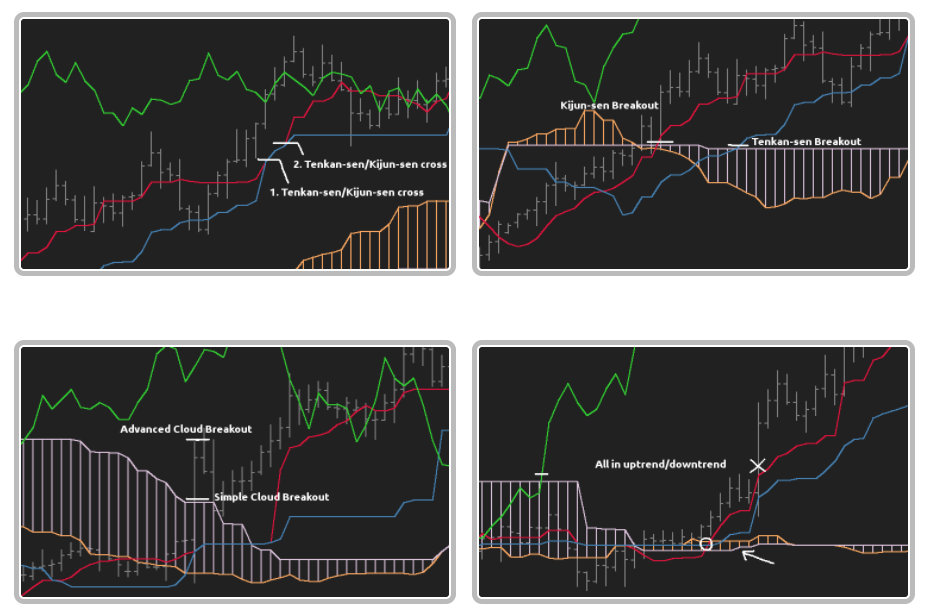

The Ichimoku Kinko Hyo indicator was developed by Goichi Hosoda in the late 1930s. It is a trend indicator based on the moving average. This indicator is based on a cloud (called Kumo), which is located between the Senkou span A line and the Senkou span B line, the Tenkan-sen and Kijun-sen line, and finally, the Chikou span line. This indicator is included in Metatrader 4 and 5. Traditional settings are: Tenkan-sen 9, Kijun-sen 26, Senkou Span B 52.

Ichimoku Kinko Hyo is, in my opinion, one of the most underused technical indicators. However, it appears to be very powerful, and its use is not too complicated after having some basic understanding of its five components.

There are several automated robots based on Ichimoku, but in this EA the creator has tried to develop a profitable commercial robot that is based on this indicator. The expert advisor we analyzed in this review is using only three lines for the input and output signals, Chikou, Senkou Span A, and Senkou Span B. The strategy is to purchase when Chikou crosses Close from below with confirmation from Kumo. Cross must happen above Kumo or Chikou must eventually come above Kumo, and the current price must close above Kumo. There is no stop-loss or take profit; positions are closed when a signal in the opposite direction is generated. The exit signal doesn’t need to be confirmed.

In addition to Ichimoku Kinko Hyo, this robot also relies on the average True Range indicator to determine the size of its positions. Of course, fixed position sizes are also available, but ATR-based risk positioning makes things look much more professional.

The trend tracking strategy is very long-term. It has been tested on many currency pairs since 1 January 2001. But only EUR/USD has shown very good results. After analyzing the data supporting this EA, the profitability curve is not very impressive. A 67% profit in more than 12 years is not a very good result. This result was generated with a fixed position size (0.1 lot).

If we perform the same test, but with ATR based on position size enabled with 2% risk size. In this case, the net profit looks much better, 238% in 12 years is already something worth achieving.

Still, many traders may think this is a robot too slow and too long-term. But using it as the only active strategy is probably not a good idea. This is a robot that can complement other strategies very effectively. Since this is a long-term trend system, you can cooperate well with some short-term counter-trade robots, reducing the drawdown periods.

This EA can be downloaded in the MT4 or MT5 version and is also available for the cTrader platform. However, in the cTrader version, unlike the Metatrader versions, the size of the ATR position is not supported due to the lack of information functions of the appropriate symbols.

We conclude by thinking that this is an excellent automated trading system, but that other systems must complement it since it does not offer very high returns. As in all EA’s marketed by Quivofx, there is a free basic version that does not include all the features, but the more complete versions called Advanced and Pro have a very reasonable price of 34.90 and 49.90 Swiss francs.