20 This is a MetaTrader 4 Expert Advisor that uses the popular “hamster” name commonly attributed to scapers working during night sessions or in very low volatility periods. The latest version is Version 9.0 updated on 9th June 2019, the first version was published in late 2017. Also, there is the MT5 version. Since then the EA received a few upgrades including the ATR filtering. The Author is a Russian named Ramil Minniakhmetov, he is the developer of 22 other products and 2 signals such as Rebate Robot, Brazil System, EA Black Star, or “TheFirst” signal service. Most of his work has above 4-star reviews on the MQL5 repository. His website is www.orangeforex.ru.

This is a MetaTrader 4 Expert Advisor that uses the popular “hamster” name commonly attributed to scapers working during night sessions or in very low volatility periods. The latest version is Version 9.0 updated on 9th June 2019, the first version was published in late 2017. Also, there is the MT5 version. Since then the EA received a few upgrades including the ATR filtering. The Author is a Russian named Ramil Minniakhmetov, he is the developer of 22 other products and 2 signals such as Rebate Robot, Brazil System, EA Black Star, or “TheFirst” signal service. Most of his work has above 4-star reviews on the MQL5 repository. His website is www.orangeforex.ru.

Overview

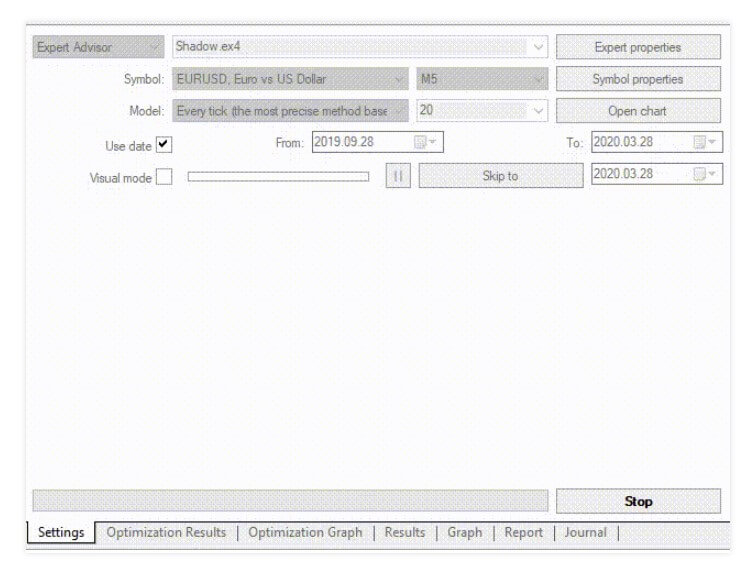

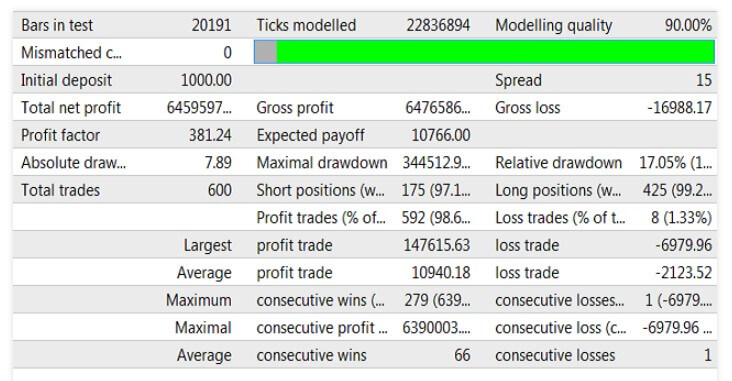

Hamster Scalping EA is fully automated and does not use the martingale strategy. Martingale is a known method of investment for many years and is allowed in casinos and other gambling institutions since it always ends with a loss. This type of EAs which use night time scalping is probably the most dominant on the market. Hamster Scalping is using two indicators, the RSI and the ATR. RSI is used to provide a signal on the 5M timeframe to which the EA is designed to and on the EUR/USD currency pair GMT+2. ATR is used to filter the signal if the volatility is too high. Since this kind of scalping is very sensitive and any bigger movements can throw off the indicators, ATR is one of the better indicators used for this purpose.

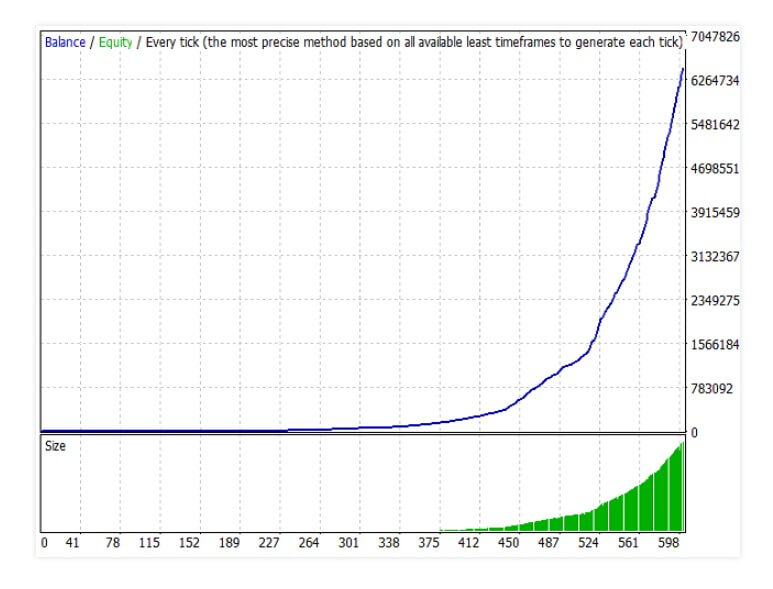

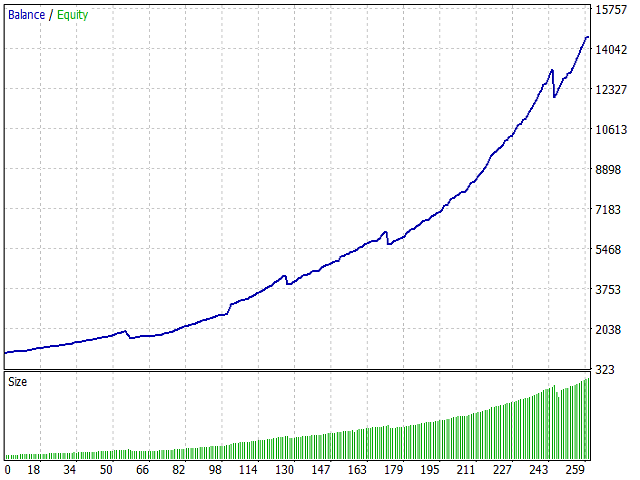

The development of this EA took almost 4 years, much longer than the typical night scalper. Hamster Scalping’s performance is variable but according to the author’s readings, it is highly profitable but with a high drawdown of more than 50%. This is typical for EAs that allow relatively high Stop Loss tolerance to close the trade in small profit after a rebound if it happens at all. It is not unusual to see two Stop Loss triggers to counter several weeks of profit trades.

General recommendations are $100 minimum deposit with an ECN broker with fast execution times and low spreads, up to 5 points. If you are using VPS, the latency must not be higher than 3ms. Brokers with 4 or 5 digit price quoting will work, settings value entry should be in points regardless. The EA allows for enough customization although tempering even in small amounts may result in a very different performance.

Hamster Scalping allows changing the periods for both ATR and RSI, signal levels, Autolot size calculation, Take Profit and Stop Loss levels, Virtual Stop Loss or Take Profit (it is not relayed to the broker server, it is internally set instead thus invisible for the broker), and almost every function of the EA is configurable. The EA also features the newsreader, that can be adjusted to filter trading for high, mid, and even low impact news. The news feed comes from the ec.forexprostools.com, so it is not the most popular news feed media. Some additional tweaking is required to set this in the EA settings. You can set to avoid Wednesday triple swaps, although some brokers have this on Fridays.

Hamster Scalping is a relatively simple EA with a good amount of testing behind it and is not abandoned by the devs in favor of new products. Most of the developers and companies decide to focus efforts on more complex EA after initial success and often leave some good EAs outdated and unreliable to new market conditions. It is a good sign to see this simple EA recently updated.

Service Cost

Hamster Scalping price is $99 to buy and $45 per month if you rent it. For this, you will have 5 activations. The demo is available. This price is not high but compared to other night time scalpers it is in the mid-range. Still, since it has a good amount of testing and is being updated, it is well worth the money, especially if the demo works for you.

Conclusion

The attention this EA has received is high. There are over 20,000 comments on it and over 500 user reviews. On average the score is 4.4 at the moment of this review which is very good, there is a good number of reviews so the rating is based on a large sample, confirming a solid user satisfaction. Although, on the side, some of the reviews could be based on short term EA usage, where bad trades did not yet happen. Some of the notable negative reviews are mentioning the high Stop Loss tolerance, for example:

“Too risky!! BIG STOP LOSS…small profits..no loss position management…It’s a lottery!”

Or a 4-star review from Dhruv Patel:

“A lot of people with 1 star review are correct with their experiences with this EA. However, this EA has a lot of potential. I have made modifications to the set and put external measures in place to avoid those disastrous trades that gave this EA 1 star and backtested for 9 years. It works like a charm! Money management is crucial with this EA. This EA does not manage the big losses well, thus human intervention is required.”

Our recommendation is to try the default settings on the demo account, both backtest and forward test. The price of $99 is probably low enough for this EA to repay itself a few times over.

This Forex service can be found at the following web address: https://www.mql5.com/en/market/product/25853

The latest version is 2.4 updated recently, on the 10th of March 2020 during the latest COVID-19 world market event. The base code and idea of this EA are not new from the author, the previous product called NY Close Scalper is using the same principles except Density Scalper is optimized for better slippage management. Therefore the release date does not mean the EA does not have enough forward testing done.

The latest version is 2.4 updated recently, on the 10th of March 2020 during the latest COVID-19 world market event. The base code and idea of this EA are not new from the author, the previous product called NY Close Scalper is using the same principles except Density Scalper is optimized for better slippage management. Therefore the release date does not mean the EA does not have enough forward testing done.

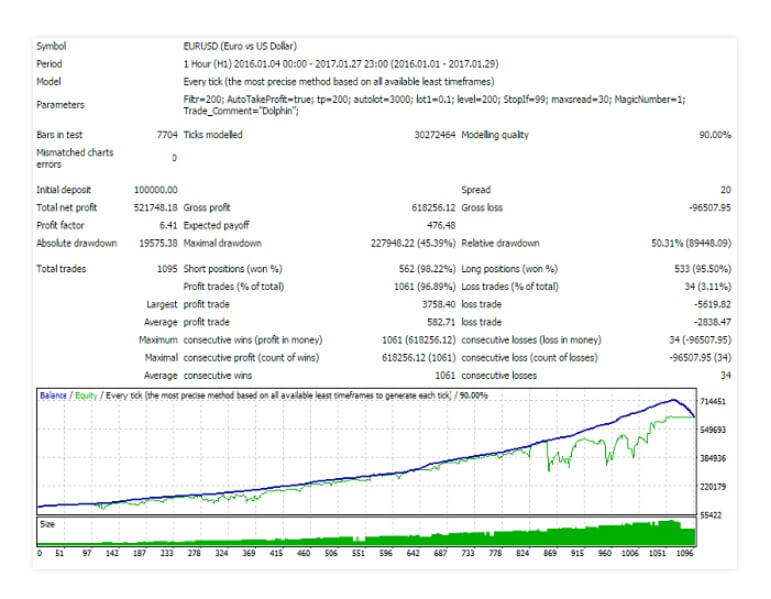

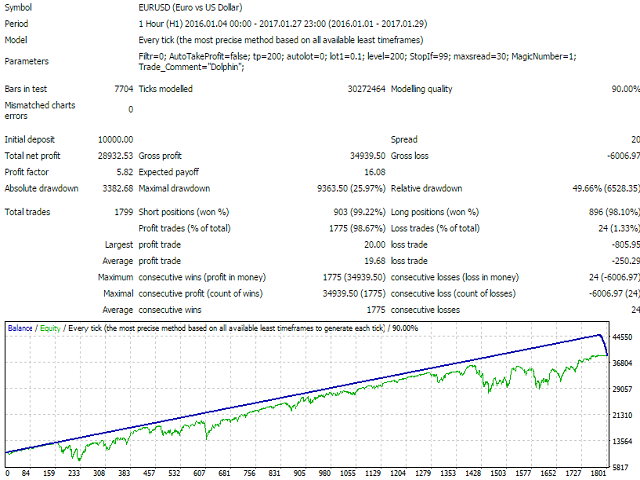

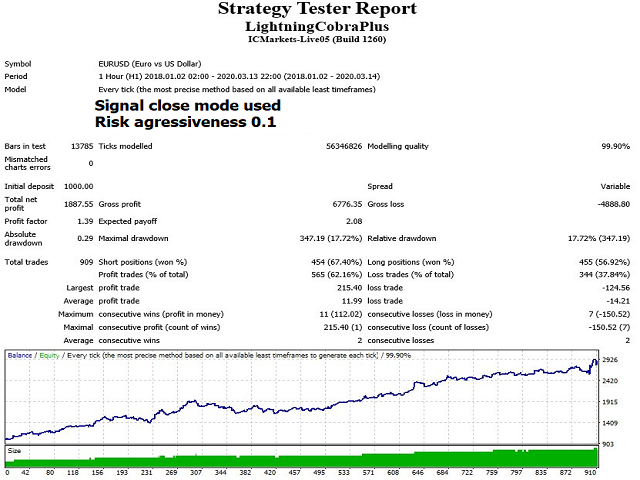

Do IT is an Expert Advisor developed for the MetaTrader 4 platform and is published on the MQL5.com by Ildar Kabirov from Russia. The EA is also available for the MT5. The latest version is 7.77 updated in March 2020. Ratings received are generally positive and there is a high activity in the comments section. Do IT is designed to be fully automated and specialized for Forex, and indices on the 1H timeframe.

Do IT is an Expert Advisor developed for the MetaTrader 4 platform and is published on the MQL5.com by Ildar Kabirov from Russia. The EA is also available for the MT5. The latest version is 7.77 updated in March 2020. Ratings received are generally positive and there is a high activity in the comments section. Do IT is designed to be fully automated and specialized for Forex, and indices on the 1H timeframe.

This EA is based on several trading algorithms and designed for major currency pairs. It is not known how it works or what is the strategy behind it. What is certain is the absurd price and the extremely low rating raising the question if this is a serious offer after all. The latest version is 2.4 updated in October 2019 with the additions of controlling module that adapts to trading conditions. Also, some new settings are added for better risk management. The initial version is published on 11th June 2019 by the developer Aleksandr Shurgin from Russia.

This EA is based on several trading algorithms and designed for major currency pairs. It is not known how it works or what is the strategy behind it. What is certain is the absurd price and the extremely low rating raising the question if this is a serious offer after all. The latest version is 2.4 updated in October 2019 with the additions of controlling module that adapts to trading conditions. Also, some new settings are added for better risk management. The initial version is published on 11th June 2019 by the developer Aleksandr Shurgin from Russia.

This product does not leave enough information for a trader to understand what kind of Expert Advisor Big Bang MT4 is. Nothing is disclosed about the indicator used or the system, even the settings range does not point to a specific strategy used. However, the EA is new, from April 2020 and probably the Overview page will be updated. The updated version is already out on the MQL5 market, reaching label 1.2. The update contains major improvement, specifically the entry signal is improved and added the filter to only apply strong signals. This way the signals are more reliable although less frequent.

This product does not leave enough information for a trader to understand what kind of Expert Advisor Big Bang MT4 is. Nothing is disclosed about the indicator used or the system, even the settings range does not point to a specific strategy used. However, the EA is new, from April 2020 and probably the Overview page will be updated. The updated version is already out on the MQL5 market, reaching label 1.2. The update contains major improvement, specifically the entry signal is improved and added the filter to only apply strong signals. This way the signals are more reliable although less frequent.

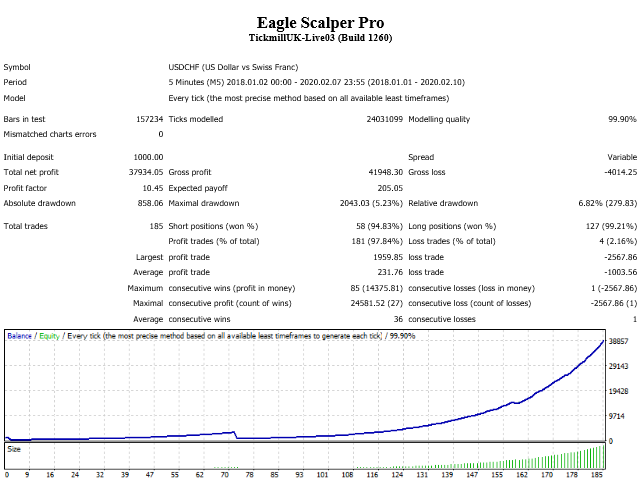

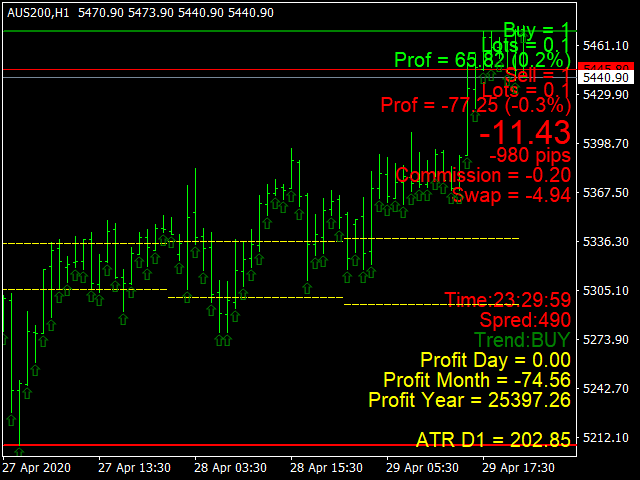

Eagle Scalper Pro is a new Expert Advisor published on the MQL5 market that reached significant popularity and user review rating already. The initial version was uploaded on the 10th of February 2020 and has been updated in March to the current 1.50 version. Updates are minor, just bug fixing and FIFO compatibility in case traders have this ordering method imposed by their broker. This EA belongs to the Trend Following strategy category and it is not frequently used the same as the scalper EAs. It does not use the Arbitrage method which is commonly frowned upon by brokers and traders alike.

Eagle Scalper Pro is a new Expert Advisor published on the MQL5 market that reached significant popularity and user review rating already. The initial version was uploaded on the 10th of February 2020 and has been updated in March to the current 1.50 version. Updates are minor, just bug fixing and FIFO compatibility in case traders have this ordering method imposed by their broker. This EA belongs to the Trend Following strategy category and it is not frequently used the same as the scalper EAs. It does not use the Arbitrage method which is commonly frowned upon by brokers and traders alike.

This EA belongs to the Grid strategies with integrated averaging. It is developed for the MetaTrader 4 platform by Sergey Kruglov from Russia. The initial version was published on 6th February 2017 on the MQL5 market set in the paid category. It is updated once in late 2017 adding a few functional averaging parameters such as Averaging Point, Averaging Take Profit points, and Auto Averaging. Sergey Kruglov has 26 other products on the market but none of them have any notable ratings or popularity. He seems to develop mostly Grid-based EAs.

This EA belongs to the Grid strategies with integrated averaging. It is developed for the MetaTrader 4 platform by Sergey Kruglov from Russia. The initial version was published on 6th February 2017 on the MQL5 market set in the paid category. It is updated once in late 2017 adding a few functional averaging parameters such as Averaging Point, Averaging Take Profit points, and Auto Averaging. Sergey Kruglov has 26 other products on the market but none of them have any notable ratings or popularity. He seems to develop mostly Grid-based EAs.

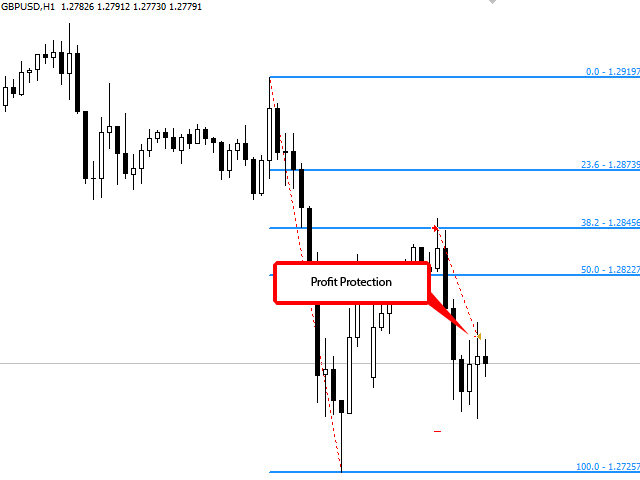

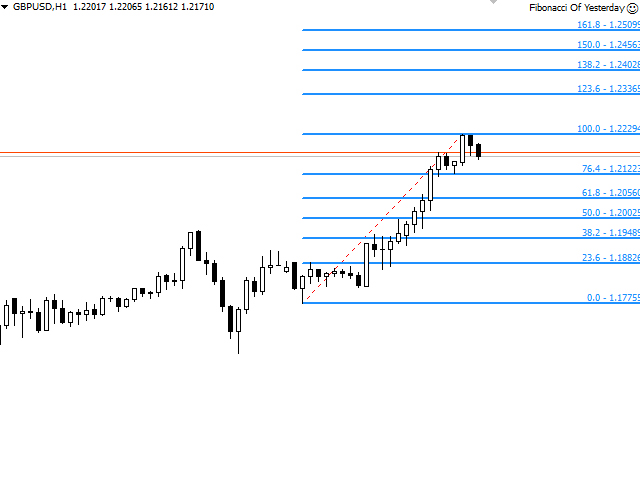

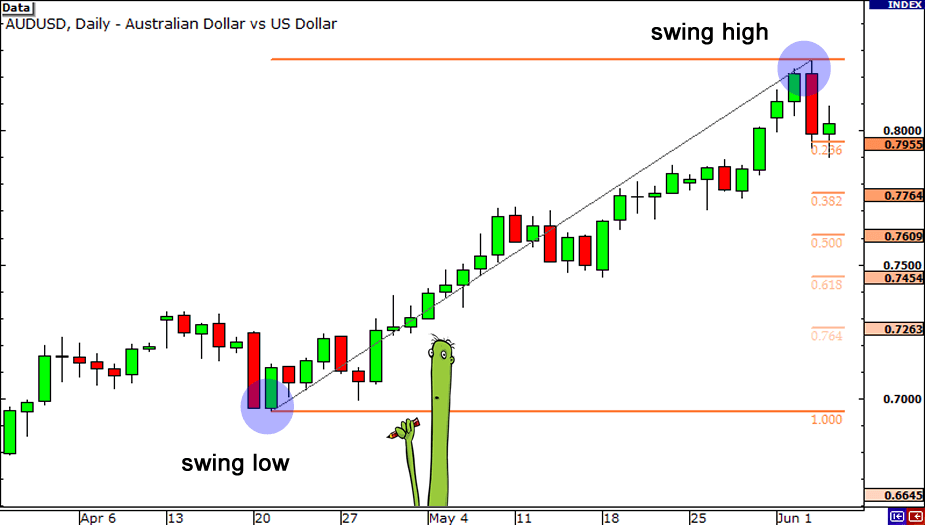

Eng GBP is a modest product by a Kuwait developer using a breakout strategy with Fibonacci levels. This Expert Advisor for the MetaTrader 4 is new, published on the 5th of April 2020 on the MQL5 market. It has no updates yet although it is evident Ahmad Alsaegh, the author of Eng GBP, is still testing new settings and uploads them in the Comments section. He has one other product also specialized for certain Indicies, using a similar breakout strategy. Eng GBP, as the name applies, is specialized for the GBP/USD currency pair although the author states it is suitable for all currency pairs. The Overview page does not have enough information about how the EA is working or anything about the set of indicators aside Fibonacci. According to the settings, it is clear additional Risk management tools are integrated.

Eng GBP is a modest product by a Kuwait developer using a breakout strategy with Fibonacci levels. This Expert Advisor for the MetaTrader 4 is new, published on the 5th of April 2020 on the MQL5 market. It has no updates yet although it is evident Ahmad Alsaegh, the author of Eng GBP, is still testing new settings and uploads them in the Comments section. He has one other product also specialized for certain Indicies, using a similar breakout strategy. Eng GBP, as the name applies, is specialized for the GBP/USD currency pair although the author states it is suitable for all currency pairs. The Overview page does not have enough information about how the EA is working or anything about the set of indicators aside Fibonacci. According to the settings, it is clear additional Risk management tools are integrated.

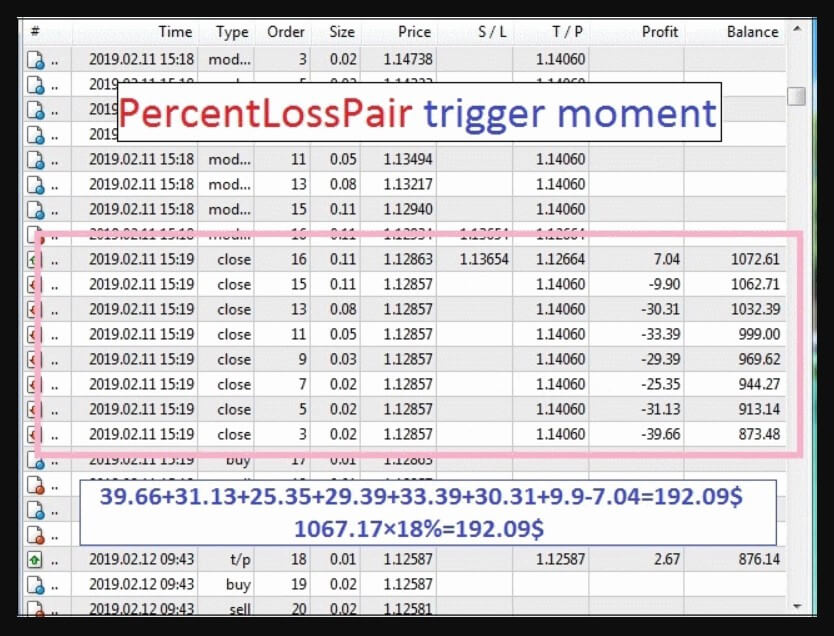

This is one of the most popular Expert Advisors that implement the Grid and the Martingale methods without using any indicators. Brazil System Premium is designed for the MetaTrader 4 platform and published on the MQL market in the paid category. This EA appeared on 11th October 2016 and has been updated many times, finalizing with version 13.0 from the 6th of April 2020. The updates contained bugfixes, additional functionalities, and optimizations.

This is one of the most popular Expert Advisors that implement the Grid and the Martingale methods without using any indicators. Brazil System Premium is designed for the MetaTrader 4 platform and published on the MQL market in the paid category. This EA appeared on 11th October 2016 and has been updated many times, finalizing with version 13.0 from the 6th of April 2020. The updates contained bugfixes, additional functionalities, and optimizations.

Judging by the provided video presentation on the Overview page of Greed GvGold for MT4 platform, this is a grid-like channel breakout strategy used with mixed performance results. Its first appearance was on the MQL5 marketplace in late March 2020, without much attention from the users. A couple of weeks later, it has been updated to version 2.1 introducing new features that dramatically change the final results from backtesting. It looks like the product was released in an incomplete stage or still in the testing.

Judging by the provided video presentation on the Overview page of Greed GvGold for MT4 platform, this is a grid-like channel breakout strategy used with mixed performance results. Its first appearance was on the MQL5 marketplace in late March 2020, without much attention from the users. A couple of weeks later, it has been updated to version 2.1 introducing new features that dramatically change the final results from backtesting. It looks like the product was released in an incomplete stage or still in the testing.

The Final Code is a relatively new EA without a clear description of how it works or any meaningful overview. It is made by Vitalii Zakharuk who has at least 46 products put into the MQL5 market. Final Code EA is published on 9th February 2020 without any updates so far. Based on what we have seen in the screenshots, The EA is a fast reversal strategy scalper working on lower timeframes. It belongs to the paid category and has no reviews or comments to date. The overview page presentation is very ambiguous, lacks even the elementary highlights, certainly inappropriate for the price set.

The Final Code is a relatively new EA without a clear description of how it works or any meaningful overview. It is made by Vitalii Zakharuk who has at least 46 products put into the MQL5 market. Final Code EA is published on 9th February 2020 without any updates so far. Based on what we have seen in the screenshots, The EA is a fast reversal strategy scalper working on lower timeframes. It belongs to the paid category and has no reviews or comments to date. The overview page presentation is very ambiguous, lacks even the elementary highlights, certainly inappropriate for the price set.

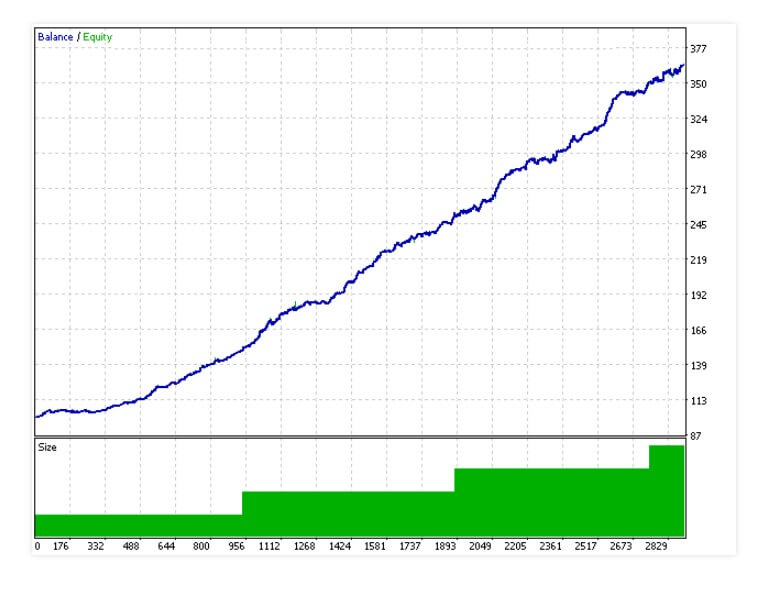

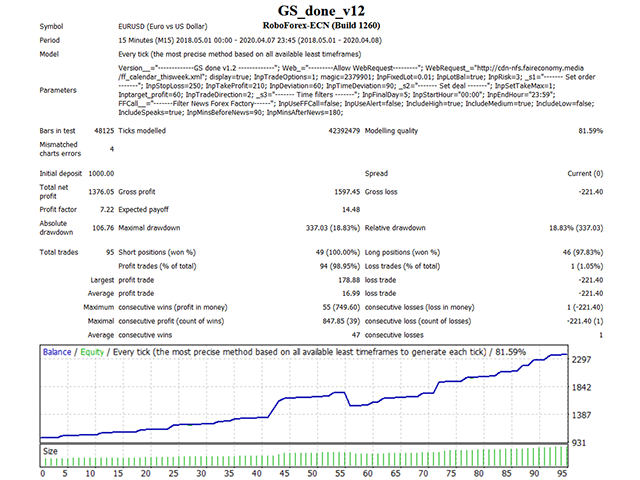

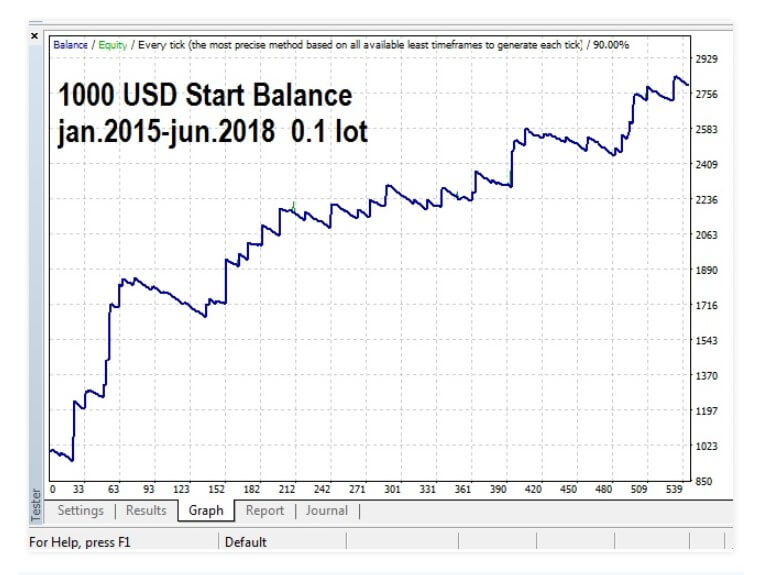

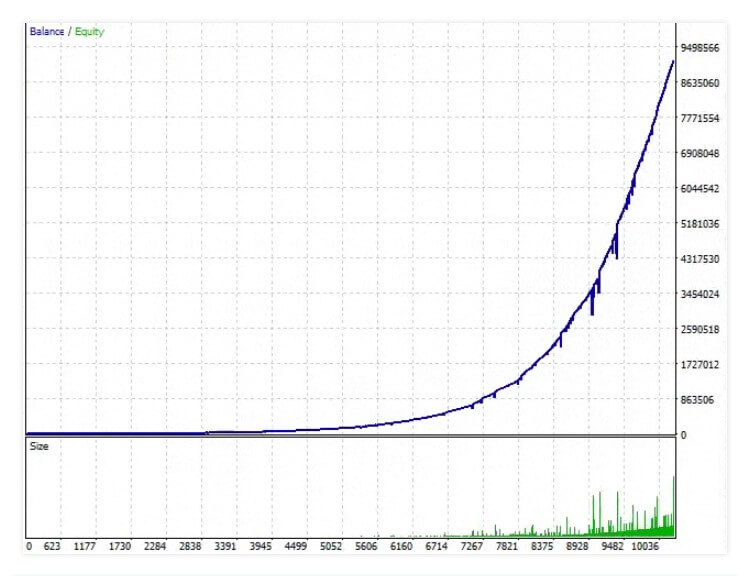

GS Done is an Expert Advisor made for the MetaTrader 4 platform that does not use Martingale or Grid methods in its strategy. The exact strategy and indicators used are not disclosed in the Overview page for this product published on the MQL5 market. The developer is Aleksander Gladkov from Russia, who has 11 product total on the market. This author is relatively new on the scene, only a handful of products have received attention form the community. Other products use Martingale methods in his EAs, but this one is different.

GS Done is an Expert Advisor made for the MetaTrader 4 platform that does not use Martingale or Grid methods in its strategy. The exact strategy and indicators used are not disclosed in the Overview page for this product published on the MQL5 market. The developer is Aleksander Gladkov from Russia, who has 11 product total on the market. This author is relatively new on the scene, only a handful of products have received attention form the community. Other products use Martingale methods in his EAs, but this one is different.

Based on the information and the settings for this EA we have determined it is using a channel breakout strategy for trade entries with several modifications and indicator combos for Risk Management and exits. HitAndRun is developed by Catalin Zachiu from Romania who has at least 26 other products, a couple of them having notable popularity and high ratings. The initial version of HitAndRun was published on the MQL5 market for the MetaTrader 4 platform on 10th February 2019. Updates are frequent with many new functionalities, the latest version 3.6 is from 31st of March 2020. The author’s dedication is notable as it is also evident in the comments page with the users. This EA is in the paid category but also has a free version linked.

Based on the information and the settings for this EA we have determined it is using a channel breakout strategy for trade entries with several modifications and indicator combos for Risk Management and exits. HitAndRun is developed by Catalin Zachiu from Romania who has at least 26 other products, a couple of them having notable popularity and high ratings. The initial version of HitAndRun was published on the MQL5 market for the MetaTrader 4 platform on 10th February 2019. Updates are frequent with many new functionalities, the latest version 3.6 is from 31st of March 2020. The author’s dedication is notable as it is also evident in the comments page with the users. This EA is in the paid category but also has a free version linked.

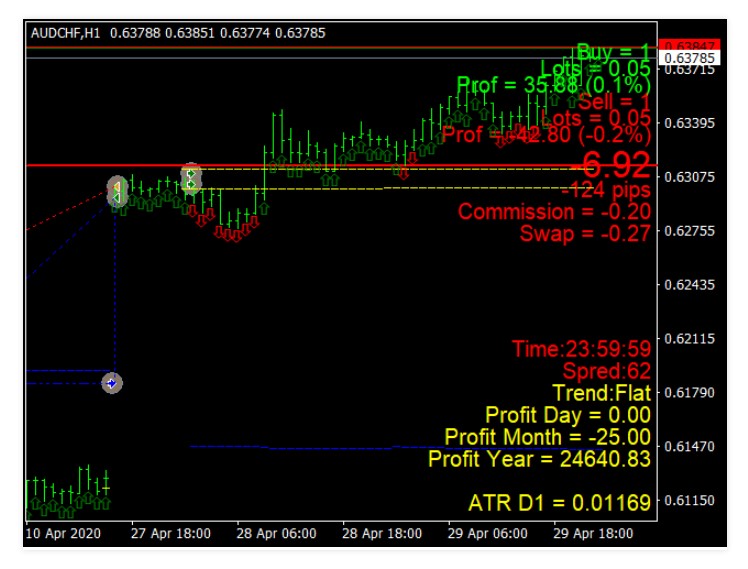

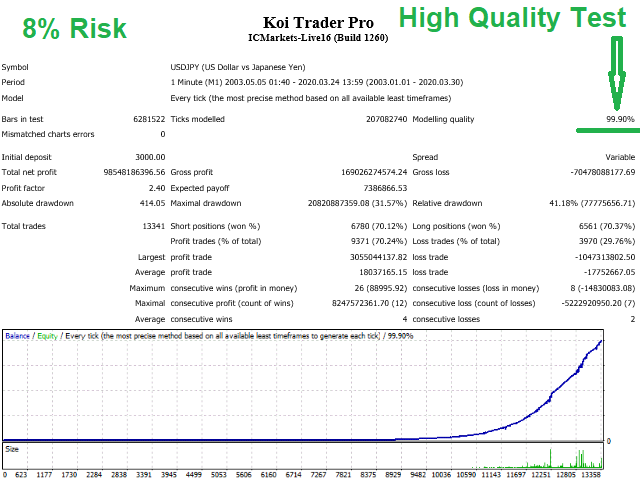

The developer of this Expert Advisor for the MetaTrader 4 platform has received some attention from the MQL5 community publishing many EAs with great ratings. Koi Trade Pro is Michaela Russo’s newly developed EA released on the 28th of March 2020. It is a trend-following EA that is not suited to higher timeframes and has plenty of settings. Since the EA is new it is still waiting for updates, however, it has received comments and reviews already. Michaela Russo has 20 total products published on the

The developer of this Expert Advisor for the MetaTrader 4 platform has received some attention from the MQL5 community publishing many EAs with great ratings. Koi Trade Pro is Michaela Russo’s newly developed EA released on the 28th of March 2020. It is a trend-following EA that is not suited to higher timeframes and has plenty of settings. Since the EA is new it is still waiting for updates, however, it has received comments and reviews already. Michaela Russo has 20 total products published on the

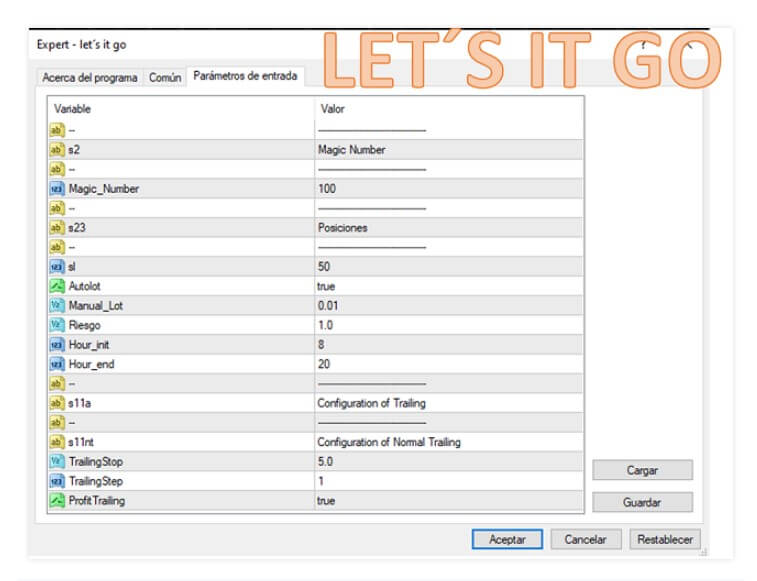

This version of the Let’s Do it EA is designed for the MetaTrader 4 platform and published on the MQL5 market as a simple averaging method EA for beginners. There are no specific traits about this EA and probably it is meant to avoid the promotion of any content that they could not consume. Let’s Do it is developed by Marta Gonzalez from Spain who has at least 53 products published on the MQL5 market and mostly works as a freelance programmer receiving good ratings. The first version of this EA is published on the 8th of February 2020, it is a new product with one update bringing the current version to 1.1. The update contains just the adaptation to Asian traders.

This version of the Let’s Do it EA is designed for the MetaTrader 4 platform and published on the MQL5 market as a simple averaging method EA for beginners. There are no specific traits about this EA and probably it is meant to avoid the promotion of any content that they could not consume. Let’s Do it is developed by Marta Gonzalez from Spain who has at least 53 products published on the MQL5 market and mostly works as a freelance programmer receiving good ratings. The first version of this EA is published on the 8th of February 2020, it is a new product with one update bringing the current version to 1.1. The update contains just the adaptation to Asian traders.

Shark is a relatively new Expert Advisor or automated software designed for the MetaTrader 4 platform. It is published on the MQL5 market by Yongzhi Wu from China on 10th December 2019. It has not received any updates yet and is not popular on the scene. Based on the somewhat roughly described Overview page, this EA is a scalper operating on specific currency pairs and timeframes. Even though scalper EAs are popular, this one missed its chance for various reasons. Notably, the developer has only published this product on the market that currently has no success. However, traders will not know how this EA is performing until they test it.

Shark is a relatively new Expert Advisor or automated software designed for the MetaTrader 4 platform. It is published on the MQL5 market by Yongzhi Wu from China on 10th December 2019. It has not received any updates yet and is not popular on the scene. Based on the somewhat roughly described Overview page, this EA is a scalper operating on specific currency pairs and timeframes. Even though scalper EAs are popular, this one missed its chance for various reasons. Notably, the developer has only published this product on the market that currently has no success. However, traders will not know how this EA is performing until they test it.

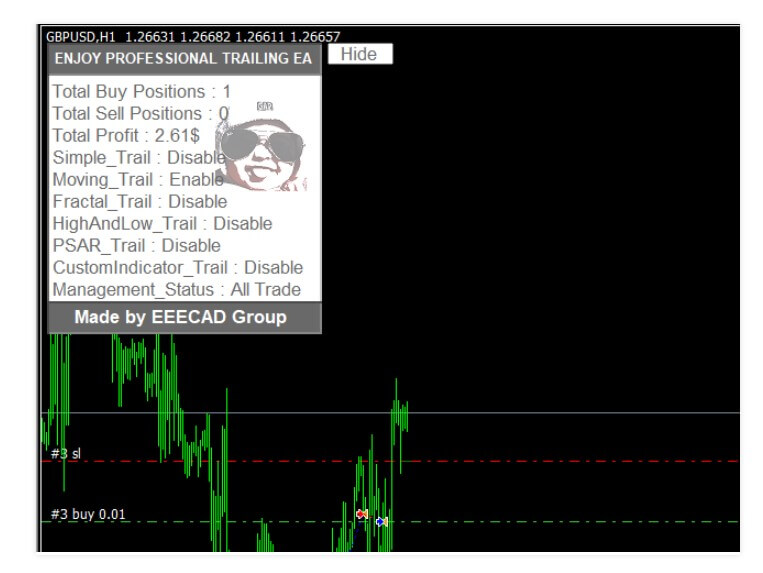

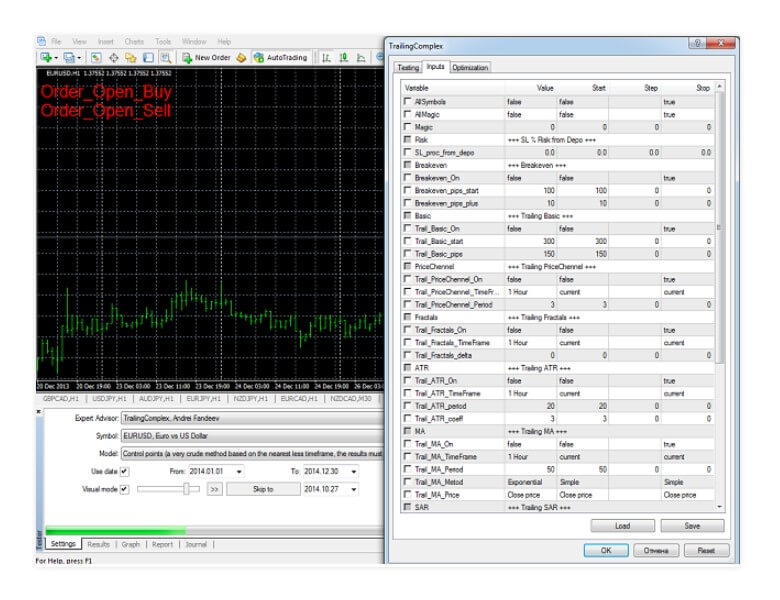

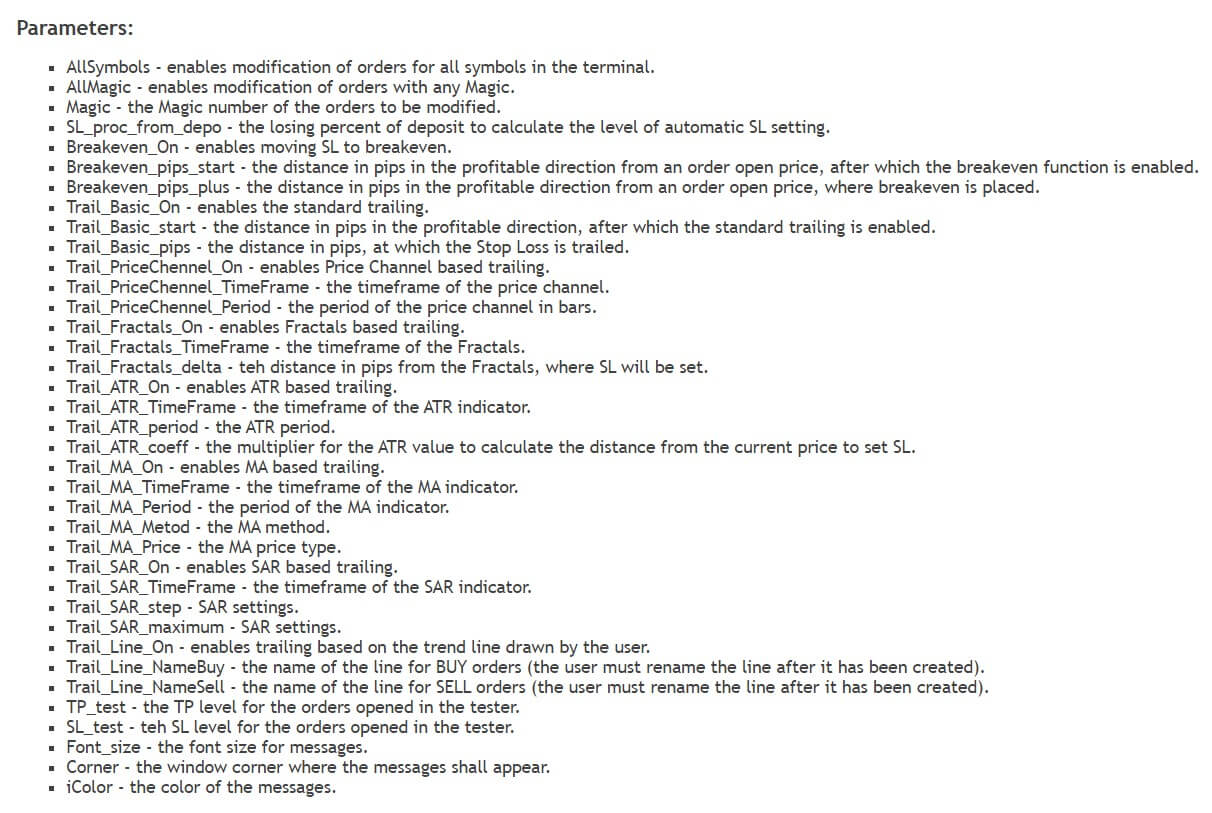

The Trailing Complex EA is not related to independent automated trading but to Trailing Stop Loss management with 9 variants and combinations. The tool is designed for the MetaTrader 4 platform that does not feature such advanced options for trailing. Trailing Stop is one of the most sought out and used elements of trading systems using any strategy. There are many similar tools although this one is very affordable.

The Trailing Complex EA is not related to independent automated trading but to Trailing Stop Loss management with 9 variants and combinations. The tool is designed for the MetaTrader 4 platform that does not feature such advanced options for trailing. Trailing Stop is one of the most sought out and used elements of trading systems using any strategy. There are many similar tools although this one is very affordable.

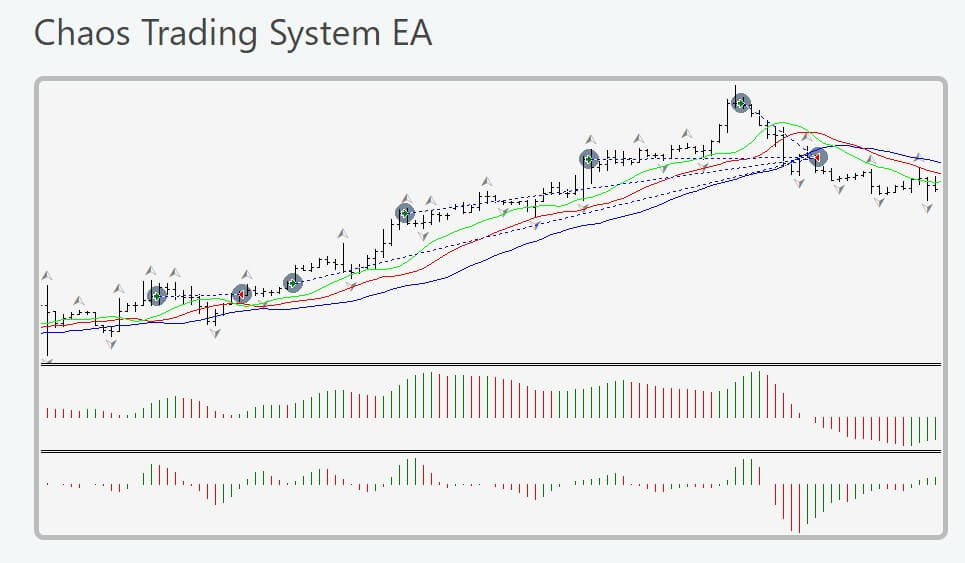

Moving Averages are the elementary indicators with many variations and used almost in every trading system. Adding multiple MAs with different settings and calculations could result in complete trading systems. Triple Moving Average EA MT4 is such an Expert Advisor designed for the MetaTrader 4 platform. It is developed by Jan Flodin from the Czech Republic who has 36 other products published on the MQL5 market, many of them are popular with great ratings.

Moving Averages are the elementary indicators with many variations and used almost in every trading system. Adding multiple MAs with different settings and calculations could result in complete trading systems. Triple Moving Average EA MT4 is such an Expert Advisor designed for the MetaTrader 4 platform. It is developed by Jan Flodin from the Czech Republic who has 36 other products published on the MQL5 market, many of them are popular with great ratings.