

This account has a deposit requirement of $25 and must be in USD. The contract size is 100,000 units and leverage can go as high as 1:2000. Expert advisors are allowed as is hedging. There are no added commissions on the account which has a minimum trade size of 0.01 lots, a maximum of 50 lots and can have 200 orders open at any one time. Swap-free versions are available and the margin call level is set at 60% with the stop out level at 30%. It has a variable spread and has affiliate rewards available.

Standard (Bonus) Account:

This account has a deposit requirement of $25 and must be in USD. The contract size is 100,000 units and leverage can go as high as 1:2000. Expert advisors are allowed as is hedging. There are no added commissions on the account which has a minimum trade size of 0.01 lots, a maximum of 50 lots and can have 200 orders open at any one time. Swap-free versions are available and the margin call level is set at 60% with the stop out level at 30%. It has a variable spread and has affiliate rewards available.

Cent Account:

This account has a deposit requirement of $2.50 and must be in USD. The contract size is 1,000 units and leverage can go as high as 1:1000. Expert advisors are allowed as is hedging. There are no added commissions on the account which has a minimum trade size of 0.01 lots, a maximum of 150 lots and can have 200 orders open at any one time. Swap-free versions are available and the margin call level is set at 60% with the stop out level at 30%. It has a variable spread and has affiliate rewards available.

ECN Account:

This account has a deposit requirement of $100 and must be in USD. The contract size is 100,000 units and leverage can go as high as 1:5000. Expert advisors are allowed as is hedging. There is an added commission of $4 per lot on the account which has a minimum trade size of 0.01 lots, a maximum of 50 lots and can have 200 orders open at any one time. Swap-free versions are available and the margin call level is set at 60% with the stop out level at 30%. It has a variable spread and has affiliate rewards available.

Platforms

Platforms

The only platform on offer is MetaTrader 4 which is one of the most used and secure platforms for trading Forex, allowing you to analyze the financial markets, use Expert Advisors (EA) and use a whole host of indicators and scripts to analyze your next move and transaction. Millions of traders with a wide range of needs choose MetaTrader 4 to trade in the market. Usable and accessible by all, MT4 is available as a mobile application, web trader and as a download for your desktop or laptop.

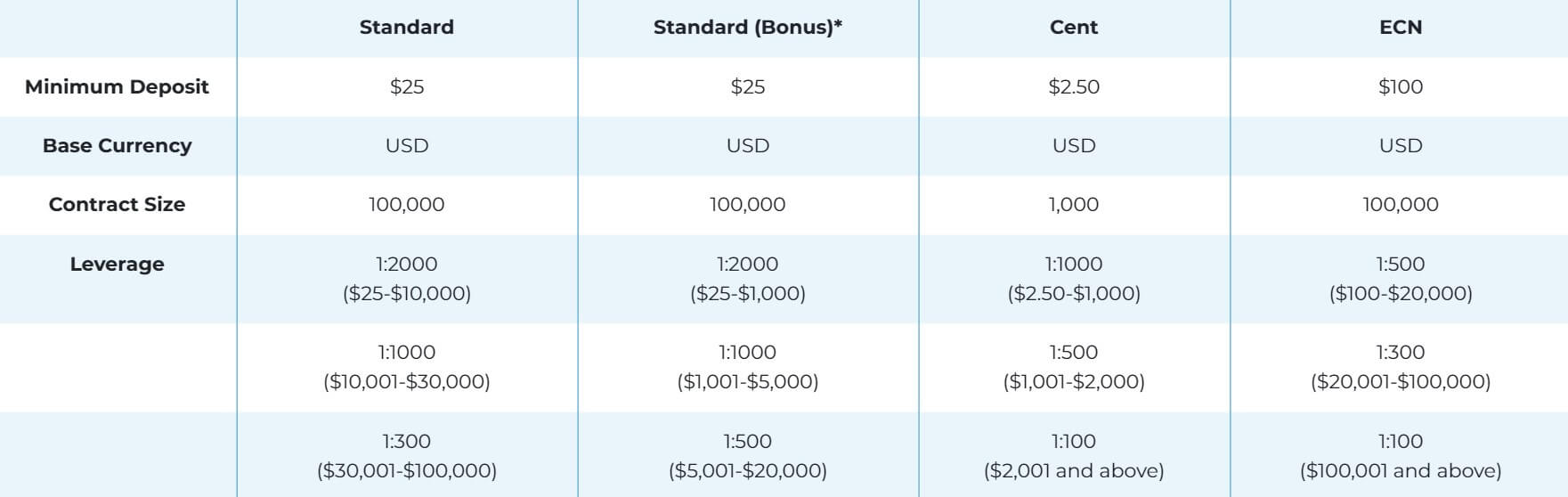

Leverage

The leverage that you get depends on the account you use and the balance you have. We have outlined the differences in available leverage below.

Standard Account:

$25 – $10,000 = 1:2000 max

$10,001 – $30,000 = 1:1000 max

$30,001 – $100,000 = 1:300 max

$100,001 and above = 1:100 max

Standard (Bonus) Account:

$25 – $1,000 = 1:2000 max

$1,001 – $5,000 = 1:1000 max

$5,001 – $20,000 = 1:500 max

$20,001 – $100,000 = 1:200 max

$100,001 and above = 1:100 max

Cent Account:

$2.50 – $1,000 = 1:1000 max

$1,001 – $2,000 = 1:500 max

$2,001 and above = 1:100 max

ECN Account:

$100 – $20,000 = 1:500 max

$20,001 – $100,000 = 1:300 max

$100,001 and above = 1P:100 max

The leverage is fixed and selected when opening up an account.

Trade Sizes

Trade sizes for all accounts start from 0.01 lots and go up in increments of 0.01 lots. The Standard, Standard (bonus) and ECN accounts have a max trade size of 50 lots and the Cent account has a maximum of 150 lots. You can also have a maximum of 200 orders at any one time.

Trading Costs

The ECN account is the only account that has an added commission, the commission of $4 per lot traded. The other accounts use a spread based system that we will look at later. There are also spread charges which are charged for holding trades overnight. Islamic swap-free versions of each account are also available.

Assets

The assets have been broken down into a few different categories. We have outlined them below including the instruments within them.

Forex: EURUSD, USDJPY, GBPUSD, USDCHF, AUDUSD, NZDUSD, USDCAD, EURGBP, EURCHF, EURJPY, GBPJPY, CHFJPY, AUDJPY, NZDJPY, CADJPY, AUDNZD, EURAUD, EURCAD, GBPCHF, GBPAUD, GBPCAD, GBPNZD, EURNZD, AUDCHF, AUDCAD, CADCHF, NZDCAD, NZDCHF, USDMXN, USDHKD, USDCNH, EURSEK, EURNOK, USDSEK, USDDKK, NOKSEC, USDZAR, USDNOK, EURTRY, USDTRY, USDSGD.

Metals: Gold and Silver.

Energy: US Crude Oil and UK Crude Oil.

Indices: These are not yet available and the site states that it is coming soon.

Spreads

The different accounts have different spreads if we look at EURUSD, the Standard and ent accounts have an average spread of 1.6 pips, the ECN account has an average spread of 0.2 pips. The spreads are variable which means they move with the markets when there is added volatility they will be seen higher. Different instruments also have different spreads so while EURUSD has an average of 1.6 pips, GBPJPY has an average of 2.8 pips.

Minimum Deposit

The minimum deposit amount is $2.50 which will allow you to open up a cent account if you want a standard account the minimum deposit required is $25.

Deposit Methods & Costs

There are a number of different ways to deposit, these are Local Bank Transfer, Neteller, Skrill, Perfect Money, DragonPay and FasaPay. The site states that there are no added fees from GMI Edge, however, there is an added fee of 3.95% on all deposits from Neteller, Skrill, Perfect Money, DragonPay and FasaPay. So there is, in fact, an added fee.

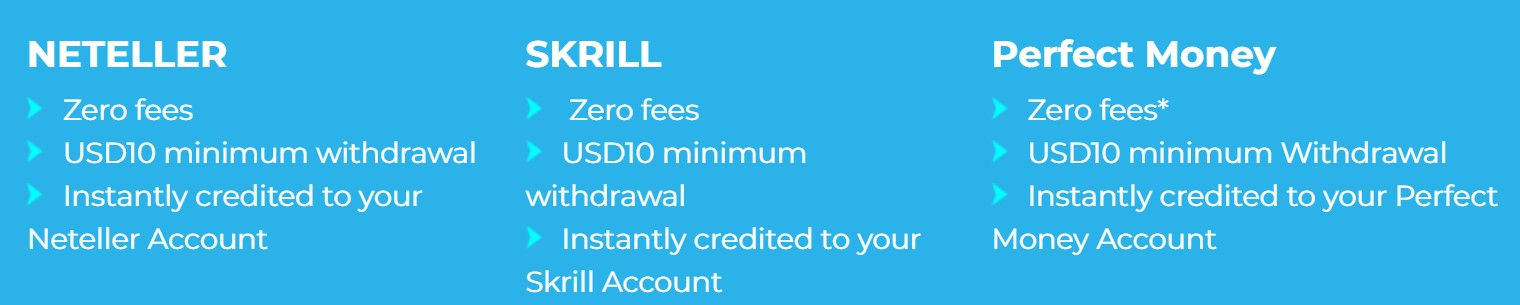

Withdrawal Methods & Costs

The same methods are available to withdraw with, for clarification these are Local Bank Transfer, Neteller, Skrill, Perfect Money, DragonPay and FasaPay. There are no added fees for withdrawals but be sure to check with your own bank to see if they will add any incoming transaction fees.

Withdrawal Processing & Wait Time

GMI Edge will aim to process any withdrawals within 24 hours of the request. All methods are then transferred instantly apart from Local Bank Transfer which will be available the next working day.

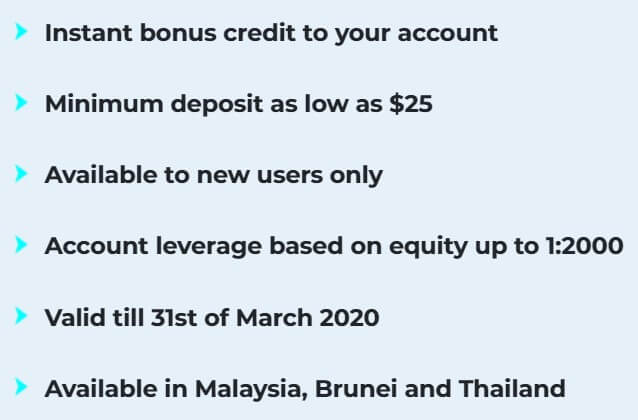

Bonuses & Promotions

There are two different promotions on offer.

30% Bonus: You can receive a 30% bonus up to $500 on your first deposit. This bonus is automatically available for all clients who deposit into their trading accounts with the maximum bonus amount of $500. Your bonus can be used to open positions as well as cover losses in floating positions. Any profits generated can be withdrawn at any point in time, however, any withdrawal of funds will result in the full removal of your trading bonus.

15% Bonus: You can receive a 15% bonus of up to $5,000. This bonus is automatically available for all clients who have used the 30% Deposit Bonus and continue to make deposits into their trading accounts. You will continue to receive the 15% bonus until you reach the maximum total bonus amount of $5000. Your bonus can be used to open positions as well as cover losses in floating positions. Any profits generated can be withdrawn at any point in time, however, any withdrawal of funds will result in the full removal of your trading bonus.

Educational & Trading Tools

There doesn’t seem to be any educational material available, many brokers are now looking to help their clients improve their trading so it would be good to see GMI Edge follow this route and add some educational material.

Customer Service

Should you need to contact GMI Edge, you can do so by using the online submission form to fill in your query and get a reply via email You can also use the available email address and phone number. There is also a live chat feature available.

Email: [email protected]

Phone: 1800 282260

Demo Account

Demo accounts are available and allow you to test out the trading conditions and strategies with no risk. We do not know the details of the account such as what account it mimics or any potential expiration times.

Countries Accepted

This information is not available on the site so if you are interested in joining, get in touch with the customer service team first to see if you are eligible or not.

Conclusion

GMI Edge is offering a few different accounts, each having its own conditions, they cater to everyone with both Cent accounts and Standard lot size accounts. The spreads and commissions are ok, the commission is below the industry average but the spreads are a little higher. There is also a small lack of tradable assets with indices coming soon it will help to improve this issue. Looking at deposits and withdrawals, there are enough options available and withdrawals are fee-free, there are some fees for depositing which could be a little expensive at just under 4%. Whether they are the right broker to sue is up to you.