Many developers would like to have a successful starting career on the MQL5 market as the developer of Prado and Prado Micro Expert Advisors. Both products are new, Prado Micro is published on 13th of March 2020, just a few days after the full version. The author of both is Tatyana Kulyapina from Russia, successfully launching her first products. Both are designed for the Metatrader 4 platform and they already have attention and some reviews. Whatsmore, they are updated and have new settings files attached in the Comments section for certain assets.

Prado Micro is updated on 4th April 2020 with new filters and settings files, raising the version mark to 2.2. Tatyana Kulyapina is also a Forex trader and seems to understand systematic, effective methods for Risk Management. The Overview page, unfortunately, does not disclose any indicators used or has any details about the strategy. We were able to extract some more information based on the published EA signal performance and statistics.

Overview

Prado Micro is just a Money Management deprived version of Prado. This is done for the cent account traders who do not need lot allocation methods. The trading methods for both EAs are the same. Based on the description, the essence of the EA is the breakout strategy. For each day, as stated, the extremes are measured based on which pending orders are placed, Buy Stop and Sell Stop. Once they are triggered, the EA takes over the management of the trend following. As stated, the EA does not use Martingale, Grid, any of the fast trading strategies or Averaging.

The exact indicators used for managing trades are not disclosed, but what is described in the settings looks serious, more than the usual we find with other EAs. For Prado Micro, the recommended initial deposit is $100 although since the recent increase in volatility the developer is now suggesting $500. FIFO ordering method will not invalidate the EA functioning.

Once the pending orders are placed, along with that Stop Loss and Take Profit, the rest is of the position is defined by the Trailing Stop. The exact positioning is probably done using the ATR indicator, as some of the settings deal with the coefficients or factors. It is known that the ATR factor such as 2x ATR or 1.5x ATR is used for placing Take Profit or Stop Loss, and in case of this EA, Buy and Sell Stop pending orders. Still, we can only guess as the developer clearly does not want to disclose this.

The settings panel is full of such parameters where you are not sure how they affect the EA. It is like pushing buttons without a clear label. For example, the TakeProfitCoef parameter by default is 12, but if we change it to six does it mean it is two times lower or deeper, or is it a multiplier of the ATR? The same is for the StopLossCoef, OpenOrderCoef, EveningCoef, and so on. In the comments section, no user has posed a question to the developer about this. However, few elements are certain. Prado micro has Trailing Stop customization, using the TralCoef, BoomCoef, BoomMinDistCoef, BoomMaxPrc, and TralBoomStep (stepping off the trailing). Similar parameters are optional for the Stop Loss and the Take Profit. Other settings are related to the slippage filtering, the EA starting and session finish tactics and hours, broker server time, and the info display by the Prado EA on the chart.

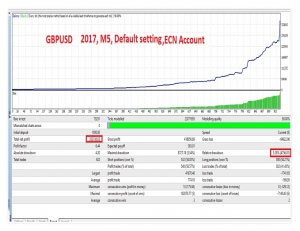

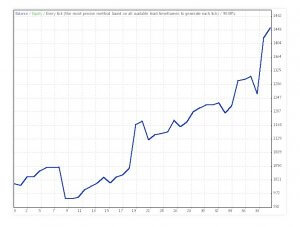

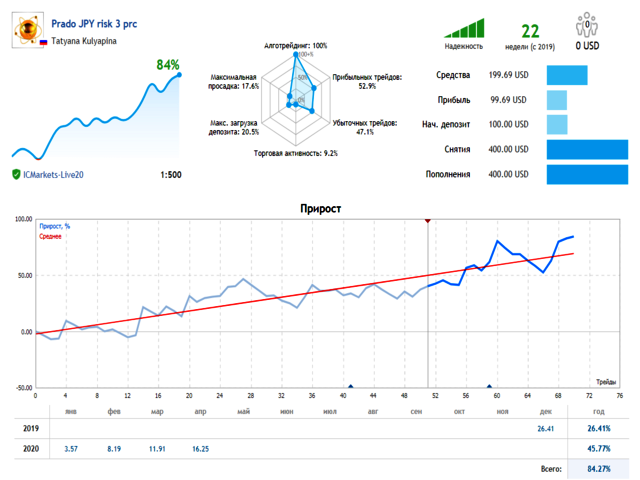

The performance charts show very good results for the Prado Ea on various assets and risk levels for the little time they have been put to work. The signal service on the MQL5 shows 4 types, Prado on XAU/USD using 3% risk, USD/JPY with 2%, 3%, and 5%. We will assess the one that has been the longest-running, the USD/JPY with 3% that has been working for 21 weeks. Right away we are somewhat intrigued by a mediocre trade success ratio of 52.4% and a medium maximum drawdown of 17.6%. This could point out that the EA has very good trade management and loss protection. Because the final result is a 69% gain till now. Prado EA enters only 3 trades per week, holding them for 3 hours on average.

Another interesting fact is that the statistics show “80% of the growth is achieved within 3 days. This comprises 2.11% of days out of 142 days of the signal’s entire lifetime.”. We are not sure if this is a false warning since the signal shows steady growth since 2019. The EA could still need time to stabilize the results or the latest results are caused by the extreme stir on the markets in the first quarter of 2020. Interesting results are also achieved in other categories, maximum consecutive wins are 6 vs 3 losses, the average profit is larger than the loss (8.03 vs -6.07) and the gross profit is 265.02 vs -182.15. The initial balance is 100.

Service Price

Prado Micro price is $145 with 5 activations and no rental options. The demo has been downloaded 55 times which is good for a new EA specialized for the micro accounts, without the Money Management module. This version even has 1 perfect review and one comment for a user.

Conclusion

As for the monthly gains, since 2019, in December it was 26.41%, January 3.57%, February 8.19%, March 11.91%, and partially April 6.46%. These results show consistency despite only 52.4% profitable trades. One of the most important elements of the system is the loss protection, Prado EA seems to excel here. Overall, Prado EA is a new kid on the block from a new developer that seems to know about trading, risk, strategies, and how to code them properly, although not very transparent. It is definitely worth testing and trying out.

This Forex service can be found at the following web address: https://www.mql5.com/en/market/product/47218