MEX Exchange was established in Sydney, Australia in 2012 and offers advanced trading platforms and the tightest pricing in the field of online financial trading in products, including Foreign Exchange, Metals (Gold & Silver), Stocks and CFDs. MEX Exchange is regulated by the Australian Securities and Investment Commission (ASIC).

Account Types

There are two account types available to traders:

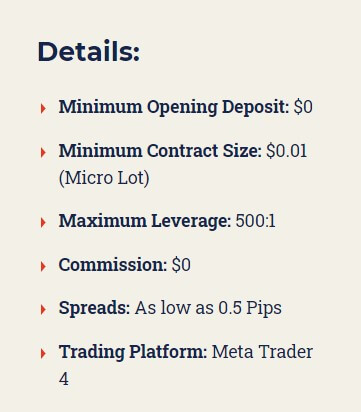

Classic Account – MT4 standard account provides clients with swift execution speeds and with market-leading spreads this account type is suited for all traders.

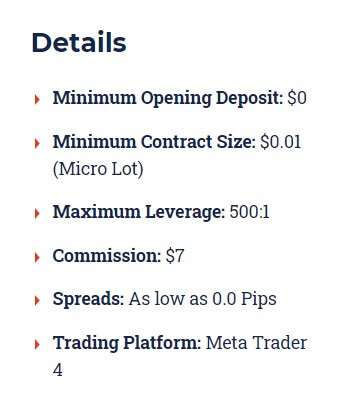

ECN Account – Market leading pricing and trading conditions through the MT4 platform by providing clients with the True ECN Connectivity.

Platforms

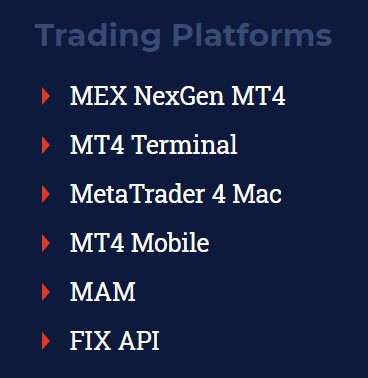

You can trade with Mex on the following platforms:

MEX NexGen MT4 – Provides traders with a clearer trading foresight through an additional 11 features on MT4. MEX NexGen MT4 is free to all traders who open a MEX Live or Demo trading account.

MEX NexGen MT4 – Provides traders with a clearer trading foresight through an additional 11 features on MT4. MEX NexGen MT4 is free to all traders who open a MEX Live or Demo trading account.

MEX Exchange MT4 – Offers trading in Forex, Metals, and CFDs.

MetaTrader4 Mac – The Mac OSX platform has the full MT4 functionality and can run all the same Expert Advisors and Indicators.

Mobile Trading MT4 – Trade anywhere, anytime with the MT4 APP with full MT4 functionality.

MAM & PAMM – MEX Account Manager (MAM) and the Percent Allocation Management Module (PAMM) represent an ideal solution to manage and trade multiple MT4 accounts simultaneously.

FIX API – FIX is the leading protocol for fast messaging, direct connectivity and trading in the financial markets. The MEX FIX API Service is a turnkey solution for institutional and high volume clients looking for direct access to market-leading liquidity at affordable prices and without relying on external applications/front ends.

Leverage

The maximum leverage on offer is 500:1.

Trade Sizes

The minimum trade size is $0.01 (Micro Lot).

Trading Costs

Trading costs for the two account types are as follows:

Commission:

Classic Account: £0

ECN Account: £7

Swap Fees: Swaps are applied to your trading account only when positions are kept open until the next Forex trading day. Each currency pair has its own swap charge and is measured on a standard size of 1.0 standard lot (100,000 base units). Swaps are calculated and applied on every trading night. On Wednesday night swaps are charged at triple the usual rate.

Assets

MEX Exchange offers a broad range of financial instruments to choose from, including Forex pairs, Metals (Gold & Silver) and CFDs.

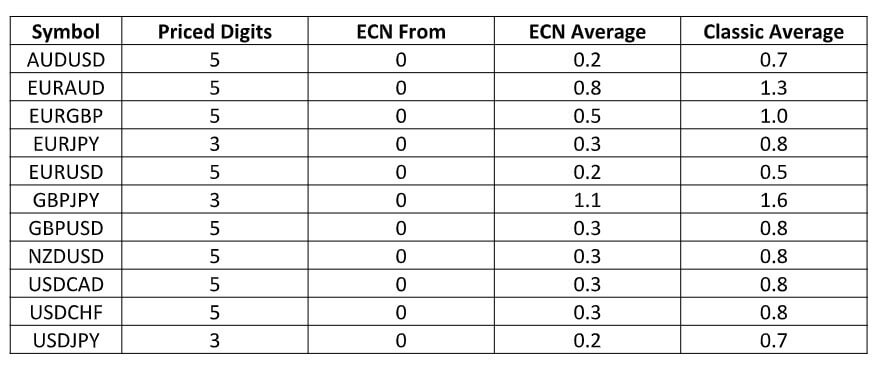

Spreads

Typical spreads at MEX are shown in the chart below.

Minimum Deposit

MEX Exchange allows clients to open MetaTrader 4 Standard or True ECN accounts with as little as USD $200 or currency equivalent.

Deposit Methods & Costs

MEX offers the following deposit methods.

- Credit and Debit Card – Deposits are instant in most cases. Available Currencies: AUD, EUR, GBP, HKD, SGD, USD.

- Wire Transfer / Bank Transfer – Processed within 1 business day of receiving funds. Available Currencies: AUD, CAD, EUR, GBP, HKD, NZD, SGD, USD.

- Neteller – Processed within 1-4 business hours. Available Currencies: USD, AUD, EUR.

- Skrill – Processed within 1-4 business hours. Available Currencies: EUR, GBP, USD.

- China Union Pay – Processed within 1-4 business hours. Available Currencies: RMB.

MEX Exchange does not charge any internal fees for deposits. However, please note payments to and from international banking institutions may attract intermediary transfer fees and/or conversion fees from either party which is independent of MEX. Any such fees will be the responsibility of the client.

Withdrawal Methods & Costs

Withdrawals are processed by completing an online form. Funds can only be withdrawn to an account/credit card in the same name as your MEX trading account.

MEX does not charge any internal fees for withdrawals. However, please note payments to and from international banking institutions may attract intermediary transfer fees and/or conversion fees from either party which is independent of MEX. Any such fees will be the responsibility of the client.

Withdrawal Processing & Wait Time

Mex endeavors to process transfer requests as soon as possible after they are received. Withdrawals are generally processed within hours but may take up to 72 hours.

Bonuses & Promotions

MEX does not currently offer any deposit bonuses or promotions.

Educational & Trading Tools

MEX offers the following trading tools:

Market Analysis – A trade of the day is provided along with some technical analysis.

MEX Blog – A blog containing articles full of trading advice.

Lepus Proprietary Trading – Mex Exchange has partnered with Lepus Proprietary Trading, a world-class Forex Educator run by a trading veteran, Richard Jackson. Lepus offers an array of comprehensive educational content modules, video tutorials, and webcasts all produced first hand by a professional trader with 20 years of experience.

Autochartist – Autochartist simplifies the trading process. Powerful search engines continuously scan markets and automatically recognize trade set-ups based on support and resistance levels. Once an opportunity has been identified traders are informed.

Economic Calendar – A calendar showing upcoming news events.

DupliTrade – DupliTrade provides clients with an advanced auto-execution mirror system, which allows clients to automate their trading on Forex, Indices, and Commodities, by duplicating the trades of strategy providers, whose accounts are displayed on the DupliTrade site.

MT4 Video Tutorial – Get your MT4 set up quickly with this handy video tutorial.

Customer Service

The following methods of contact are available for Mex Exchange customers:

Telephone Numbers:

1800 859 092 (TOLL-FREE)

+61 02 9195 4000 (General)

1800 859 092 (Australia)

Emails:

[email protected] (Customer Support)

[email protected] (Sales)

[email protected] (Accounts)

Postal Address:

MEX Exchange, 227 Elizabeth Street, Sydney, NSW 2000, Australia.

Demo Account

All live & funded clients are entitled to a non-expiring demo account. If you would like a demo account, simply open and fund a Live Account and request your demo from [email protected].

Countries Accepted

Residents from all countries apart from the ones below can open accounts with MEX.

Conclusion

Mex Exchange is not the worst broker in the world. There are plenty of interesting platform options and tools available to their customers. On the downside they don’t have as many assets available to trade as you would expect and not having a live support option is an oversight in my opinion. However, when I did contact them via email, they responded promptly and always gave thorough answers to my questions. I’d be tempted to give them a chance if I was looking for a new broker.