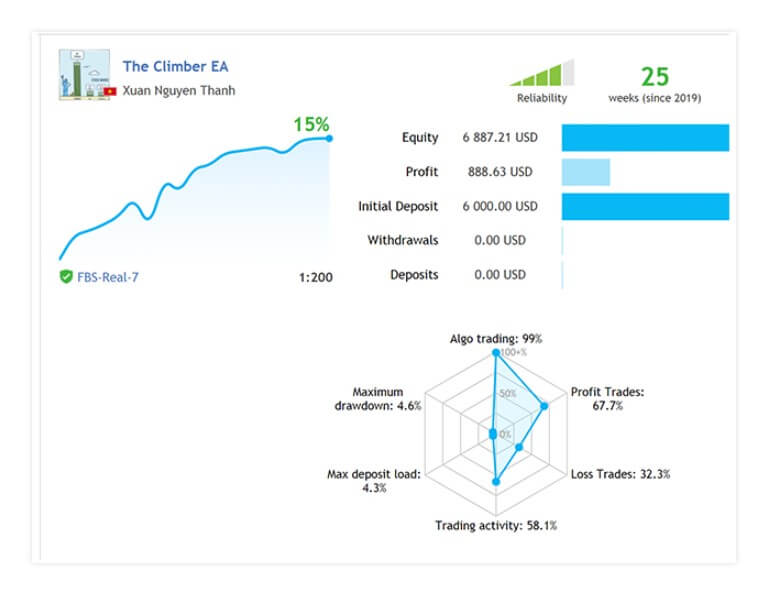

This is a composite strategy Expert Advisor for the MetaTrader 4 platform with several modules integrated. According to the short description, Price Action, Patterns, and Neural Networks are used in conjunction with the signal generation. The developer of Climber EA is Xuan Nguyen Thanh from Vietnam who has one other scalper EA published on the MQL5 market. Both EAs have their respective signal service too, which means a lot when buying EAs.

There are no updates yet, the initial version was released on 23rd of march 2020 and does not have any attention from the community yet. The Overview page is minimalistic, just a few lines about the EA, and the rest is about the settings range. To some traders, this is enough, with all the signal information, although it is not clear what exactly is the EA doing is unknown. However, the figures on the charts are showing low risk and stable gain.

Overview

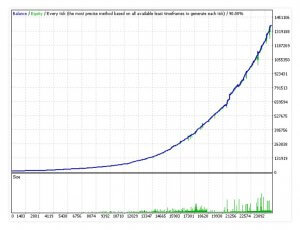

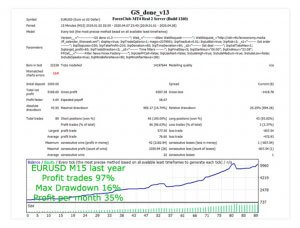

Unfortunately, The Climber EA could have more success at the start with a better presentation of the strategies. The Price Action element is probably the automatic Support and Resistance zones plotting and used as a filter not to enter Buy trades close to the Resistance zone and Sell trades close to the Support Zone. Patterns and Neural Network elements are responsible for the trade entry signals. These methods require and are based on past data patterns, and are good as the data stored in them is relevant to the current market conditions.

Recently, the forex and equity markets are having a sharp change in terms of volatility, making new patterns, as COVID-19 is also a new occurrence for the first time in 100 years. How this affects the EA and Neural Networks with past data can be seen in the current signal performance. AI is also stated as capable of learning. If this is correct, we should not see any drastic changes in the new market conditions. Based on the past position management list, we could see most of the trades EA made are coles by the Stop Loss order. This gives us a clue that the exit method is based purely on the Stop Loss. Interestingly, Take Profit is present but it is rarely triggered. Other indicators are not disclosed directly but are used to “balance the price”. This element could be a smoothing MA or a filter based on volatility, however, we could only guess.

At least the developer is transparent with the settings range. The automatic trade size allocation parameter (Auto Compound) and the lot size multiplier (Next Lot Size Multiplier) could implicate the EA uses a sort of Martingale recovery mode. The sharp dips and quick recoveries on the chart equity line cover this assumption. Take Profit is the classic, defined as fixed, in points. Interestingly, the Stop Loss parameter is not available, so we take it the EA uses his internal dynamic Stop Loss placement using the Support and Resistance Zones. Among the settings is also the RSI indicator parameter and it is related only to the RSI period. The RSI is probably used for filtering, signal confirmation, and the S/R Zones. There are no other options so traders will have to rely on these for backtesting, although, a small number of customizable variables are not a bad thing per se.

The Climber EA is very specialized. Its Neural Network data is only optimized for the EUR/USD currency pair and on the H1 timeframe. Whatsmore, the author recommends deposits from $2000 and for best results, $5000. Now, in addition to the already high EA price, you will need at least a few thousands more, creating one more barrier for this EA to breakthrough the MQL5 market. The author uses Tickmill and recommends NordFX broker too, however, the signals provided for his two published EAs do not use these with live accounts. By default settings, The Climber is good to go.

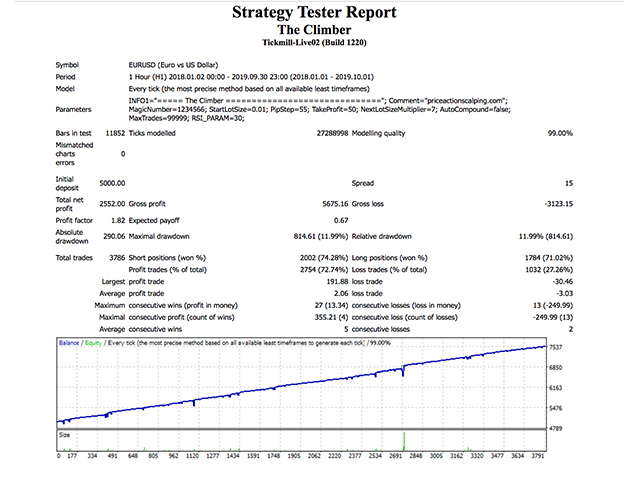

Before we go on to signal performance, we will take a look at the MT4 Strategy Tester backtesting results. For the period of 1 year, from 2018 to January 2019 on the recommended settings, the EA gained 2552 on the 5000 initial balance. Note that the testing period does not cover the latest 2020 events. Out of 3766 trades, 72.74% were successful or closed in profit. The maximal drawdown is 11.99% which is an acceptable level of risk regardless of the sharp dips in the balance graph. The average profit trade is 2.06 against the -3.03 loss. The average winning streak is 5 vs 2 meaning the EA has a solid loss control.

Service Cost

The signal service does not have subscribers yet but it is available for $200 per month. The demo has been downloaded 19 times which is very low, many low-quality products have better attention than this EA and this is probably because of steep requirements and high initial price. This is a composite strategy EA with Neural Networks optimization, meaning the price cannot be in the lower range. You will need $1500 to purchase without the option to rent it. A demo is available of course and you should also try to run the EA on a broker demo account too.

Conclusion

In the live signal results, The Climber EA has been engaged for 75 trading days till now. It made 62 trades per week since the 11th of March 2020. For this time the total growth is 19.30% meaning the new market events did not affect the EA, besides, the gains are better than in 2019. Even more impressive is the Drawdown of just 4.6%. The average results are in line with the MT4 backtesting with more info such as the average position holding time of 11 hours. This could mean you will need to be prepared to have an uninterrupted connection for 24 hours and possibly have swaps charged. Monthly growth is a solid 3.06% with the initial $6000 deposit and one $1000 withdrawal.

This Forex service can be found at the following web address: https://www.mql5.com/en/market/product/47140