Forex Robotron is an Expert Advisor developed by the Forex Robotron team. The team behind the development of this robot exists since 2013 but has perfected the EA until 2016 with a stable backtesting performance. No information is available about the developers. The latest version is 27 released in October 2019.

This MetaTrader 4 EA is based on the scalper strategy, executing a trade or two daily, during the calm, session end times around 9-11 pm GMT. The performance backtesting is stated to be based on real tick data, which means the testing precision is maximum. This EA is specialized for EUR/AUD, EUR/CAD, EUR/CHF, EUR/GBP, EUR/USD, and USD/CAD pairs on the 5-minute timeframe as with many scalping EAs.

Overview

The performance of each pair is presented on myfxbook.com but including the older versions. Although, we have noticed that the robot is also run on USD/JPY, AUD/NZD, and other currency pairs on myfxbook.com stats summary. Forex Robotron webpage presents the results right away after their calculator that calculates how much you would gain with a specified deposit. The accounts presented on the website do not match the myfxbook account names. These are accounts before the 25 version of the EA. The current accounts are provided by external users and match the 25 version and have very good results but with a few warnings.

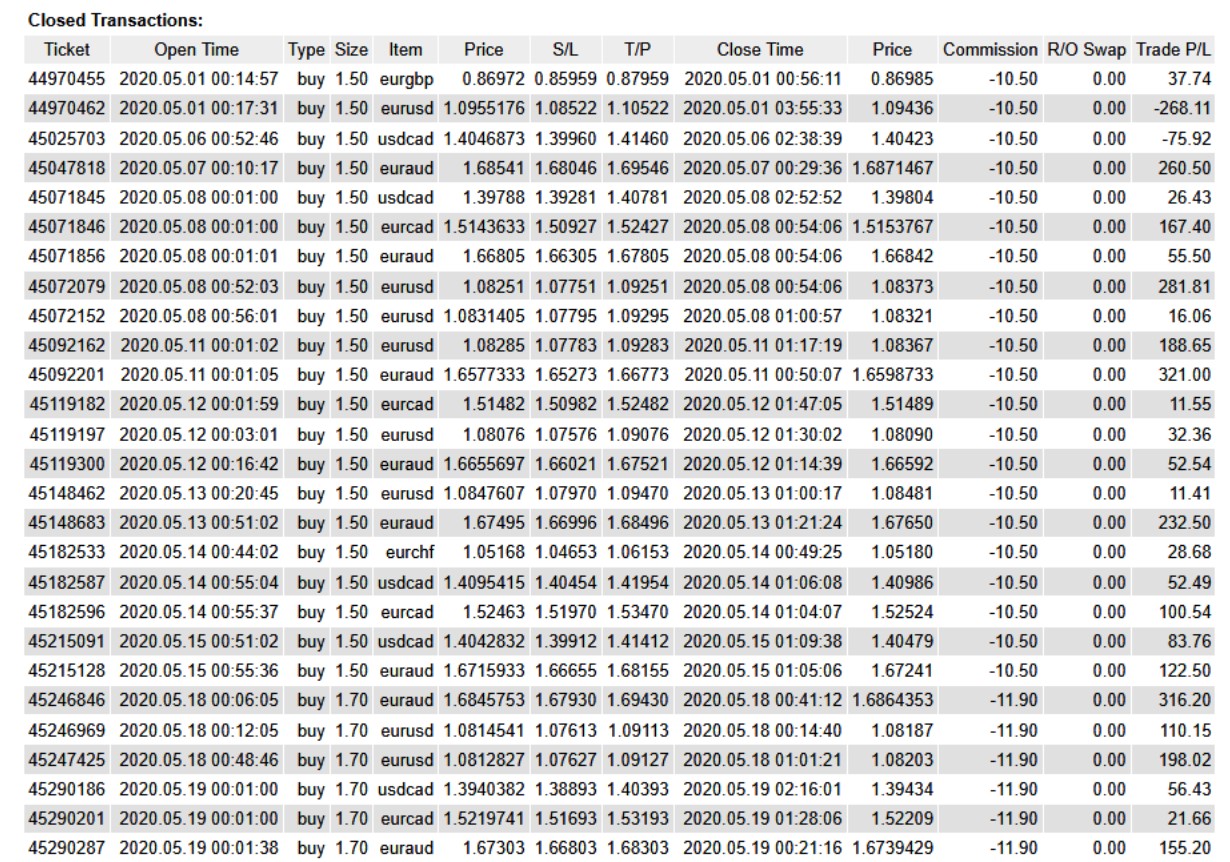

Namely, the testing and performance are done on Pepperstone, FXOpen, and KnitFX brokers. The presenting period does not account for the 2018 year where a huge drawdown is noted. A 57.21% drawdown is not attractive to most mid to long term traders and is one of the most important criteria for gauging how the EA manages risk. Even though the Forex Robotron features a fixed Stop Loss setting (20 pips) the balance drawdown is extreme. Daily gain is 0.32%, monthly 4.78% and total gain of 202.36% since 24 July 2018. The trades are open for a10 minutes or going longer to 4 hours, most of them being longs.

Trades that run longer than 2 hours proved to be mostly heavy losers. The Pepperstone account is used for these figures and according to the users, this EA is sensitive and will not show the same results with various brokers. Account number 3477293 shows the 2018 history but 3477294 and 3477295 show selective results from 2019 only where very good figures are presented. Yet, when we expand the analysis from the beginning, on 18th September 2018, we can see a 51% balance drawdown. We are no sure if this was done with an unperfected version of the EA. It is not known how this EA performs under FIFO broker restrictions.

Forex Robotron website is not well structured, performance charts create a very long page and at the bottom, the devs published a list of email feedback from users. All of them are positive which reduces the value of reading them. The FAQ page contains good answers on some critical points such as about the Spot Loss but in the majority is meant for Forex beginners. The developers do not disclose how the EA works, on what indicators are it based, and do not show an expert knowledge level about trading, at least not based on the website content.

Service Cost

At this point, the EA starts at $299 offering unlimited demo account licenses, 1 real account license, support, and updates. The standard package is $399 and offers 2 real licenses without any other benefits. Gold package is $499 with 3 real licenses and if you want an unlimited number of real account licenses the cost is $999. This sets Forex Robotron in the higher price range, especially since there is no demo EA available.

Conclusion

According to the other reviews and user reports, Forex Robotron does not show consistent results, is only optimal with brokers with very narrow spreads, no slippage, and fast execution times. The performance is inconclusive, unfortunately, the Forex Robotron team does not provide a demo so there is no way to test it for free.

This Forex service can be found at the following web address: https://forexrobotron.com