500 Capital has a very fashionable website design and almost devoid of any useful information for traders. The name of this broker is very similar to the well known plus500 broker. Sometimes this is very useful for masking the name of a company involved in a dishonest activity to say at least. The information about 500 Capital is very obscured, from various sources there is almost no information.

As stated, this brand is owned by 500 CAPITAL PTY LIMITED that has a registration but not the license for CFD offering. Therefore, this broker is not regulated and the address points to a commercial leasing tower. The website is in Russian by default and EUR as the only currency expression, clearly intended for Russian clients as many reports also mention Russian agent names from 500 Capital. Founded in 2018, 500 Capital has a god range of assets but no details, only categories are described. This review will tell you what traders can expect when trading with 500 Capital.

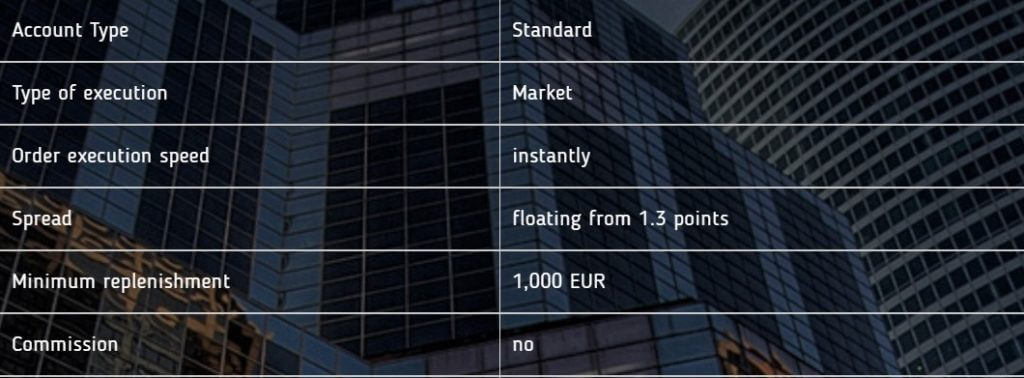

Account Types

500 Capital has two account types, Standard and VIP. The Standard Account features a bonus for deposits of 1000 EUR, although no additional info is disclosed. The account includes floating spreads, no commissions, and a personal manager.

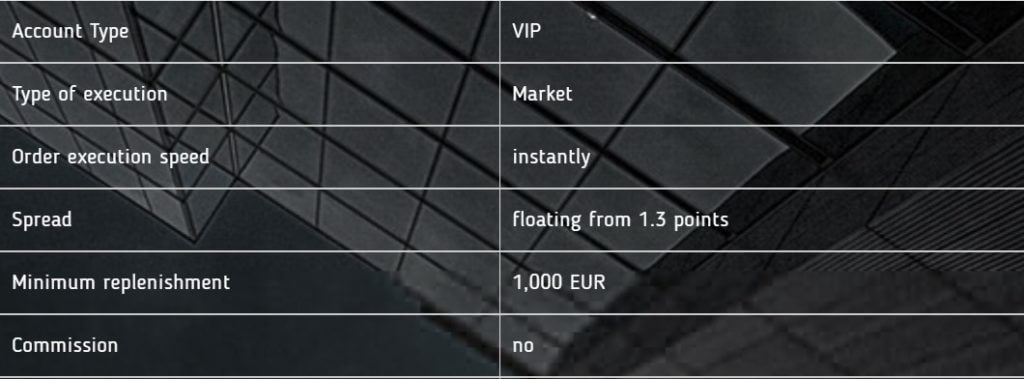

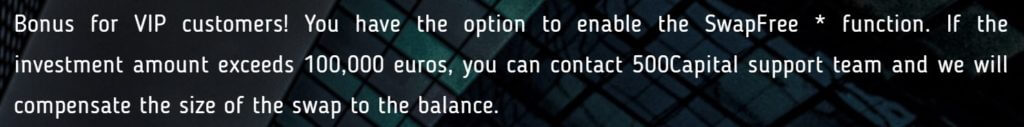

VIP Account requires no less than 100.000 EUR and features Swap-Free compensation. For many traders, the swap should not be a concern so offering this compensation points that the swap levels are very high. More on this in the Trading Costs section. All the other published conditions are the same, as with the Standard Account.

Platforms

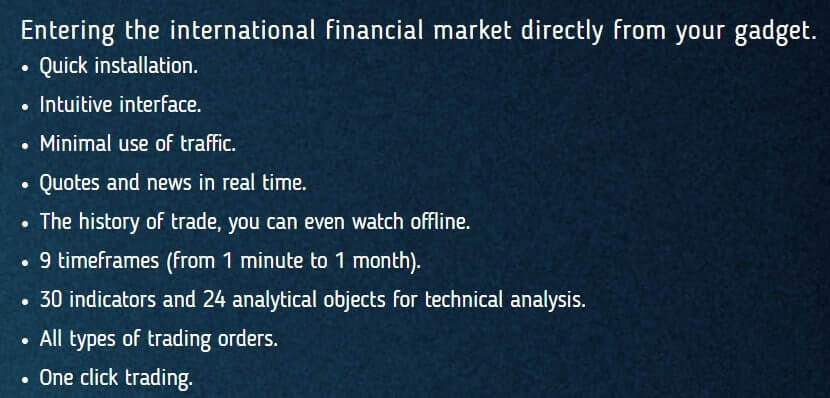

The only platform available is the Metatrader 4 available for the desktop with Windows and Mac operating systems. Mobile devices are also supported with Android or IOS. For those that do not want to install anything, MT4 Web is available but within the Traders Cabinet. MT4 client is updated to the latest version, by default settings. Connection to the servers has a 150ms latency. The execution response time is around 300ms which is above average compared to other brokers.

Both, Demo and Live Account did not have trading enabled for any asset and we are unsure if this was a measure against us or default setting. This may be a sign of restriction so no one can trade until the agent makes a phone connection with the client. The market watch window shows many disabled Forex duplicate assets and counterparts with a dot suffix. Some information from the asset specifications window is missing, like the minimal volume in some cases. This is a strange setup that is not common with other brokers.

Leverage

The leverage level for both Account types is adaptable from 1:10 to 1:200. This level is high enough for deposits of 1000EUR as traders can place micro-lot positions. This leverage can be set in the Traders Cabinet.

Trade Sizes

500 Capital uses the common minimum trading volumes of 0.01 lots or micro-lots. The minimum step volume is also 0.01 lots making precise, low-risk positions easier to scale in and out. Although this is the info from the 500 Capital web page, the real volume step, and minimum initial volume is different against the readings in the MT4 platform for the demo account. The asset specification showed 0.1 lot step volume and the minimum volume size figure is missing in the demo account. The real account shows the levels stated on the web site. The maximum volume is 1000 lots. The closest distance traders can put pending orders like Stop Loss and Take Profit is 1 pip, also called Stops level. The margin call is at 100% as stated for both Account types and Stop Outs is at 25%

Trading Costs

500 capital does not charge commissions on any of the offered account types. For those that want a swap compensation will have to deposit 100.000 EUR, although the levels look normal and acceptable, note that the swaps are not calculated in points, but percentages. For example, the EUR/USD pair swap is -12.07% for short and +6.03% for long, so even positive swaps are present, but pay attention that if you leave a short position overnight you will have a significant cost.

The fast-moving major, GBP/JPY has a -2.84% short and +0.22% long swap. If we go into exotics zone, USD/ILS has -3.5% and -2.9%. Gold has a swap for long at -1.9% and -5% for short. Some pairs like the USD/TRY have swap levels expressed in points. Now, in the crypto category, for BTC/USD the swap is -18% on both positions, meaning any trades left overnight will probably be completely unprofitable. Most of the cryptocurrency pairs have the swap in percentage terms but not all.

A dormant fee of $75 exists if traders are not active for one month and will be charged every month.

Assets

500 Capital has a total of 6 categories are listed on the website, Forex, Crypto, Indices, Shares, Commodities and, a rare category – Portfolios. This is almost a complete coverage of asset classes compared with the industry canon.

Starting with Forex, Capital 500 has 41 currency pairs that we have counted, a bit more than 39 mentioned in the Account types web page. All majors are present, and some exotics are not common, like the USD/ILS, EUR/TRY, and EUR/MXN. Other exotics are RUB, Scandinavian currencies, HKD and SGD.

The crypto range is above average for sure. Of course, major coins like BTC and XRP are listed, but also a lot of altcoins. Monero is available in 3 combinations, Monero/Ethereum, Monero/USD and Monero/Bitcoin. Ethereum Classic can be found against Ethereum, USD, and Bitcoin. Bitcoin itself has an amazing list of combinations. How many times can you see BTC/CNY or BTC/RUB? Other Bitcoin variants like Mili Bitcoin and Bitcoin Gold are rare to see too. A total of 46 crypto combinations are found in the MT4 platform. From the exotics not mentioned, we found QTUM, OmiseGO, NEO, IOTA and Zcash, It looks like a crypto enthusiast heaven.

The crypto range is above average for sure. Of course, major coins like BTC and XRP are listed, but also a lot of altcoins. Monero is available in 3 combinations, Monero/Ethereum, Monero/USD and Monero/Bitcoin. Ethereum Classic can be found against Ethereum, USD, and Bitcoin. Bitcoin itself has an amazing list of combinations. How many times can you see BTC/CNY or BTC/RUB? Other Bitcoin variants like Mili Bitcoin and Bitcoin Gold are rare to see too. A total of 46 crypto combinations are found in the MT4 platform. From the exotics not mentioned, we found QTUM, OmiseGO, NEO, IOTA and Zcash, It looks like a crypto enthusiast heaven.

Indicies are modest compared to the crypto range but a total of 11 Indices are listed. Major are all there, S&5500, DAX, NASDAQ, Nikkei, UK100, STOXX, France 40, Spain 35, etc. Less common ones are RTS (Russian Trading System), Hong kong 33, and mini Dow Jones.

Precious metals range is good, containing all 4 precious metals and Copper under the Commodities category in MT4. Gold, Silver, Platinum and the “independent” Palladium are all listed. The only thing that could be a drawback for using these for hedging is the swap rate, otherwise, this range is almost complete.

Stocks range is great, 500 Capital offers 38 EU companies, 124 US companies, and 26 Russian – of course, more familiar to the Russian clientele. Most of these major, big companies from different industry sectors. This range is also unique for the list of not so common Russian corporations.

Commodities list is very extended, which is rare to see among brokers. A total of 20 commodities means commodity specialists will like what they see with 500 Capital. WTI and Brent Oil is a must, on top, there is Natural Gas in the energies section. Now, rare to see commodities are Feeder Cattle, Live Cattle, Lean Hog, Soymeal, Rough Rice, Oats, Aluminium, Zinc, and Nickel. We are not sure if these are popular in Russia.

Finally, Portfolios are grouped assets that can be traded as CFD. Each portfolio assets have some unique characteristics so they can be useful when grouped. For example, Beer, Weed, and Spirit. US financial company portfolio, IT portfolio, etc. 500 Capital went even further offering Crypto portfolio. What cryptos are included inside is not disclosed but the same swap percentage is set as with Cryptocurrency pairs(-18%). Unlike cryptocurrencies, trading with this portfolio is not 24/7.

Spreads

The spreads are floating type and both Account types are from 1.3 pips. Metatrader 4 confirmed that this is true for the EUR/USD and also USD/JPY pairs. Other pairs did not have many deviations and under normal levels. Exotics like USD/RUB USD/TRY and USD/MXN seem to have fixed spreads at 9000, 2182 and 1600 points respectively, even though in the specification floating spread is typed in. USD/ILS has a 21 pips spread.

Metals category spreads are average, XAU/USD has 54 pips spread, XAG/USD 4.8 pips, Platinum 10 pips and Palladium 61 pips. Oils had a range from 3 to 5 pips and Bitcoin/USD a very wide 120 pips, making the major crypto very hard to trade profitably even without the -18% swap. BTC/EUR has a much lower spread at 25 pips, which is a strange deviation. Other coins have a similarly widespread like the BTC/USD.

Minimum Deposit

The minimum deposit is not stated but we believe it is 500 EUR. Once you select the account registration type in the Traders cabinet, there will be a 500 EUR Account name. Also, the deposit amount of 500 EUR will be granted within the Cabinet, but not less. For the VIP the minimum is 100.000 EUR.

Deposit Methods & Costs

500 Capital has an interesting way to deposit with Bitcoin. Other ways are Visa/MasterCard, Bank Transfer, ePayments, and so-called “COINPAYMENTS”. 500 Capital also mentioned QIWI and Yandex.Money as payments, although these were an option in the deposit drop menu. The broker does not seem to charge any fees for deposits, but the exact statement about this does not exist anywhere on the site or the documents.

What is important to know is that we have found out that the Bank Transfer method does not exist n practice. The information needed for the transfer is not displayed such as the IBAN. Furthermore, Visa/MasterCard is used but only to buy cryptocurrencies that are later deposited to the 500 Capital wallet. This is one of the methods to invalidate your right for a chargeback as Bitcoin is irreversible and unregulated by design.

The ePayments method exists and the recipient account name is Private Genesys Fund. Finally, the “COINPAYMENTS” payment method will lead you to the portal where you can also buy crypto to deposit to 500 Capital. The company behind this portal is very interesting.

More on this company and about Private Genesys Fund in the conclusion section at the bottom of this review.

Withdrawal Methods & Costs

Withdrawal methods are the same as with deposits. Fees are undisclosed.

Withdrawal Processing & Wait Time

This information is undisclosed although the withdrawal method by ePayments is instant. As other methods are, in essence, Bitcoin transfers, a transaction will be complete once 3 confirmations are processed, which usually takes about 1 hour if the Bitcoin network is nominal. Card withdrawals are also processed within minutes generally.

Bonuses & Promotions

500 Capital mentioned the bonus in the Accounts page, as stated if clients deposit 1000EUR is required to receive the “500Capital” bonuses. As to what is exactly a bonus and the conditions for the same are undisclosed.

Educational & Trading Tools

500 Capital does not have even the most basic tools or education material. The only instance of tools is in the Account types page where tools are available to those who deposit at least 1000EUR.

Customer Service

There is a form within the Trader Cabinet once you log in. The social network buttons do not work, as well as any social network account in the name of the company. The phone number is presented in different parts of the site and the Traders Portal, sometimes with a different calling country code, for UK, Russia, and Australia. Chat service does not exist although mentioned in the Traders Cabinet.

Demo Account

500 Capital not only that it does not present the Demo Account but looks like they prohibit the use of it. The Demo is not available to open going the usual way. To be able to see the demo you need to open a web trader and register for a demo within the MT4 Web Trader. That way you can get credentials to your email and see what is offered, since there almost no info from the website. The Demo is set not to allow trading.

Countries Accepted

Even though 500 Capital is oriented to Russia, anyone that wants to risk can make a deposit. This broker is unregulated and uses crypto for transactions.

Conclusion

This broker looks very good on paper, or better to say within the MT4. 500 Capital can be categorized as a market maker type although it could also be classified as a scam. What we have found out is that the location of this company is virtual, or in other words, 500 CAPITAL PTY LIMITED really is registered at “5 11 Queens Road, Melbourne, Victoria, 3000, Australia”. Whatsoever, “COINSPAYMENT” proxy points to pacifictradelp.com, a partner company that also opens Virtual Offices. This is a service that enables a company to work remotely and present a registered business location with Virtual Office anywhere.

Furthermore, using an IP phone, the lines are also virtual. Private Genesys Fund is a previous brand name of 500 Capital that got exposed as many scam reports arose before March 2018. Of course, 500 Capital has scam reports although the company is still not easy to find for the search engines. Finally, the company documents reveal a few discouraging key points, as if they hold any value given to the above mentioned. Terms and Conditions under point 10 enable this company to restrict trader’s orders, 11.1.10 does not allow scalping, 11.2.7 does not allow EAs and some more under point 17.

Furthermore, using an IP phone, the lines are also virtual. Private Genesys Fund is a previous brand name of 500 Capital that got exposed as many scam reports arose before March 2018. Of course, 500 Capital has scam reports although the company is still not easy to find for the search engines. Finally, the company documents reveal a few discouraging key points, as if they hold any value given to the above mentioned. Terms and Conditions under point 10 enable this company to restrict trader’s orders, 11.1.10 does not allow scalping, 11.2.7 does not allow EAs and some more under point 17.