Some market indicators are single-purpose juggernauts that resemble something designed in a Soviet tractor factory to inflexibly do one job and one job only and others look on the surface like sleek, adaptable, multi-function jet fighters that can serve a number of purposes and be used across different markets. But does that make them better? Or even good? Is it good as a confirmation or trade exit indicator? Read on to find out.

What is the CCI?

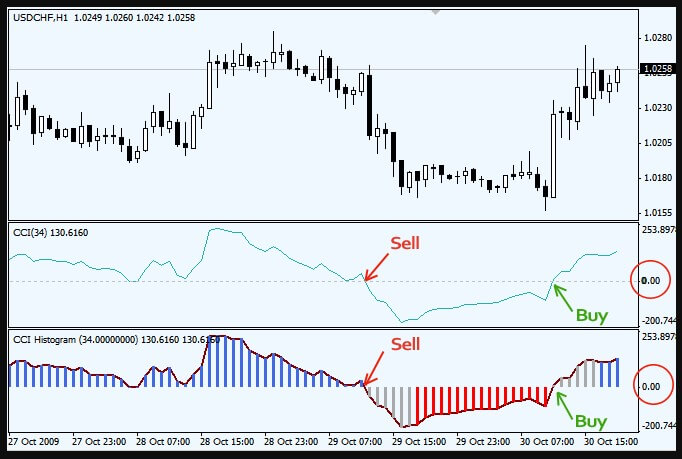

It’ll take you no time at all to figure out that the Commodity Channel Index – popularly known as the CCI – was originally developed for commodity trading. It was developed back in the 1980s, at a time when spot forex trading wasn’t even a thing, to help commodities traders identify changes in long-term market trends. However, as anyone and everyone in the social media forex sphere (and beyond) will tell you, it isn’t used just for trading in commodities and forex traders regularly make use of its adaptability to hammer it into several different roles.

Indeed, one of the praise-worthy things about the CCI is how it can be adapted to perform various tasks and how you can use it in different ways. This is partly a result of how it was designed. In short, the CCI takes the current price of a stock or currency and compares it to an average price for that stock or currency over a period that you can adjust. This means that what it’s ultimately telling you is how much from the mean the price is deviating at the moment. Coupled with lines offset at deviations of +100, +200, +300 and -100, -200 and -300 and with the fact that it is used across different timeframes and scooping up different periods to generate the average (typically 14, 20, 30, or 50), which means it can suit numerous different applications.

Common CCI Strategies

If you go online and search CCI strategies or how to use the CCI you will easily find a plethora of different approaches. There are probably about five or six main ways The CCI gets packaged but of those, there are three dominant categories that will crop up again and again – which is why these three merit a closer look.

Before we get started, however, it is worth pointing out a few basics. As mentioned, the CCI is pretty flexible – meaning that adjusting its settings allows you to use it in different ways and with different outcomes. One aspect of this is that the strategies below often rely on the CCI to be set up differently and to be used in different approaches to trading, including different timeframes and trading styles.

A crucial setting of the CCI that you need to adapt to the way you are using the CCI is the period it covers. It is important here that you are aware of the trade-off you are making when adjusting the indicator’s period. The CCI uses the period to generate the average price from which the actual price of the currency is deviating. It is fundamental to how the CCI works. A short period (for example, 14 or 20 – both of which are common CCI defaults) will give you more signals and they will appear earlier in the price movement but they will contain more inaccuracies. And inaccuracies here could spell more failed signals so that’s something to really watch out for.

Increasing the time period the CCI scoops up to generate its average price will result in more accurate signals but the downside is that they will often appear late when the price movement is already well underway. So while this might mean you are getting more reliable trade signals, you are not necessarily getting them on time to make the most of your trades. It’s a trade-off you will need to play around with to get the hang of it but it is also something that affects how you will end up using the CCI in your trading.

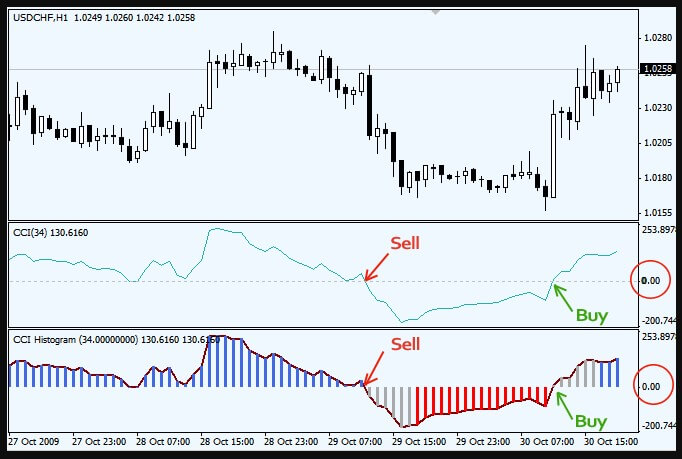

Another thing to bear in mind is that CCI trading signals usually come in the form of it crossing the +100 line into “overbought” territory or the -100 line into “oversold” territory. In forex trading, currencies can’t be overbought or oversold in the same way as commodities but these signals nonetheless remain the crux of using the CCI to trade forex. It is worth remembering that some strategies will rely on an even more cautious approach where the trade signal is defined as the CCI crossing the +200 or -200 line and that some traders also use a zero-line cross strategy.

By covering some of the more popular strategies here it is not our intention to recommend any of them – they are here to give you a basic overview of how the CCI is commonly used and what it can potentially do. It should go without saying that you are not advised to start using the CCI – or any other indicator, for that matter – without first taking it through a rigorous testing phase (including both back and forward testing) where you will check and double-check both that it works as you need it to and that it suits your own personal trading style.

The Zero-Line Cross

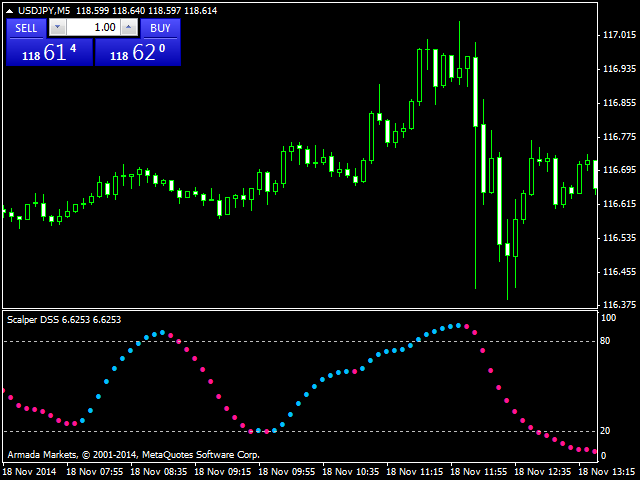

In most cases, the zero-line cross strategy with the CCI is used on short or very short timeframes to catch price movements that develop into small mini-trends. This approach gives better results during those times when the market is particularly active and are also better at catching trends on short timeframes than they are on longer timeframes.

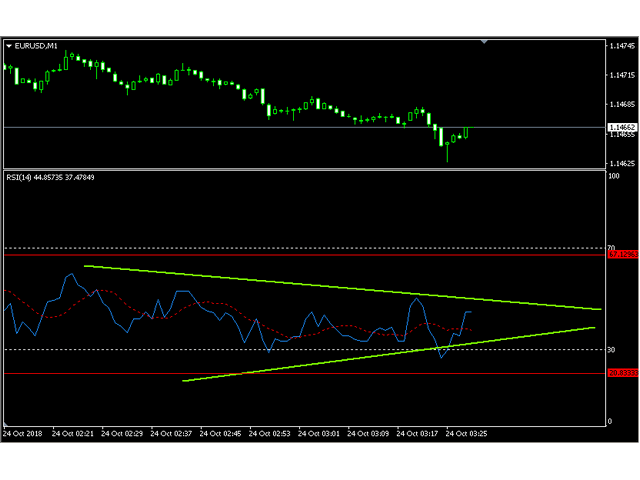

A popular version of this approach would be to combine two CCI indicators operating on different periods (for example, 20 and 50) with an exponential moving average on a short timeframe – say, the one-minute chart. An entry signal would then be generated when the 50 period CCI crosses the zero-line and is confirmed by the shorter-period CCI and the moving average. If the price movement is long and the 50 CCI crosses the zero-line, the confirmation should come in the form of the 20 CCI line remaining below the zero-line and the price is above the moving average. If either one of these confirmations fails to occur, the trade signal is false and you should not enter the trade.

This same set-up will also generate a handy exit signal. If you entered a long trade, like in the above example, and you are still in the trade when the indicators line up again to give you a short trade signal, this is your cue to close the trade. The kicker is that this will sometimes happen before your trade has had a chance to become a winner. To mitigate against this, you should be particularly careful about the market conditions when entering into short-term trades. It will take a great deal of backtesting and time spent on your demo account before you be comfortable about when this approach is likely to reliably and consistently give you winners.

Reversal Hunting with the CCI

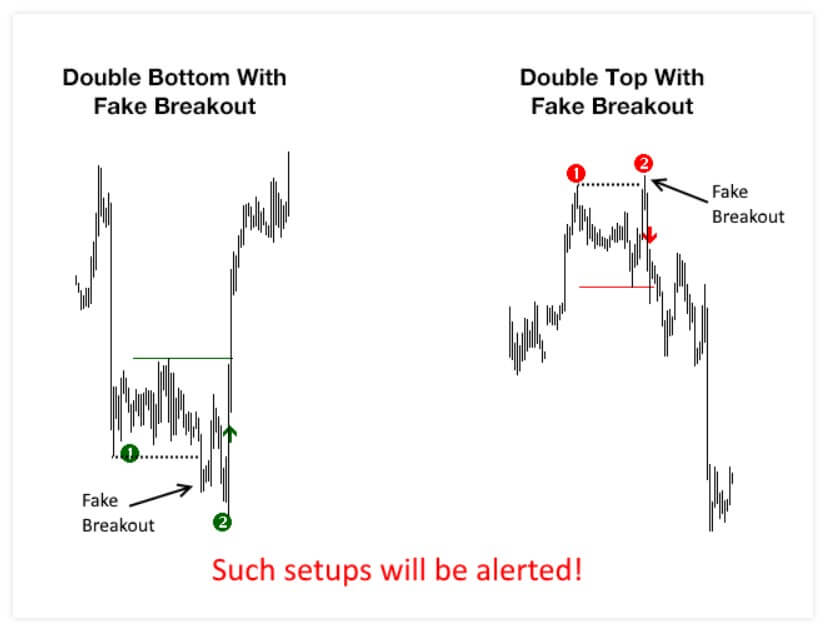

Another popular trading strategy that is advertised for the CCI across online trading guides is its use in reversal trading. Reversal trading is an inherently risky business and should not be entered into lightly. Whether the CCI is the right tool for this approach or not is something that is hotly debated and only those who have thoroughly tested a reversal strategy to the point at which they are happy with its results should attempt it. That said, there are a huge number of reversal strategies out there relying on the CCI so it is worth looking at what a typical one might involve, even just for completeness sake.

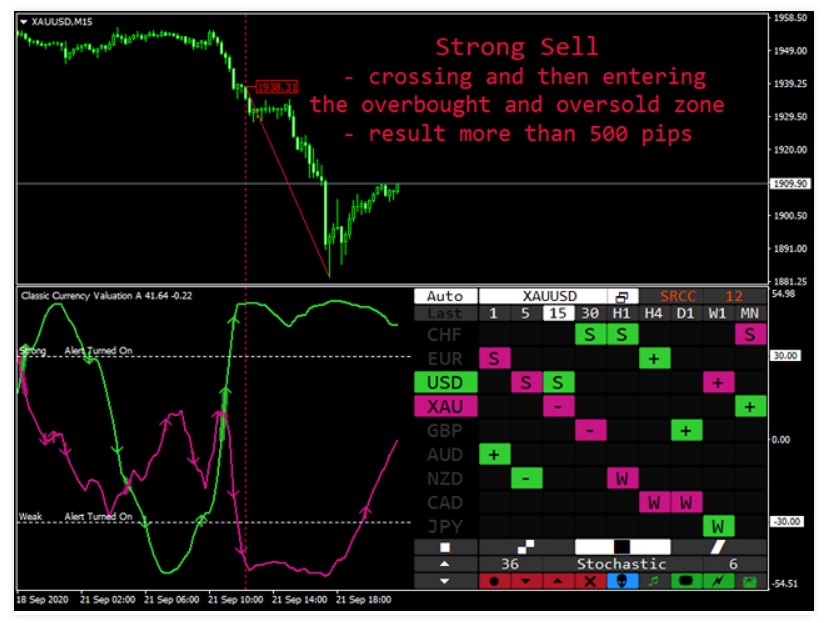

In most of these strategies, you are waiting for the CCI line to cross the +100 line or the -100 line and then cross back. As you can already guess, this will throw up a lot of failed trades so most strategies seek to limit those by adding in more lines for the CCI to cross. If you do this your trade signal will be generated when the CCI crosses one of these outlying lines (say the +250, for a short trade) and then drops back down to cross the +100 line as well. Reverse this for a long trade, where the line crosses the -250 line, crosses back, and then also crosses the -100 line. Adding in that extra line will, of course, drastically reduce the number of trade signals you get out of this thing but the hope is that it will also drastically cut down the number of false reversals it leads you into. Combine this approach with a filter indicator, such as a good volume indicator to further reduce the number of false signals.

Whether an approach such as this is viable is something you will have to figure out yourself through a robust testing regimen, which will also give you an opportunity to try out tweaks to the approach, such as the distance between the overbought and oversold lines or the period of the CCI.

Breakouts with the CCI

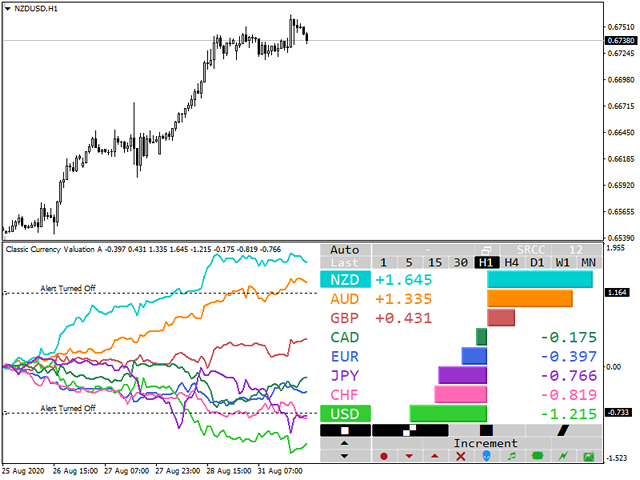

Of the three most common uses for the CCI, hunting down breakouts from low or high bases is probably the most workable. The neat thing about this approach is that it works on a greater variety of timeframes, making it more appealing to a broader range of traders. The crux of the strategy is to wait until the market enters a high or low base (i.e. it goes sideways and forms a base after a strong movement upwards or downwards). Here the hope is that a signal from the CCI will confirm that the price is about to break out of the base and continue its previous movement.

As with most other strategies using the CCI, this one also relies on the overbought and oversold lines at +100 and -100 but here the market conditions and how the price has been moving before the signal are critical. To enter a trade using this strategy, wait until the price forms a base after a strong movement in one direction or the other. In this example, let’s assume the market has gone to a high base after it has trended upwards for a while. If that’s the case, you are looking for the CCI to cross the +100 overbought line – and that’s your trade entry signal. To catch low bases, you are simply looking for the mirror image of this to occur, where the CCI crosses the -100 line after a low base has formed. Again, this is your signal that a breakdown from here is likely.

As with anything in forex trading, there are a couple of problems with this approach. The first of these is that you are relying on the market to provide you with the right conditions for entry and that might leave you hanging around and waiting for quite a while. This is because in a market where there isn’t a clear trend, you will still get these signals but they will burn you if you use them outside of the price movement pattern described above. This makes the CCI a potentially useful indicator to have as a backup. You can use your usual setup to trade in more varied market conditions and then only pull the CCI out for those occasions when you feel you can really put it to work. Getting this right will, of course, take a lot of testing and long sessions in a demo account, making sure that this approach fits with the system you have in place and with the way you like to trade.

The second serious problem is that even if you wait until the ideal conditions are in place, the CCI will still throw up false signals that will lead you into losing trades. You can mitigate this somewhat by waiting for it to cross the +200 or -200 line (depending on whether you’re looking at a high or low base). But this is a trade-off where what you gain in risk reduction, you lose in responsiveness. So, if you’re waiting for it to cut across an overbought or oversold line that’s further out, you might miss trades that would have been winners and you also might enter winning trades later, which could cut into your profits.

A third problem with using the CCI in this way is that it will cause you serious angst once you are already in a trade. Let’s say you followed all the rules, waited for a high base to form, waited for the CCI to give you your trade entry signal, and pulled the trigger on that trade. Now you’re in it, wondering how long you should stay in to maximise gains. Well, this is where the CCI can easily trip you up by tumbling in the other direction and crashing through that oversold line. This will look like a pretty hefty exit signal and many traders would take that as a sign that it’s time to bug out. But even if you do get out when it looks like the CCI is telling you, you could easily end up watching the price simply carry on in the same direction it was already going as though the CCI wasn’t even there. Well, that’s not a happy sight for any trader, you feel like you’re watching money you could have made simply sailing away. The trouble is these exit signals are often false. The upshot is that if you used the CCI to get you into a trade from a high or low base breakout, you shouldn’t also use it as an exit indicator. It simply won’t give you reliable enough signals for that.

Troublesome Hurdles or Insurmountable Problems?

So as you can see from these preferred strategies for using the CCI in forex trading there are different things you can use it for. It’s clearly easy enough to adapt to a variety of trading strategies and the sheer volume of suggested strategies out there on the forex internet tells you that this thing is popular. But, here’s the catch, just because something is flexible and popular doesn’t automatically mean it’s any good.

The first red flag that should pop up in your head when you look at the CCI is that it was designed well over a decade before the spot trading of forex was even a thing. Now, on its own, that doesn’t necessarily have to translate into a major problem for the indicator itself. You might even wonder whether the fact that it was designed so long ago doesn’t lend it a certain kind of venerability. Like, if it was designed so long ago and is still used today, doesn’t that mean it has survived the test of time? Well, let’s put it like this, how many items of technology do you use on a regular basis that are from the 1980s? Are you still using an 80s cell phone? Are you watching shows on an 80s TV? You might still have an 80s car in the garage and you might even love it but you know that it is by now a classic car and that if you really needed a car to do a job – because ultimately that’s what you need from an indicator – you’re going to want something more up to date. At the end of the day, the age of this thing should at the very least make you think, “Hey, I wonder if there are more recent, better indicators out there that are designed for what I need?” And, of course, there are.

That’s another thing about the CCI – not only was it designed in the early nineteen eighties but it was also designed with commodity trading in mind. At its most basic level, measures whether a security is overbought or oversold and that alone should make you think twice. Because, while it’s important to know if stocks or commodities are overbought and oversold since they have intrinsic value, this isn’t particularly useful for forex. That isn’t to say that there are no limits on the price of a currency, that the price can go as high or low as it wants with nothing holding it back. If the price movement in either direction is drastic enough, then a government or national financial institution is going to step in and try to rein it in. But that isn’t the same kind of thing as the limits of supply and demand that perform the role of, let’s say, natural checks and balances in the equity and commodity worlds. Moreover, that intervention might take a long time to get agreed upon and could come many thousands of pips down the line and even when it comes, it will bear no relationship to the overbought and oversold lines on your indicator.

Now, these are pretty fundamental problems with the CCI but if its age and the fact that the way it functions is basically completely divorced from the way forex markets work aren’t enough to give you pause, there’s another thing for you to think about.

Circular Popularity

Reading all of this, you might be wondering, if it’s old and designed for different markets, why in the world would the CCI continue to be popular. There are a couple of main reasons for this. The first is that it is pretty popular in commodity trading where it is used pretty commonly and is more suited to doing a good job. What then happens is that traders who come over to forex trading from commodities are familiar with it and want to go on using it. So they try to make it work by bashing what is basically a square peg into a round hole. But they don’t just stop there, in addition to carrying on trying to use it for forex trading, they also make tutorials about it for youtube and sing its praises on forex social media.

The second reason it’s popular is simply because it’s popular. The forex internet can sometimes become its own little group-think bubble. Not only do people happily regurgitate what they’ve heard without actually giving it a try but they also often tell each other what they want to hear. Now, the first part of this is a big enough problem on its own because when lots of people – even people with a certain standing in the community, for want of a better term – talk about a thing as though its good they can amplify it to the point where the voices of those people who’ve tried it and might have something critical to say get drowned out.

Add to that the fact that there are people out there trying to get likes and views and follows and that they can do this by telling you what you want to hear and you’ve got a much more serious problem on your hands. There are no magic bullets in forex trading and no one indicator can solve all of your problems but if you put out a video or blog saying, “Hey, this indicator is a magic bullet that solves all your problems” then people are going to tune in. And not just that but you’re going to get way more viewers or readers than the guy saying, “you know what, this indicator doesn’t work too well”.

Lastly, this vicious popularity circle gets compounded by the fact that people are not too willing, generally speaking, to own up to their own mistakes and failings. So even in the comments under a blog piece or video or social media post you won’t get too many people saying, “Hey, I tried this and it didn’t work at all for me, in fact, I lost money using it.” This is pretty understandable since most forex traders are more likely to assume they were doing something wrong with the tool they were using than that the tool itself was the problem. That and no one likes shouting from the hilltops about something that went wrong – we’d all much rather boast about the things that went right.

But it goes further than that even because sometimes you will see people skating over the losses the CCI generates even in the videos and posts they put out to sing its praises. Sometimes you can see these on the very chart they’ve pulled up to show you how well it works but they’ll just mention them in passing or not mention them at all. Now, this is kind of cherry-picking is downright misleading – especially for people who are new to trading and who might not spot those losses because they’re working so hard to understand the wins properly. As disingenuous as this is, it still contributes to an indicator’s popularity because it gets people talking about it.

Okay, so it’s popular but not necessarily because it’s genuinely good – you’ve got that by now. But, in this case, popularity is a problem all on its own. You see when an indicator is as popular as the CCI (or a few others out there that also seem to draw a crowd even though they aren’t very useful) then people coming into trading see it and get it into their heads that this is all there is out there. If you’re just starting out as a forex trader and you see thousands of people out there talking about the CCI, you’re going to start to think that there aren’t other indicators that can fill this role. But nothing could be further from the truth.

So What Now?

First thing’s first. There is no harm in trying to understand how the CCI works and how you might use it in its optimal role. By trying it out harmlessly and at no risk to yourself or others in a backtesting/forward testing trial, you can view the whole process as an incredibly useful learning experience. Not only will you see what it can and can’t do but you will also learn something more about your own trading habits and the system you use will naturally evolve as you become more experienced.

That said, by testing this thing thoroughly, you will also be able to evaluate whether it can be put to use in some limited scenarios and in specific market conditions – such as, for breakouts from high and low bases as described above. Ultimately, however, the best thing to do would be to take the contents of this piece and use them as a springboard from which you can embark on a search for newer, better indicators. Rest assured, there are indicators out there that perform similar roles to the CCI but are specifically designed for forex trading and for integration with the kinds of platforms forex traders use.

All you need to do is get out there, search around, and do your own research and testing. After all, why would you use an old jack of all trades indicator designed for the commodities markets at a time when personal computers were barely a thing when you could instead find more modern, better tools out there for free on the internet. You will have to put in the work, of course, but the rewards are out there for the taking.

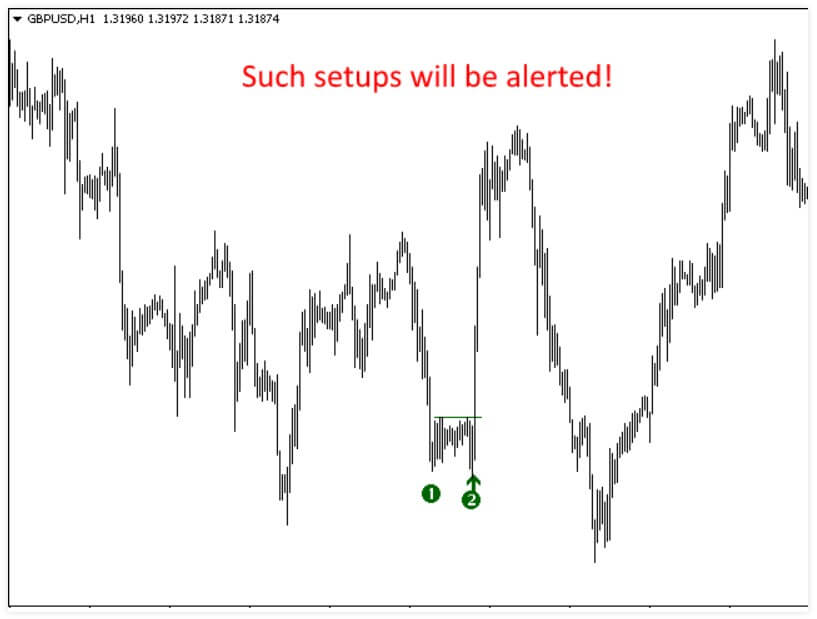

Mr Top Bottom is an indicator that was created in March 2019 by developer Mostafa Fouladi. Mr Top Bottom is a powerful no-paint indicator that draws arrows on Tops and Bottoms. It has too complicated calculations but is very simple to use. Each arrow has a specific impact value of 1 to 10. If the impact is greater it means that the signal is probably more reliable, because it is calculated on the basis of a larger oscillation.

Mr Top Bottom is an indicator that was created in March 2019 by developer Mostafa Fouladi. Mr Top Bottom is a powerful no-paint indicator that draws arrows on Tops and Bottoms. It has too complicated calculations but is very simple to use. Each arrow has a specific impact value of 1 to 10. If the impact is greater it means that the signal is probably more reliable, because it is calculated on the basis of a larger oscillation.

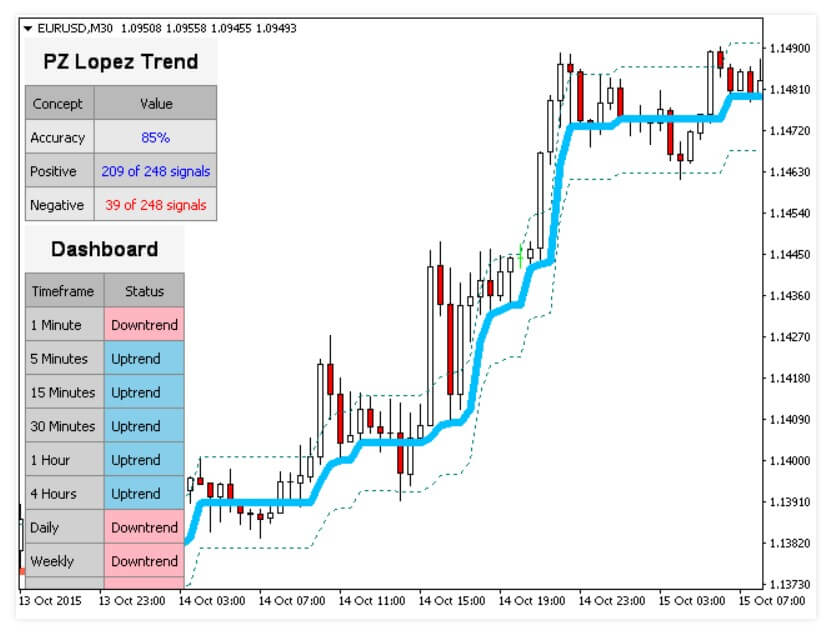

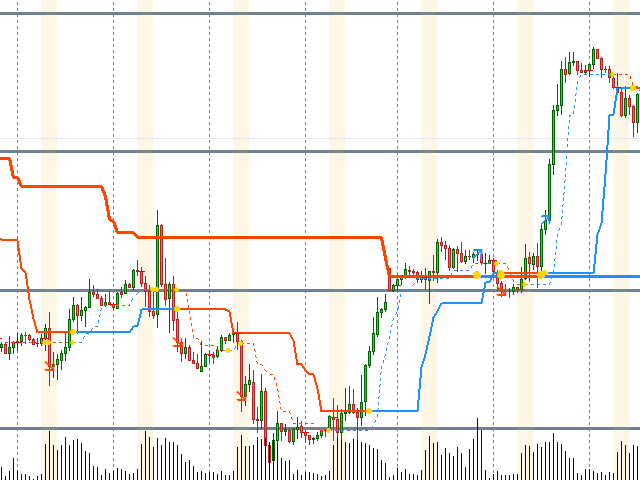

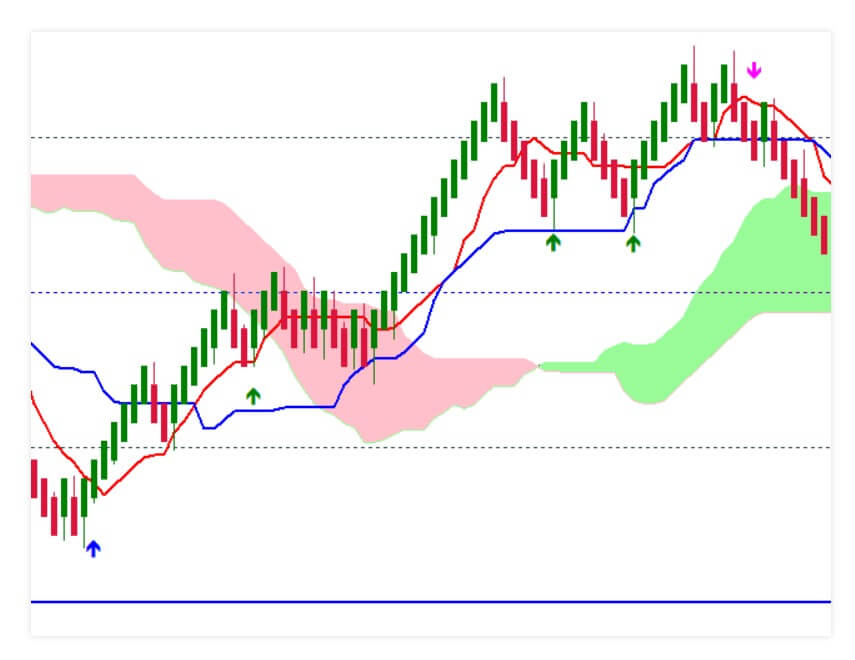

Multytrend PA is an indicator that was created in April 2019 by developer Mikhail Nazarenko. This indicator combines the principles of Price Action and a unique filtering algorithm with feedback for three moving averages. This allows you to know what are the pivot points and current trends in any time frame with a high probability of success in the trades you are pointing out. Multytrend PA is an update of the classic Trend PA indicator and can be used with the principle of the three Elder screens, but everything that is needed is shown in the same chart, which is easier for the user.

Multytrend PA is an indicator that was created in April 2019 by developer Mikhail Nazarenko. This indicator combines the principles of Price Action and a unique filtering algorithm with feedback for three moving averages. This allows you to know what are the pivot points and current trends in any time frame with a high probability of success in the trades you are pointing out. Multytrend PA is an update of the classic Trend PA indicator and can be used with the principle of the three Elder screens, but everything that is needed is shown in the same chart, which is easier for the user.

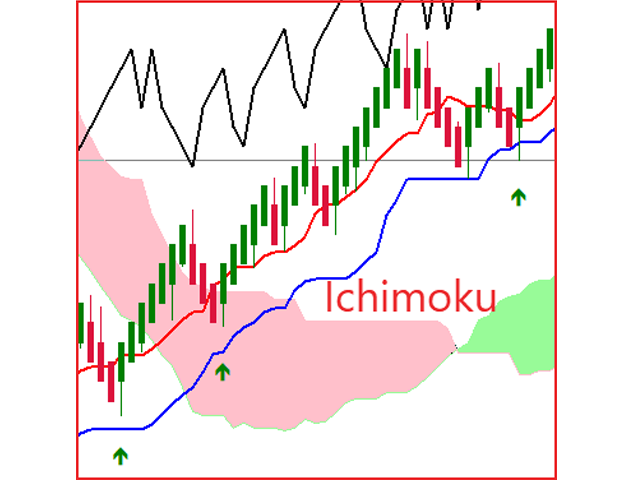

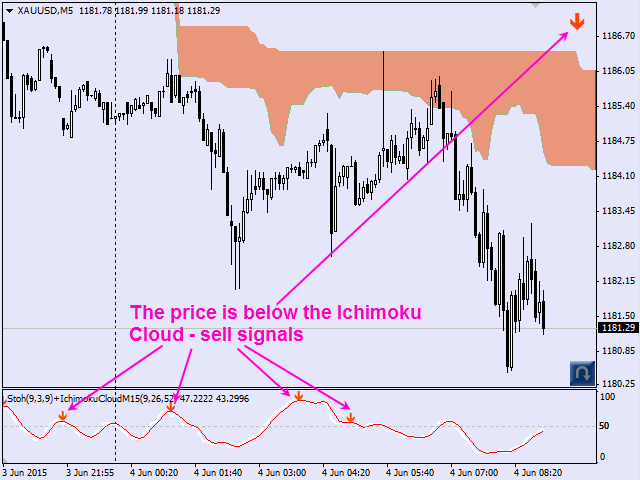

PZ Wedges is an indicator created in September 2017 by Arturo López Pérez. Arturo López Pérez is a private investor and speculator, software engineer, and founder of Point Zero Trading Solutions.

PZ Wedges is an indicator created in September 2017 by Arturo López Pérez. Arturo López Pérez is a private investor and speculator, software engineer, and founder of Point Zero Trading Solutions.

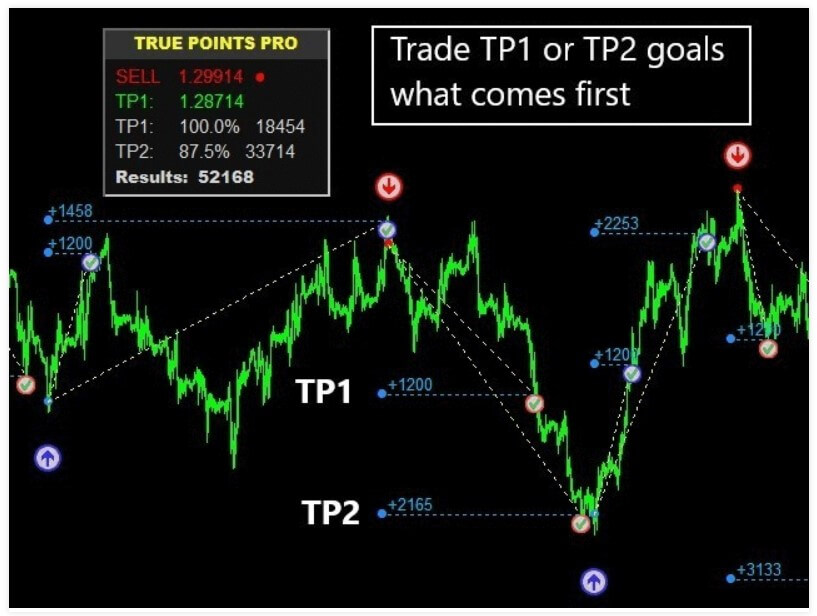

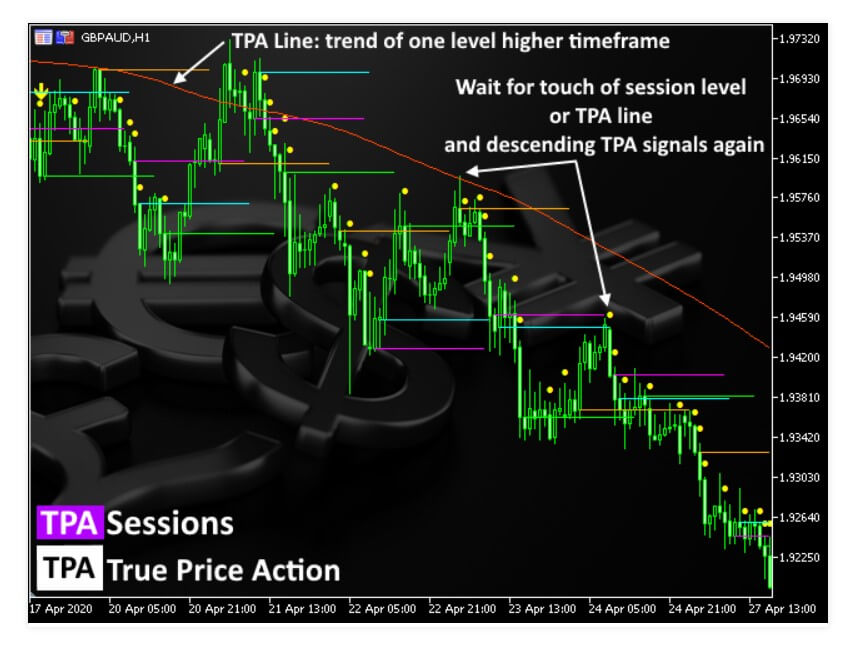

This indicator coded for the MetaTrader 4 and 5 platform belongs to the paid category and has a specific way of giving signals and trading use. The first version is published on the 3rd of July 2019, it is not a very old indicator but has received some attention. The developer is Janusz Trojca from Poland now under the team name of InvestSoft. This team has a total of 10 products with good ratings, some of them complement the TPA indicator for a complete trading system. As the name describes the indicator is based on the

This indicator coded for the MetaTrader 4 and 5 platform belongs to the paid category and has a specific way of giving signals and trading use. The first version is published on the 3rd of July 2019, it is not a very old indicator but has received some attention. The developer is Janusz Trojca from Poland now under the team name of InvestSoft. This team has a total of 10 products with good ratings, some of them complement the TPA indicator for a complete trading system. As the name describes the indicator is based on the

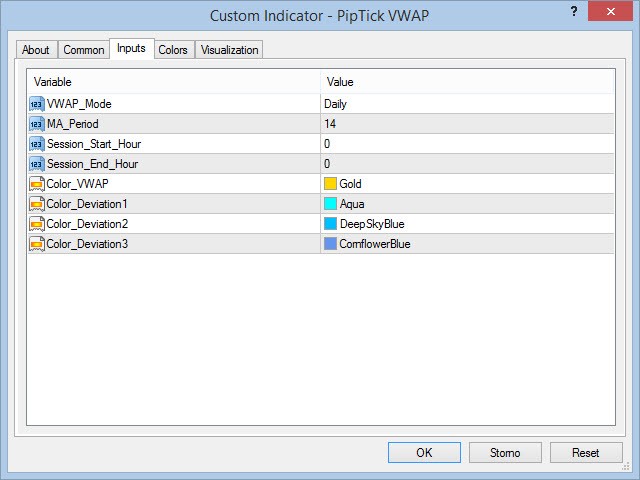

PipTick VWAP for the MT4 platform is a special form of the Volume-Weighted Average Price indicator. One of the most used Moving Averages apart from the EMA or Exponential Moving Average is VWAP for its adaptability to recent market changes. Michael Jurnik from the Czech Republic is the developer of this tool, partner at PipTick. They have published 59 products, many of them not having much popularity or ratings.

PipTick VWAP for the MT4 platform is a special form of the Volume-Weighted Average Price indicator. One of the most used Moving Averages apart from the EMA or Exponential Moving Average is VWAP for its adaptability to recent market changes. Michael Jurnik from the Czech Republic is the developer of this tool, partner at PipTick. They have published 59 products, many of them not having much popularity or ratings.

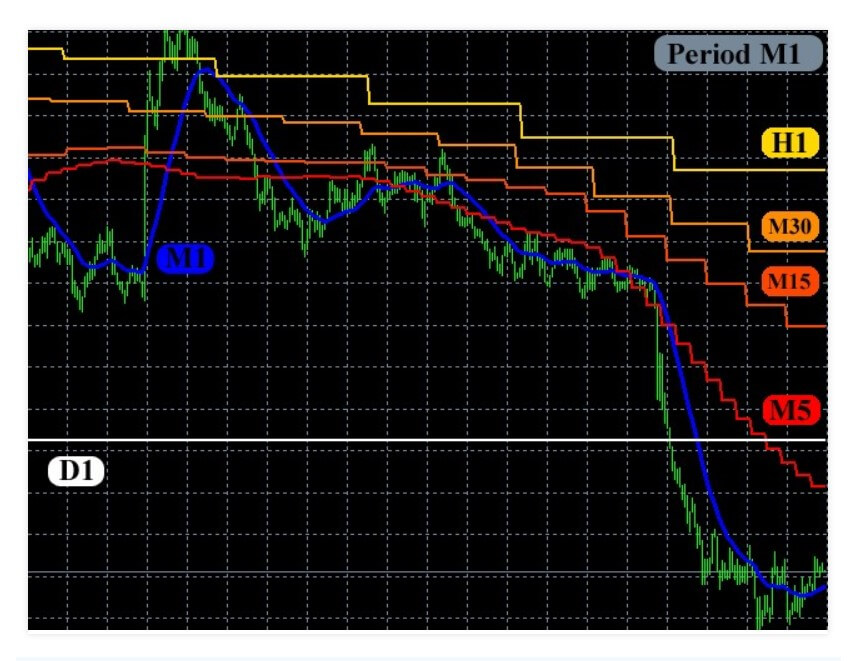

MA Multi stands for Moving Average Multi Timeframe indicator that is useful in many ways and for many strategies. The developer of this indicator is Dmitriy Susloparov from Russia having 16 products offered on the MQL5 marketplace. None of them have received much attention and only MA Multi and one more indicator have ratings. Most of the indicators published are similar, they are basic indicators made multi-timeframe on a single chart. MA Multi also exists for the MetaTrader 5 platform. The first appearance on the

MA Multi stands for Moving Average Multi Timeframe indicator that is useful in many ways and for many strategies. The developer of this indicator is Dmitriy Susloparov from Russia having 16 products offered on the MQL5 marketplace. None of them have received much attention and only MA Multi and one more indicator have ratings. Most of the indicators published are similar, they are basic indicators made multi-timeframe on a single chart. MA Multi also exists for the MetaTrader 5 platform. The first appearance on the

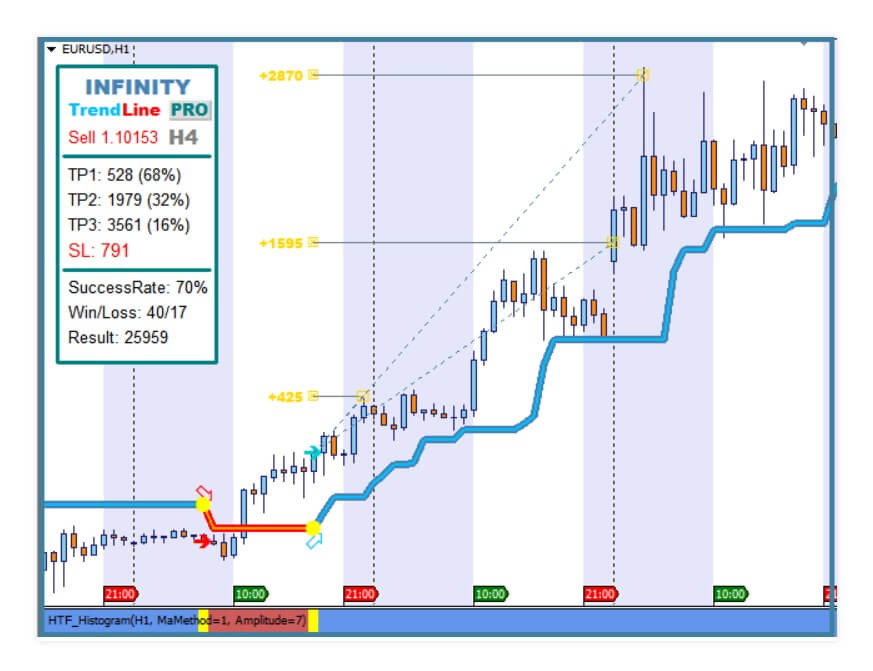

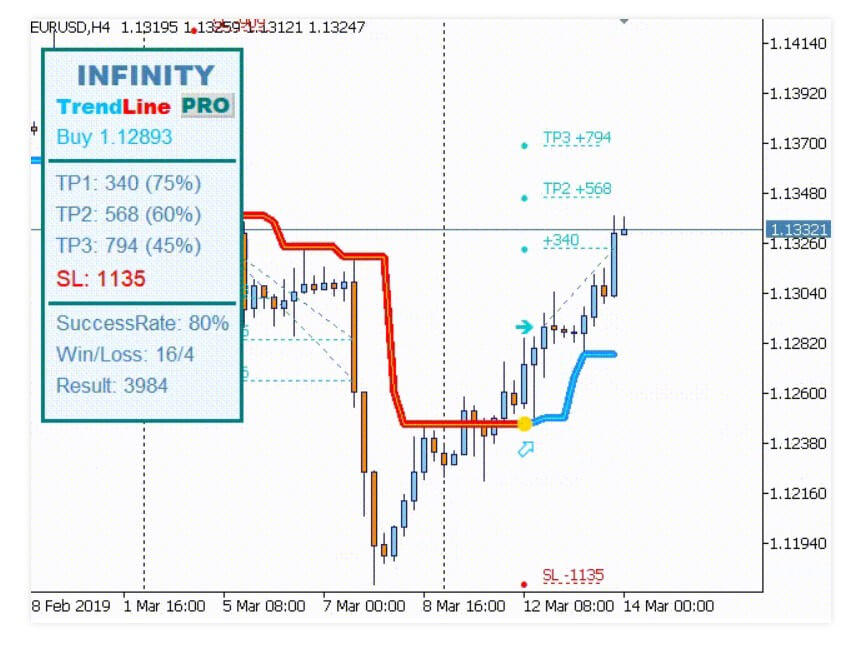

Infinity Trendline is a trend following indicator with integrated solutions for Taking Profit and Stop Loss management. It is developed for the MetaTrader 4 and 5. It was a top free indicator once it showed up in November 2018 on the MQL5 market and since it has received many updates. New things are mostly about adding features and updating the code, enriching the indicator with new goodies. The latest update sets the version to 52.0 and is updated recently, in March 2020. Evgenii Aksenov is the author of this popular indicator/ trading system consisting of few indicators. Main takeaways are the easy-to-use trading signal system, good support, and the fact this is a free indicator that is usable even though the PRO version has more features.

Infinity Trendline is a trend following indicator with integrated solutions for Taking Profit and Stop Loss management. It is developed for the MetaTrader 4 and 5. It was a top free indicator once it showed up in November 2018 on the MQL5 market and since it has received many updates. New things are mostly about adding features and updating the code, enriching the indicator with new goodies. The latest update sets the version to 52.0 and is updated recently, in March 2020. Evgenii Aksenov is the author of this popular indicator/ trading system consisting of few indicators. Main takeaways are the easy-to-use trading signal system, good support, and the fact this is a free indicator that is usable even though the PRO version has more features.

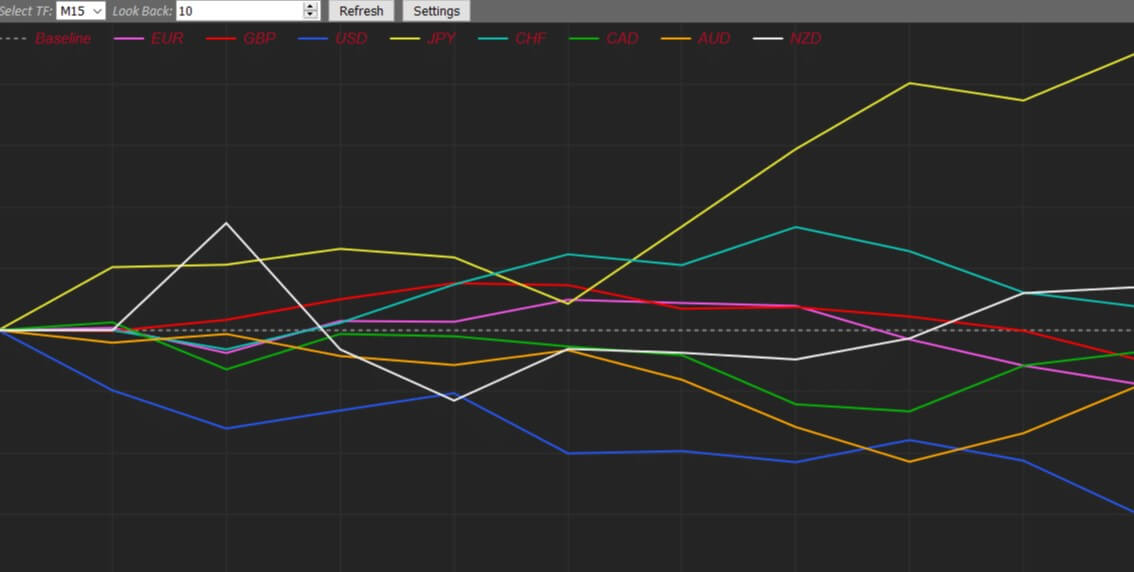

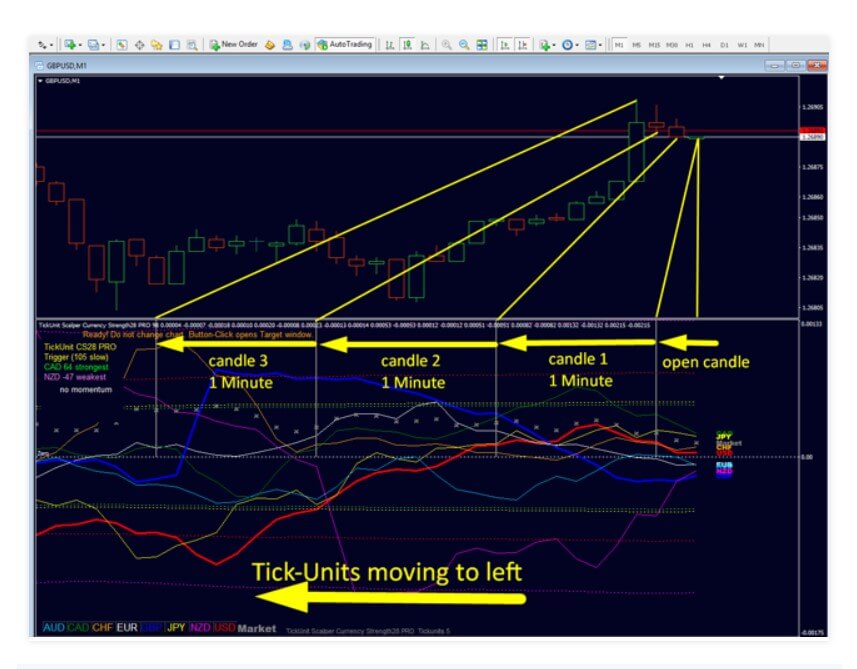

TickUnit Scalper Currency Strength28 PRO is a new indicator type on the scene popular with the scalper trading strategies. It is designed for the MetaTrader 4 and published on 5th July 2019. Since then it has received frequent updates with very good additions such as to save tick data for faster recovery. The developer of this combo indicator is Bernhard Schweigert from Morroco and he has 12 products offered on the MQL5 repository, most of them are popular and have very high ratings from the users. He made a currency correlation/strength indicator using Tick-Units data on 28 currency pairs, or all of the major currency combinations. It belongs to the paid category and could be regarded as a complete trading system.

TickUnit Scalper Currency Strength28 PRO is a new indicator type on the scene popular with the scalper trading strategies. It is designed for the MetaTrader 4 and published on 5th July 2019. Since then it has received frequent updates with very good additions such as to save tick data for faster recovery. The developer of this combo indicator is Bernhard Schweigert from Morroco and he has 12 products offered on the MQL5 repository, most of them are popular and have very high ratings from the users. He made a currency correlation/strength indicator using Tick-Units data on 28 currency pairs, or all of the major currency combinations. It belongs to the paid category and could be regarded as a complete trading system.

Scalp Tools Support and Resistance Levels is designed to do one thing, to identify the Support and Resistance levels. Usually, indicators that are specialized to do one thing are the ones that do this very well. Most successful trading systems are composed of a few specialized indicators for every aspect of the system. Even though the indicator name has the Scalp word, it is not limited just for scalper systems, most Price Action systems will rely on the Support and Resistance levels. This word is probably included in the name of the indicator for SEO purposes.

Scalp Tools Support and Resistance Levels is designed to do one thing, to identify the Support and Resistance levels. Usually, indicators that are specialized to do one thing are the ones that do this very well. Most successful trading systems are composed of a few specialized indicators for every aspect of the system. Even though the indicator name has the Scalp word, it is not limited just for scalper systems, most Price Action systems will rely on the Support and Resistance levels. This word is probably included in the name of the indicator for SEO purposes.

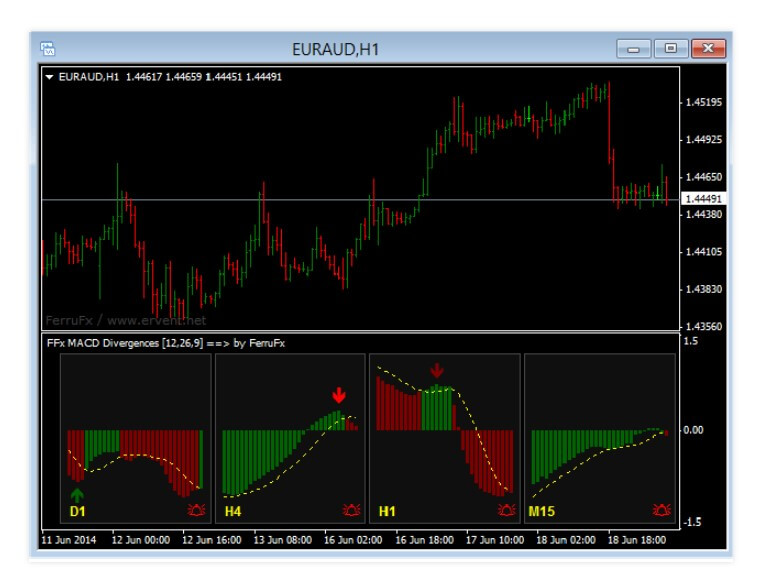

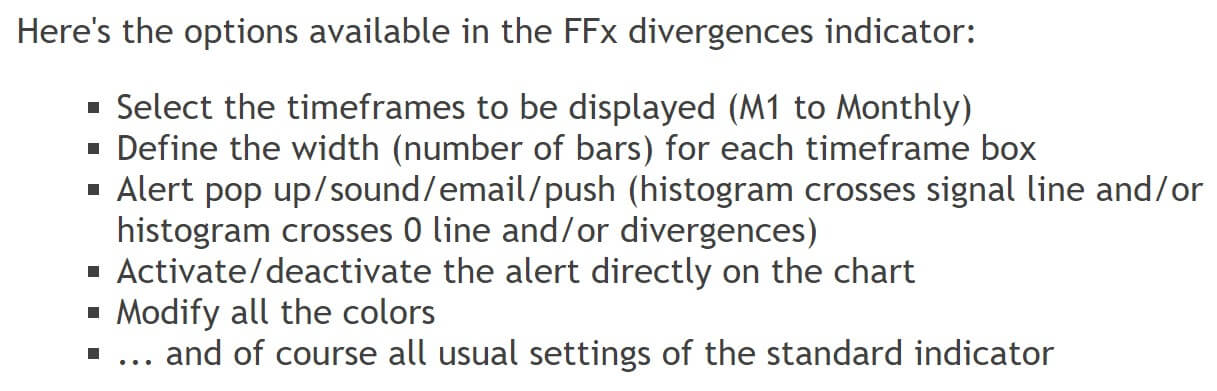

The MetaTrader 4 and 5 platforms come with one of the most popular indicators known to traders – MACD. FFx MACD Divergences build upon the already integrated indicator in the MT4 platform, extending the functionality especially useful for divergence strategy traders. This paid indicator is published on 4th July 2014 on the MQL5 repository and since then has no received much attention. The latest version has not changed since the initial placement and remains at 1.0. The author of this extension tool is Eric Venturi-Bloxs from Thailand. This author has no less than 52 products on the mql5.com, a good portion of that is free.

The MetaTrader 4 and 5 platforms come with one of the most popular indicators known to traders – MACD. FFx MACD Divergences build upon the already integrated indicator in the MT4 platform, extending the functionality especially useful for divergence strategy traders. This paid indicator is published on 4th July 2014 on the MQL5 repository and since then has no received much attention. The latest version has not changed since the initial placement and remains at 1.0. The author of this extension tool is Eric Venturi-Bloxs from Thailand. This author has no less than 52 products on the mql5.com, a good portion of that is free.

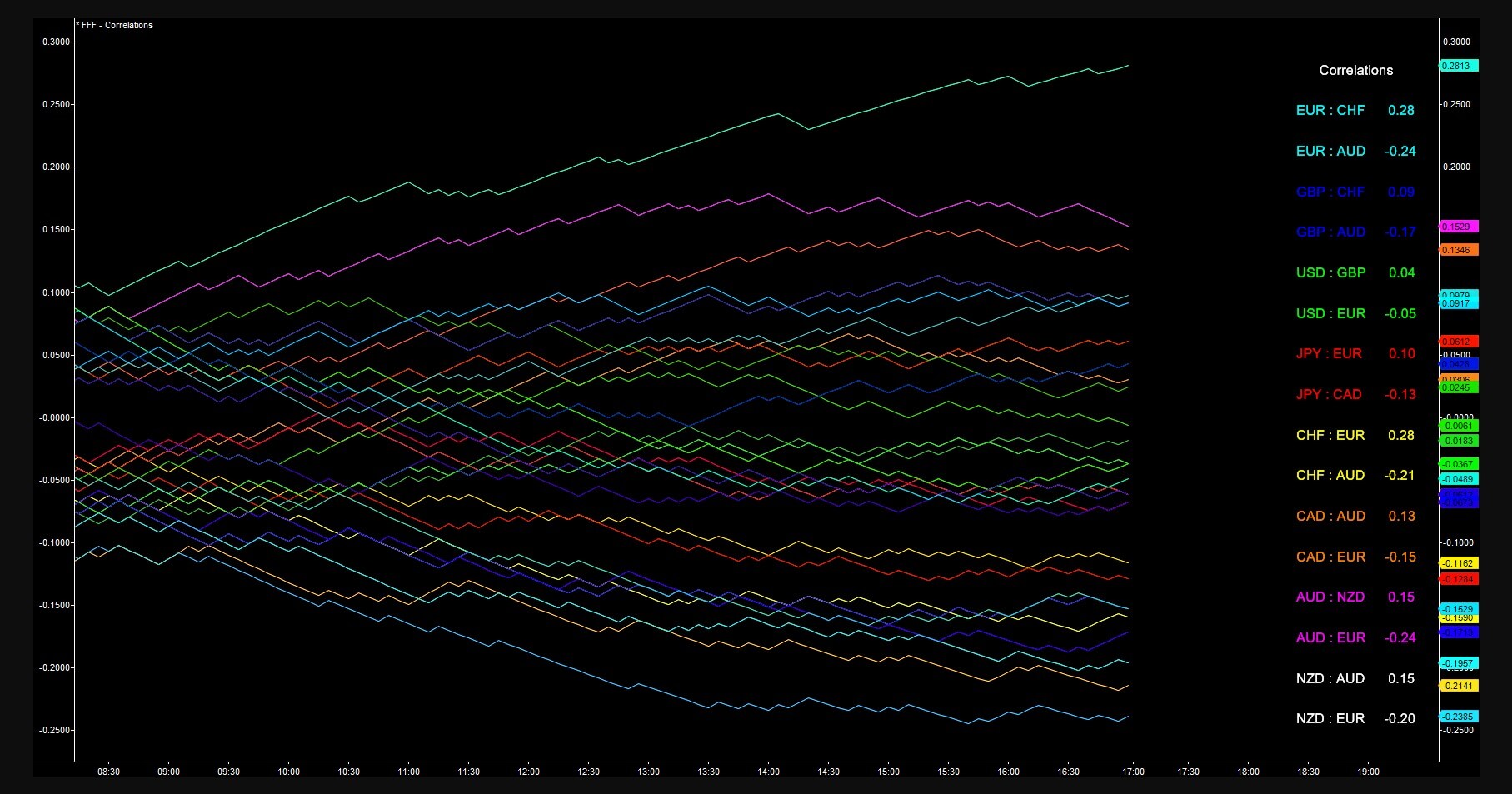

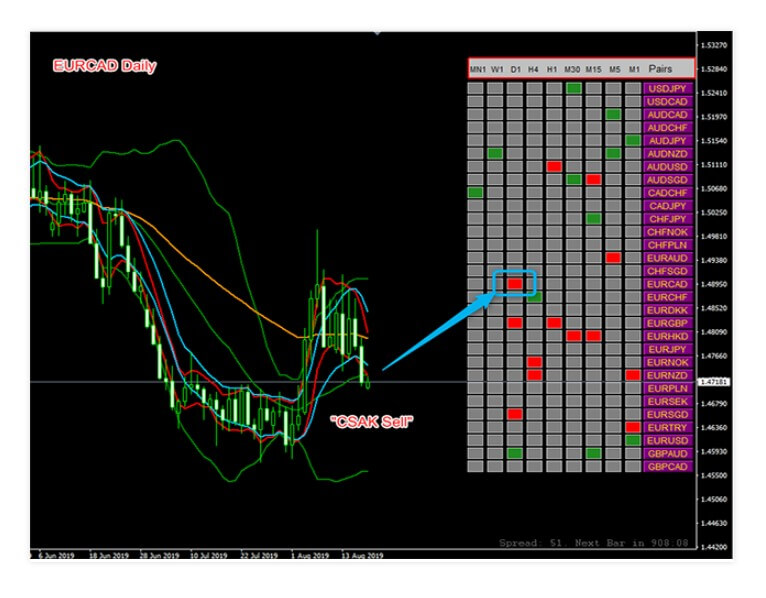

Currency Strength Matrix is a paid indicator published on the MQL5 marketplace designed for the MetaTrader 4 platform. It belongs to the trend confirmation category although it is used in conjunction with other indicators. It tries to differentiate by offering better information for Price Action, Reversal, and Momentum trading strategies, according to the developer’s words. The initial version was published on 5th July 2017 by Raymond Gilmour from the United Kingdom, author of just one more indicator called Cycle Finder Pro.

Currency Strength Matrix is a paid indicator published on the MQL5 marketplace designed for the MetaTrader 4 platform. It belongs to the trend confirmation category although it is used in conjunction with other indicators. It tries to differentiate by offering better information for Price Action, Reversal, and Momentum trading strategies, according to the developer’s words. The initial version was published on 5th July 2017 by Raymond Gilmour from the United Kingdom, author of just one more indicator called Cycle Finder Pro.

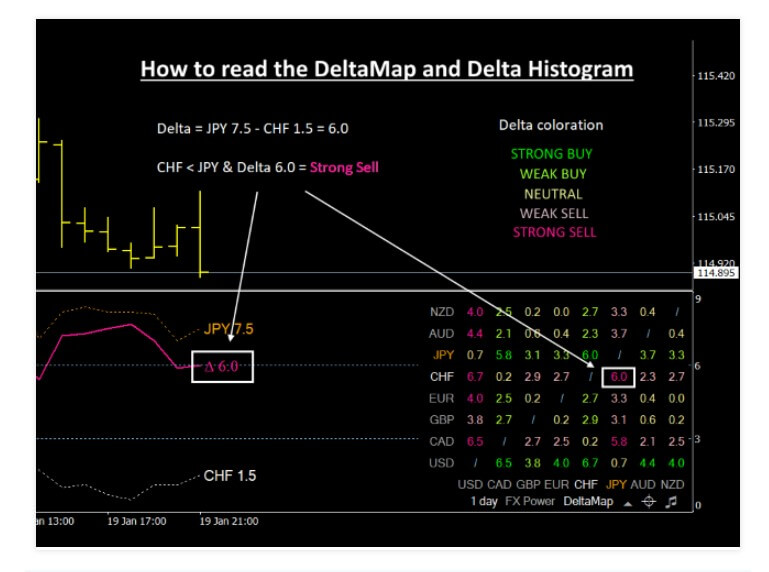

FX Power for the MetaTrader 5 (MT4 also available) is an indicator presented as “the first currency strength meter with a complete history across all timeframes”. Essentially it can be used standalone or as one of there indicators that compose the author’s Simple Trading System. The FX Power indicator developers are the Stein Investments team from Germany. The latest version is 3.76 updated in March 2020 and the first version is published in 2016.

FX Power for the MetaTrader 5 (MT4 also available) is an indicator presented as “the first currency strength meter with a complete history across all timeframes”. Essentially it can be used standalone or as one of there indicators that compose the author’s Simple Trading System. The FX Power indicator developers are the Stein Investments team from Germany. The latest version is 3.76 updated in March 2020 and the first version is published in 2016.

EMA Cross alert is a simple but paid category indicator created by Suriya Thammalungka from Thailand. The EMA means Exponential Moving Average, an indicator used very frequently in many combinations but mostly as a two-line crossing for trend following. The indicator is simple and is never updated since the initial version in June 2016 for MetaTrader 4. It is interesting to see this indicator in the paid category as it is too simple to belong here and the indicators used are basic.

EMA Cross alert is a simple but paid category indicator created by Suriya Thammalungka from Thailand. The EMA means Exponential Moving Average, an indicator used very frequently in many combinations but mostly as a two-line crossing for trend following. The indicator is simple and is never updated since the initial version in June 2016 for MetaTrader 4. It is interesting to see this indicator in the paid category as it is too simple to belong here and the indicators used are basic.

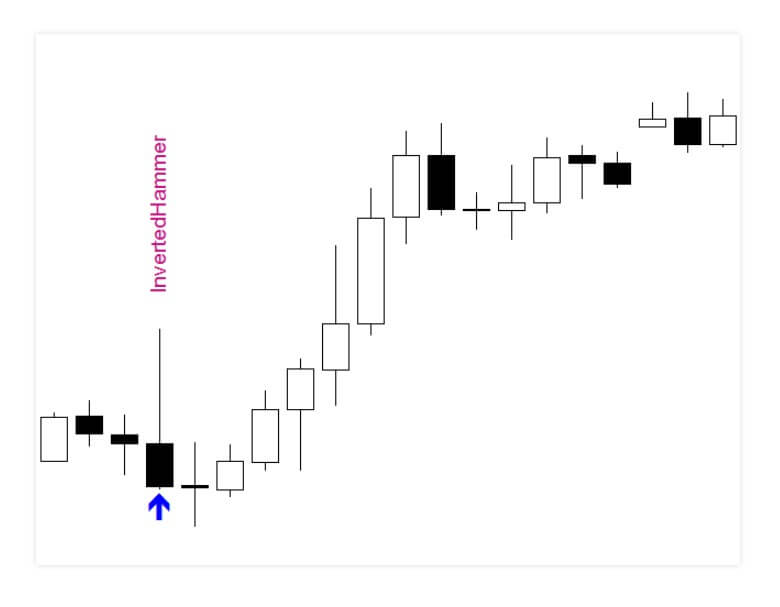

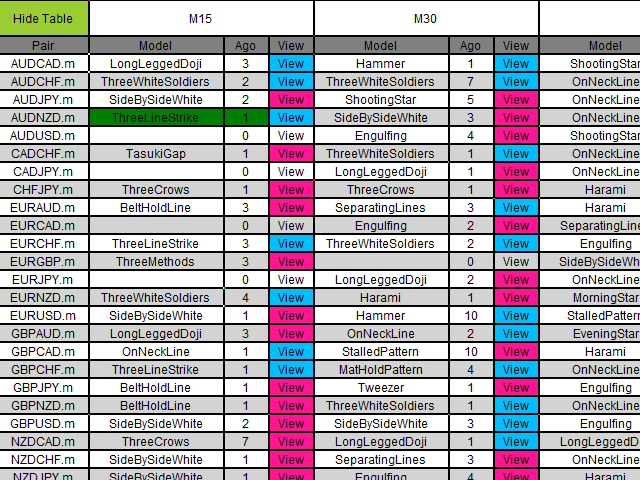

Candlestick Patterns All Pair is an indicator developed for automatic pattern recognition and plotting them on the MetaTrader 4 chart. The tool belongs to the paid category on the MQL5 market and is developed by Denis Luchinkin from Russia. He has over 20 published products but without notable popularity or ratings. This tool is published on the 23rd of March 2017 and has not been updated since. The candle patterns are used as predictive signals and could be reversal, trend, and sometimes scalp strategy elements.

Candlestick Patterns All Pair is an indicator developed for automatic pattern recognition and plotting them on the MetaTrader 4 chart. The tool belongs to the paid category on the MQL5 market and is developed by Denis Luchinkin from Russia. He has over 20 published products but without notable popularity or ratings. This tool is published on the 23rd of March 2017 and has not been updated since. The candle patterns are used as predictive signals and could be reversal, trend, and sometimes scalp strategy elements.

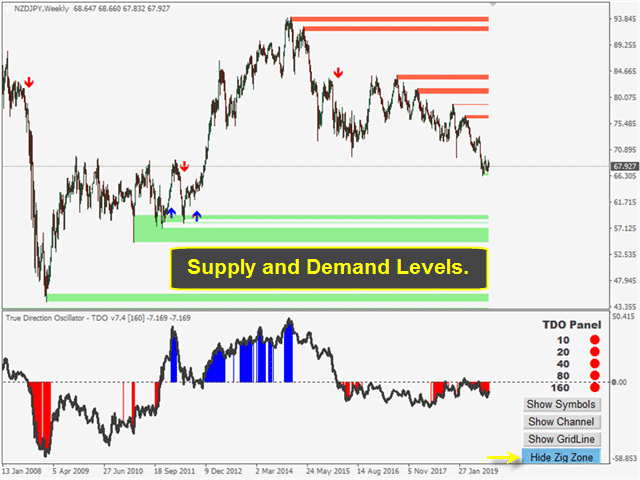

True Direction Oscillator or TDO is a trend gauging oscillator type indicator using a simple but effective formula. The developer is very open and transparent on how the indicator works and the Overview page has professionally made content. TDO has been initially published on the MQL5 market on 23rd November 2015 and since has received many updates. The latest version is v9.1, freshly updated in February this year. The author of this very interesting and popular indicator is Muhammad Al Bermaui from Egypt, showing great dedication to support his work.

True Direction Oscillator or TDO is a trend gauging oscillator type indicator using a simple but effective formula. The developer is very open and transparent on how the indicator works and the Overview page has professionally made content. TDO has been initially published on the MQL5 market on 23rd November 2015 and since has received many updates. The latest version is v9.1, freshly updated in February this year. The author of this very interesting and popular indicator is Muhammad Al Bermaui from Egypt, showing great dedication to support his work.

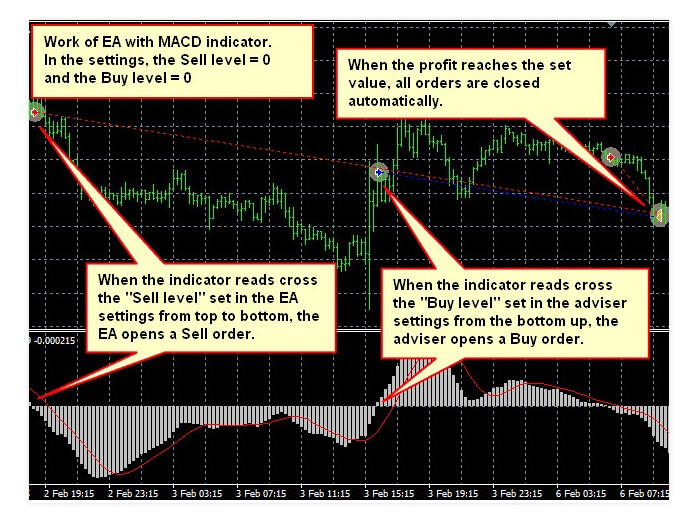

Most of the EAs follow a certain method or strategy, but it is uncommon to see an Expert Advisor made for traders to make their custom automated trading system. EA for Any Levels Indicators is such a product published on the MQL5 market. It is coded for the MetaTrader 4 platform and recently published, on the 14th of March 2020. The developer of this EA is Vyacheslav Nekipelov from Russia, selling 16 other products on the same market that do not have much popularity but they are useful and simple. There are no updates to this EA yet but it can certainly be upgraded with many ideas.

Most of the EAs follow a certain method or strategy, but it is uncommon to see an Expert Advisor made for traders to make their custom automated trading system. EA for Any Levels Indicators is such a product published on the MQL5 market. It is coded for the MetaTrader 4 platform and recently published, on the 14th of March 2020. The developer of this EA is Vyacheslav Nekipelov from Russia, selling 16 other products on the same market that do not have much popularity but they are useful and simple. There are no updates to this EA yet but it can certainly be upgraded with many ideas.

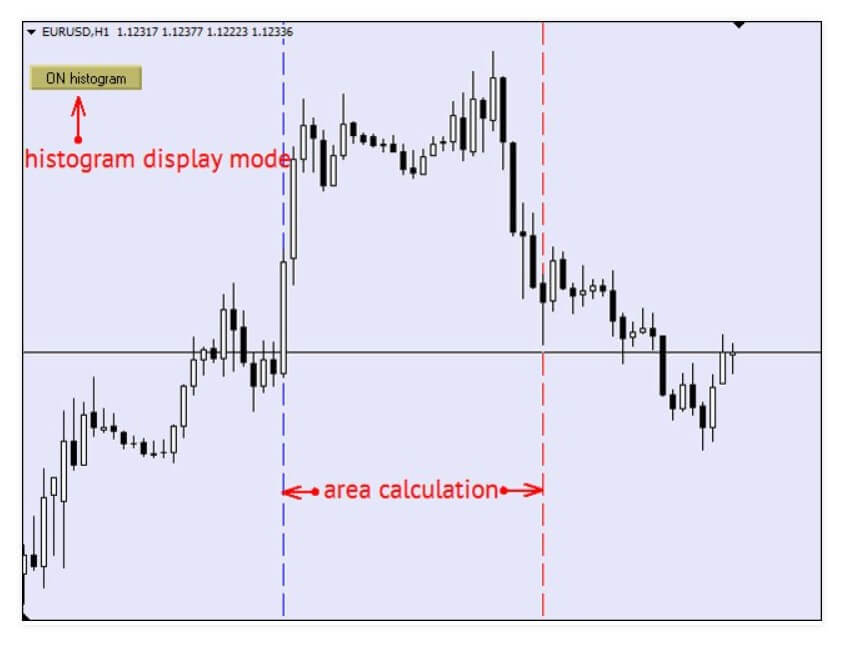

EMA or Exponential Moving Average is one of the most used and classic indicators for technical analysis. This indicator measures the difference between the closing candle prices and creates a momentum presented as an EMA in the MetaTrader 4 separate window chart. This idea is not new and is one of the classic ways of measuring momentum. The author made a simple indicator but it is very useful.

EMA or Exponential Moving Average is one of the most used and classic indicators for technical analysis. This indicator measures the difference between the closing candle prices and creates a momentum presented as an EMA in the MetaTrader 4 separate window chart. This idea is not new and is one of the classic ways of measuring momentum. The author made a simple indicator but it is very useful.

If you are familiar with the BBMA trading system, then this indicator or tool is the perfect addon. It is a specialized tool but can also be considered a complete trading system. It consists of multiple indicators designed for this algorithm trading. BBMA system is made by Mr. Oma Ally and the BBMA Dashboard tool is published by Alireza Yadegar from Iran. The system is relatively new, from mid-2016, and the tool soon followed a release on the

If you are familiar with the BBMA trading system, then this indicator or tool is the perfect addon. It is a specialized tool but can also be considered a complete trading system. It consists of multiple indicators designed for this algorithm trading. BBMA system is made by Mr. Oma Ally and the BBMA Dashboard tool is published by Alireza Yadegar from Iran. The system is relatively new, from mid-2016, and the tool soon followed a release on the

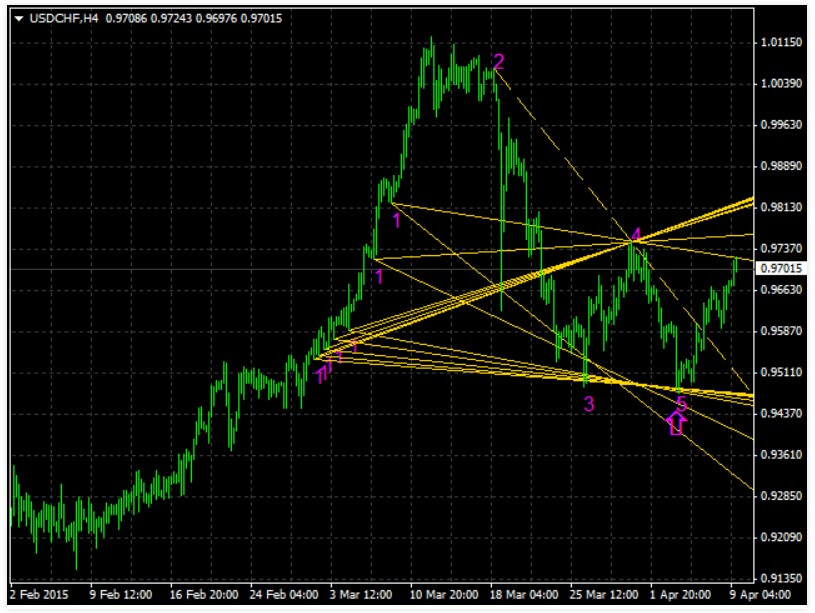

Traders familiar with Elliot Waves know there are a few elements that need to be determined before executing a trade. This indicator is developed with the idea to trade towards the 5th Elliot Wave in conjunction with other indicators, as a part of the “Trade The Fifth” swing strategy. This is a commercialized product also published in the MQL5 market for the MetaTrader 4 platform. Other platforms are supported but on the owner’s website. The developer is Paul Bratby from Spain who is the presenter of this swing strategy using Elliot Waves, publishing one more product related to this group strategy ideas. The first version is published on 13th December 2019 and has never been updated to date. Elliot Wave Indicator belongs to the paid category but it is not available to buy, this is a subscription-based service with several options.

Traders familiar with Elliot Waves know there are a few elements that need to be determined before executing a trade. This indicator is developed with the idea to trade towards the 5th Elliot Wave in conjunction with other indicators, as a part of the “Trade The Fifth” swing strategy. This is a commercialized product also published in the MQL5 market for the MetaTrader 4 platform. Other platforms are supported but on the owner’s website. The developer is Paul Bratby from Spain who is the presenter of this swing strategy using Elliot Waves, publishing one more product related to this group strategy ideas. The first version is published on 13th December 2019 and has never been updated to date. Elliot Wave Indicator belongs to the paid category but it is not available to buy, this is a subscription-based service with several options.

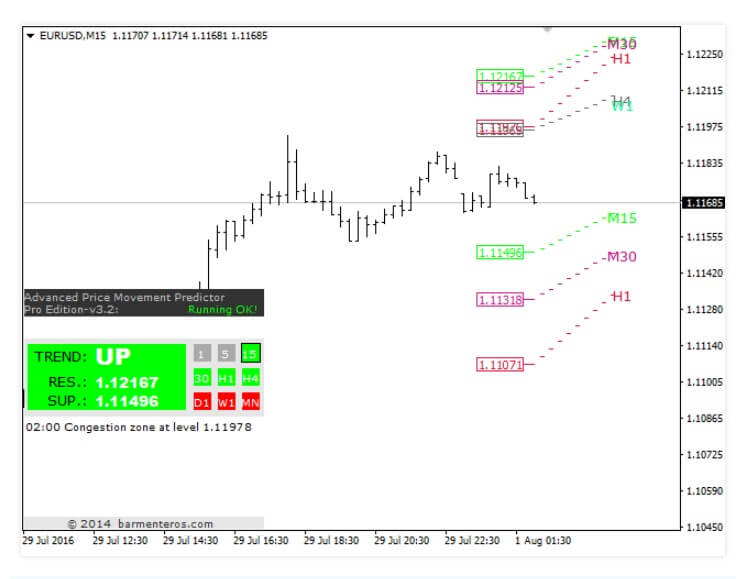

Given by the name one could think this indicator uses candle patterns or other non-lagging methods to predict trends. However, this is not true, this is a combo indicator for the trend following strategies using Price Action methodology. It is developed for the MetaTrader 4 client by Boris Armenteros from Spain, as the leader of the Barmenteros team. This team has some trading and coding experience having at least 15 products released on the MQL5 market. Advanced Price Movement Predictor is initially published in January 2014, however, it is not updated frequently.

Given by the name one could think this indicator uses candle patterns or other non-lagging methods to predict trends. However, this is not true, this is a combo indicator for the trend following strategies using Price Action methodology. It is developed for the MetaTrader 4 client by Boris Armenteros from Spain, as the leader of the Barmenteros team. This team has some trading and coding experience having at least 15 products released on the MQL5 market. Advanced Price Movement Predictor is initially published in January 2014, however, it is not updated frequently.

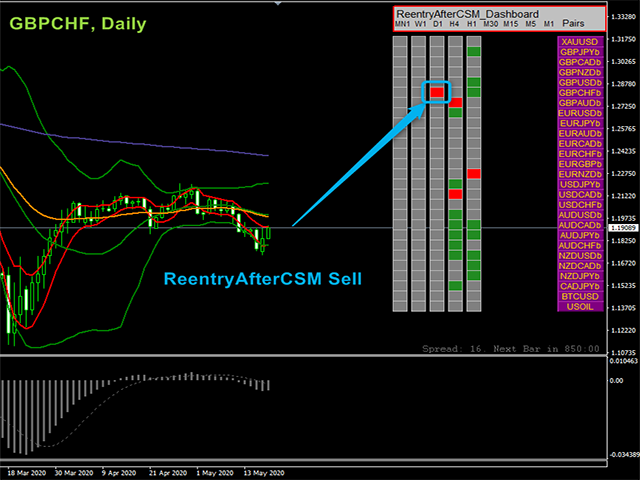

Currency Strength meter indicators are interesting to many traders and have many uses, not necessarily to enter new positions. CSM indicator is the work of Aliakbar Kavosi from Iran releasing the first version of CSM in March 2016 for the MetaTrader 4 platform and updated it twice in late 2019, giving the indicator a new code and better symbols integration with various brokers. This author is the owner of 18 published products on the MQL5 market without significant attention from the users. CSM is not free but seems to do other Currency Strength meters do, just with a small deviation.

Currency Strength meter indicators are interesting to many traders and have many uses, not necessarily to enter new positions. CSM indicator is the work of Aliakbar Kavosi from Iran releasing the first version of CSM in March 2016 for the MetaTrader 4 platform and updated it twice in late 2019, giving the indicator a new code and better symbols integration with various brokers. This author is the owner of 18 published products on the MQL5 market without significant attention from the users. CSM is not free but seems to do other Currency Strength meters do, just with a small deviation.

Price Action traders know Support and Resistance levels are the dominant element in their analysis, as well as other strategies. Support and Resistance is an elementary factor assessed for the prediction of points of trend reversals in both directions. This indicator is designed for the MetaTrader 4 for automatic recognition of concentrated prices based on which the zones are plotted on the chart. The indicator that can determine these levels instead of the trader makes the whole process faster, more precise, and non-subjective.

Price Action traders know Support and Resistance levels are the dominant element in their analysis, as well as other strategies. Support and Resistance is an elementary factor assessed for the prediction of points of trend reversals in both directions. This indicator is designed for the MetaTrader 4 for automatic recognition of concentrated prices based on which the zones are plotted on the chart. The indicator that can determine these levels instead of the trader makes the whole process faster, more precise, and non-subjective.