Trading crypto-assets is a tad different from trading such other assets as commodities and stocks. Even though they almost share the same trading platform and trading tools, there is a striking difference in how the operations are executed in each market.

In the securities market, for instance, you can easily buy equities directly for fiat currency through your broker account. While the same can be done in the crypto-market, buying cryptocurrencies directly for fiat currency is limited only to a few cryptos. Unless you plan on limiting your trading to these few digital currencies, you’ll have to exchange one crypto for acquiring another one.

As such, most digital currencies aren’t traded in isolation – or rather can’t be traded against fiat currency, as is the case with stocks and commodities. This is where the cryptocurrency pair trading concept comes into play.

How Does Cryptocurrency Pair Trading work?

Well, pair trading isn’t unique to the cryptocurrency market. It’s a trading strategy borrowed from the stock market, where traders pick two highly correlated equities and go long on one while shorting the other when the pair’s price diverges.

In the crypto-market, pair trading is less complicated. All you have to do is buy crypto using fiat currency. Once you’ve acquired the crypto, you can exchange it for or trade it against other cryptocurrencies. In this case, the cryptocurrency which you bought for fiat currency is referred to as the base currency. In most exchanges, Bitcoin, Ethereum, and Litecoin are the most preferred base currencies as they can easily be bought using domestic currencies. Litecoin is primarily preferred because of its fast transactions and affordable fees.

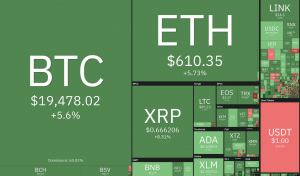

Dogecoin is also used as a base currency, especially when trading low market cap coins where it might be burdensome to trade them with large-cap coins like Bitcoin. Dogecoin is also preferred due to its relatively stable value, minimizing the volatility risk. Nonetheless, the rule of thumb when choosing a base currency is to go for one that has the highest number of trading pairs. For this reason, it’s recommended to stick to BTC and ETH as your go-to base currencies since most cryptos have pegged their value on these two currencies. Besides, both BTC and ETH are listed in virtually every exchange.

Tether (USDT) is also among the most used base currencies. It’s questionable management; notwithstanding, the currency is one of the most stable digital assets since its value is pegged to the United States dollar. This makes Tether not only ideal for pair trading but also a store of value for investors to safeguard funds they don’t want to subject to the crypto market’s aggressive price swings.

Trading Cryptocurrency Pairs

Cryptocurrency pairs are usually denoted as one against the other. For instance, ETH/LTC pair means that you’re buying Ethereum and selling Litecoin (LTC) at the same time. Selling the pair means that you are selling Ethereum and buying Litecoin simultaneously. Note that some exchanges may have different cryptocurrency pair listings, so be sure to check if the pair you intend to trade is on offer/listed.

Additionally, some cryptocurrencies cannot be exchanged directly for others. You may have to execute a few pairs of trades before getting hold of the cryptocurrency you desire. This creates an opportunity for complex arbitrage trading, where you can exchange multiple currencies and pocket price differences. This strategy may, however, be considered too risky, especially for new traders. In such a case, consider using third-party apps for seamless trading across a multitude of crypto pairs.

Does Liquidity Affect Crypto Pair Trading?

Much like any other crypto trading strategy, liquidity influences crypto pair-trading. Essentially, liquidity means the ability of a currency pair to be sold or bought on demand. A currency on high demand has high liquidity, meaning more opportunities on the market. You can buy/sell in significant amounts without much variances in its exchange rate. Even on a bearish market, crypto on high demand will always have buyers. So, you won’t have to settle for the exchange rate too low to attract buyers.

Note that not all currency pairs are liquid. Their liquidity depends on whether they are paired with cryptos that are on high demand. This is why BTC, ETH, USDT, and LTC are the ideal base currencies due to their constant demand. It’s also why exchanges with a limited number of trades tie their liquidity to one of these major base currencies.

Risks of Crypto Pair Trading

The best thing about crypto pair trading is that it is market-neutral or non-directional. This means that by pair trading, you generate profits regardless of whether the market is rallying or correcting. Yet, there are several risks and drawbacks investors need to be aware of when using this strategy, including:

I) Execution risk

While it’s easy to use the pair trading strategy, you may fail to execute the trade at an optimal price value. This is especially true when trading crypto pairs with a small market cap, whose valuation is more dynamic and unstable.

II) Correlation Breakdown

Similar to the stock market, pair trading in the crypto-market has to be between two correlated digital assets. Correlation is usually determined arithmetically on a scale of -1 to +1, whereby +1 indicates a perfect positive correlation, while -1 indicates a perfect negative correlation. If the value is 0, it means there isn’t a correlation between the two assets.

Considering the crypto market’s volatility, the correlation between assets can unexpectedly break down, and the trade may turn sour as assets move in different directions.

III) Security Risk

The security aspect of pair trading has more to do with the trading platform rather than the strategy itself. If you are an avid follower of the digital assets market, you probably know that holding your crypto funds in an exchange is a bad idea. Plus, when using a crypto exchange to execute this trading strategy, you risk losing your assets to hackers.

The safest platform for executing this strategy is a Contract for Difference (CFD) broker platform. With this platform, you enter a trade without owning the underlying asset (cryptocurrency). It’s ideally a bet between the seller and trader to trade the underlying asset at prices stipulated in the contract. With CFD trading, you never have to worry about storing the asset or losing it to hackers.

Conclusion

Pair trading, being a market-neutral strategy, is well poised for application in the volatile crypto market. On the downside, however, if you are planning on making bank on the next bull run, you should probably avoid pair trading since you won’t earn higher profits in a rally than you would during a bearish market.

Additionally, the strategy is best suited for intermediate and experienced traders who are already familiar with analyzing prices and market fundamentals. If you are looking to earn regular returns regardless of market trends, you too should consider using the pair trading strategy. Note, however, that even though pair trading is relatively safe, only invest what you can afford to lose and operate within tolerable risk levels.