Forex Robotron is an automated trading robot that works with 5 different currency pairs on the MT4 platform. The most current version of the program, version 28 was released in May of 2020.

Overview

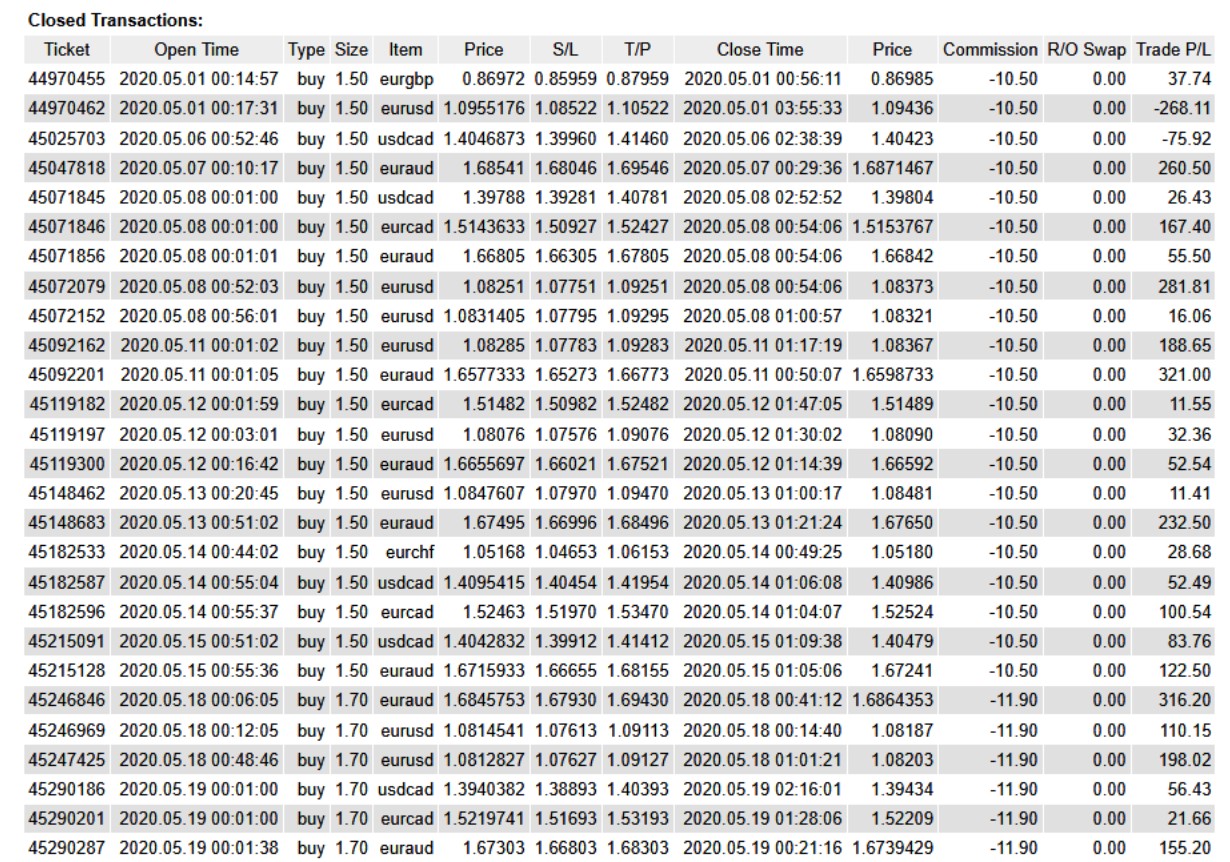

Forex Robotron is a fully automated trading system that was designed to automatically trade on the client’s behalf without requiring any effort on their part. On average, the robot trades around 500 times per year, depending on market conditions. Here are some more facts about the system:

- Trades with currency pairs EURAUD, EURCAD, EURCHF, EURGBP, USDCAD

- Compatible with the MetaTrader 4 platform

- 5-minute timeframe

- Option to disable trading on weekends

- Does not use grid, hedging, arbitrage, or martingale

- Works with US brokers, non-US brokers, and is Islamic friendly

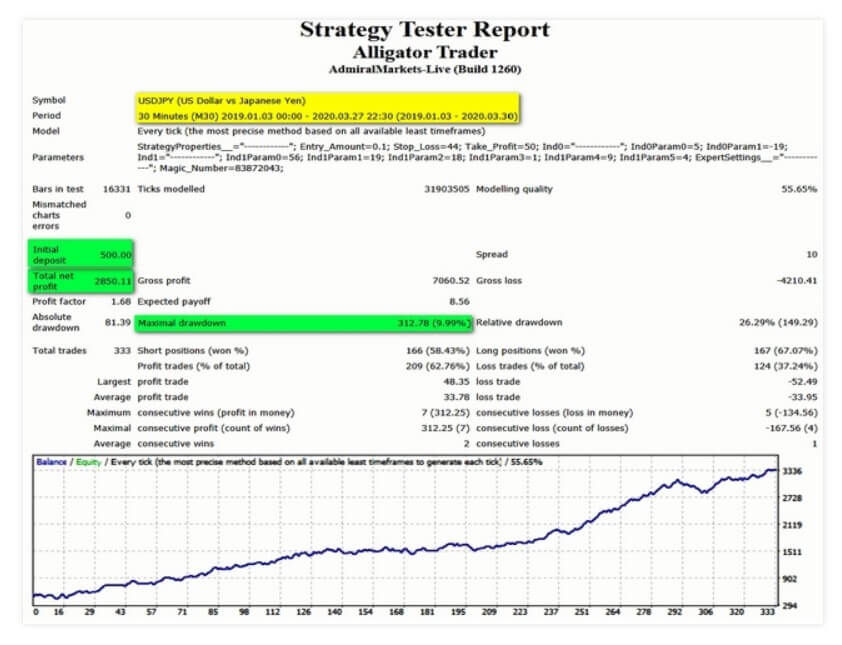

Like with any robot, results can vary based on your broker’s spreads, liquidity, and slippage. You can view results where developers have tested the robot on the website to get a better look at its success rates and profit percentages. You’ll also notice a chart with monthly gains from 6.63% up to 50.68% for the month of April 2018.

Service Cost

There are four differently priced packages available for purchasing a lifetime license of the software:

- Basic $299: 1 Real account license

- Standard $399: 2 Real account licenses

- Gold $499: 3 Real account licenses

- Premium: $999: Unlimited real account licenses

All packages work with each currency pair that is outlined, allow for an unlimited number of demo accounts, lifetime support, lifetime updates, and work on the MT4 platform. The only difference appears to be the number of real accounts that one can open based on the package that has been chosen. Note that refunds are not offered for this product.

Conclusion

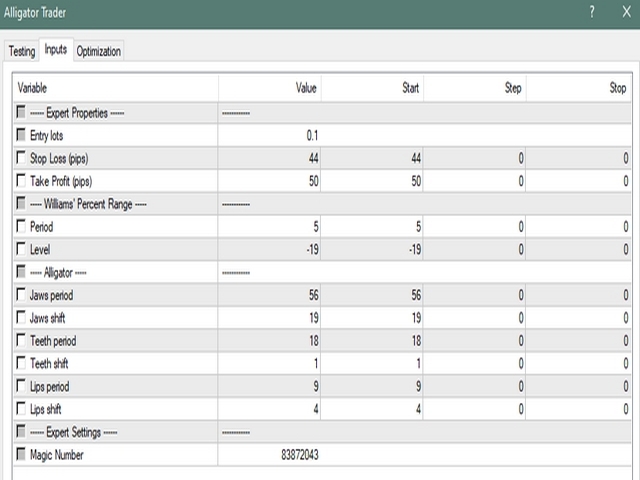

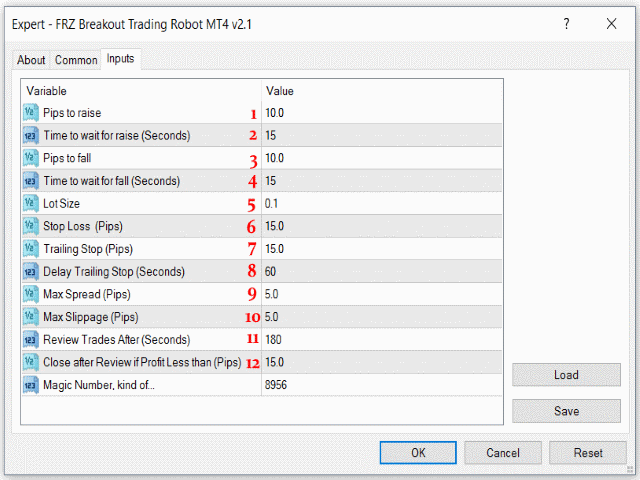

If you’re looking for historical data, then Forex Robotron’s website shouldn’t disappoint. Developers have provided 15 years’ worth of testing results and profit percentage charts on the website in order to prove that the product did give them the results they were looking for. It was tested with real tick data, real variable spreads, and trade commissions of $7 applied in order to provide more accurate results. On the downside, we do wish that developers spent more time explaining how the robot makes trading decisions.

We know what currency pairs it works with and that dangerous strategies are avoided, but more technical information would help support the case that the robot is in fact worth investing in. This isn’t a dealbreaker, but it would be nice to know more about the strategy that is being used. If you decide to buy, you’ll also want to consider how many real accounts you want the robot to trade on, as this seems to be the primary difference between paying for a package that is $299 or $999.