Neural Network EA is not easy to code and even harder to optimize. Even if the core idea is effective, the EA design or strategy can be inadequate. Lightning Cobra Plus is a Neural Network EA based on patterns, probably Fractals or candlestick patterns although it is not known for what period. It is made for the MetaTrader 4 platform and published on the MQL5 market. The first appearance was on the 7th of January 2020, therefore it is a new EA. Be aware that the EA is developed and published before the recent global crisis that is drastically changing 2020 and is never seen before. This means the AI data is not quite relevant to 2020 conditions.

Overview

As Neural Network is essentially math for pattern recognition using the data inserted, the new factors are not in the data. The latest update form 21st of March 2020 contains an improved order module probably, for this reason, marking the EA to version 1.8. The developer of Lightning Cobra Plus is Kenneth Parling from Sweden who is a member of CS Robots specialized company. He has 45 products in total on the market, some with solid ratings. This EA still has to gain some popularity.

The Overview page which does not tell much about the EA additional indicators, states that the neural core is fed with data before the recent COVID-19 pandemic. Since there are no mentions of other accompanying indicators that improve on the strategy, it means traders using the EA may rely on the already unoptimized AI core. Lightning Cobra Plus features virtual market orders that are closed once the opposite signal appears, also knows as OCO. Even though the EA is described as having a high-performance risk assessment system that adapts, it remains uncertain how “adaptable” it is today.

It has an automatic lot allocation implemented based on the account balance. In the case of server connection loss, the EA will retain the pending orders using internal memory. Stop Loss and Take Profit orders can be set to hard or virtual mode. If your broker forces FIFO ordering, you can adjust the Adviser with that option in the settings and it will adapt.

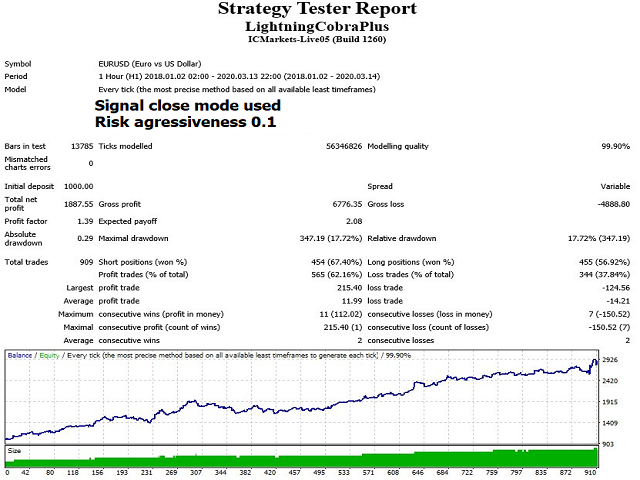

Lightning Cobra Plus seems to be optimized for the most traded currency pair, EUR/USD on the H1 timeframe. Low spreads and fast execution times are preferable, even the EA works on the H1. According to the author, the spreads play a large role in the overall performance. High leverage accounts and smaller deposits are advised with the risk set to $200/risk aggressiveness 0.1. Risk aggressiveness is a simple percentage-based lot allowance. There are no risky methods involved such as Martingale, limiting the number of opened orders to only per currency pair.

If you plan to use the EA on other pairs than EUR/USD you will have to find the optimal settings, firstly by using the pice calculation method with Open Prices or each tick. Other important settings are Weights. What are these factors remain unexplained, but according to the screenshots, there are 4 of them with the range from 1 to 200. If you want to change the working hours and disable Friday trading it is possible.

Service Cost

Neural Network EAs are usually more expensive, although Lightning Cobra Plus is in the mid-range with $99 to buy. You will have 5 activations and there is also an option to rent. One month rental is $15 and 3 months is $40. To some, it will probably be better to rent for just $15 and see it the EA has the real value now. The demo is downloaded 39 times meaning this EA has not reached the popularity boom and will probably stay in the outskirts.

Conclusion

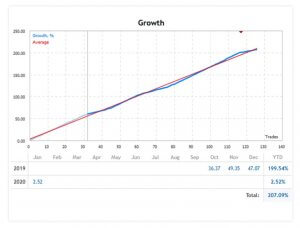

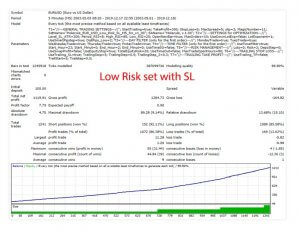

In the performance screenshots, we could see that the modeling quality is 99.9%, on the H1 timeframe and the ICMarkets servers. In roughly 2 years of testing, the EA made 1008 trades, 62.9% of them being in profit and pulled 16.69% Maximal drawdown. The average profit trade was lower than the average losing one, 9.18 versus -12.21. The final result is 1253 profit for the initial 1000 deposit. These results show too high drawdown for the gains. It would be interesting to see the chart for the first quarter of 2020. There are no user comments or reviews available at this time.

This Forex service can be found at the following web address: https://www.mql5.com/en/market/product/45088