RIS GridEA is currently located within the Experts section of the MQL5 marketplace, it was uploaded to the marketplace on the 4th of April 2020 by its creator Praveen Elango, it was uploaded as version 1.703 and has not had any updates since it was added.

Overview

RIS GridEA is an expert advisor that was designed for the MetaTrader 4 trading platform, its main purpose is to act as a martingale system that looks to capitalize on both sideways and trending markets.

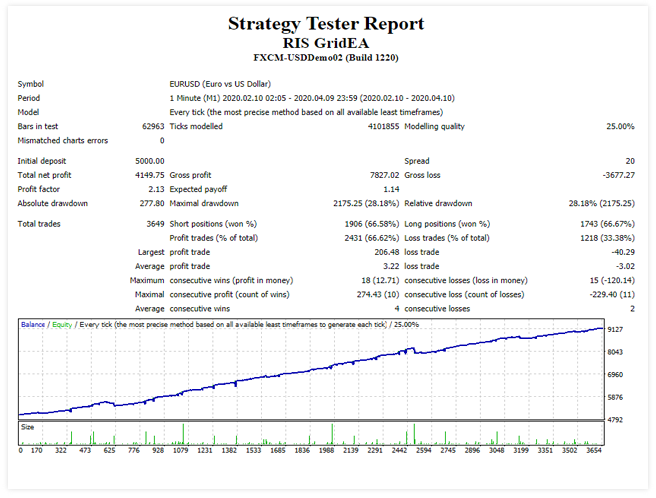

The developer of the EA recommends that you try out the EA on a smaller account before using it on your main account, they also suggest using the strategy tester, expected daily profits can be around 520% which seem a little high to us, expected drawdowns can be around 10%, 20% or even 40% depending on volatility, you should also withdraw daily according to the developer which makes it sound like this could be a risky EA.

The preferred currency pairs of the EA are EURUSD and USDJPY. It is also recommended that you have a balance of $3000 for each 0.01 lots size.

The creator of this expert advisor has provided the following information about his tool:

Use a micro account and micro lot size initially to train with our EA.

Use strategy tester to see the performance and how it works

Expected daily profit – 5-20% (exceeding this is a bonus)

Expected drawdown – 10% (20% or even to 40% assuming too sharp movements depending on the impact of news)

Do Payout on daily basis for ROI

Service Cost

The EA will currently cost you $1999 to purchase outright so it is an expensive EA to use, there is also the option to rent it, this can be monthly which will cost you $99 per month, for three months it will cost $249, for six months it will cost $499 and for a one-year rental it will cost you $999. Whichever option you take you will be able to activate the EA up to 5 times.

A free demo version of the Ea is available, this can only be sued within the strategy tester of the MT4 platform so it cant be tested on its actual live trading.

Conclusion

There are currently no user reviews or ratings so we do not know whether people are finding the EA profitable or whether it is doing what it is intended to do, there are also no comments from users so we do not know if the developer is offering support, due to this we would suggest contacting them, just to make sure they will be there should you decide to get the EA and then need some support.