FXCL is a forex broker that opened its doors in 2006 and is located and registered in Saint Vincent and the Grenadines. Some of the reasons they suggest for you to trade with them include cashback when you trade, leverage up to 1:1000, swap-free accounts, copy trading, bonuses and, fixed or variable spreads. They also claim to have 13 years in the markets, lots of happy and loyal clients and exclusive introducing broker programs. We will be diving deep into what is on offer to see if they really do offer these and so you can decide if they are the right broker for you to use.

Account Types

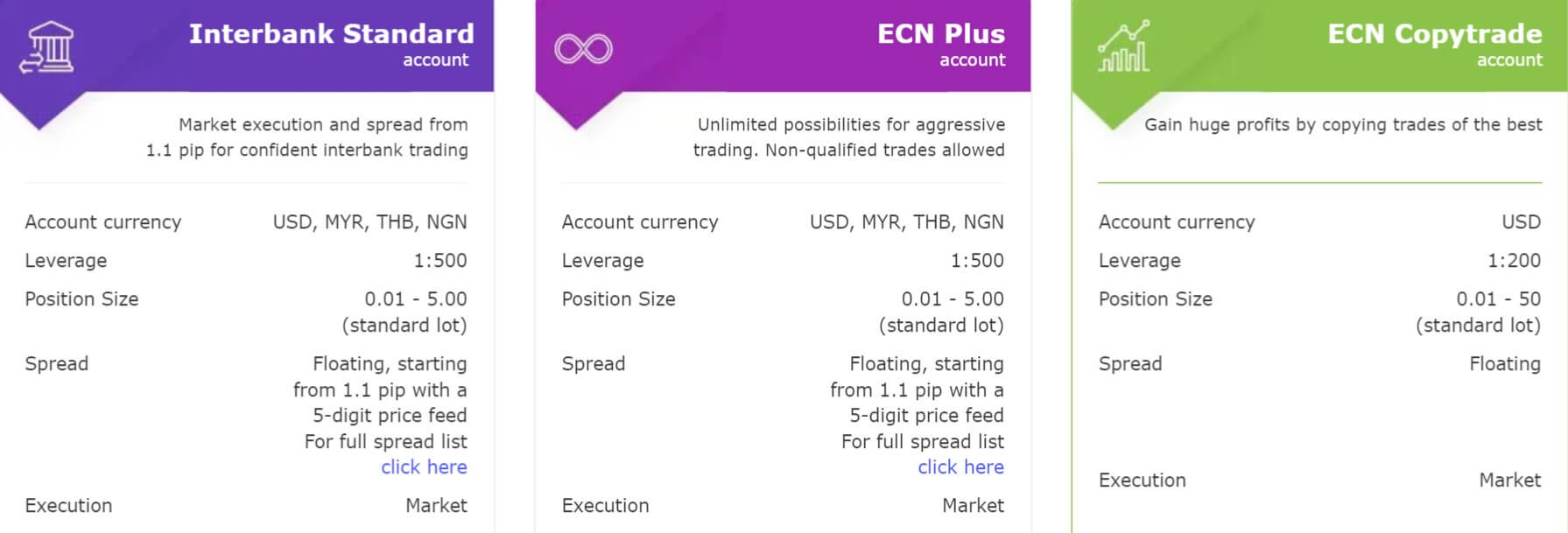

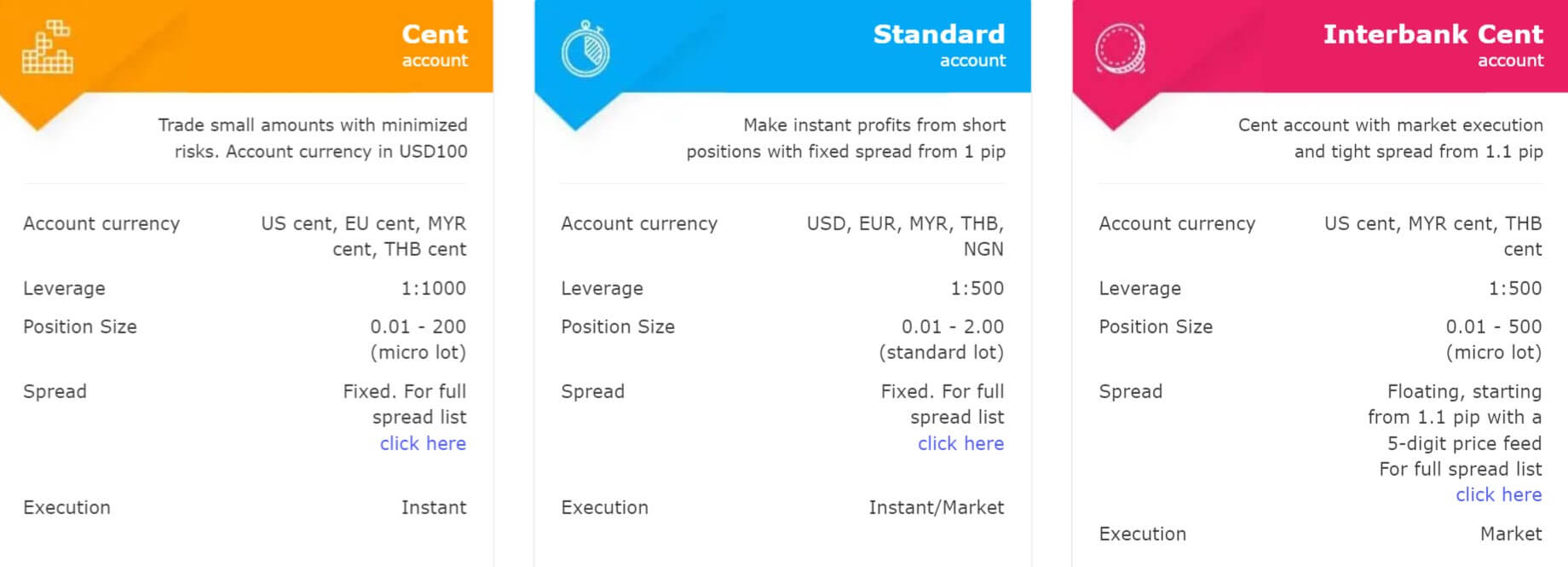

If you decide to sign up with FXCL you will be presented with 6 different accounts to choose from, we will briefly outline them below so they are easier to choose from.

Cent Account:

The Cent account can have a base currency of USD, EUR, MYR or THB. It comes with leverage up to 1:1000 and has a fixed spread starting from 1 pip. The margin call level is at 30% with the stop out level set at 10%. It uses instant execution and has a trade size starting from 0.01 lots going up to 200 lots, the account can have a maximum 150 trades open at any one time. There is no added commission and swap-free accounts are available. Hedging is allowed as are other strategies such as scalping.

Standard Account:

The Standard account can have a base currency of USD, EUR, MYR, THB or NGN. It comes with leverage up to 1:500 and has a fixed spread starting from 1 pip. The margin call level is at 30% with the stop out level set at 10%. It uses instant or market execution and has a trade size starting from 0.01 lots going up to 2 lots, the account can have a maximum of 100 trades open at any one time. There is no added commission and swap-free accounts are available. Hedging is okay to use as are other strategies such as scalping.

ECN Cent Account:

The ECN Cent account can have a base currency of USD, MYR or THB. It comes with leverage up to 1:500 and has a floating spread starting from 1 pip. The margin call level is at 60% with the stop out level set at 40%. It uses market execution and has a trade size starting from 0.01 lots going up to 500 lots, the account can have a maximum 150 trades open at any one time. There is no added commission and swap-free accounts are available. Hedging is allowed as are other strategies such as scalping.

ECN Interbank Account:

This account can have a base currency of USD, MYR, NGN or THB, it can be leveraged up to 1:500 and comes with a floating spread. The margin call level is set at 40% with the stop out is set at 20%. It uses market execution and trade sizes start from 0.01 lots and goes up to 5 lots, the account can have a maximum of 150 trades open at any one time. There is no commission on a swap account but a commission of 0.4 pips per lot on a swap-free account, hedging is allowed and all strategies including scalping are okay to use.

ECN Plus Account:

The ECN Plus account can have a base currency of USD, MYR, NGN or THB, it can be leveraged up to 1:500 and comes with a floating spread. The margin call level is set at 100% with the stop out is set at 70%. It uses market execution and trade sizes start from 0.01 lots and goes up to 500 lots, the account can have a maximum of 150 trades open at any one time. There is a commission of 0.6 pips per lot on a swap account and a commission of 1.6 pips per lot on a swap-free account, hedging is allowed and all strategies including scalping are okay to use.

ECN Copytrade Account:

This account has a base currency of just USD, it can be leveraged up to 1:200 and comes with a floating spread. The margin call level is set at 80% with the stop out is set at 60%. It uses market execution and trade sizes start from 0.01 lots and goes up to 50 lots, the account can have a maximum of 200 trades open at any one time. There is a commission of $0.1 per micro lot which equated to $10 per lot traded. There are swap-free accounts but there is an added commission on these accounts, hedging is allowed and all strategies including scalping are fine to use.

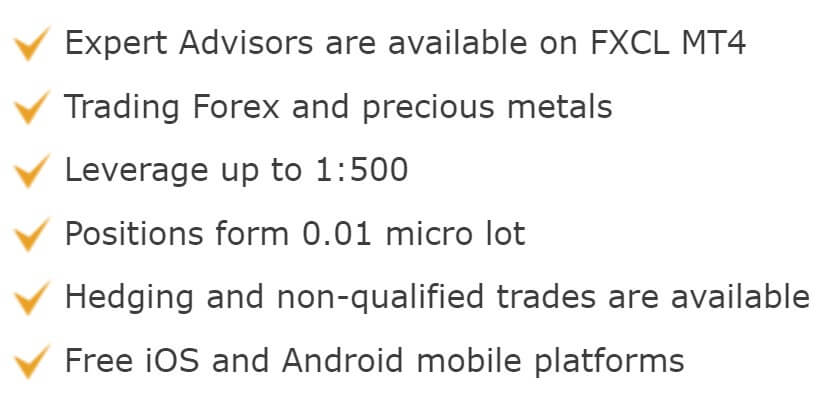

Platforms

MetaTrader 4 (MT4) is the only platform on offer from FXCL. This is one of the most popular trading platforms in the world due to its reliability, adaptability, and it is easy to use. It is also highly accessible as you can use it as a desktop download, a web trader or as an application for your mobile devices. MetaTrader 4 is compatible with thousands of expert advisors and indicators to make your trading and analysis as easy as possible. Normally being stuck with a single platform is a negative, but there could be far worse platforms to be stuck with.

MetaTrader 4 (MT4) is the only platform on offer from FXCL. This is one of the most popular trading platforms in the world due to its reliability, adaptability, and it is easy to use. It is also highly accessible as you can use it as a desktop download, a web trader or as an application for your mobile devices. MetaTrader 4 is compatible with thousands of expert advisors and indicators to make your trading and analysis as easy as possible. Normally being stuck with a single platform is a negative, but there could be far worse platforms to be stuck with.

Leverage

The leverage that you get depends on the account you are using, we have outlined the maximum leverage for each account below.

- Cent: 1:1000

- Standard: 1:500

- ECN Cent: 1:500

- ECN Interbank: 1:500

- ECN Plus: 1:500

- ECN Copytrade: 1:200

The leverage can be selected when opening up an account and should you wish to change it you will need to contact the customer service team with your request.

Trade Sizes

Trade sizes all start at 0.01 lots and go up in increments of 0.01 lots,. However, each account has a different maximum trade size and a maximum number of open trades, we have listed both below.

- Cent: 200 lots maximum / 150 open trades

- Standard: 2 lots maximum / 100 open trades

- ECN Cent: 500 lots maximum / 150 open trades

- ECN Interbank: 5 lots maximum / 150 open trades

- ECN Plus: 5 lots maximum / 150 open trades

- ECN Copytrade: 50 lots maximum / 200 open trades

Trading Costs

A few of the account shave some added commissions, we have detailed them below as it can be a little confusing.

Cent: No commissions

Standard: No commissions

ECN Cent: No commissions

ECN Interbank:

Swap accounts = No commission

Swap-free accounts = 0.4 pips per lot traded

ECN Plus:

Swap accounts = 0.6 pips per lot traded

Swap-free accounts = 1.6 pips per lot traded

ECN Copytrade:

Swap accounts = $10 per round lot traded

Swap-free accounts = $20 per round lot traded

Swap charges are fees for holding trades overnight and they can be viewed within the trading platform you are using.

Assets

The product specification list is just one long list, we have broken them down into different categories to make it easier to understand what is on offer.

Forex:

AUDCAD, AUDCHF, AUDJPY, AUDNZD, AUDUSD, CADCHF, CADJPY, CHFJPY, EURAUD, EURCAD, EURCHF, EURGBP, EURJPY, EURPLN, EURUSD, GBPAUD, GBPCAD, GBPCHF, GBPJPY, GBPNOK, GBPNZD, GBPSEK, GBPUSD, NZDCAD, NZDCHF, NZDJPY, NZDUSD, USDCAD, USDCHF, USDJPY, USDMXN, USDNOK, USDPLN and, USDSEK.

Metals:

Gold (EUR and USD) and, Silver.

Crypto:

BTCUSD (Bitcoin), ETHUSD (Ethereum), LTCUSD (Litecoin) and, XRPUSD (Ripple).

Spreads

The spreads differ from account to account and are as follows.

- Cent: Fixed spreads starting from 1 pip

- Standard: Fixed spreads starting from 1 pip

- ECN Cent: Floating spreads starting from 1.1 pips

- ECN Interbank: Floating spreads starting from 1.1 pips

- ECN Plus: Floating spreads starting from 1.1 pips

- ECN Copytrade: Variable spreads

Fixed spreads mean thewy do not move or change, no matter what happens in the markets. Floating and Variable spreads mean they change depending on the market when there is added volatility they are often seen higher.

Minimum Deposit

The minimum deposit amount for FXCL is currently $1. We are not sure what the minimum requirements are for the individual accounts though.

Deposit Methods & Costs

Deposit Methods & Costs

There are a few different ways you can deposit, and these are Online Bank, Instant Deposits from the bank, Perfect Money, Bank Wire Transfer, Local Deposit and Fasapay. There are no additional fees from FXCL for deposit with them.

Withdrawal Methods & Costs

The same methods are available to withdraw with, for clarification these are Online Bank, Instant Deposits from the bank, Perfect Money, Bank Wire Transfer, Local Deposit and Fasapay Just like with deposits, FXCL does not add any fees to their withdrawals.

Withdrawal Processing & Wait Time

Withdrawal requests will be processed within 1 to 2 business days of the request being made. How long the total process takes depends on the processing time of the method or bank used.

Bonuses & Promotions

There are plenty of offers available at the time of writing this review, we will outline them so you can see the sorts of bonuses that are available.

200% New Year Bonus:

200% New Year Bonus:

Simply fund your account before the end of January and receive a 200% bonus of up to $2,000. Bonus can be withdrawn after 10% of the bonus has been traded in lots.

50% Tradable Bonus:

Deposit and receive up to $500 as a 50% bonus, you will then get a 35% bonus for any further deposits. This bonus cannot be withdrawn and is removed after 30 days.

100% Smart Bonus:

Get a 100% bonus when you deposit and turn it into real funds by trading half of it. We are not entirely sure that means.

Automatic Cashback:

Receive up to 4 pips cashback per trade. Only available on Standard, ECN Cent, and ECN Interbank accounts.

Birthday Present:

You can get a bonus of 100% + your age as a bonus between 10 days before and after your birthday. It is trading only bonus and cannot be withdrawn, it is removed after 90 days.

Educational & Trading Tools

In terms of education, there are few small things on offer. The first being a financial glossary, simply listing what different terms mean, there is also some analysis theory, but this is very basic information on what analysis is. There is a calculator that can be used to work out pip value and profits and finally, there is an economic calendar detailing upcoming news and which markets they may affect.

Customer Service

Should you wish to get in contact you can do so via email. There is an online form to fill out which you will then get a reply via email, there are then a number of different email addresses to use depending on the department you want, there is also a postal address available.

Address: Suite 305, Griffith Corporate Center, P.O. Box 1510, Beachmont, Kingstown, St. Vincent, and the Grenadines

Support: [email protected]

Bonuses: [email protected]

Introducing Brokers: [email protected]

Partners / Marketing: [email protected]

You can also use Skype to contact the FXCL customer service team.

Demo Account

Demo accounts are available at FXCL, but they do not offer much information about them such as which accounts they mimic, what the trading conditions are or if there is an expiration time on the accounts. It is good that they are offered because demo accounts allow clients to test out the trading conditions and also to test new strategies without risking any capital.

Countries Accepted

The following statement is present on the site: “FXCL Markets Ltd. does not solicit residents of Japan, USA and Canada to open trading accounts. Citizens of mentioned countries (regardless of residence) are not accepted. Residents and citizens of the UN-sanctioned countries are also not accepted.” If you are still not sure of your eligibility, we would recommend getting in contact with the customer service team to check.

Conclusion

There is a lot to choose from when it comes to FXCL and they are offering a lot to their clients. The accounts are all varied and it is nice to have a choice between STP and ECN and then also floating or fixed spreads. The spreads can be a little high on the accounts that also have a commission. When it comes to asserts there is a fair selection of currency pairs but not a lot else. The deposits and withdrawals are suitable, not as many options as much of the competition but it is nice to have no fees. Overall, FXClearing does not seem like a bad broker, but whether they are worth using is up to you.