Prado is a newly released Expert Advisor for the MetaTrader 4 platform from a new developer that has already attracted some users. Prado EA is also developed for the Cent accounts under the name of Prado Micro, without the trade size dynamics function. It is just $5 cheaper so it is probably better to purchase the normal Prado EA. The developer of Prado is Tatyana Kulyapina from Russia with Prado EA as her main and only product published on the MQL5 market.

Prado’s first version is released on the 13th of March 2020, updating the EA with new functions and settings to the latest 2.2 version on the 4th of April. New iterations contain the fixed lot allocation option, spot Gold settings, some bugfixes, control options for the Stop Loss, Take Profit, and other pending orders, spread filter, and additional settings range.

Overview

As we take a look at the settings of the EA, we could say Money Management well developed implying the developer has some experience with trading. There are 4 signals provided with various risk exposures and assets Prado is engaged, giving traders a much-needed insight into how this EA performs. On the other hand, the Overview page will not disclose much about the EA, most of the content is just filled with links to the signals and setting files. Still, we were able to extract some information based on the settings panel.

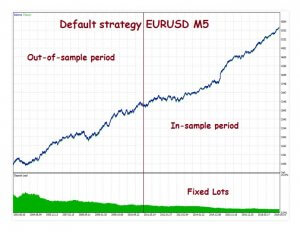

It is common to see the Russian language used in the Comments section and other pages when dealing with Russian speaking authors, making English a rare sight. Almost all content in the Comments section is like this so you might find it difficult to find some information. Prado’s main strategy is the daily breakouts followed by trailing stops and ATR managed risk exposure. Therefore, it is a slower trading EA with strict Risk Management, adaptive to volatility, with good exit signaling. All this combined draws a well-composed system with good figures in the backtesting charts.

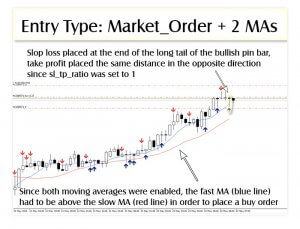

Once the EA is started, it will open Buy Stop and Sell Stop pending orders and the day extremes defined by the ATR or also called ADR (Average Daily Range) if set to the daily timeframe. Once the pending order gets triggered, Stop Loss and Take Profit are placed in with the composite Trailing Stop method trailing the price. Strategies like Martingale, Grid, or Averaging are not used here, Just breakouts on the ATR defined zone. Except for the obvious ATR indicator involvement, others remain undisclosed. One reason could be that the developer is not skilled with a presentation or English, but it could also be to refrain from the scary technical content.

Prado is described as a safe, FIFO compliant, volatility riding EA with a good loss control module. Interestingly, to understand the EA functioning, one could look at the EA thumbnail picture and see all the starting setup and the strategy to follow. After the Q1 2020 volatility jump caused by the COVID-19 in forex, commodity, and other markets, the developer posted a few screenshots of how the EA jumped into the action and resulted in a staggering gain. Still, now it is recommended to increase the minimum deposit to $500 from the initial $100.

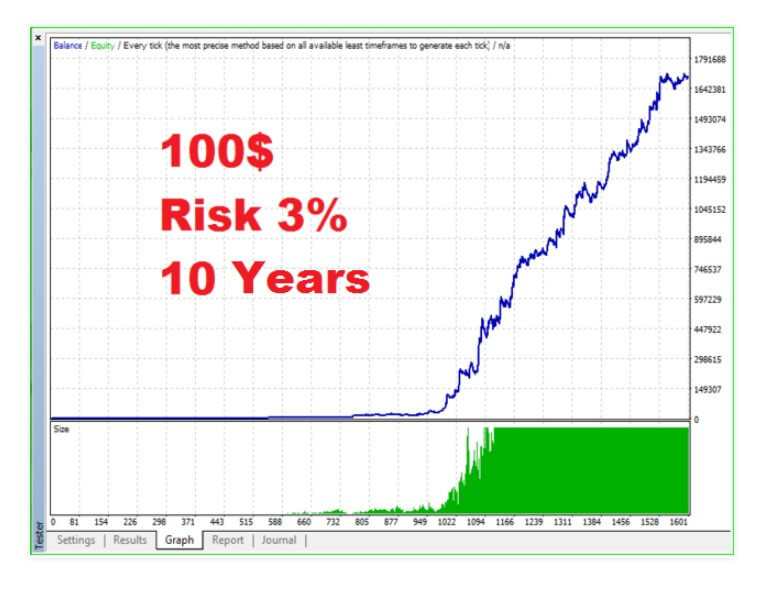

The default setting off the shelf is for the USD/JPY currency pair but there is no mention of the optimized timeframe. Settings for the spot Gold can be downloaded from the attached post in the Comments section, the link is provided. For testing purposes, it is recommended to count every tick and set it to the H1 timeframe. It is very likely the EA is most suited for this timeframe, as mentioned in the comments. Prado has a risk setting according to which you will have different backtesting gains. Of course, more risk percentages will result in bigger gains.

In the settings menu, you will have a lot of ambiguous parameters you will not get a feeling for backtesting purposes if you want to change it form the default levels. A few of the parameters are clear though. Risk is the exposure percentage of your balance for each trade, measure probably in Stop Loss distance in pips per dollar. LotFIxS is the classic lot allocation per amount from the account balance. The Stop Loss and Take Profit adjustments are made via the coefficient parameters which are not tangible.

The parameter values are not in pips obviously, so you will have to experiment with these as the formula is not disclosed. Other coefficient related parameters are OpenOrderCoef (2.0) for pending orders placement, the same description is given to the OrderCoefLevel, but this parameter is set to 0 by default. EveningCoef is another parameter affecting evening trading sessions but again, it is defined by the coefficient. TralCoef is the Trailing Stop factor, as well as the BoomCoef and the BoomMinDistCoef.

The coefficient is probably related to the same variable, most likely the ATR indicator, and this could be easily tested by comparing the values to the ATR current level on default settings. TralBoomStep is the classic step Trailing Stop jumping distance. There are other parameters related to the Trailing Stop such as BoomMaxPrc probably related to the price change percentage. This implies the EA is heavy with Risk Management measures as mentioned. Other settings are concerned with the slippage filter, EA working hours and evening tactics, comments plotting, and trade closing time point.

Prado performance is presented by 4 signals, and we will use these “forward” testing performance instead of the MT4 Strategy Tester results screenshots. On the IC Markets broker live account, Prado has gained 22% on the XAU/USD from the 4th of April 2020. This period is too short for any conclusions but the EA made 7 trades. Using the 3% risk scheme, 5 trades were in negative. This means Prado has a very sensitive trade exit, most likely the Trailing Stop. However, the 22% gain is generated by only 2 trades.

The average holding time is 4 hours making 3 trades per week. So entry timing is very careful, picking the right moments on the H1 timeframe. These two trades made a profit of $140.35 against -$73.41 5 losing trades. This caused a 16.7% drawdown which is acceptable for 22% monthly gain and a 3% risk scheme. Prado EA performance on the USD/JPY pair has almost the same gain on 3% and 5% risk. Both testings are on live accounts. The 3% signal shows 17.6% drawdown and 63% gain form the 15th of March 2020. When averaged, the EA made 15.33% per month, 5 trades per week, and 3 hours holding time. Profitable trades are almost on par with the losing ones, again demonstrating a great loss protection mechanism.

Service Cost

Prado price is $150 to buy with 5 activations and the Prado Micro is $145. Interestingly there are no options to rent the EA but the price is not an issue for most traders. The demo has been downloaded 379 times until now showing good attention in its early stage.

Conclusion

Prado has 7 reviews and all are positive, resulting in a perfect 5-star score. One of the more notable reviews reads as follows:

”That’s why I bought the EA: no risky tactics, no martingale, no grid, just pending and win or loss, well-calculated SL and well-calculated trailing stop. And now I’m looking forward to the results!”

Prado EA has a very sound strategy and great Risk management although it is not very friendly for optimization by users. Therefore, for now, it is best to use only the developer published settings files in the Comments section if you do not know how the settings affect the trading.

This Forex service can be found at the following web address: https://www.mql5.com/en/market/product/45995