Far from being something that will help you operate profitably, the usual use of Forex indicators really causes more losses than gains among inexperienced traders. However, if you are going to use them, then you should know that the best Forex indicator is the RSI (Relative Strength Index).

What is the RSI (Relative Strength Index)?

The RSI reflects the momentum and it is well known that following the momentum in the foreign exchange market increases the chances of profits. The RSI is an indicator of momentum in the Forex market and, in fact, it is the best indicator of momentum. If you are willing to use the RSI, probably the best way to use it is to go long when it is above 50 in all time frames, and operate short if it is below 50 in all time frames. It is best to always operate with the trend of the last 10 weeks or so. The formula of the relative strength index was created in the 70s, as were many other concepts of technical analysis.

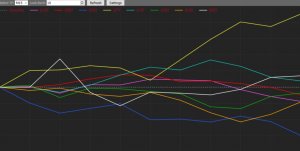

Relative Strength Index – Forex Indicators

The calculation of the relative force is performed by calculating the ratio of upward changes per unit of time to downward changes per unit of time during the review period. The actual calculation of the indicator, however, is more complex than we need to know here. What is important to know is that if we look back over a period of, say, 10 units of time and each of those 10 candles closed upwards, the RSI will show a number very close to 100. If each and every one of those 10 closed candles, the number will always be very close to 0. If the financial asset is fairly balanced between drops and raises, the RSI will show 50. The relative force index is defined as a pulse oscillator. Shows whether bulls or bears are winning in the review period, and this period can be adjusted by the trader.

Technical Analysis of the Relative Force Index

The RSI indicator is normally used in forex trading strategies in the following ways:

- When the RSI is above 70, a price drop should be expected. A drop below 70 after having been above 70 is taken as confirmation that the price is starting a downward movement.

- When the RSI is below 30, a price increase should be expected. A rise above the level of 30 after having been below 30 is taken as confirmation that the price is starting an upward movement.

- When the RSI crosses above 50 after being below 50, it is taken as a sign that the price is beginning a bullish movement.

- When the RSI crosses below 50 after being above 50, it is taken as a sign that the price is beginning a bearish movement.

Methods 3 and 4 described above in relation to crossing the level of 50 are generally higher than the first and second methods concerning 30 and 70. That’s because more long-term Forex earnings can be achieved by following trends instead of always expecting prices to bounce back to where they were: just be careful not to move the stop loss to the break-even point too quickly.

Forex Indicators

This is a point where we will pay more attention – if it is better to follow trends, or “diminish” them by doing trades against them. There are many outdated tips on this subject, most of which were in the years prior to 1971, at a time when exchange rates, although they were fixed at the price of gold or other currencies. In this era, trading was mainly in shares or, to a lesser extent, in raw materials. It is a reality that commodities and stocks tend to show markedly different pricing behaviour from the exchange rates of Forex currency pairs – stocks and commodities show trends more often, are more volatile, and follow longer and stronger trends than Forex currency pairs, which show a stronger tendency to return to average.

This means that when making Forex trades, most of the time, using the RSI to trades against directional moves using methods 1 and 2 described above, will work more often, but it will generate less utility than the use of Methods 3 and 4 to track trading trends in the direction of the strong prevailing trend, where such a trend exists. Although it may seem attractive to try to earn smaller amounts more often and use money management to increase profits quickly, It is much more difficult to build a cost-effective medium-reversion model than to build a cost-effective trend tracking model, even when trading with Forex currency pairs. The best way to operate at RSI 50 level crossings is to use the indicator in multiple time frames for the same currency pair.

Crossing The 50 Level In Various Time Frames

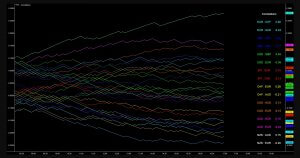

Open several charts of the same currency pair in several time frames: weekly, daily, H4, up to the minute. Open the RSI flag in all charts and make sure the 50 level is checked. Virtually all forex graphics programs or software include the RSI, so it should not be difficult to use it. A good period to use in this indicator is 10. It is also important that the market review period is the same in all different time frames.

If you can find a currency pair that in all the higher time frames is above or below 50, and in the lower time frames is on the other side of 50, then you can expect the lower time frame to cross again above 50 and should accordingly open an operation in the direction of the long-term trend.

The higher or lower the RSI, the better the operation. In the forex markets, it is a universal law: strong trends are more likely to continue and a reversal that then turns tends to move very well in the direction of the trend. This method is a smart way to use a forex indicator because it identifies setbacks within strong trends and tells you when the setback is likely to end.