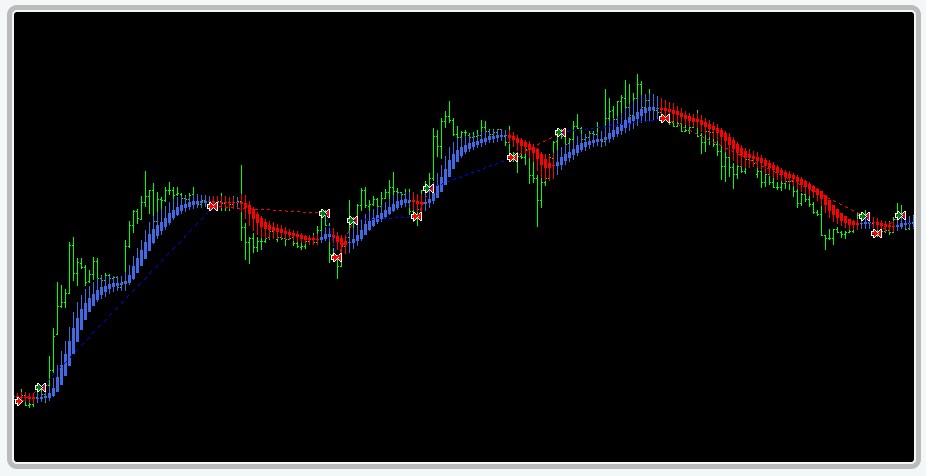

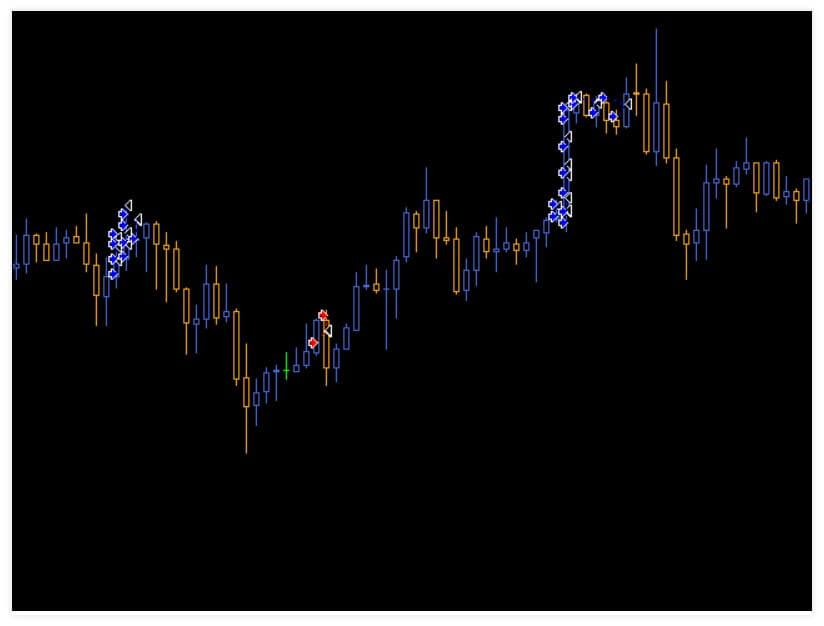

In Japanese, Ashi means “rhythm”, and Heiken means “average”. Heiken Ashi candles actually look like Japanese candles, but the benefits of using an EA with the softened Heiken Ashi indicator is that they show significant trends and eliminate a lot of noise at the same time, and thus omit a good number of failed entries. There are a lot of traders who use Heiken Ashi as their primary indicator, which means they make in and out based on what these bars tell them.

The general rule with the Heikin Ashi Smoothed indicator is when you get two bars in the same color as you are trading in that direction and leave when two investment bars are going against you.

Unlike the traditional indicator Heiken Ashi, with the EA Heiken Ashi Smoothed candles are independent candles, in the sense that they are calculated based on the above formula, but with the use as information inputs of previous candles that makes it slower and slower. Due to the nature of Heiken Ashi candles, as these use an average price may be that the case of this indicator does not reflect the most recent price, and this is one of the reasons why it is not recommended for scalping, working better in trades in the long term.

As the name of the EA suggests, it makes the trend smoother and more comfortable to detect, and that is why it is more suitable for trend operators. One of the critical features of the robot Heiken Ashi Smoothed is that both in an uptrend or downtrend usually have very few candles, because in most cases, there are no lower shadows, while extreme rising shadows are posed.

Service Cost

This Robot, like all Quivofz, has a free basic version and two other versions called Advanced and Pro, which cost 29.90 and 39.90 Swiss francs, respectively.

Heiken Ashi EA Rules

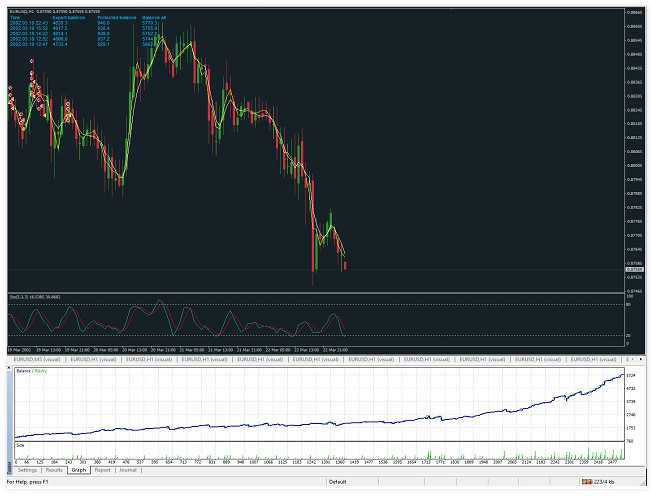

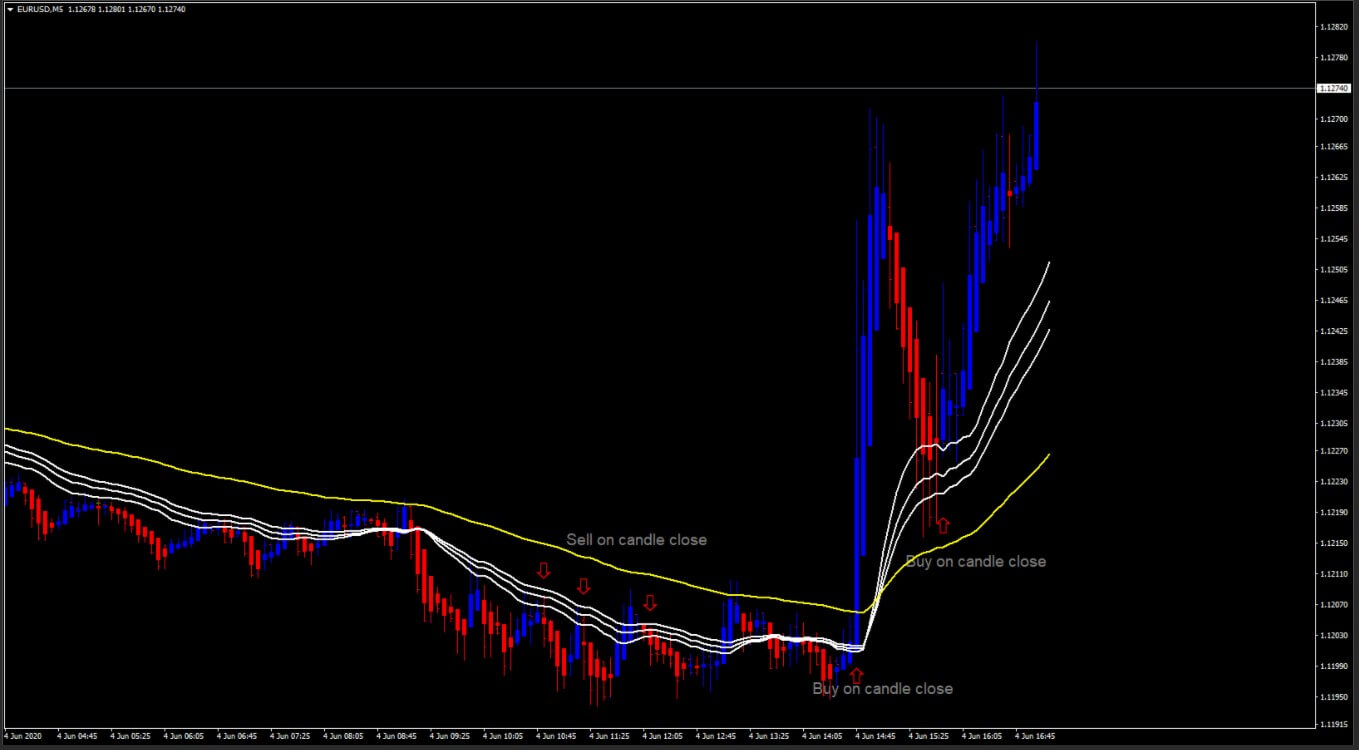

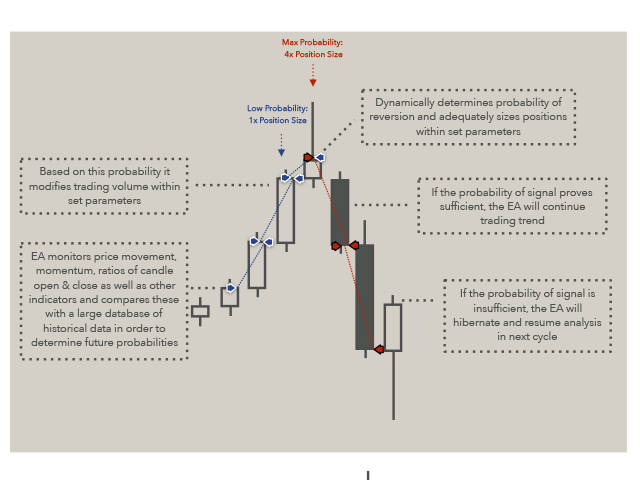

The EA for MT4 smoothed Heiken Ashi is really an indicator designed as an independent trading system, but in order to improve the performance of the indicator, as it is going to add the moving average of 200 periods because the MA 200 is considered to represent one of the most reliable and price-friendly moving averages. An effective trading system is therefore established using the Heiken Ashi Smoothed indicator in combination with the 200-day MA.

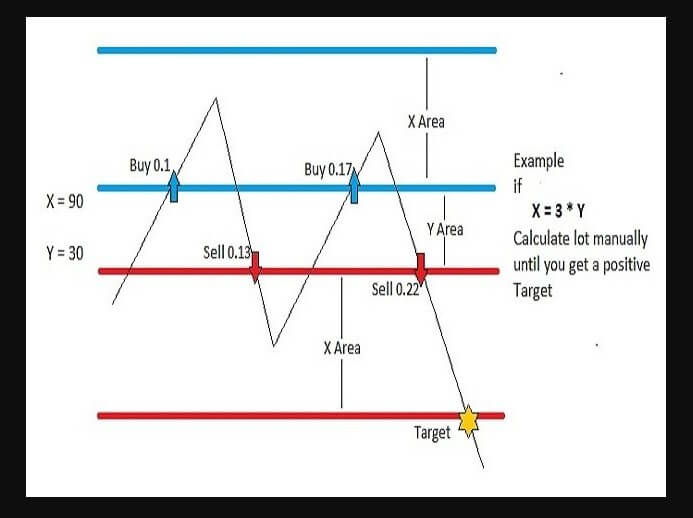

BUY and SELL Trading Rules

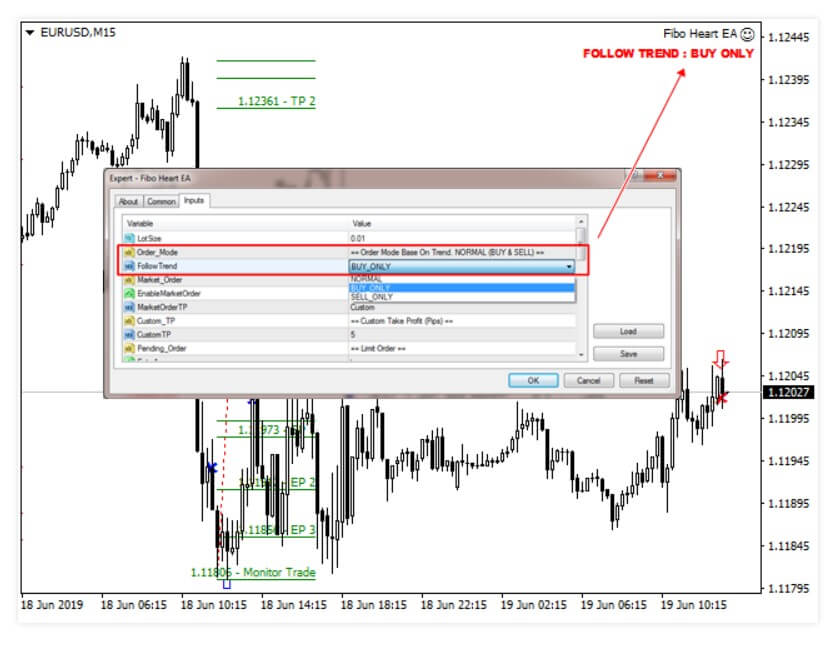

The EA only makes purchases above the moving average of 200 periods, once you have two Heiken Ashi candles pointing to the top. On the contrary, the EA will sell only below 200 days MA once we have two Heikin Ashi candles looking to the disadvantage.

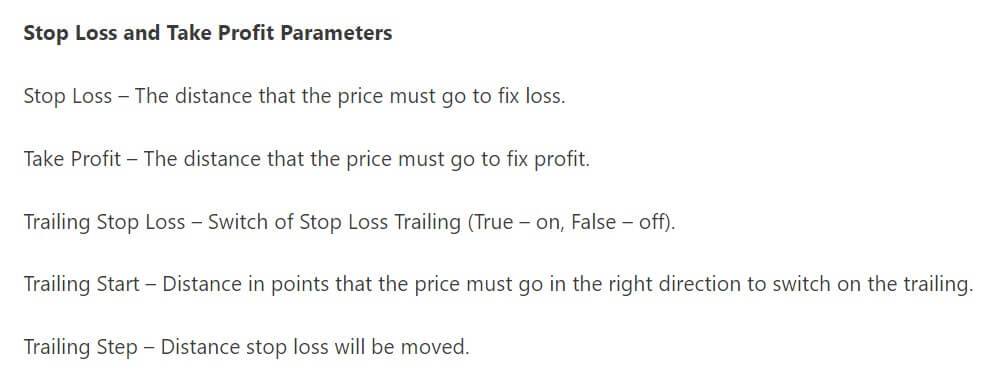

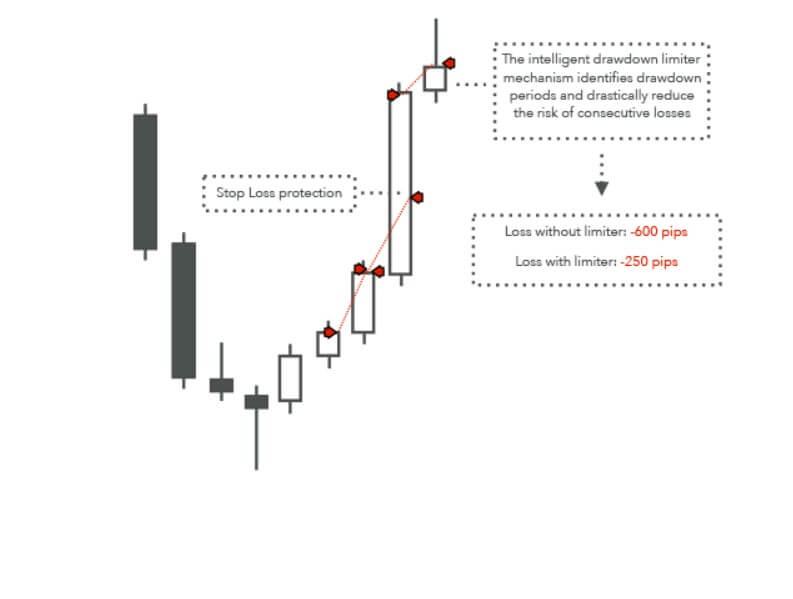

Stop Losses

For stop-loss orders, the EA uses traditional candle prices in combination with Heiken Ashi candles. In this sense, for the purchase configurations, we put our SL under the last candles, where we had red Heiken Ashi candles, and for the sales configurations, we put our SL over the last candles where we had blue Heiken Ashi candles.

Rules of Taking Profit

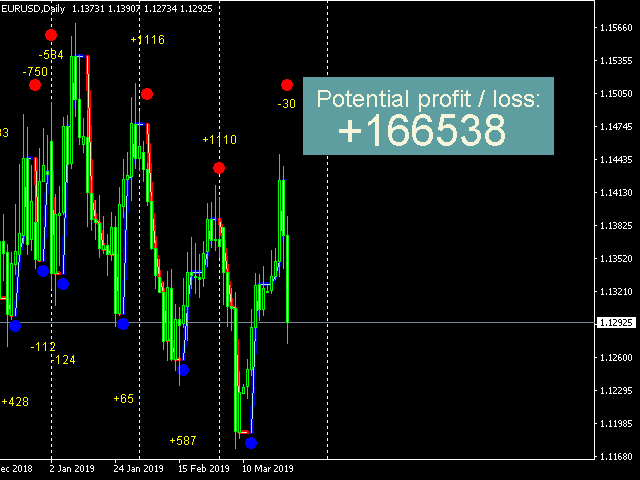

The EA gets benefits once it breaks in the opposite direction of the moving average of 200 periods. We have seen examples, where we have the Heiken Ashi Smoothed indicator and could have caught the trend in EUR/USD. As for profit-taking, we can always use the Heiken Ashi Smoothed candlesticks to detect an investment, because it does an excellent job of warning us in advance of a possible change in trend and can consider this as an alternative to the proposed rules.

Time Frames

Technically speaking, you can use this EA for all available time frames. However, the shorter the time frame, the more fluctuations and possibly more false entries that can cause small losses, and that can bring your portfolio down quickly, will be seen. We recommend that you use higher time frames like 4H for better consistency.

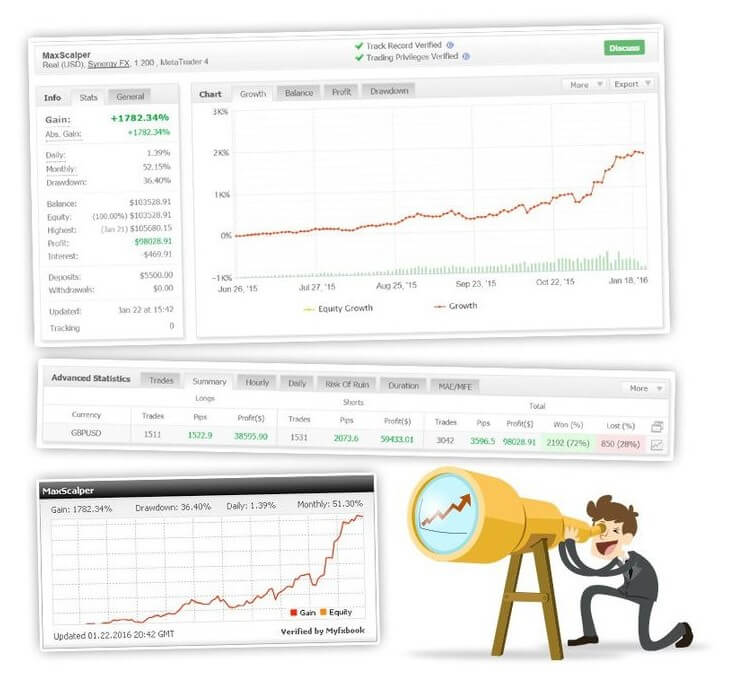

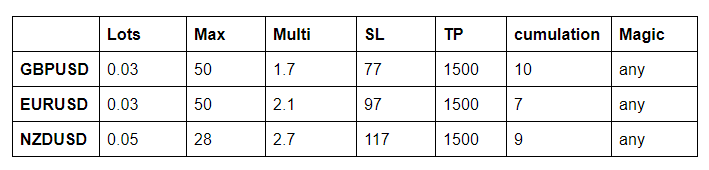

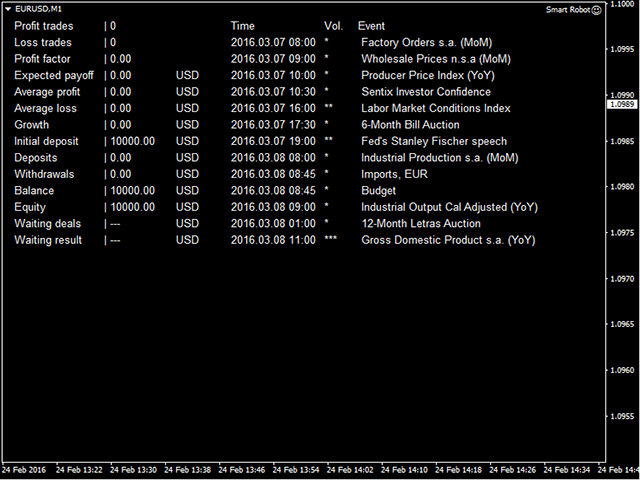

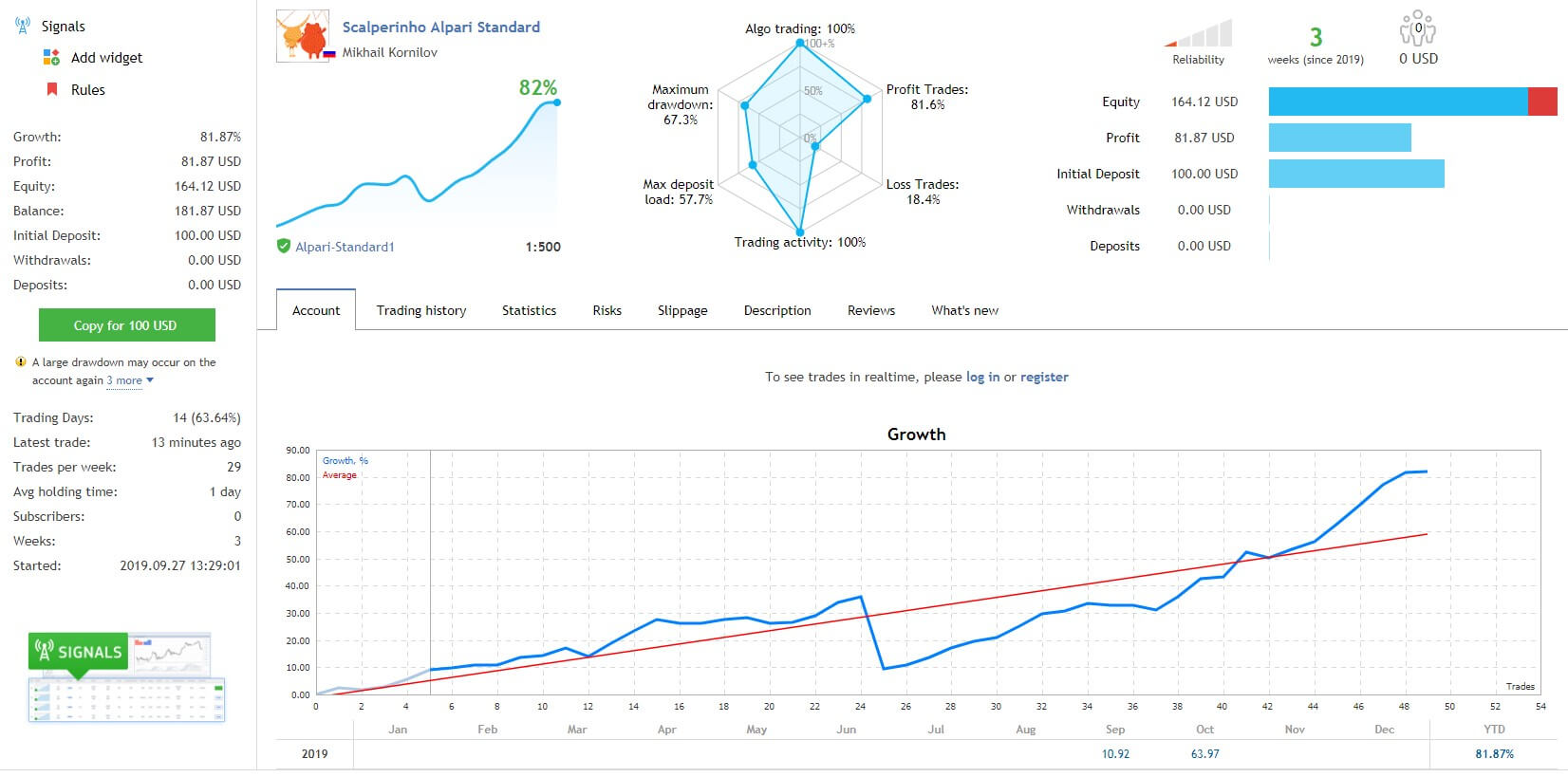

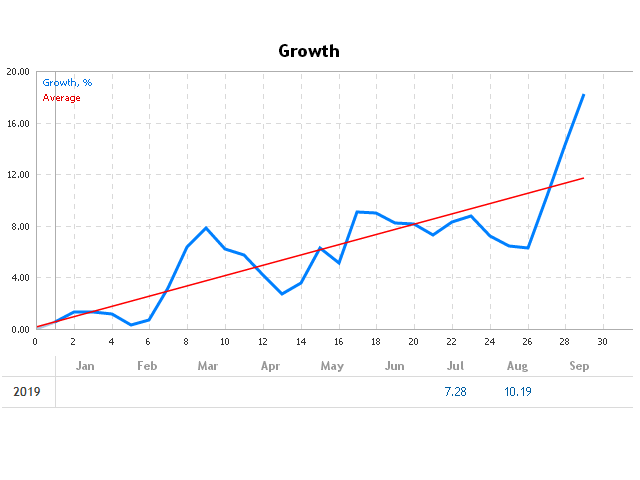

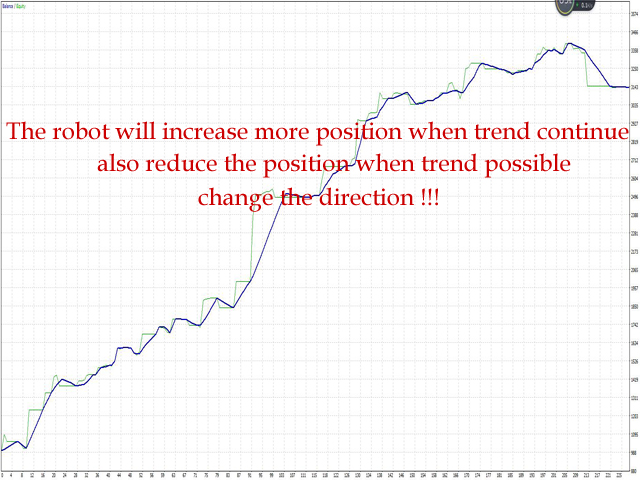

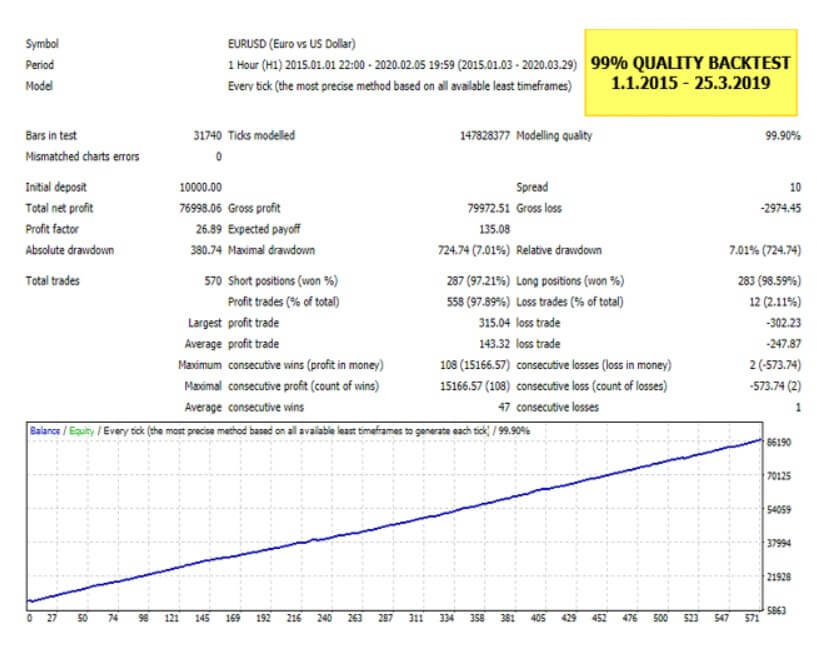

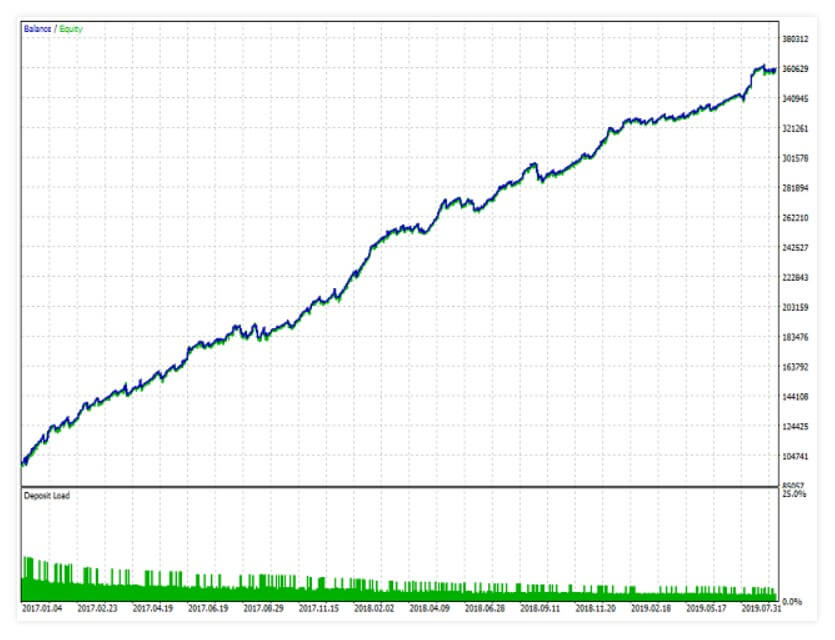

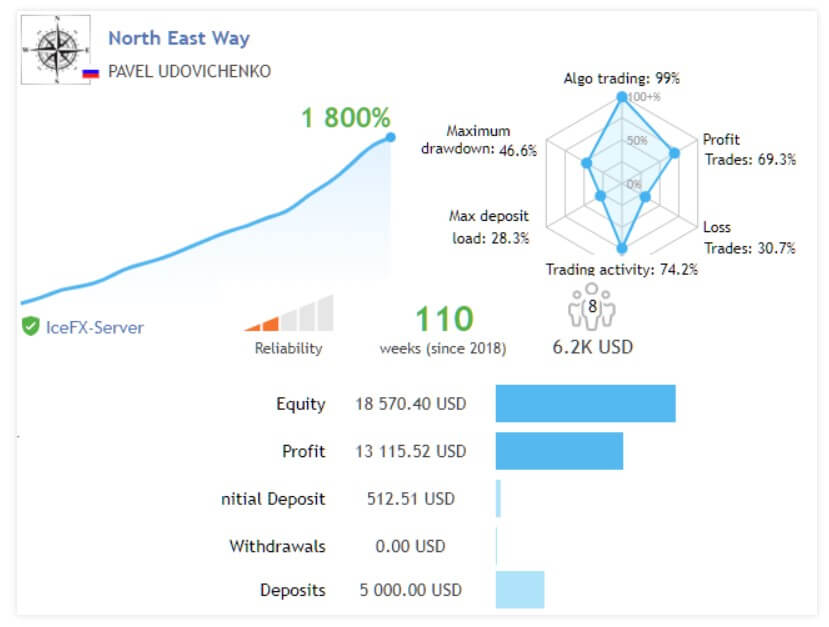

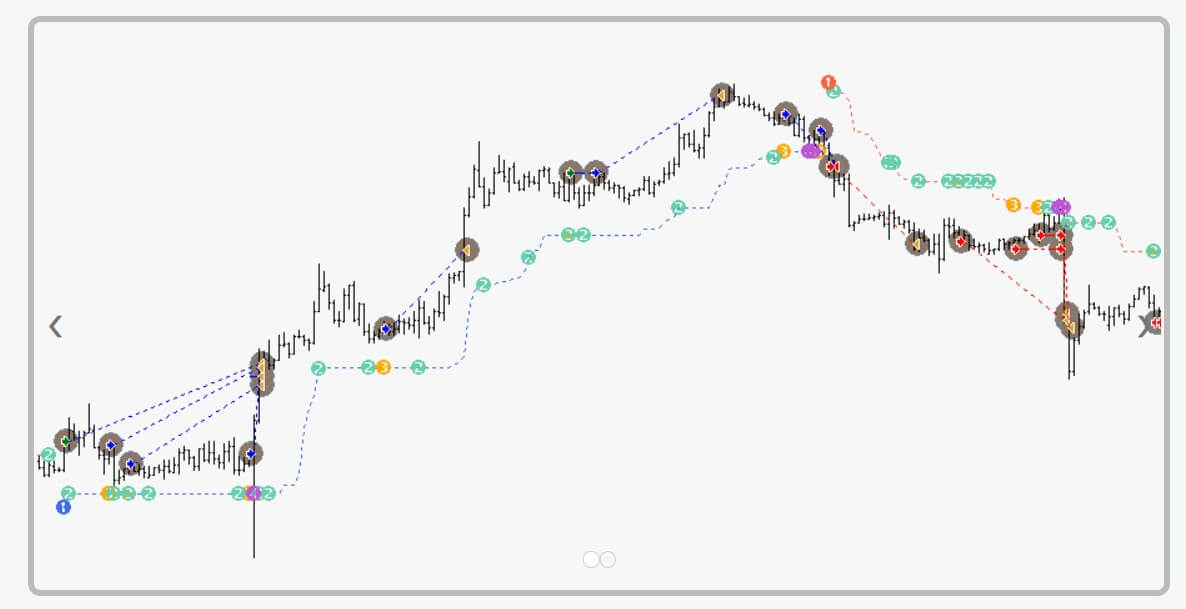

New Stable Profit is a robot that works in real accounts since August 2017. 100% of the trades in this system are based on algorithmic trading. The negotiation is based on trend correction movements, positions are opened depending on the strength of the trend and the volumes of negotiation according to a formula that the developer has not revealed.

New Stable Profit is a robot that works in real accounts since August 2017. 100% of the trades in this system are based on algorithmic trading. The negotiation is based on trend correction movements, positions are opened depending on the strength of the trend and the volumes of negotiation according to a formula that the developer has not revealed.

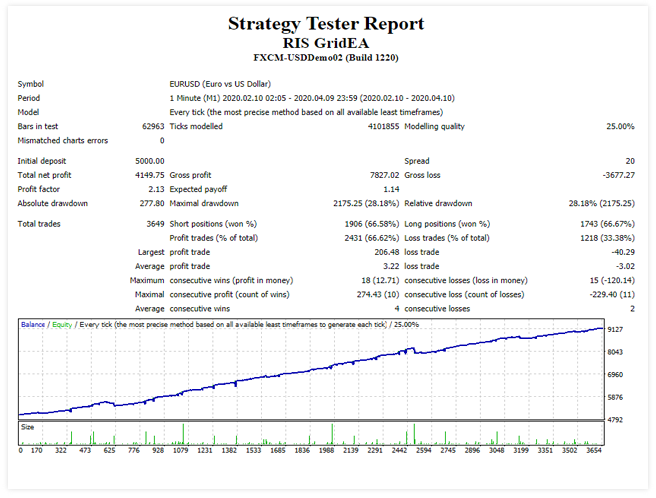

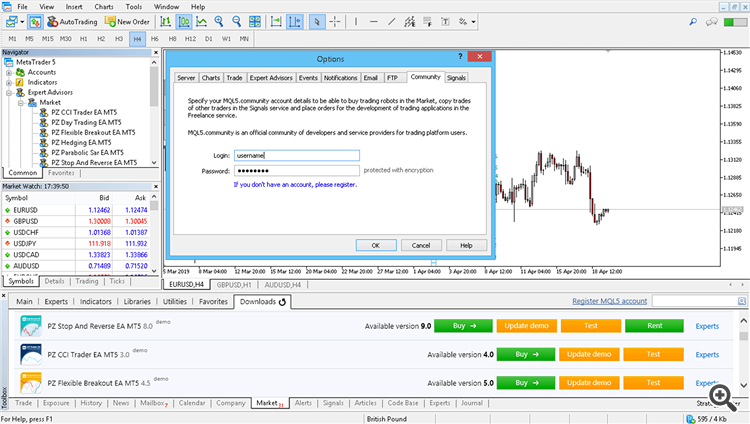

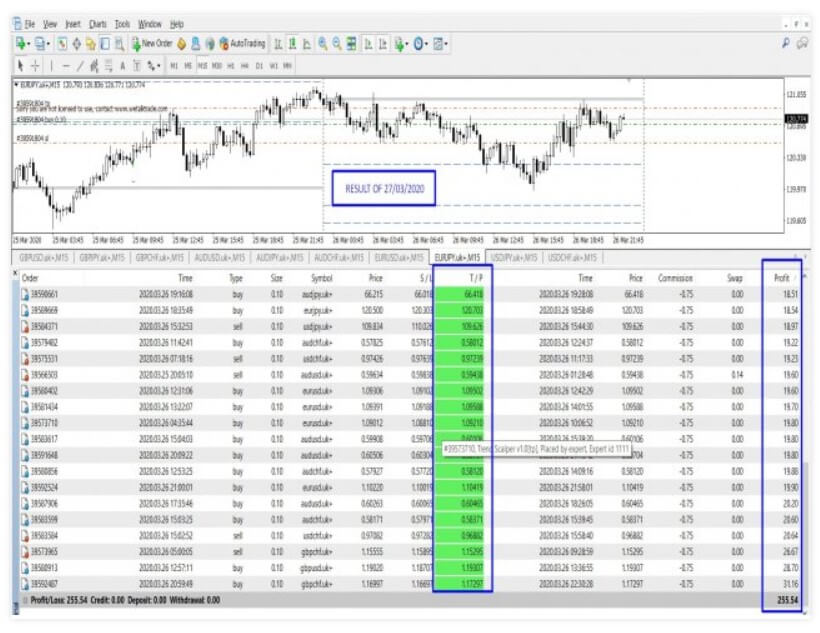

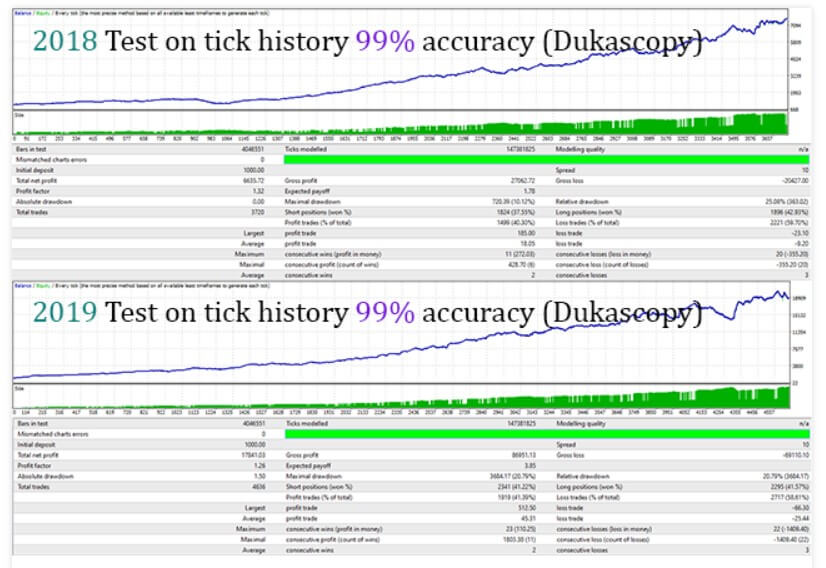

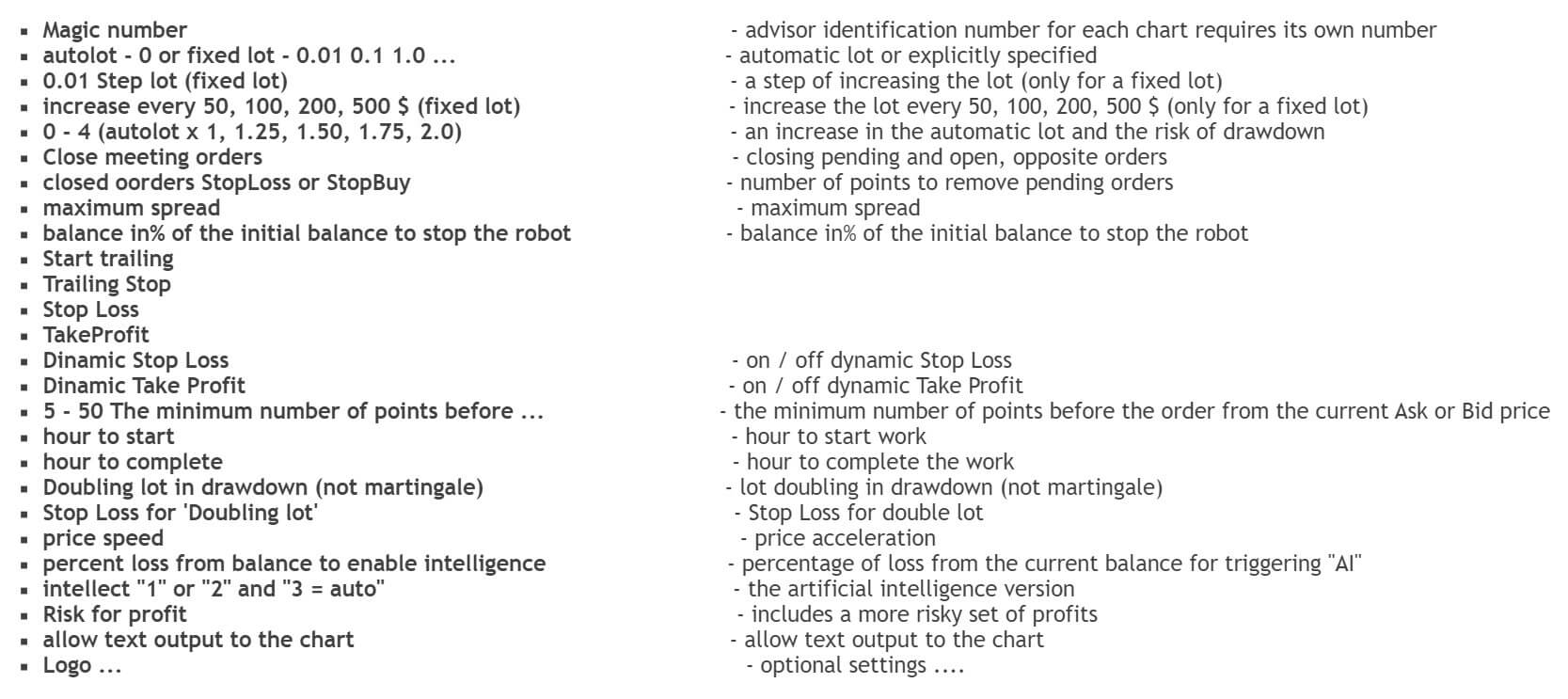

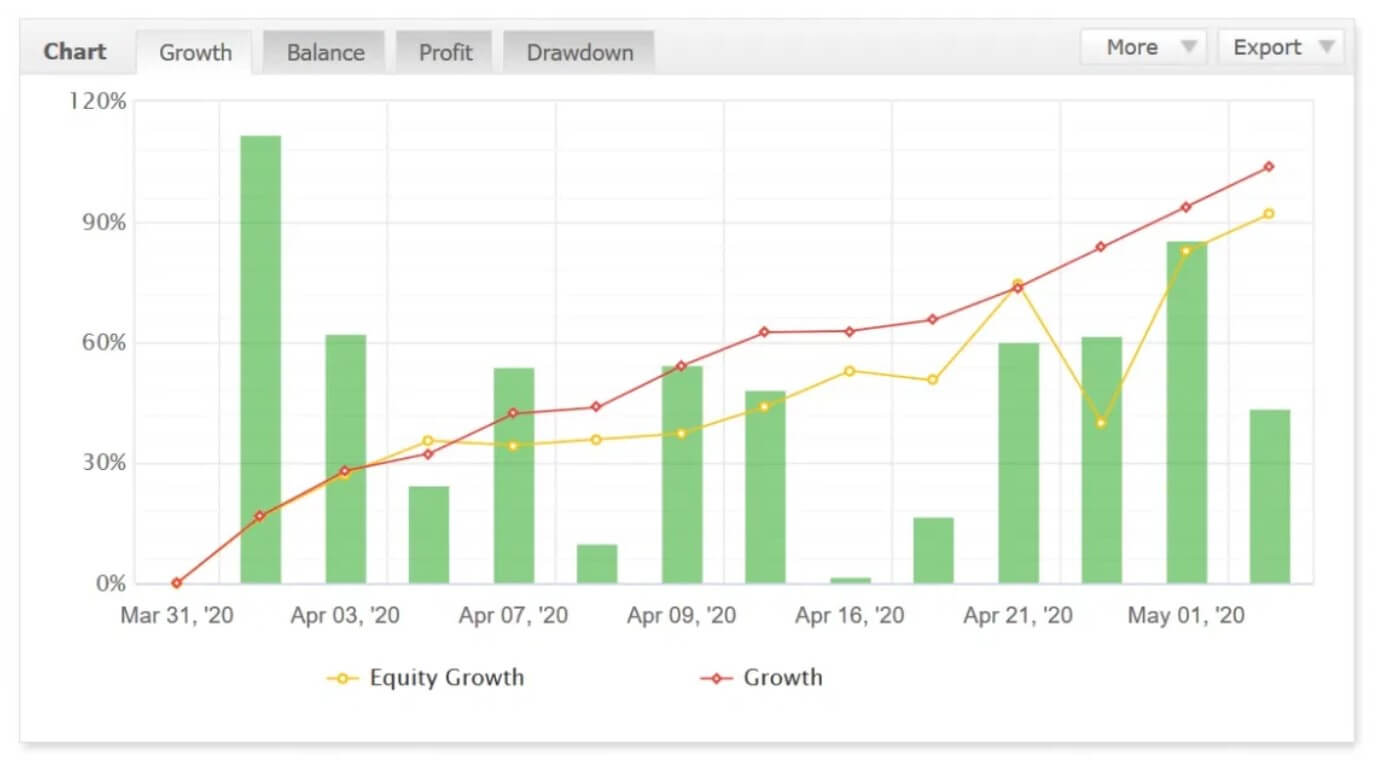

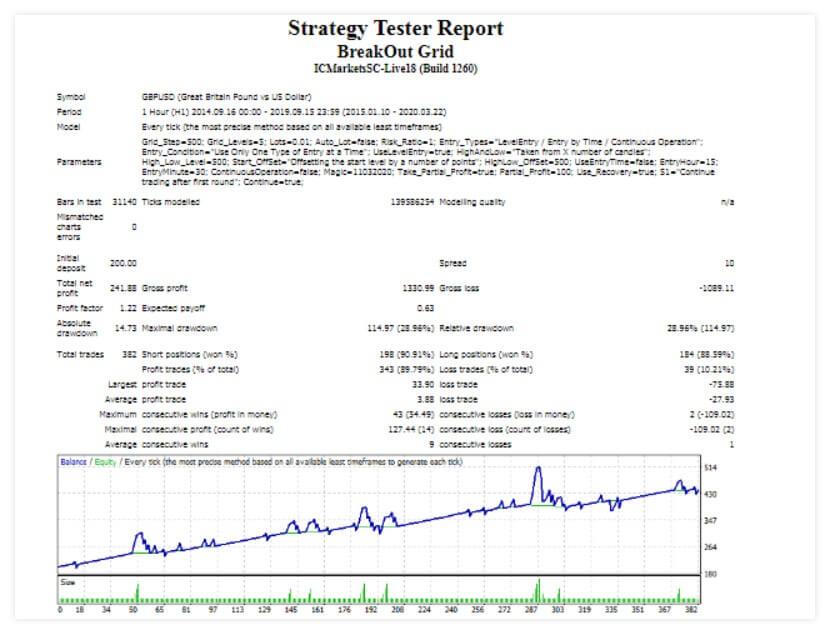

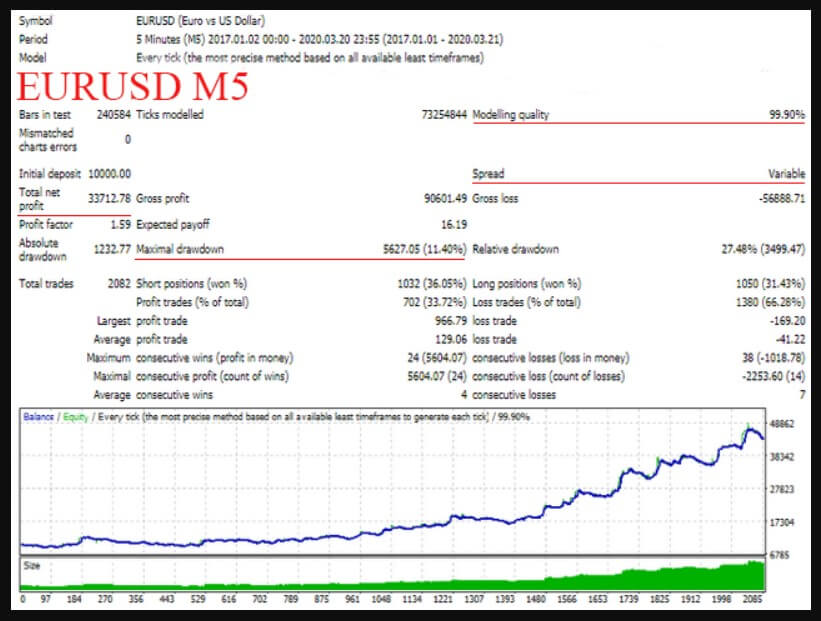

Stable Ex EA is a Forex trading robot that was created in March 2020 by German developer Vitalii Zakharuk. Vitalii Zakharuk is a prolific creator of automated trading tools and has many of them available on the MQL market.

Stable Ex EA is a Forex trading robot that was created in March 2020 by German developer Vitalii Zakharuk. Vitalii Zakharuk is a prolific creator of automated trading tools and has many of them available on the MQL market.