Introduction

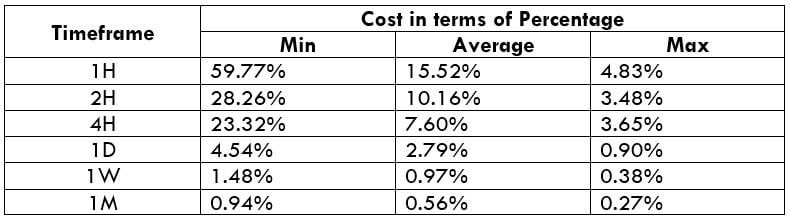

EUR/MXN is the abbreviation for the Euro Area’s euro against the Mexican Peso. It is classified as an exotic-cross currency pair. Here, the EUR is the base currency, and the MXN is the quote currency.

Understanding EUR/MXN

The market value of EURMXN determines the value of MXN that is required to buy one euro. It is quoted as 1 EUR per X MXN. So, if the market price of this pair is 24.4733, then these many units of Mexican pesos are required to buy one EUR.

Spread

The spread is the difference between the bid price and the ask price. These two prices are set by the brokers. The pip difference is through which brokers generate revenue.

ECN: 46 pips | STP: 49 pips

Fees

A fee is simply the commission you pay to the broker on each position you open. There is no fee on STP account models, but a few pips on ECN accounts.

Slippage

Slippage is the difference between the price at which the trader executed the trade and the price he actually got from the broker. This changes based on the volatility of the market and the broker’s execution speed.

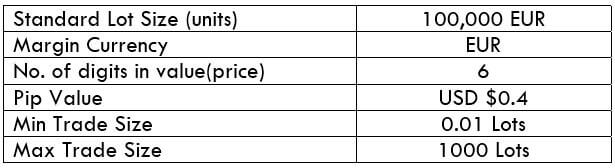

Trading Range in EUR/MXN

The amount of money you will win or lose in a given amount of time can be assessed using the trading range table. This is a representation of the minimum, average, and maximum pip movement in a currency pair.

Procedure to assess Pip Ranges

- Add the ATR indicator to your chart

- Set the period to 1

- Add a 200-period SMA to this indicator

- Shrink the chart so you can assess a large time period

- Select your desired timeframe

- Measure the floor level and set this value as the min

- Measure the level of the 200-period SMA and set this as the average

- Measure the peak levels and set this as Max.

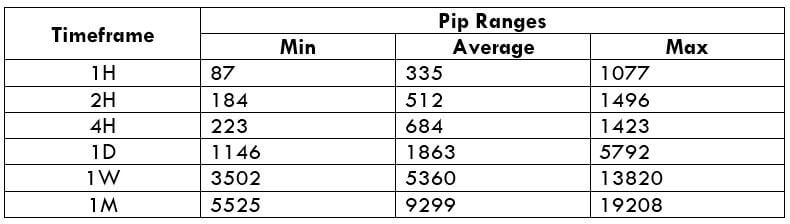

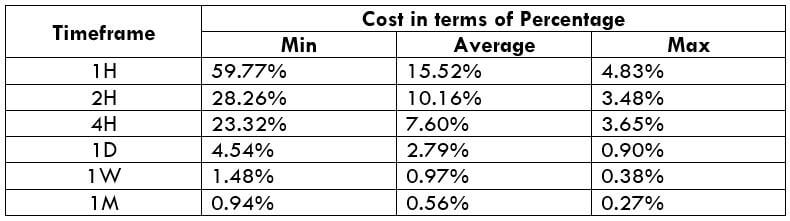

EUR/MXN Cost as a Percent of the Trading Range

The cost of trade varies based on the volatility of the market. This is because the total cost involves slippage and spreads apart from the trading fee. Below is the representation of the cost variation in terms of percentages. The comprehension of it is discussed in the coming sections.

ECN Model Account

Spread = 46 | Slippage = 3 |Trading fee = 3

Total cost = Slippage + Spread + Trading Fee = 3 + 46 + 3 = 52

STP Model Account

Spread = 49 | Slippage = 3 | Trading fee = 0

Total cost = Slippage + Spread + Trading Fee = 3 + 49 + 0 = 52

Trading the EUR/MXN

The EURMXN is a very volatile pair. For instance, the average pip movement on the 1H timeframe is only 335 pips. Note that the higher the volatility, the lower is the cost of the trade. However, this is not an advantage as it is risky to trade highly volatile markets.

Also, the larger/smaller the percentages, the higher/lower are the costs on the trade. So, we can infer that the costs are higher for low volatile markets and high for highly volatile markets.

To reduce your risk, it is recommended to trade when the volatility is around the minimum values. The volatility here is low, and the costs are a little high compared to the average and the maximum values. But, if you’re priority is towards reducing costs, you may trade when the volatility of the market is around the maximum values.

Advantage from Limit orders

When orders are executed as market orders, there is slippage on the trade. But, with limit orders, there is no slippage as such. Only trading fees and the spread will be taken into consideration to calculate the total costs. Hence, this will bring down the cost significantly.