ActivTrades are a long-standing broker in the industry, regulated by the FCA. On the first look, the website is logically set out, and information on this broker’s services can easily be found. The presence of an FAQ page and 24 hour/5 support is also nice to have. Their website also shows stamps for a strong selection of awards they have been given for their services, over the years.

Account Types

With AcvtivTrades, for a standard account, namely the Individual, you may use MT4, MT5 or ActivTrade’s very own customized trading platform (desktop and mobile versions available on both types of platforms). The minimum deposit to get started is 1,000 Euro.

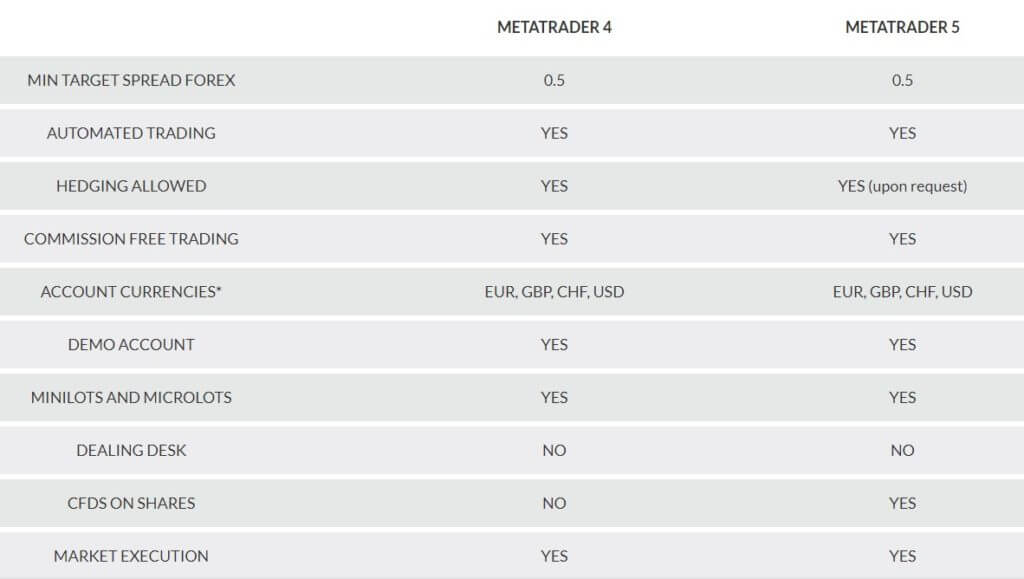

Platforms

ActivTrade offers MT4, MT5, and their own customized platform. You may choose whichever platform you prefer.

Leverage

As a result of Regulation policies set by the FCA, whom of which ActivTrade are regulated with, the maximum leverage that can be offered is 1:30.some traders may find this restricting while others may find this satisfactory, which evens things out a bit when you learn the minimum deposit is 1,000euro; The leverage caps would be more of a restriction if the client were to only deposit very small amounts.

Trade Sizes

The minimum trade size allowed on the Individual and the professional account is 0.01 lot. You may trade 0.01, 0.1 or 1 lot. The maximum for Forex is 50 lots, and 10 maximum on Indices.

Trading Costs

Activ Trades do not charge trade commissions on Forex trading as they make their profit via the spreads. For Share CFDs, you will be charged trade commissions, however, and these depend on your locality. For example, for residents from Europe (excluding London), commission fees are 0.01% of the transaction value, (€5 minimum commission) or 0.05% of the transaction value (€1 minimum commission). For Swap fees, you must calculate according to your trade size. You can learn how with a handy link on the website.

Assets

ActivTrade offers more than a fair variety of instruments to trade: Forex, Indices, Options, Shares, Commodities, and Cryptocurrencies. A full list and information on the markets, in general, can be found on the website along with the average spreads on each pair.

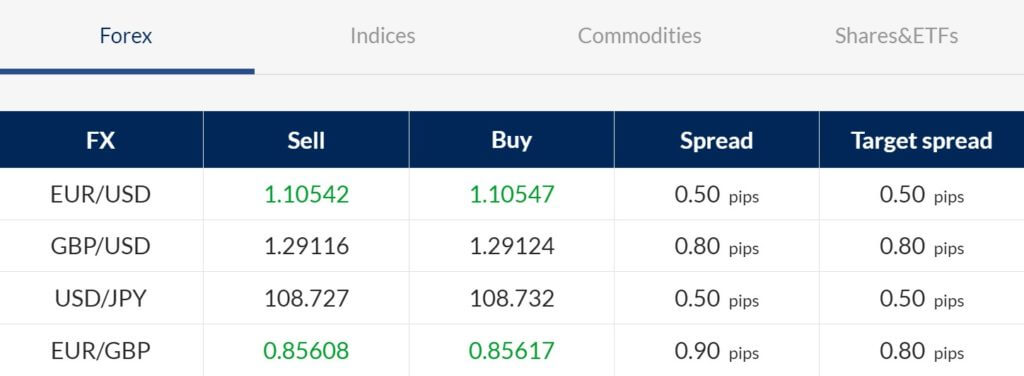

Spreads

If you opt for the ActivTrade platform or MetaTrader 4/5, you will have access to floating spreads. It is also interesting and nice to note that the spreads do not vary in accordance with the platform you choose; it is merely down to you as the trade which platform you prefer and you will not be penalized with different trade conditions for choosing one or the other.

Minimum Deposit

The minimum deposit that ActivTrade requires to get started on the live account is 1,000 Euro. This is not cheap, and definitely above the average minimum that most brokers offer. Alternatively, if you opt for the professional client account, the minimum deposit requirement is 2,000 Euro.

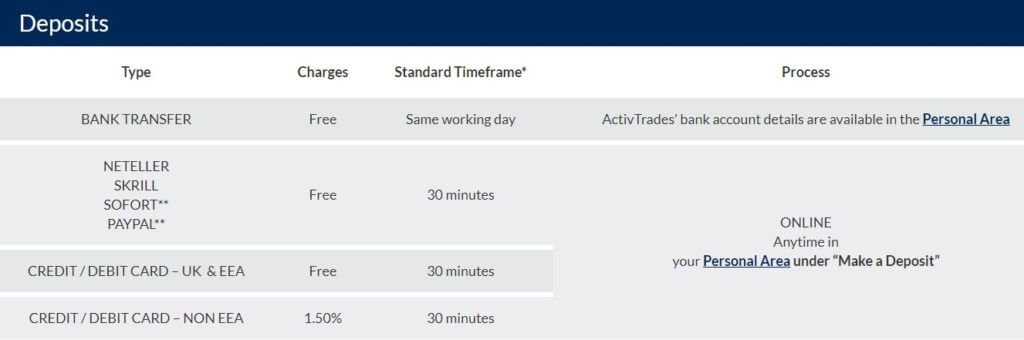

Deposit Methods & Costs

The following methods of deposit are available:

- Bank Transfer

- Neteller

- Skrill

- Sofort

- Paypal

- Credit/Debit card – UK & EEA

- Credit/Debit card – NON-EEA

All deposits are not charged by ActivTrades, with the exception of the Credit/Debit card – NON EEA method which carries a fee of 1.50% of the deposit amount.

Withdrawal Methods & Costs

For withdrawals, the methods available are the same as the deposits, however, there are charges for Non-Sepa bank transfers(15EUR) and 12.50EUR for USD bank transfers.

Withdrawal Processing & Wait Time

According to the website, the processing time for withdrawals are all on the same day, if requested before 12.30(UK time zone). Of course, the actual time for withdrawals to reach back to you could depend on your banking provider but it is good to know this broker processed requests very efficiently from their side.

Bonuses & Promotions

Nowhere on the website does it mention any deposit bonus or promotional schemes. Given the fact this broker is FCA regulated, they would not be able to offer such schemes.

Educational & Trading Tools

In the way of learning material, ActivTrade does provide it’s clients with a good selection to choose from: videos, seminars, a trading glossary and much more. All can be found on the website.

Customer Service

Should you need assistance, you can get in touch with ActivTrades on a 24/5 (GMT+1) basis via telephone, email and live chat. The quality of customer service is also very high, and the agents respond very efficiently.

Demo Account

It is a standard service to offer a demo account, and AcivTrade do offer this facility. It is always good practice to try a demo account with a new broker, before opening a live account and deposit real money.

Countries Accepted

Due to regulation policy, the following countries are not accepted to trade with ActivTrade: Afghanistan, Åland Islands, Al-Qaida & Taliban, Belarus, British Columbia, Burma/Myanmar, Canada, Central African Republic, Democratic Republic of the Congo, Eritrea, Serbia, Guinea, Guinea-Bissau, Iran, Islamic Republic of, Iraq, Japan, Liberia, Libya, North Korea (Democratic People’s Republic of Korea), Poland (business decision), Somalia, Sudan, Syria, Tunisia, U.S. Virgin Islands, USA, United States Minor Outlying Islands, Yemen, Zimbabwe.

Conclusion

Activ Trade offers a fair variety of tradable instruments and a good selection of deposit and withdrawal methods. A nice touch to this broker is that even though they offer MetaTrader as well as their own platform, the trading conditions such as spreads and leverage remain the same on both platforms. This demonstrates a fair attitude towards the clients. Clients can also appreciate the quality of customer support this broker provides; efficient response time and a very personable manner from the agents.