WinFinance is a foreign exchange broker based in the Marshall Islands, the company was founded in 2013 and aims to provide an unequaled value to their clients. They claim to offer an outstanding customer support team, a host of tradable assets, advanced trading platforms, tight spreads, and an experienced team. We will be looking into the services on offer to see how they stand up next to the competition.

Account Types

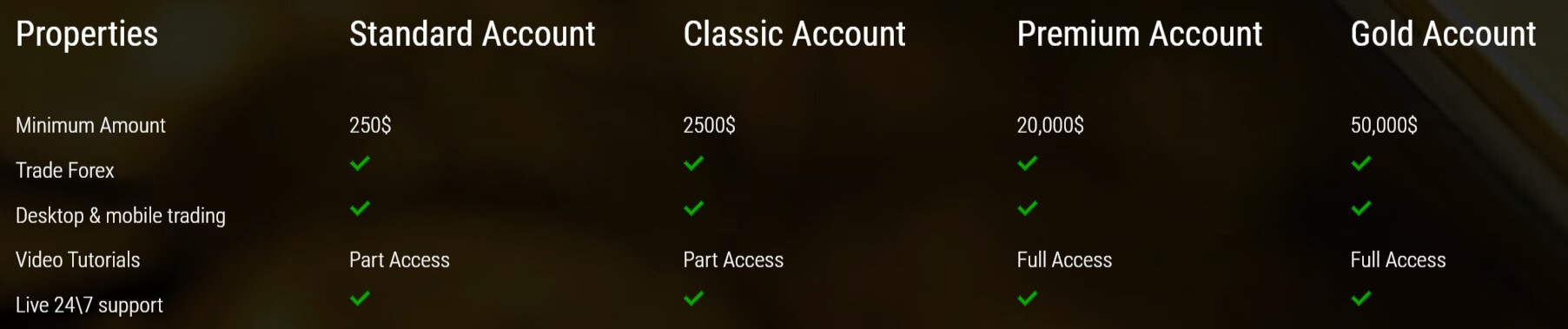

There are four different accounts available to use from WinFinance, we have outlined some of their main features below.

Standard Account: This account requires a minimum deposit of $250, it allows you to trade forex and uses a desktop and mobile platform. It gives part access to video tutorials and has access to a support team 24 hours a day 7 days a week. It can trade base currencies and typical spreads range from EUR/USD 2.4 pips, AUD/USD 3.3 pips, and USD/JPY 2.8 pips. The account has a fixed spread, access to an account manager and can be leveraged up to 1:200.

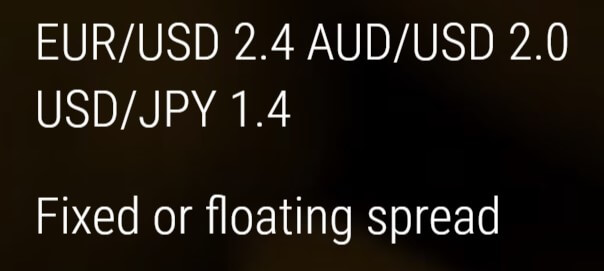

Classic Account: This account requires a minimum deposit of $2,500, it allows you to trade forex and uses a desktop and mobile platform. It gives part access to video tutorials and has access to a support team 24 hours a day 7 days a week. It can trade base currencies, Gold, Silver and Oil and typical spreads range from EUR/USD 2.4 pips, AUD/USD 2.0 pips, and USD/JPY 1.4 pips. The account has a choice of fixed or floating spread, access to an account manager and can be leveraged up to 1:200.

Premium Account: This account requires a minimum deposit of $20,000, it allows you to trade forex and uses a desktop and mobile platform. It gives full access to video tutorials and has access to a support team 24 hours a day 7 days a week. It can trade all currencies, indices, and shares and typical spreads range from EUR/USD 0.6 pips, AUD/USD 1.3 pips, and USD/JPY 0.6 pips. The account has a choice of fixed or floating spread, access to an account manager and can be leveraged up to 1:200.

Gold Account: This account requires a minimum deposit of $50,000, it allows you to trade forex and uses a desktop and mobile platform. It gives full access to video tutorials and has access to a support team 24 hours a day 7 days a week. It can trade all instruments and typical spreads range from EUR/USD 0.6 pips, AUD/USD 1.3 pips, and USD/JPY 0.6 pips. The account has a choice of fixed or floating spread which is adjustable, access to premium customer support and has adjustable leverage.

Platforms

Just the one platform available to use is xStation, xStation was designed for advanced currency traders who prefer more control, flexibility, customizations, and speed than traditional retail trading software packages. It provides true one-click trading on Level 2 market depth/order book views, built-in trading calculator, in-platform economic calendar, customizable layouts saved in the cloud, and a direct connection to the WinFinance liquidity infrastructure. It was designed from the ground up as an ECN/STP platform. It is usable as a desktop download, mobile application and as a web trade.

Leverage

The Standard, Classic and Premium accounts all have a maximum leverage of 1:200, the Gold account doesn’t have a set limit, it instead can be selected when creating an account. All accounts can have their leverage (up to the maximum) selected when opening up an account and can have it changed by sending a request to the customer service team.

The Standard, Classic and Premium accounts all have a maximum leverage of 1:200, the Gold account doesn’t have a set limit, it instead can be selected when creating an account. All accounts can have their leverage (up to the maximum) selected when opening up an account and can have it changed by sending a request to the customer service team.

Trade Sizes

Trade sizes start from 0.01 lots on all accounts, they then also go up in increments of 0.01 lots so the next trade size would be 0.02 lots and then 0.03 lots. Unfortunately, we do not know what the maximum trade size is or how many trades/orders you can have open at any one time.

Trading Costs

There doesn’t appear to be any added commission on any of the accounts as they all use a spread based system that we will look at later in this review. There are however spread fees, these are interest charges that take effect when holding trades overnight, they can be both positive or negative and can be viewed from within the trading platform you are using.

Assets

Unfortunately, there isn’t a full breakdown or any sort of product specification so we cannot see exactly which assets or instruments are available to trade, this is disappointing as many potential clients will look to see if their preferred assets are available, the last thing they want is to sign up and find that they cannot trade it.

Spreads

The spreads are based around the account that you use. The Standard account has spread starting at EUR/USD 2.4 pips, AUD/USD 3.3 pips, and USD/JPY 2.8 pips. These spreads are fixed which means they will never change, no matter what is happening in the markets or how volatile they are.

The Classic account has spreads ranging from EUR/USD 2.4 pips, AUD/USD 2.0 pips, and USD/JPY 1.4 pips. These spreads can be either fixed or variable, variable spreads mean they move with the markets, the more volatility there is the higher they will be, the starting figure for variable spreads is often lower than fixed spreads.

The Premium and Gold accounts also have a choice of fixed or variable spreads and start at around EUR/USD 0.6 pips, AUD/USD 1.3 pips, and USD/JPY 0.6 pips.

Minimum Deposit

The minimum amount required to open up an account with WinFinance is $250, this allows you to use the Standard account, if you want a higher tier account you will need to deposit at least $2,500. We do not know if this amount reduces once an account has already been opened.

Deposit Methods & Costs

Sadly there isn’t any information on the site regarding deposit methods or anything to do with them except for three little images of Visa, MasterCard, and Maestro, so we will be confident to say that they will be available, but we cannot say about any other methods. We also cannot comment on whether there are any added fees for depositing by WinFinance.

Withdrawal Methods & Costs

As we do not know how you can deposit we also do not know how you can withdraw, the same three images are available but that is it. Just like with the deposits we do not know if there are any added fees when withdrawing.

Withdrawal Processing & Wait Time

Unfortunately, we also do not have any information on this topic, we would hope that any withdrawal requests would be fully processed between 1 to 7 working days after the request is made depending on what methods are available to withdraw with.

Bonuses & Promotions

We had a good look around the site and could not see any indications of an active promotion or bonus so we do not believe there are any. This does not mean that there won’t be any in the future, if you are interested in bonuses we would suggest contacting the customer service team to see if there are any coming up that you could take part in.

Educational & Trading Tools

There doesn’t appear to be any educational material or tools on the site which is a shame as a lot of modern brokers are now trying to help their clients improve, so it would be good to see WinFinance add something to help their clients.

Customer Service

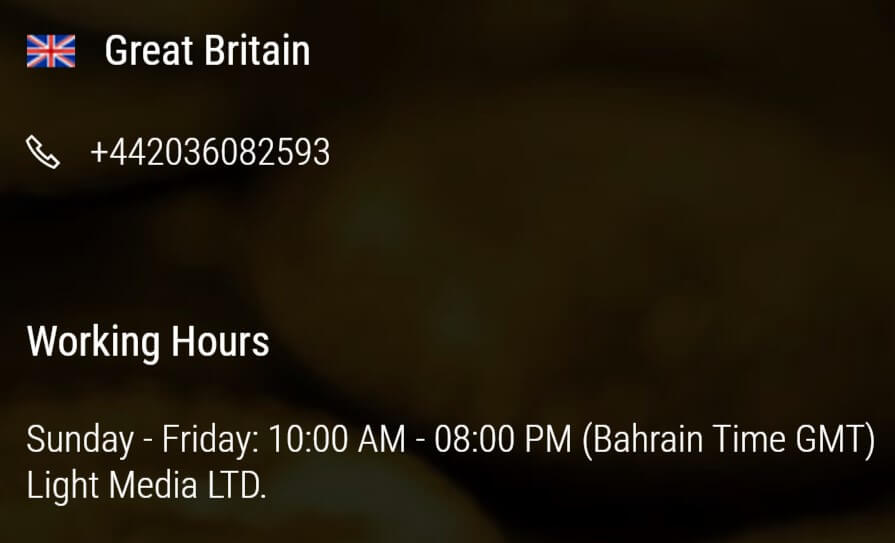

The customer service page states that the team is available from Sunday to Friday 10 am – 8 pm GMT, however, the account page states that there is 24/7 support available, so they contradict each other.

You can use the online submission form to send in your query and then you should get a reply via email. There is also a postal address available along with two emails and two phone numbers.

Address: Trust Company Complex, Majuro, MH 96960, Marshall Islands

Support Email: [email protected]

Marketing Email: [email protected]

Great Britain Phone: +442036082593

Italy Phone: +97316195023

Demo Account

There isn’t any information surrounding demo accounts on the site, however, we do not have a full account so we cannot see if there are any available in there if there aren’t then it is a shame as demo accounts allow clients to test out the trading conditions and new strategies without risking any real capital.

Countries Accepted

This information is not present on the site so we would suggest contacting the customer service team to find out if you are eligible for an account or not.

Conclusion

The four different accounts offer some variety especially when it comes to the choice of fixed or variable spreads. Sadly, that is about where all the positives end, there is no information about what assets and instruments are available to trade or how you can deposit and withdraw your funds., This information is vital if a company is going to be holding onto your money, you need to know how you can move it about and also if it will cost you to do so, without this information being available is it hard for us to recommend them as a broker to use, and would instead suggest looking somewhere that is being a little bit more transparent.