The developer of this Expert Advisor for the MetaTrader 4 platform has received some attention from the MQL5 community publishing many EAs with great ratings. Koi Trade Pro is Michaela Russo’s newly developed EA released on the 28th of March 2020. It is a trend-following EA that is not suited to higher timeframes and has plenty of settings. Since the EA is new it is still waiting for updates, however, it has received comments and reviews already. Michaela Russo has 20 total products published on the MQL5 market and has 18 signal service using her products where you can follow their performance.

The developer of this Expert Advisor for the MetaTrader 4 platform has received some attention from the MQL5 community publishing many EAs with great ratings. Koi Trade Pro is Michaela Russo’s newly developed EA released on the 28th of March 2020. It is a trend-following EA that is not suited to higher timeframes and has plenty of settings. Since the EA is new it is still waiting for updates, however, it has received comments and reviews already. Michaela Russo has 20 total products published on the MQL5 market and has 18 signal service using her products where you can follow their performance.

Overview

The overview page for this EA is similar to the other products by this developer, it has a promotion for a free additional EA, brief EA explanation, and the settings range. The recommended currency pairs are mostly related to the JPY. These are USD/JPY and EUR/JPY set on the M1 timeframe. As a trend following system, it is hard to understand how the EA works in a highly volatile environment. Still, the EA performed exceptionally good in backtests.

Similar to some other products, it seems this EA is just an optimized version of the same trend following systems published by this developer. It is stated the EA uses AI that analyzes the market and predicts future trends. Ichimoku indicator is disclosed as the main trend confirmation element. Ichimoku Kinko Hyo is a multilayered indicator specifically designed for higher timeframes than M1. One of his main features is the cloud range and the Moving Averages with different calculations.

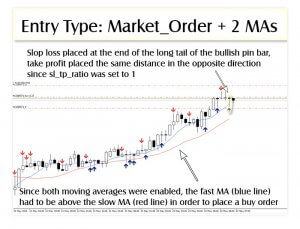

Moving Averages are the key for trend confirmation while other elements serve as filtering and to some extent trend prediction. This trend prediction element might be the one responsible for the EA algorithm decisions. The Ichimoku indicator will be visible on the chart once you attach the EA. Based on the animated screenshot, we could not see the direct influence of Ichimoku’s MAs to the trend entry, Koi Trader Pro acted more like a scalper on a trend than as a swing trading system. It traded frequently and used the averaging method with trade was negative.

https://youtu.be/sz9JgnQ_h44

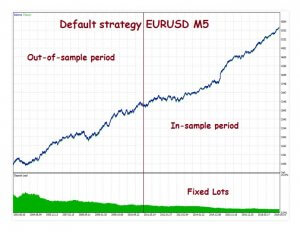

Recommendations for testing purposes is to start from 2013, the developer is proud to mention the EA has consistent results using precise testing modeling until now. The backtesting done in the MT4 Strategy Tester module is recorded and attached to the Overview page. Brokers most suitable are of course the ones with low spreads and fast execution times, important for scalpers, and fast-paced strategies like Koi Trader Pro applies. A minimum of $2000 is needed too. It will not matter if the broker is using the FIFO ordering methodology, the EA is compatible.

In the setting panel, you will see many parameters, some of them are directly tied to the Ichimoku element. The auto lot feature is integrated with the adjustable risk setting and fixed lot allocation if preferred. Spread filtering is done via the Spread Allowed clause, calculated in points after which no trades will be opened. Ichimoku settings are related to Tenkan Sen MA, Kijun-Sen, Senkou Span and Snekou Span B. Timeframe for Ichimoku is also adjustable which means the indicator may be based on higher timeframes than M1. Each day in the week can be set on or off. The EA also has some ordering management settings such as One trade for one bar, timeframe for EA First order, Max Orders number, Minimum Distance For secondary Positions, and so on.

Interestingly, these settings are not the usual and traders might be confused about what each parameter does as the explanation content is not useful. After further settings overview, we have noticed the One Trade Bar Grid clause which means the EA could use Grid methods aside from position averaging. Both methods are considered risky. Take Profit and Stop Loss management is implemented but without any trailing or advanced methods. You can adjust Take Profit with classical fixed range, close only on the bar end, first-order modifications, and similar.

Stop Loss is defined in a slightly different way. You will have a mix parameters for limiting the risk such as Enable Money Max Loss, Maximum Monetary loss, and close trading on Friday. News filter is added too, but you will have to insert the newsfeed link in the MT4, which is provided. Having the news filter means the algorithm is not suitable for high volatility. Still, the EA is optimized for Asian trading sessions. News filter can also be adjusted using the level of event impact, time pause after and before the news, and set the broker GMT.

Service Cost

Koi Trader Pro’s price is $150 with renting options. For one month the cost is $90 and $135 for one year. You will have 5 activations and a demo before you decide to buy where you can do your back and forward testing. Until now, the demo has been downloaded 107 times. The EA has received 3 reviews already giving it a perfect 5-star rating and 5 comments where users mostly asked for the free EA that comes along with the purchase of Koi Trader Pro.

Conclusion

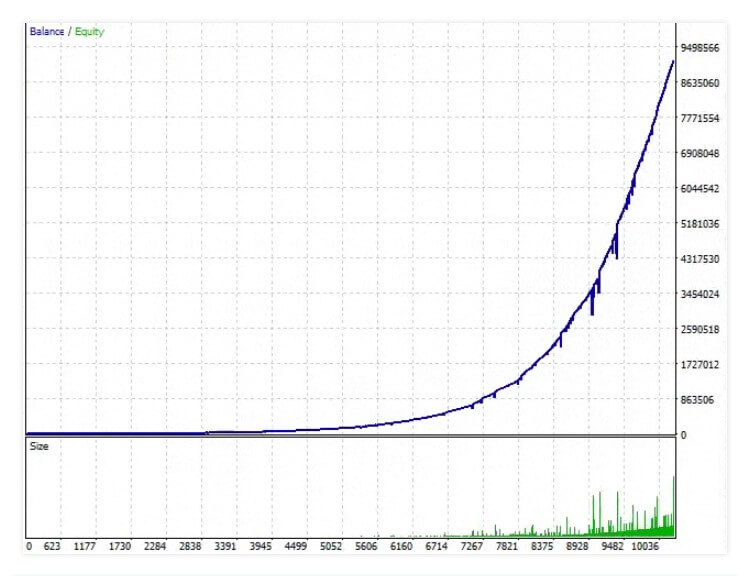

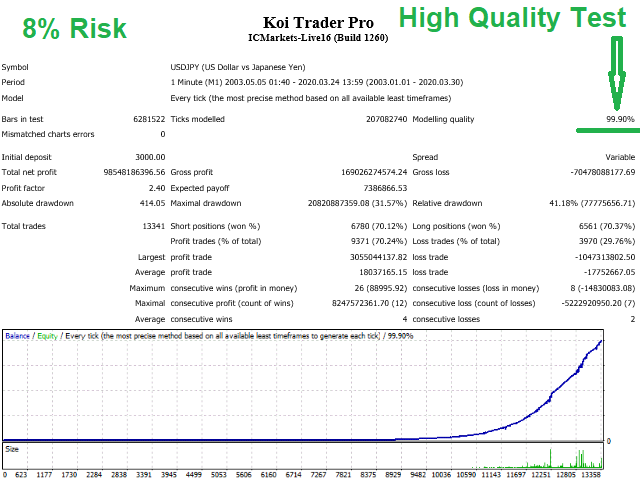

According to the 8% risk performance chart attached to the Overview page, Koi Trader Pro has a 70.24% trade success rate and 31.57% maximum drawdown, using 99.90%. modeling quality. This drawdown is not very attractive but the average profit trade is not bigger than the losing one, they are almost the same. The maximum number of consecutive wins is 26 to 8 losses. This may be attributed to solid Money Management integrated into the EA. Also, average consecutive wins are 4 versus 2 losses. Since the EA was run from 2003 until now, starting with 3000, it reached an 11 digit figure on the M1 timeframe. The chart gain line has an exponential growth with notable fast dips once a losing trade is made.

One of the good user reviews that has some details is from Haseeb Ali:

“Purchased it last night and activated. The EUR and USD pairs are really swinging since yesterday and the EA is still making a profit. I hope it performs well in the long run.”

The product has definitely a good start, so you can expect support from the author and additional updates and enhancements. Also, since the EA is using several risky methods and has a significant drawdown, test the algorithm thoroughly

This Forex service can be found at the following web address: https://www.mql5.com/en/market/product/46617