FXCharger is an Expert Advisor (EA) for the MetaTrader 4 platform. It is on the scene since 2016 and is updated in 2019 to look more professionally. According to external sources, the company behind FXCharger also has other domains and products such as FXMower.com, ForexBringer.com, ForexSeven.com, and so on. Some of these brands are out of business. FXChrger has performance charts uploaded on myfxbook.com and some of them are verified. Note that this EA still does not have wide popularity and according to the charts has good performance.

Overview

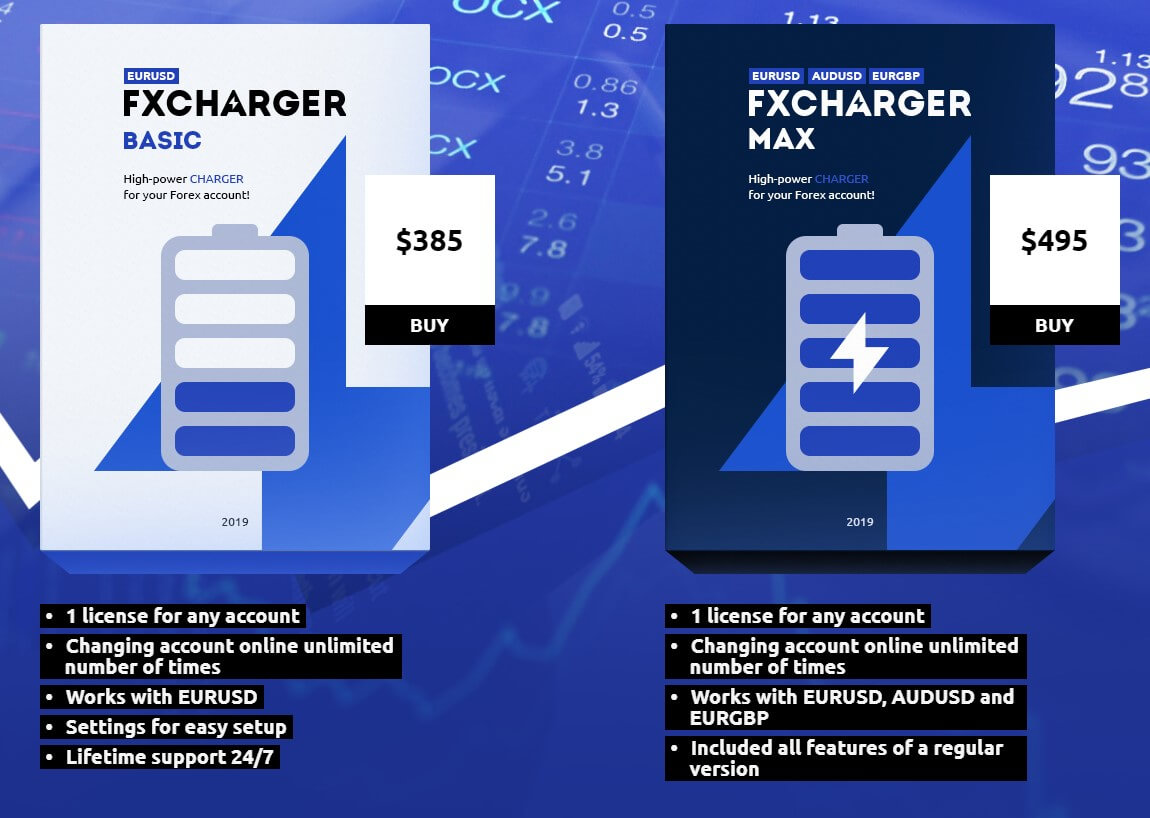

FXCharger is a martingale EA at its base but includes adaptive Stop Loss and Take Profit levels according to market conditions. We believe this is based on volatility but it could be some other indicator values. There are two versions, FXCharger Basic and FXCharger Max. They are essentially the same EAs except the Max version is also applicable for the AUD/USD and EUR/GBP currency pairs, not only for the EUR/USD as the Basic version.

According to the developer, the EA is designed to have frequent trades, trades every day. This means the EA is also for the less patient, young traders that like to see results right away. The EA does not hold positions for long, it should end a trade in 1 to 4 days max. The EA setting allows the user to ser the maximum possible risk amount so every position has its limit to how much drawdown per position EA can tolerate. This function is more or less common with many EAs, although, for promotional reasons, the devs decided to state it as a special feature. Even if the EA is not connected to the market anymore for any reason, the Stop loss should be executed. This means the Stop Loss or Take Profit is set onto the broker server thus it is not invisible and acts like a normal Stop Loss set from the MT4.

Now, this setting could be crucial for martingale EAs. As with other martingales EAs, FXCharger has the same sudden drop patterns in the chart followed by gradual and smooth gains until the next drop and so on. Setting the low-risk tolerance could mean the trades will be closed before they can rebound to positives and Take Profit levels. As such, if this setting is not optimal, or better to say not by developer defaults, the EA performance could be very different.

On the website, there are 3 points where it is described (1) you will trade in profit thanks to smart Take Profit levels, (2) save deposit with smart Stop Loss, and (3) use reliable setting to get a stable profit. We cannot agree that even the best Take Profit leveling can make you profits but we agree that optimal Stop Loss protection can at least save you from complete account busting in a short time. FXCharger settings should not be tickled with is seems, as the devs have a refund policy in 30 days only if the EA is working by default settings.

Myfxbook performance charts show high levels or return. The EUR/USD pair shows gains of 1528.63% since Merch 2016. Three dips are evident, showing the Stop Loss in effect and according to our estimates, even after FXCharger made about 1400% gain, in May it dropped to 1100% from one Stop Loss trigger, 4 Stop Loss triggers in that month would almost bring the account to breakeven. Drawdown is increased to 29.46% in 2020 since the EA performed poorly in January and February piling the losses up to -15% per month. FXCharger average trade length is 5 days, a bit longer than advertised, won 60% of trades, winning 55.59 pips on average, and losing -79.86 pips. The Sharpe ratio is very low with this EA, a mere 0.01, meaning the returns do not compensate for the risk taken. The year 2016 and 217 were much better for this EA, none of the months ended negative and in 2018 19 and especially the beginning of 2020 is disappointing. Still, the EA has a total positive gain. The broker used for the testing is FXOpen.

The AUD/USD testing gained 580% since min 2018 and 14% on average per month. In contrary to the EUR/USD, the 2018 and 2019 year are all positive for FXCharger but seems to be off since July 2019. The trade success rate is 60%, the same as with the EUR/USD with a bit better Sharpe ratio of 0.04. The average win per trade is 54.57 pips and the average loss is -62.08 pips. The exposure is set to private. The drawdown presented on the website is an extreme 54.72%. The EUR/GBP pair performance chart and analysis is not published.

Service Cost

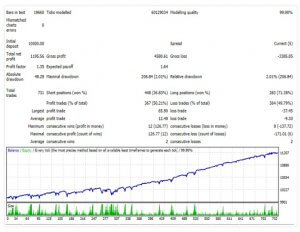

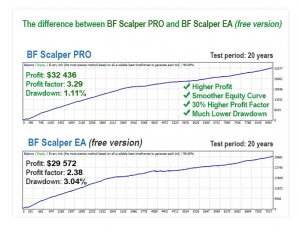

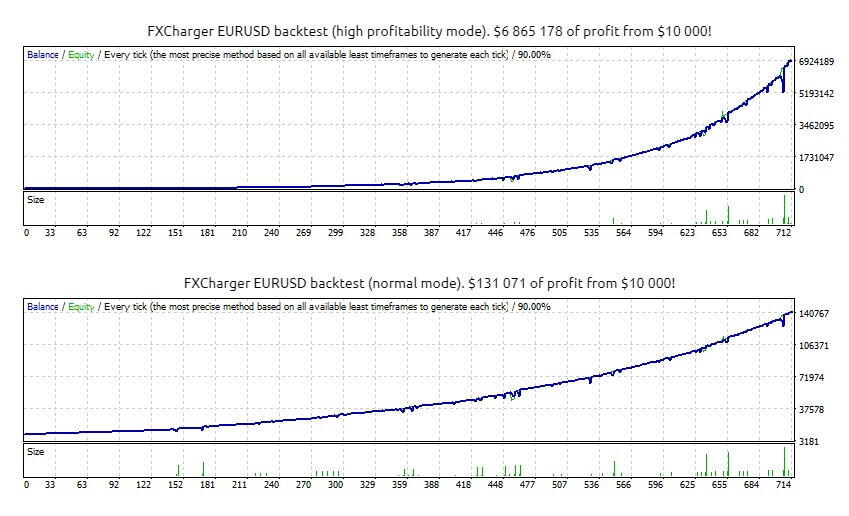

The FXCharger website will not disclose what indicators are used and the major content will be the statistics section. You will see multiple charts for the backtesting results for the EUR/USD, AUD/USD, and the EUR/GBP pair. FXCharger works on the 1-hour timeframe and has the normal and High Profitability modes.

The cost for the Basic version that works only on the EUR/USD is $385, which puts this EA in the mid to higher price range. For this price, you will get one license for any account, unlimited account online changes, and lifetime 24/7 support. A 30-day refund policy is valid if settings are not modified. FXCharger Max version is $495 which is regarded as expensive. The Max version has the same benefits but works with the other currency pairs mentioned. No demo is available.

Conclusion

In our opinion, this website does not give out enough information about this EA given the price range and does not mention the martingale strategy that is applied. Users report mixed results from major benchmark sites. Some of them state the refund policy is just a fake promotion:

“Fraud, a liar company. 5 days ago I bought it on the forexstore.com. Thither are written that 30 day warranty for the EA, I wrote that the robot did margin call on the demo account , he’s wrote this is not enough for a refund. I question what the warranty applies to??? If i could not give an asterisk. Nobody take the https://forexstore.com page for anything. Company fraud and criminals.”

Another seemingly unhappy reviewer wrote:

“Other reviewer is right that this company and other sites own by this EA developer are luring people in by fake 30 day money back guarantee. Run away.”

Others, however, say the support is responsive and that they have solid results. The final rating is mixed but not enough for anyone at this price for a martingale EA, especially concerning the extreme drawdowns and inconsistent results in 2020. Another concern is the undisclosed exposure and no performance since 2019 on the AUD/USD pair. Finally, we can only see backtesting results and no live results for the EUR/GBP. The website does not set strong selling points and even the 30-day return policy validity is arguable.

This Forex service can be found at the following web address: https://fxcharger.com/