What is Myfxbook? How do I create an account? What can I find on this platform? What should I do if I want to be a provider of trading signals? In this guide, you will find everything relative to how to handle Myfxbook, a platform that has given a turn to social trading.

More than 100 online Forex brokers offer the services of the Myfxbook platform. It is a tool that has gone beyond social trading to become a provider of services related to the world of world-class short-term financial investments.

But what is the novelty of this platform? Until now, social trading communities had simply been confined to a particular broker. Thanks to Myfxbook, the community is growing. It is a multi-broker platform, with which signal services, Experts Advisors, programmers, PAMM accounts, copy trading, and more.

This feature, together with the number of parallel services it offers and the reliability it provides to copy traders, has made Myfxbook one of the reference trading pages. Through these paragraphs, you will discover how this platform works and what it can do for you.

What is Myfxbook?

This website was born as a trading account analysis system, a community created for traders in which transparency in the operation of those service providers took precedence. In turn, making the learning process easier for other less-experienced traders. Myfxbook is one of the first websites dedicated to social trading.

As we can see, everyone wins: expert traders can make profits by being followed (in the form of commissions) and novice traders can develop their knowledge thanks to the monitoring of other traders. A collaborative project where ideas are shared.

The main difference between Myfxbook and other platforms, also dedicated to social trading, is its ability to work with different intermediaries and the security it brings by showing real and verified results.

Myfxbook puts at your disposal the following benefits:

-Analyze your trading systems automatically and in one place, without the need for manual calculations.

-You can observe (and copy) other traders to discover how they do their trading and, in this way, develop your skills.

-You can share your system and your results to find customers and become a fund manager.

-Likewise, you will also have access to the audited results of other traders in cases where you need to hire some social trading service (copy trader, signal system, PAMM accounts, etc.).

-You will have the possibility to buy and sell trading systems.

-You will be part of a community, Myfxbook is a great social network dedicated to trading.

-You’ll access a wealth of news and market information services to make trading decisions.

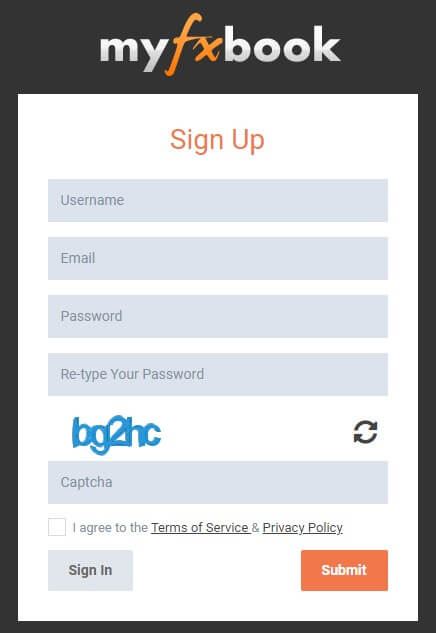

How Do I Access Myfxbook?

The first step is to register in Myfxbook (in myfxbook.com), this page is available in Spanish. To be able to use the platform you need to have a trading account with one of the more than 100 brokers that are compatible with its use and allow you to participate in its program. The trading platforms supported are:

The process is very easy, what you should do is fill out the form that you will find on the left side of the home screen, after accessing the page (myfxbook.com). You must define:

- Your username

- A password

- Provide an email address

They’ll send you an email from which you must confirm the newly created account and you can now access Myfxbook by logging in (i.e., entering your username and password).

After this first step, the next step is to connect your trading account with Myfxbook. This option is available in the “Portfolio” menu, by pressing the “Add Account” button. You can also do this task in “Settings” in the user menu (where your username appears).

With MetaTrader, you can link your account through Publisher or by downloading an Expert Advisor (EA) specially designed for this purpose. After that, you will have to install the app, after it is downloaded. It will ask you to select a specific account from the chosen platform (it is advisable to select an account that already has a history).

The following steps are done from the trading platform itself, we can anticipate that, in MetaTrader 4, these tasks are performed from the “Options” command, within the “Tools” menu.

In the “Activity” menu of Myfxbook (top of the screen), you will be notified that your trading account has been linked to your Myfxbook account.

Once your trading account is linked to the platform, in the “Portfolio” menu you can get a view of your trading statistics and associated account information. This will be of great use to carry out a thorough analysis of your profitability, your percentage of winning trades, drawdown, and other variables that you will have to take care of as a trader. Especially if you have multiple accounts, so you can monitor your entire operation.

Prepare Your Profile

On the right side of the screen, at the top, at the aforementioned user menu, you have everything to leave your profile ready in this new social network of which you are already part.

Your profile is your cover letter to other traders and will be essential if you intend to initiate or participate in any conversation, debate, ask questions, or market any social trading service.

To fill your profile you must select the “Edit Profile” submenu or enter “Settings” and select the “Profile” tab (both options are located within your user menu at the top right of the screen, where your name appears).

What Can You Find in Myfxbook?

It is necessary to say that some of these services are available without the need to create an account in Myfxbook, that is, without the need for previous registration on the page. However, once created, you will have full access to all the utilities that this platform has. As we have seen, the process of creating an account is simple and fast: it is worth taking this step. Among the menus of Myfxbook, you will find all this amount of tools that we show you below, menu to menu.

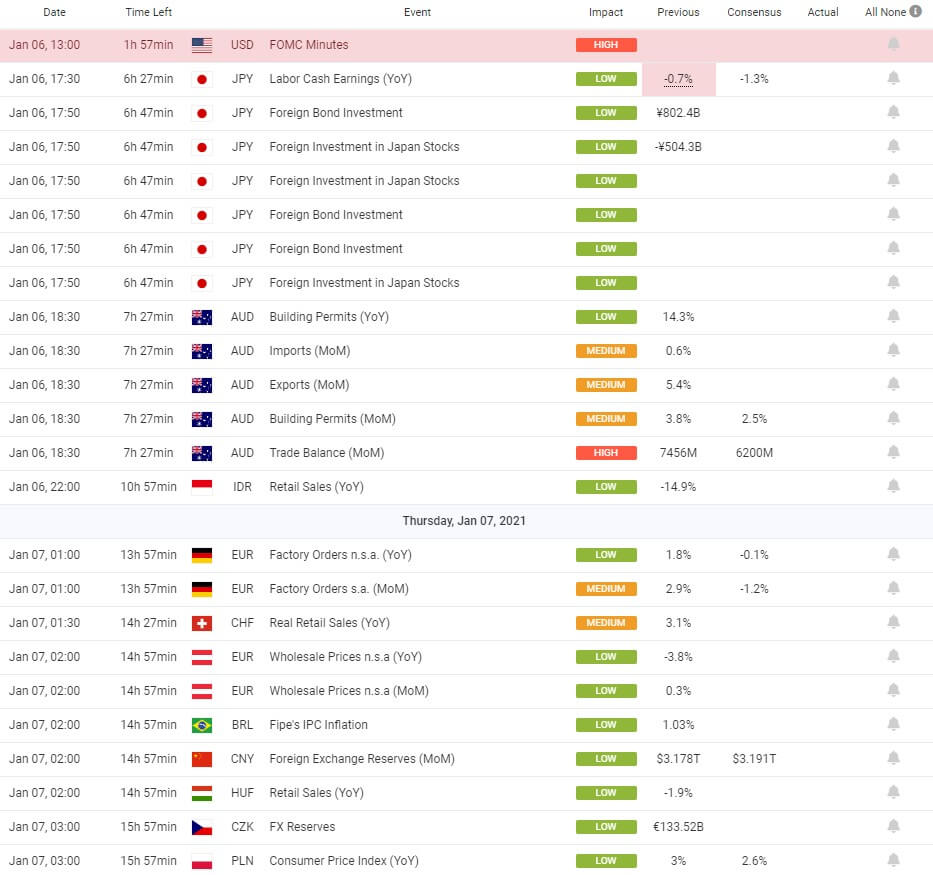

This first menu is related to the latest market news, very useful to keep you up to date. The menu is composed of:

News: access to the latest news related to the Forex market.

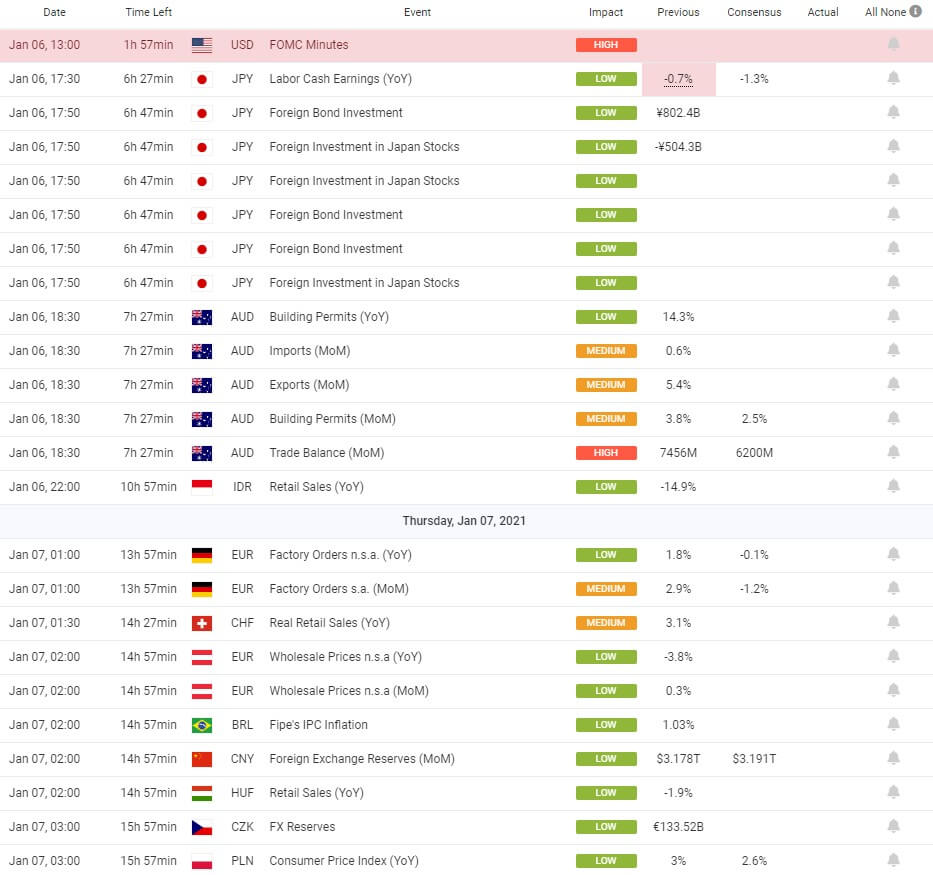

Economic Calendar: economic publications that move currencies.

Recent Posts: Last threads in the Myfxbook forum.

Forex Calculators: In this command, you have available a series of calculators designed to make your trading easier (for example, pips calculator, margin calculator, Fibonacci, etc.).

Portfolio: From this menu, you can link your accounts and access their statistics. In short, you can analyze your trading to improve it.

Then we’ll see how we can perform this data public so that other traders can assess if it is advisable to contract some product or service that is intended to offer.

Autotrade: The Autotrade menu is the corresponding menu for replicating operations. When a trader is a signal provider and carries out a trade, Myfxbook sends a signal to all those trading accounts that follow it (that is, the accounts of its customers). In this way, the same position as the aforementioned supplier is opened or closed.

The menu consists of a submenu with the frequently asked questions of this service (FAQs), the help submenu, and a simulator that we can test the strategy of any provider before making the decision to follow it.

Soon we will see the requirements to be able to be a signal provider in Myfxbook.

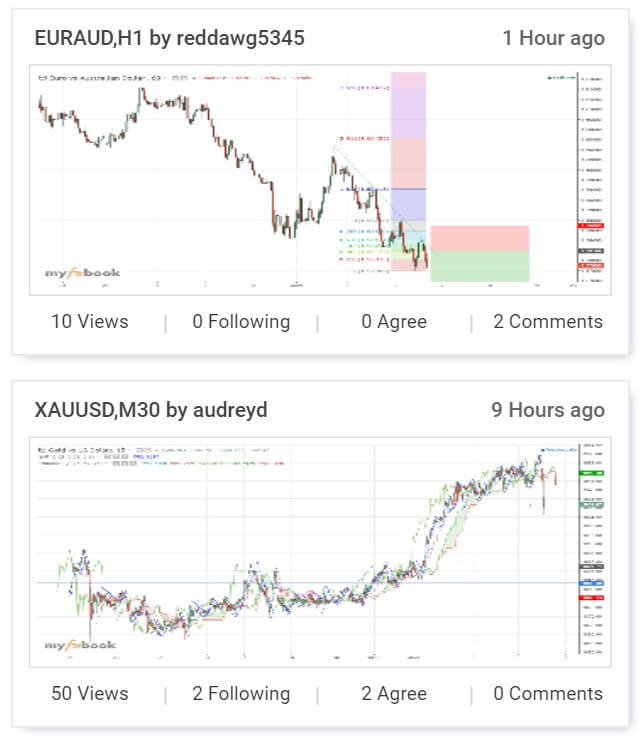

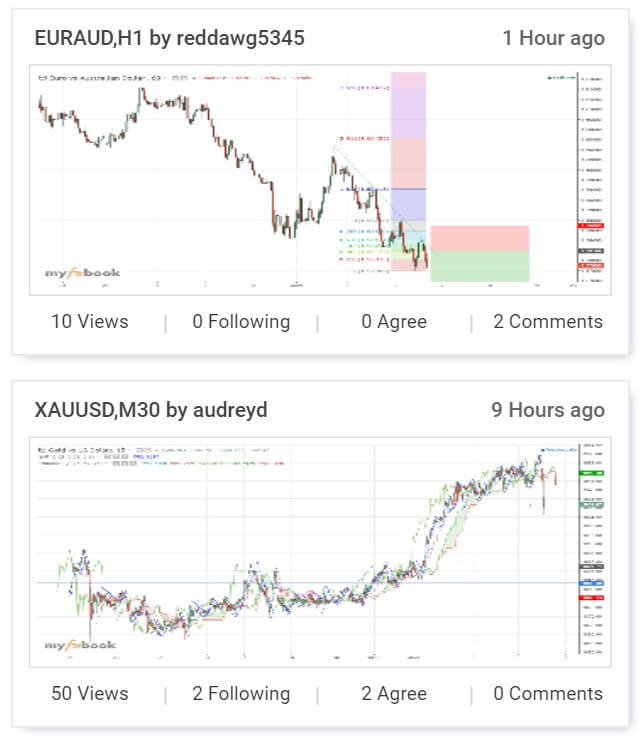

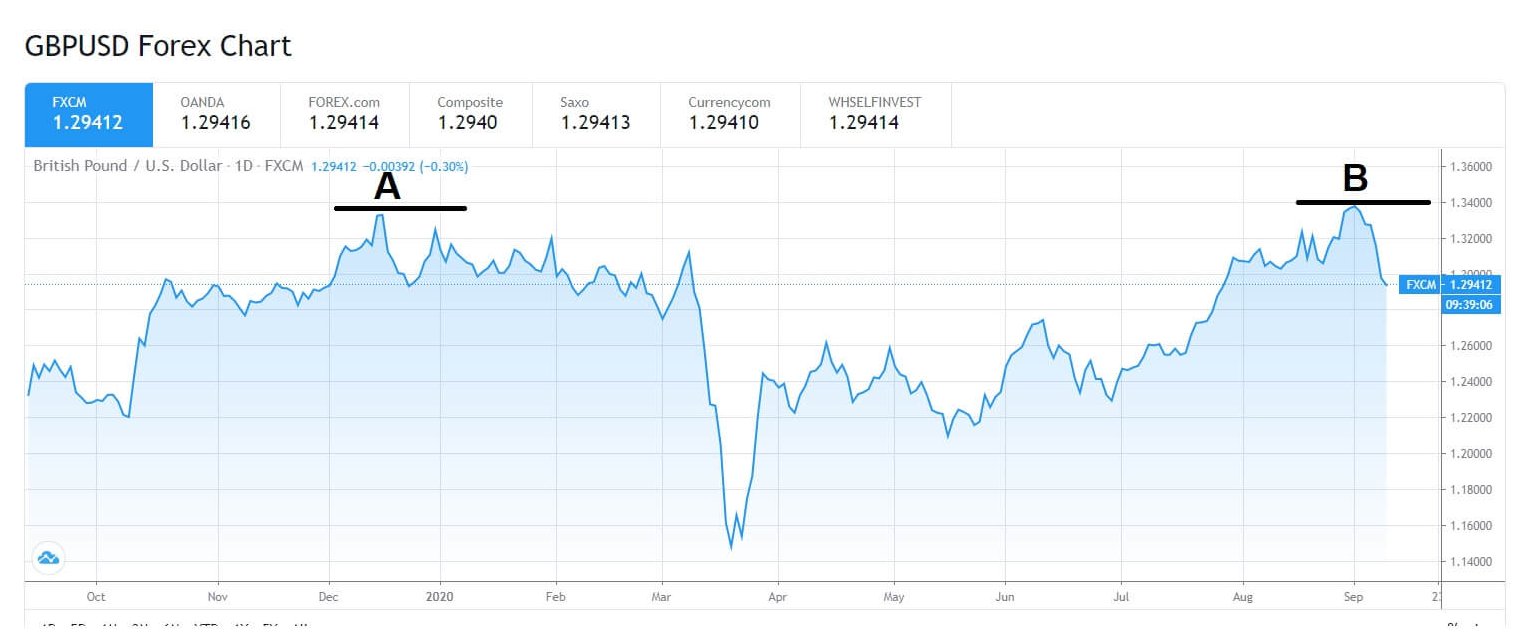

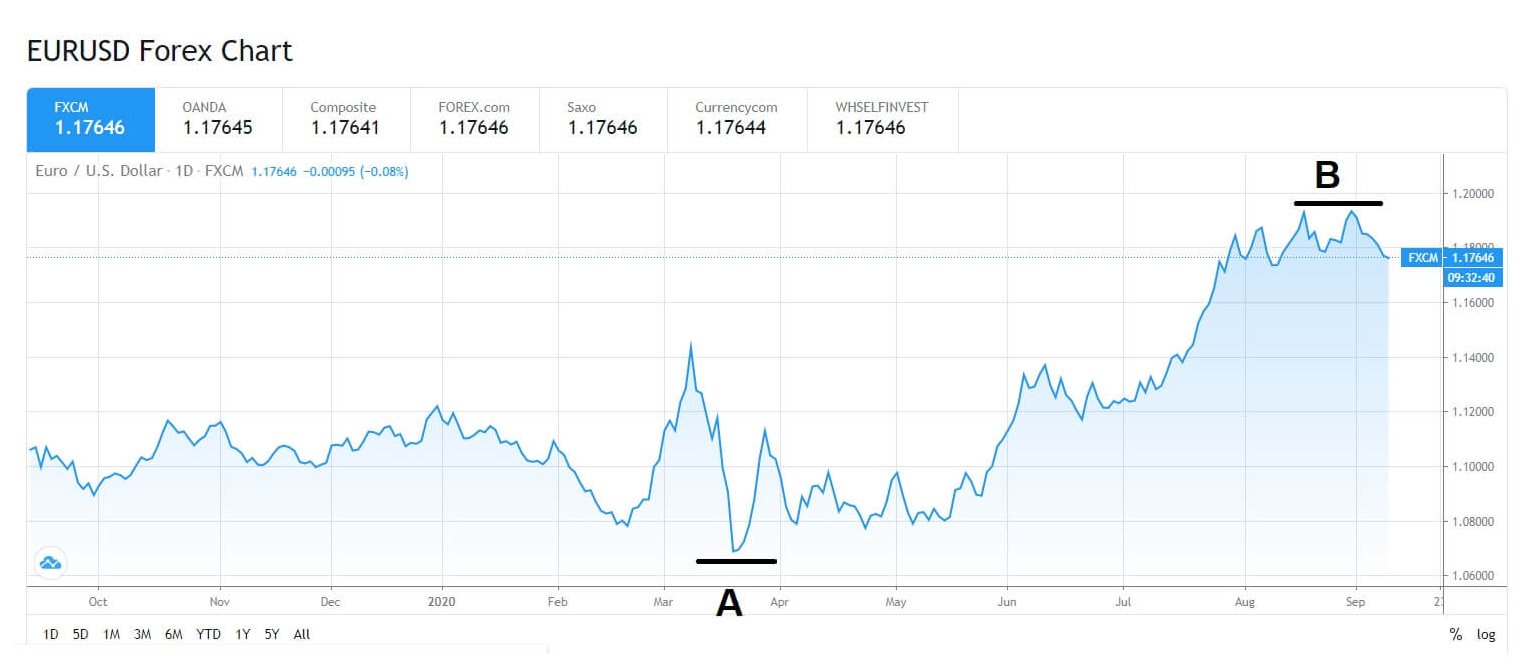

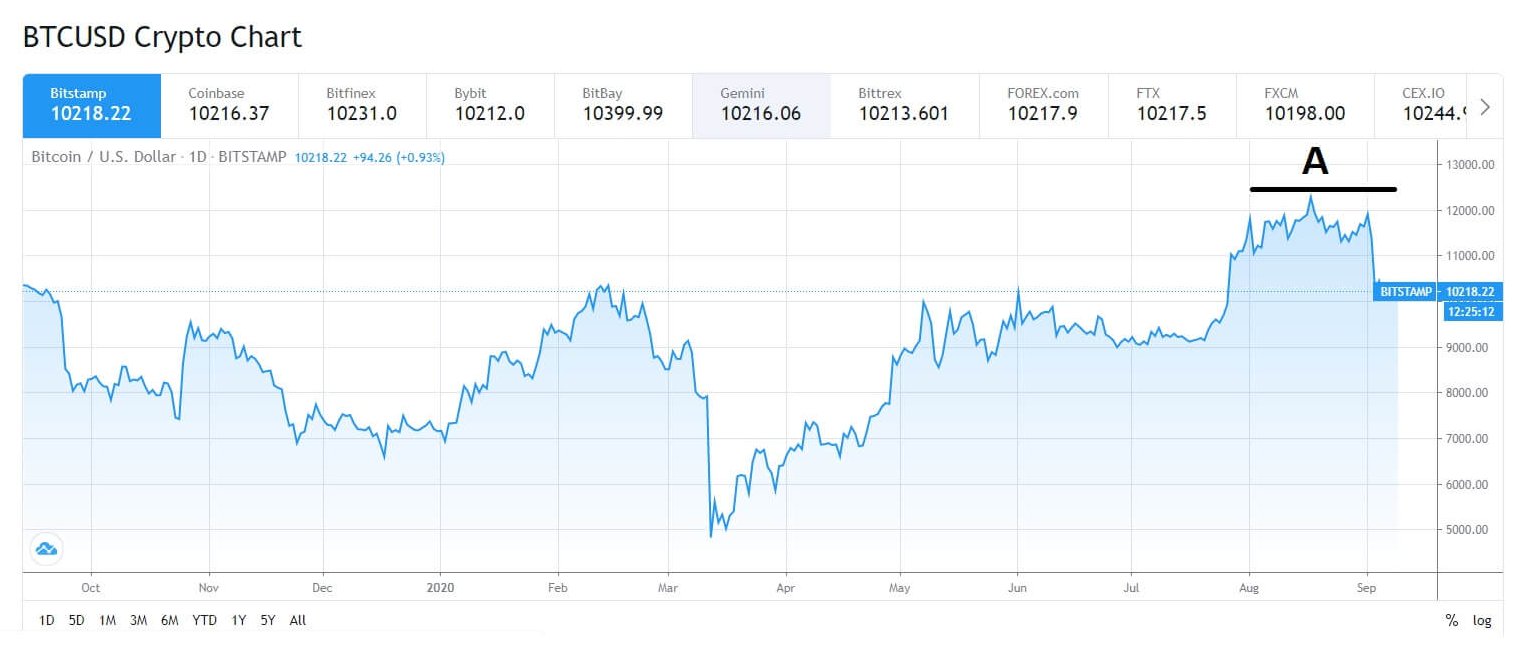

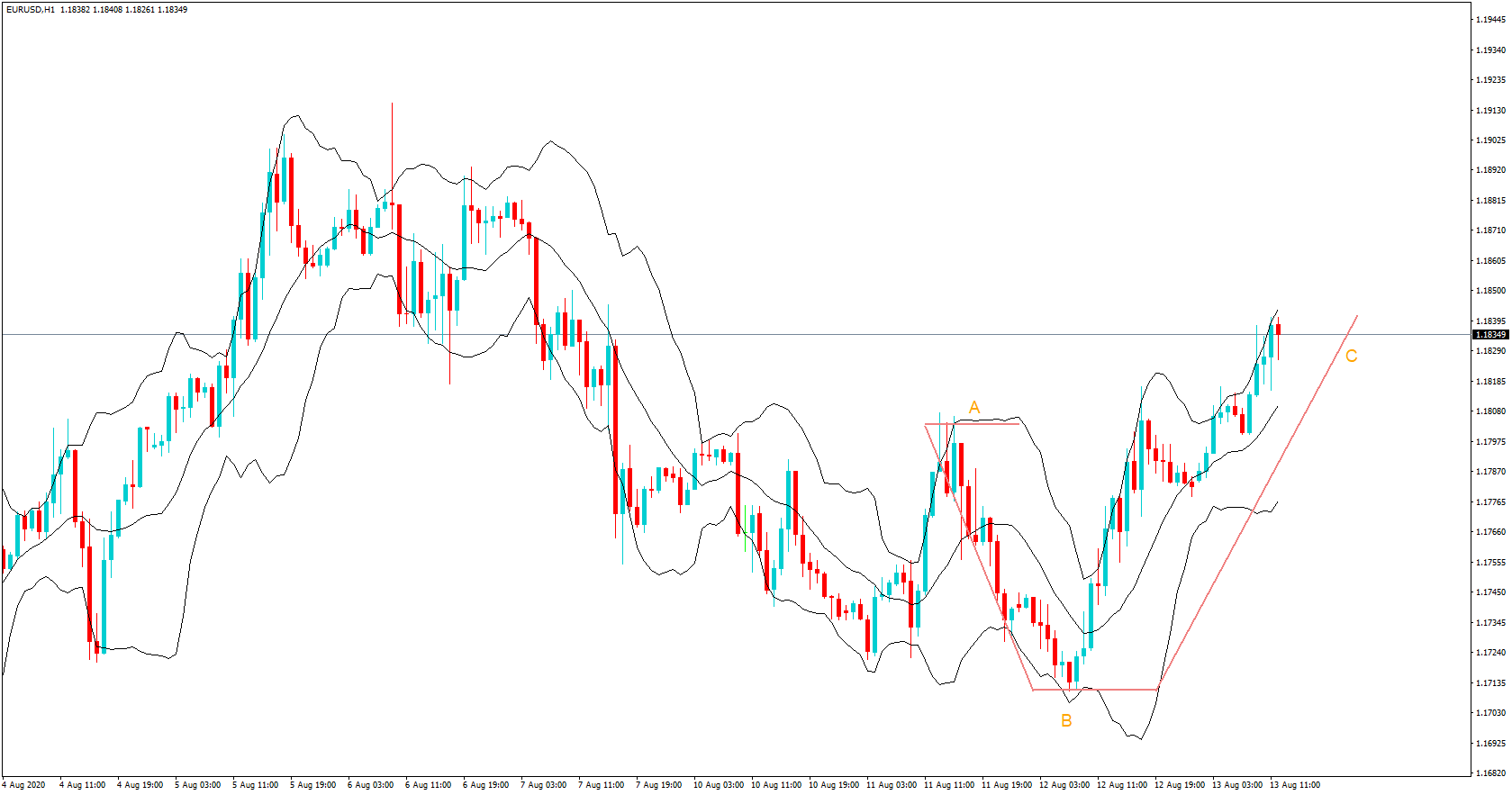

Charts: Charts are one of the tools that Myfxbook provides to members of its community. Any user can create an analysis and post it so that other traders can view and comment on it. It is possible to see the most followed, the most recent, or the most commented charts (among others). Everything depends on the specific option you choose in the submenu.

You also have the opportunity to create your own analyses and share them in this social network, in this way analysis is shared and learned through shared opinions. It will also help you boost your personal brand as a trader.

Markets: In this section, we will find several sub-menus with information about the Forex market useful for making trading decisions:

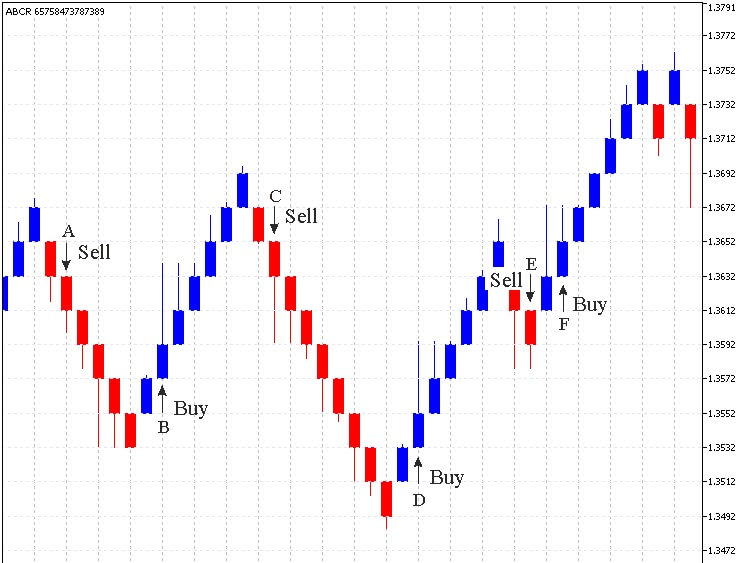

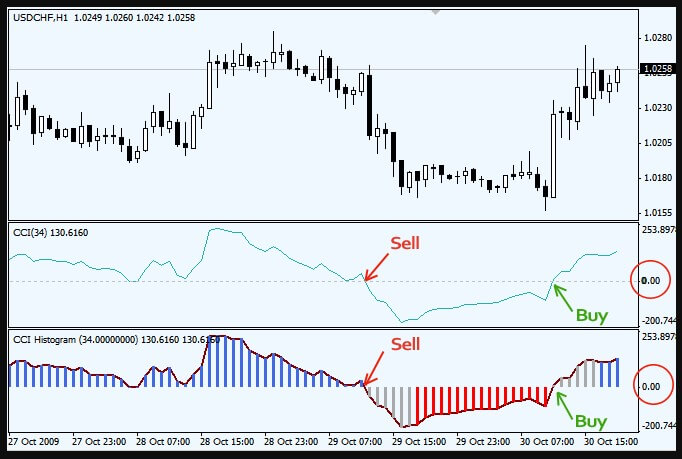

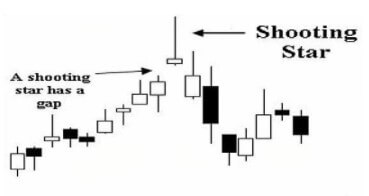

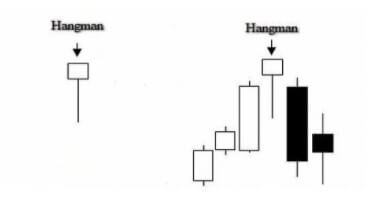

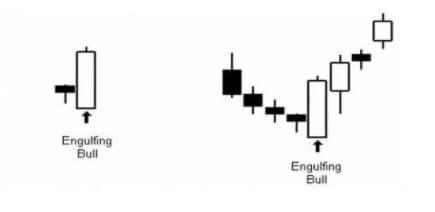

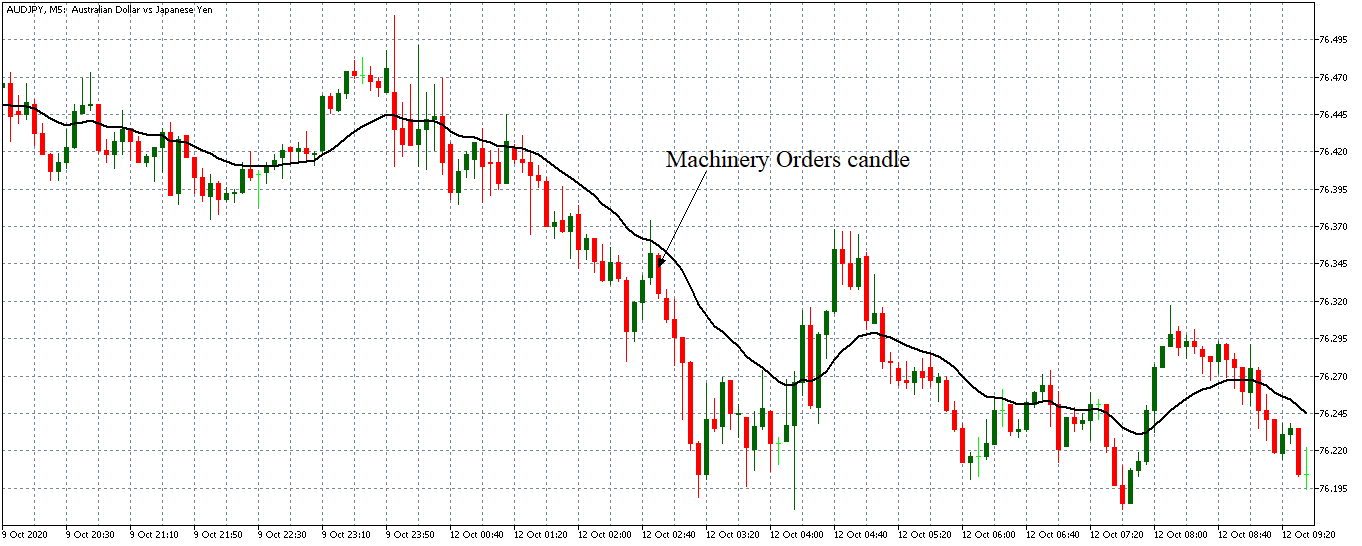

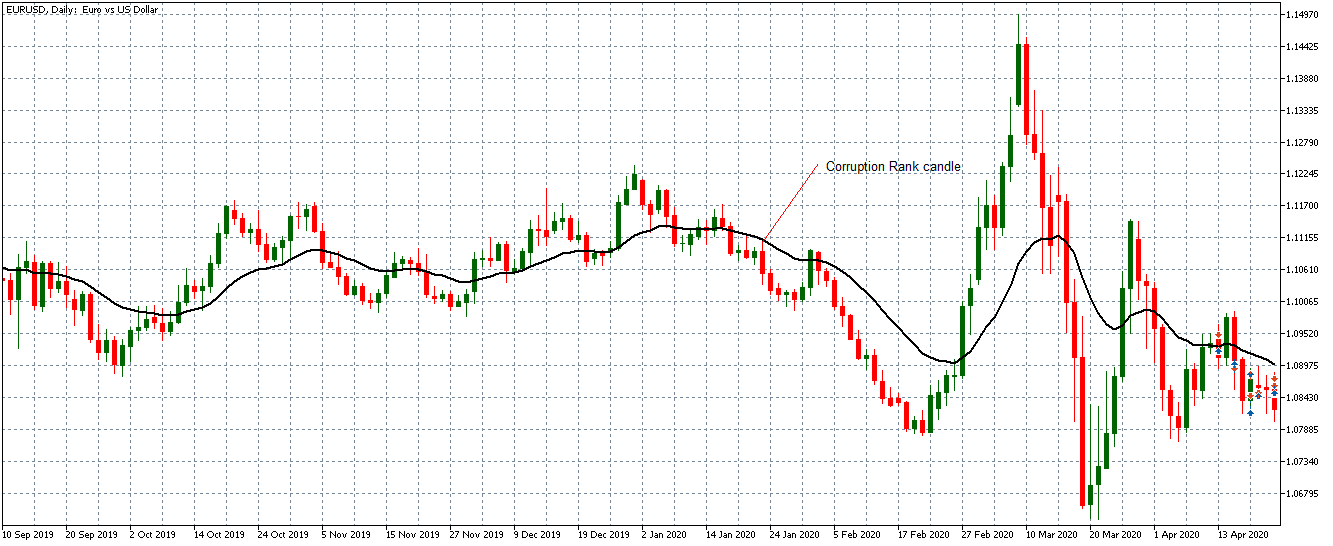

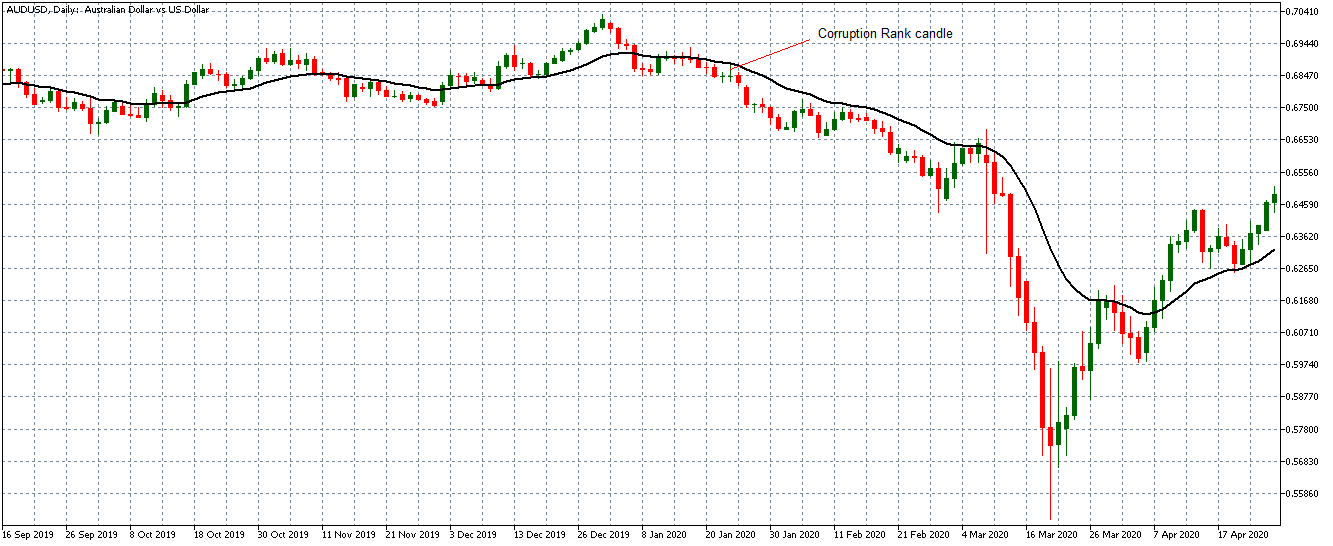

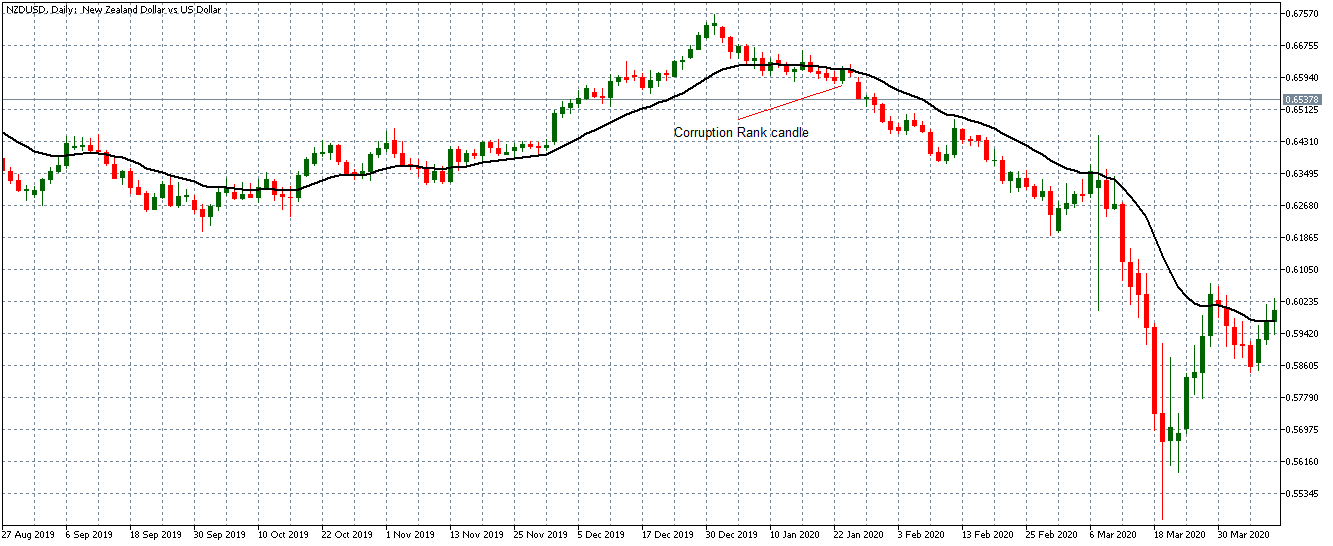

Technical Analysis Patterns: shows the different Japanese candle patterns that follow each other in major currency pairs. The temporality in which they appear and the implications they have (bullish or bearish) can be defined. You can also comment (and see the corresponding comments).

Volatility: you can visualize the volatility, in pips, of the main currency pairs (in several seasons).

Heat Map: Do you want to know which are the hottest currencies? Here you are indicated the strongest and weakest in different time periods.

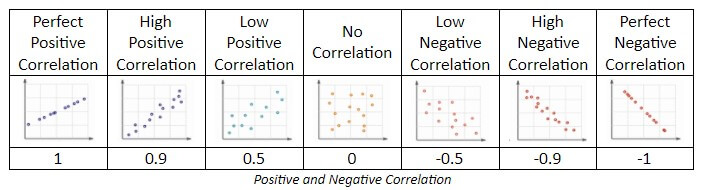

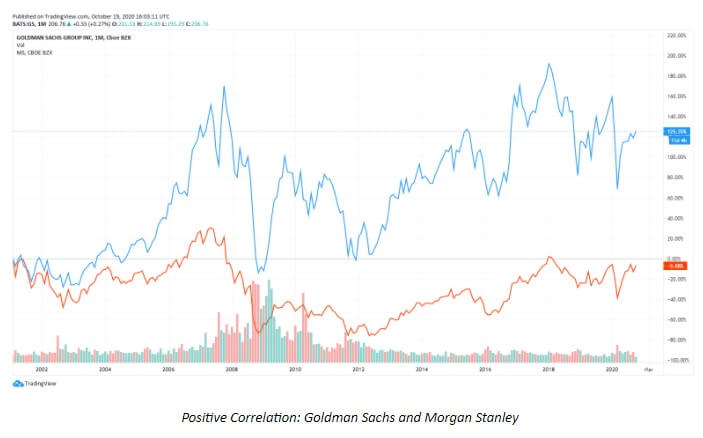

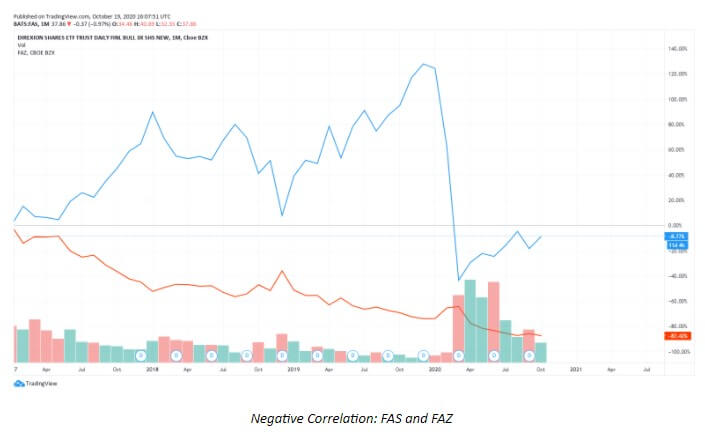

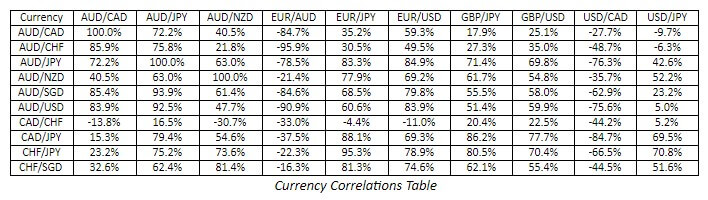

Correlation: The relationship between currency pairs is important to avoid overexposure to the risk of a particular currency pair. There are also trading strategies based on correlation. In this command, you can have it under control.

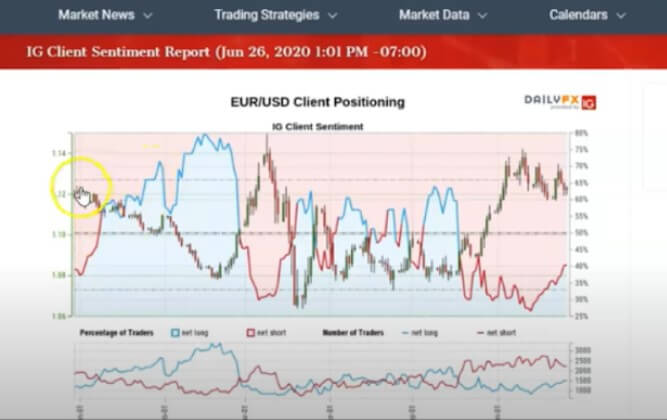

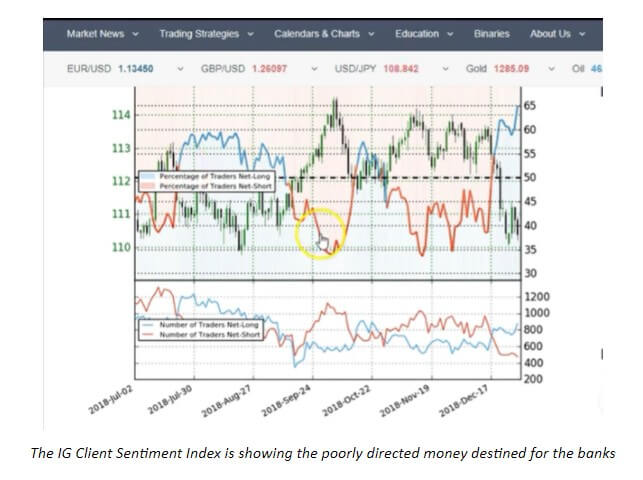

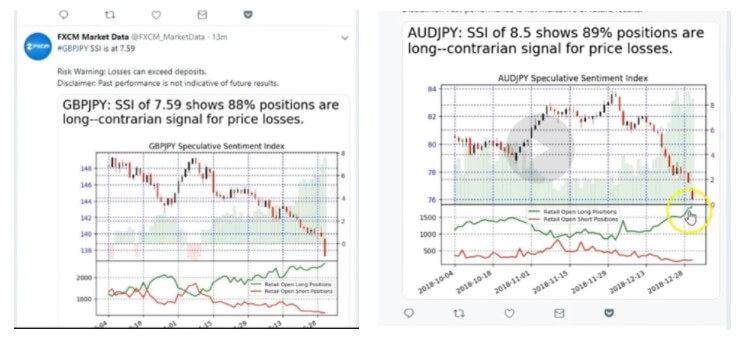

COT (Traders’ Commitments) Data: data obtained from Commodity Futures Trading and in which you can read the positions of the participants of the forex futures market, to get an idea of what they think.

Liquidity: You can look at the estimates of trading activity in the market in this subsection.

Systems: This menu is only visible to all users who have created an account in Myfxbook. In it, you will have the opportunity to visualize the different trading systems and strategies of those users who have made this information public, in order to be followed. Through the statistics provided by the platform (and that we have already seen in a previous image).

Also, you have the option to follow any of them that you find interesting, by clicking on the button “Autotrade”. You can have direct access to the most popular ones by selecting the corresponding submenu. You can also compare different trading systems.

Remember that one of the advantages that Myfxbook provides is the transparency and reliability in the statistics of the different historical data, the accounts are audited at the time they are linked to this platform.

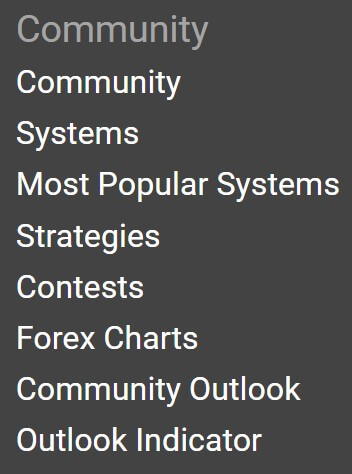

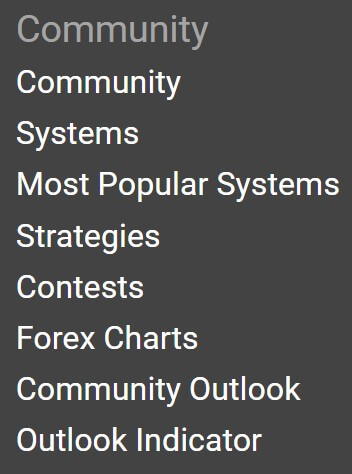

Community: This is a communication space, where you will be able to ask, share, debate, and learn about any topic of trading in the Forex market.

Beyond the general forum, this section is composed of several sub-menus, in which you can see conversations regarding:

Beyond the general forum, this section is composed of several sub-menus, in which you can see conversations regarding:

- New traders

- Experienced traders

- Investment systems

- Strategies

- Programmers

- Suggestion box

- Contests

- Technical patterns

- A feeling of community

Any user can open a new discussion thread. Being proactive in this aspect improves our visibility within the platform and, therefore, we will be more transparent and reliable traders. In addition, it is a good meeting point to share ideas and market products and/or services related to currency trading.

Comments: In this section, you can access, in addition to participating directly, various comments, reviews, ratings, etc. about:

- Brokers

- Automatic systems

- Signal providers

- VPS services

- Programming services of EAs

- PAMM services

- Reimbursement programs

- Trading platforms

As we can see, once again, Myfxbook stands out for the transparency it offers. On this occasion, the users of the platform are the judges of any service offered. There is nothing like seeing the ratings and reviews to check the reliability of any product or service.

Competitive examinations: As its name suggests, this menu will help us to be aware of the different trading contests organized by different sponsors. We will be able to see, also, the contests that at that time may be active.

If we access the menu, we will have the relevant data to decide whether or not we are interested in participating in a trading contest. Data such as:

- Sponsor

- Number of competitors

- Whether it’s a demo or real

- Awards

- Winners (if the contest is over)

- Start and end dates of the competition

- Statistical analysis of the operations carried out

Without a doubt, it is another advantage of Myfxbook: to have under control the trading contests and all the information about them.

Brokers: This section is a comparative table of the different online financial intermediaries trading in the currency market. From it, we can see, compare, analyze, and decide which broker is the most interesting for our operation, depending on our trading style and our preferences. We will be able to undertake a follow-up of the spreads they offer, swap commissions, as well as other costs and promotions they can offer us.

Hiring a broker adapted to your needs is essential to develop a good trade. Through this menu you can see all the information of interest in this sense: one more reason to have Myfxbook among your favorite trading pages.

How Can I Become a Trading Service Provider in Myfxbook?

As mentioned above, Myfxbook gives you the opportunity to promote yourself as a trader, offer a range of services, and develop all your skills in the currency market. However, to market any social trading service you need to make public the statistics of at least one of the accounts you have linked to this platform.

Myfxbook stands out for offering a real, verified, and transparent information of the different traders, so, to have the opportunity to be a top trader, you must make a good operation and this contributes to the professionalization and regulation of this professional activity.

To make your trading account data public, simply click on the “Invitations” tab (in the “Settings” or “Portfolio” menu) and mark all options as public.

Trading providers earn a 0.5 pip commission on each account subscribed for each winning trade. If you are content to be a successful trader, you must first learn and take experience in the markets. In this respect, Myfxbook will also be of great help to you thanks to the information and possibility of communication it offers.

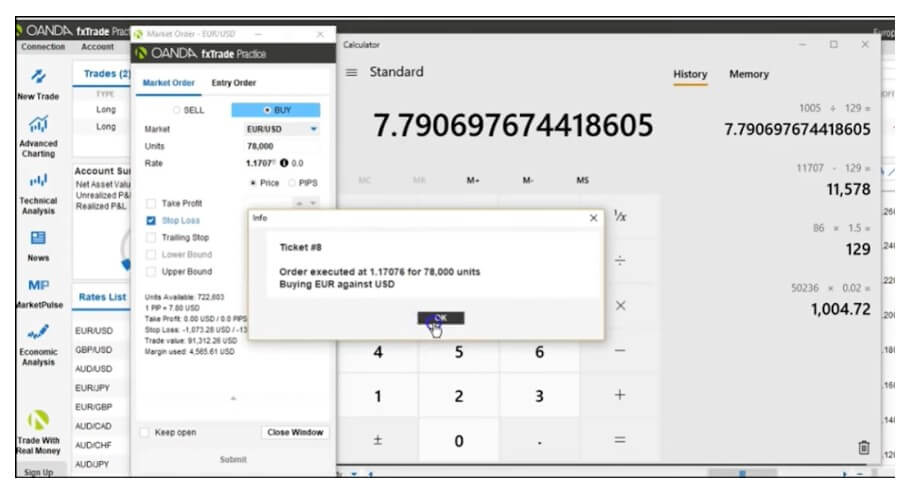

To access the Autotrade service and to be a signal provider, the following requirements must be met:

-Only real accounts with MetaTrader 4, verified and connected to Myfxbook, are accepted.

-The account must credit a minimum balance of USD 1,000.

-You must have a history of at least three months and at least 100 operations.

-The historical drawdown must be less than 50%.

-The historical return should be greater than 10% and greater than the historical drawdown.

-You must have earned an average of 3 pips per operation.

-As for the duration of operations, the average will be more than 5 minutes.

-The system should not use any martingale technique.

In other words, it is necessary to demonstrate some value in trading in order to be a provider of social trading services. It is another feature that defines Myfxbook as a secure and reliable platform.

The Reality of Myfxbook

The reality of this platform is that you will find many martingale systems and hidden scams. Most of them may look very promising but then they have a big fall and they get out of the way. In the end, most are hidden under a username.

So, all that being said, in my case I take advantage of this tool to get statistics from my accounts and little else. You can access profitable systems and they can give you an idea of how they work if you’re smart looking at some of their statistics, but remember that it’s a mine of martingale and grid systems, which we already know ends up blowing up accounts. So far all this guidance on this well-known tool within currency trading and trading systems, forex brokers.

Beyond the general forum, this section is composed of several sub-menus, in which you can see conversations regarding:

Beyond the general forum, this section is composed of several sub-menus, in which you can see conversations regarding:

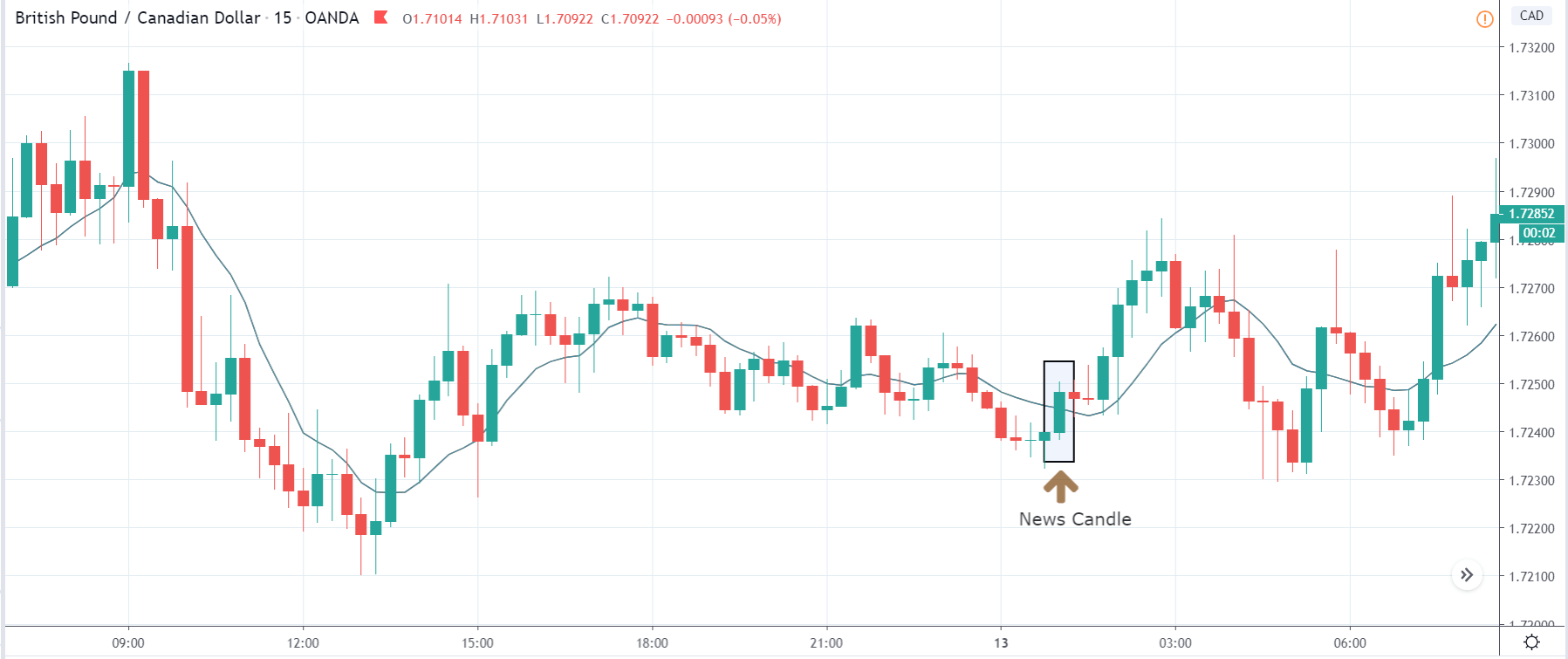

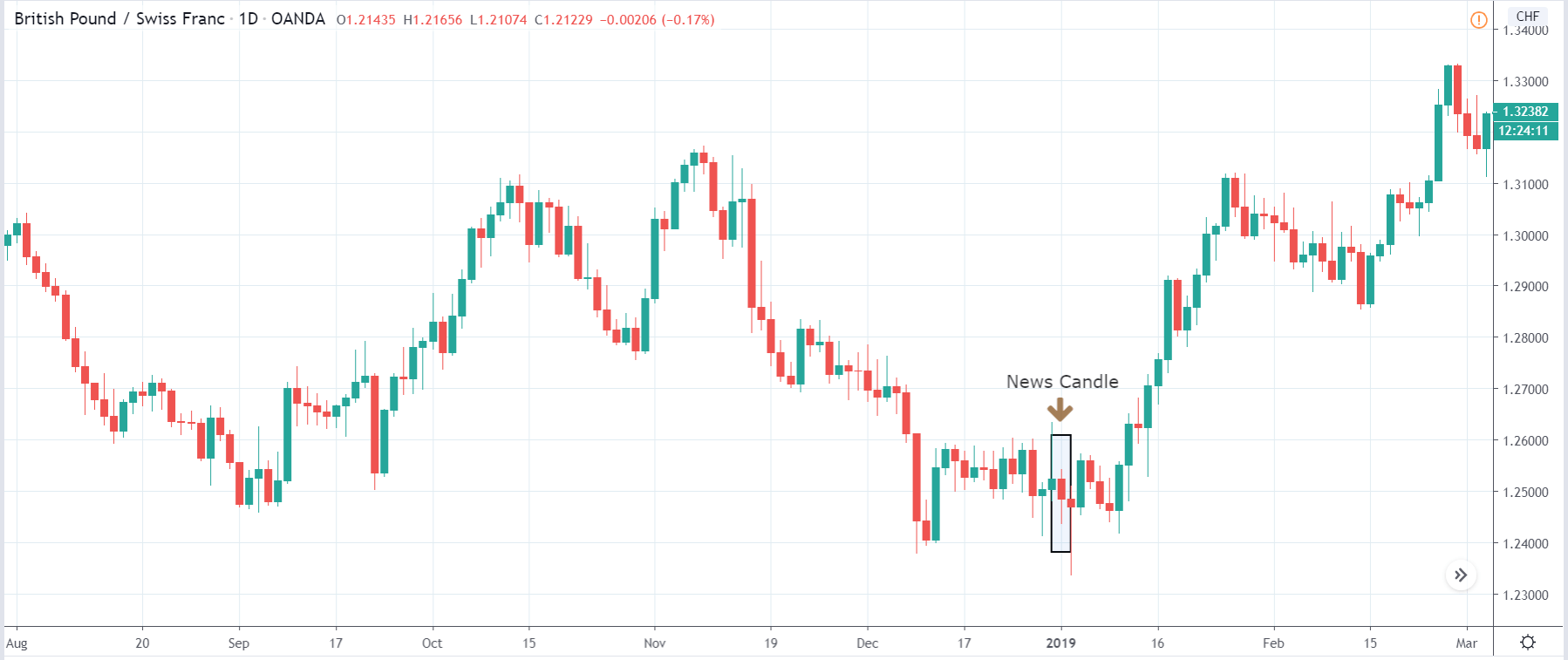

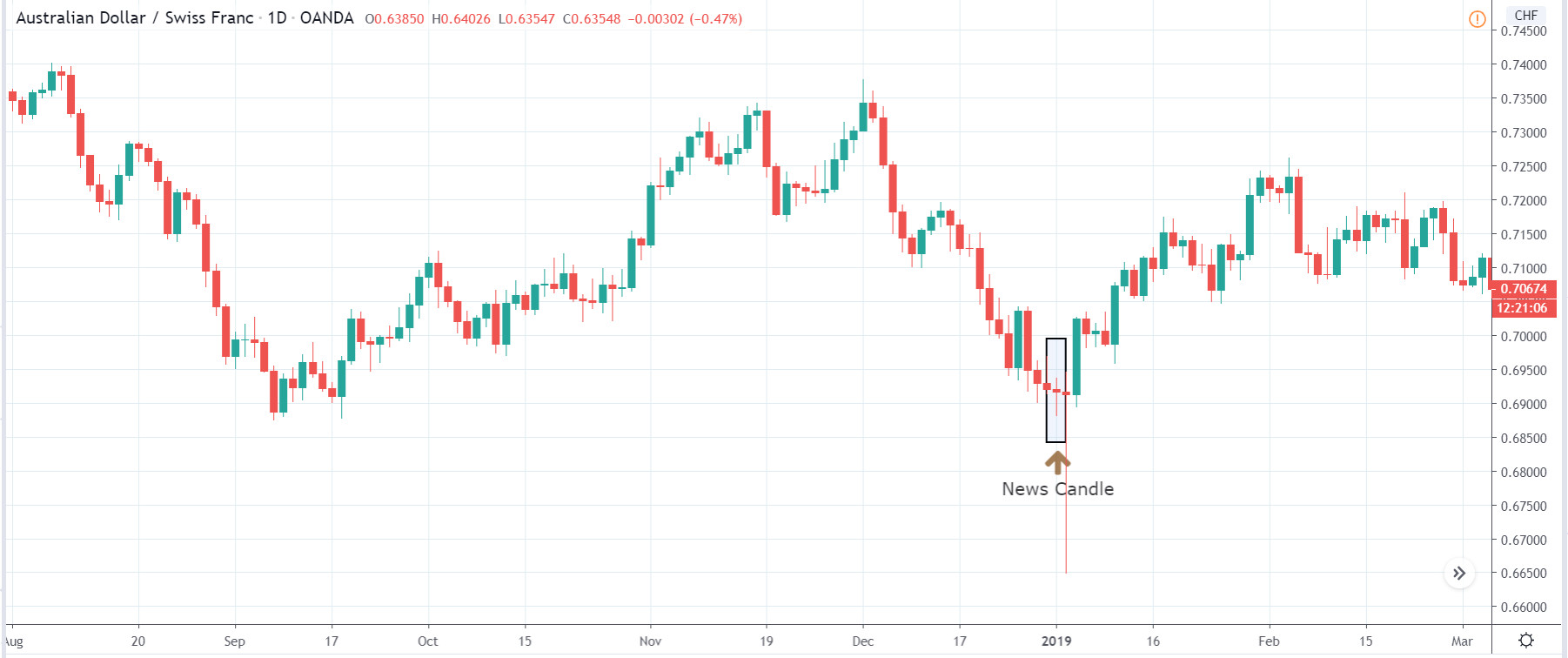

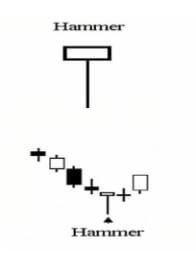

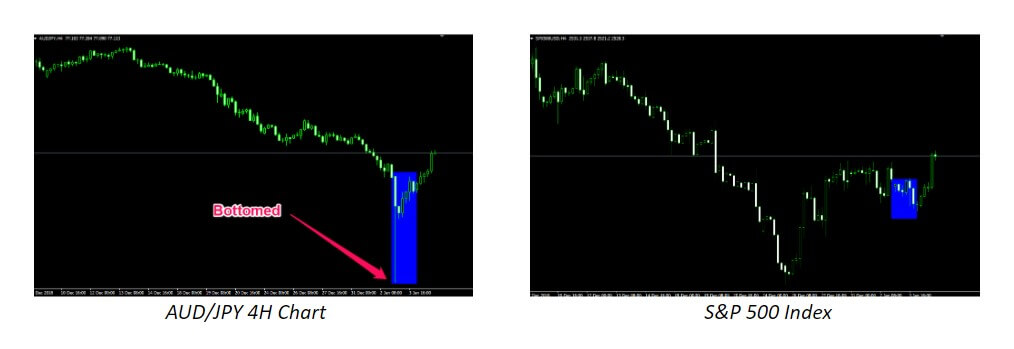

A hammer is a candlestick with a short body, a long lower shadow, and a small or no upper shadow. The story the candlestick is telling you is that the price dropped after opening but rallied during the time period and ended up close to the opening price (sometimes over and sometimes under).

A hammer is a candlestick with a short body, a long lower shadow, and a small or no upper shadow. The story the candlestick is telling you is that the price dropped after opening but rallied during the time period and ended up close to the opening price (sometimes over and sometimes under).

In case you are facing a similar problem, the best step you can take is to withdraw from trading, start all over again, and learn more about this market. This is such a specific situation and such an important signal that some traders should consider moving on to some other markets or businesses. Having this outcome directly indicates that a trader has not developed the necessary mindset which this particular market requires. Both reckless trading and the timid one may equally endanger your account because the risk can never be too high or too low in the forex market. Even if you managed to increase your account by 4% in a single year, it would still not be good enough if you had to go at great lengths to achieve this. Traders need to find that right balance and also think of some other factors, such as time, effort, and profitability, because there may be a safe but much easier, faster, and more lucrative way to seeing your finances grow.

In case you are facing a similar problem, the best step you can take is to withdraw from trading, start all over again, and learn more about this market. This is such a specific situation and such an important signal that some traders should consider moving on to some other markets or businesses. Having this outcome directly indicates that a trader has not developed the necessary mindset which this particular market requires. Both reckless trading and the timid one may equally endanger your account because the risk can never be too high or too low in the forex market. Even if you managed to increase your account by 4% in a single year, it would still not be good enough if you had to go at great lengths to achieve this. Traders need to find that right balance and also think of some other factors, such as time, effort, and profitability, because there may be a safe but much easier, faster, and more lucrative way to seeing your finances grow.

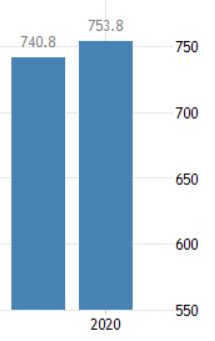

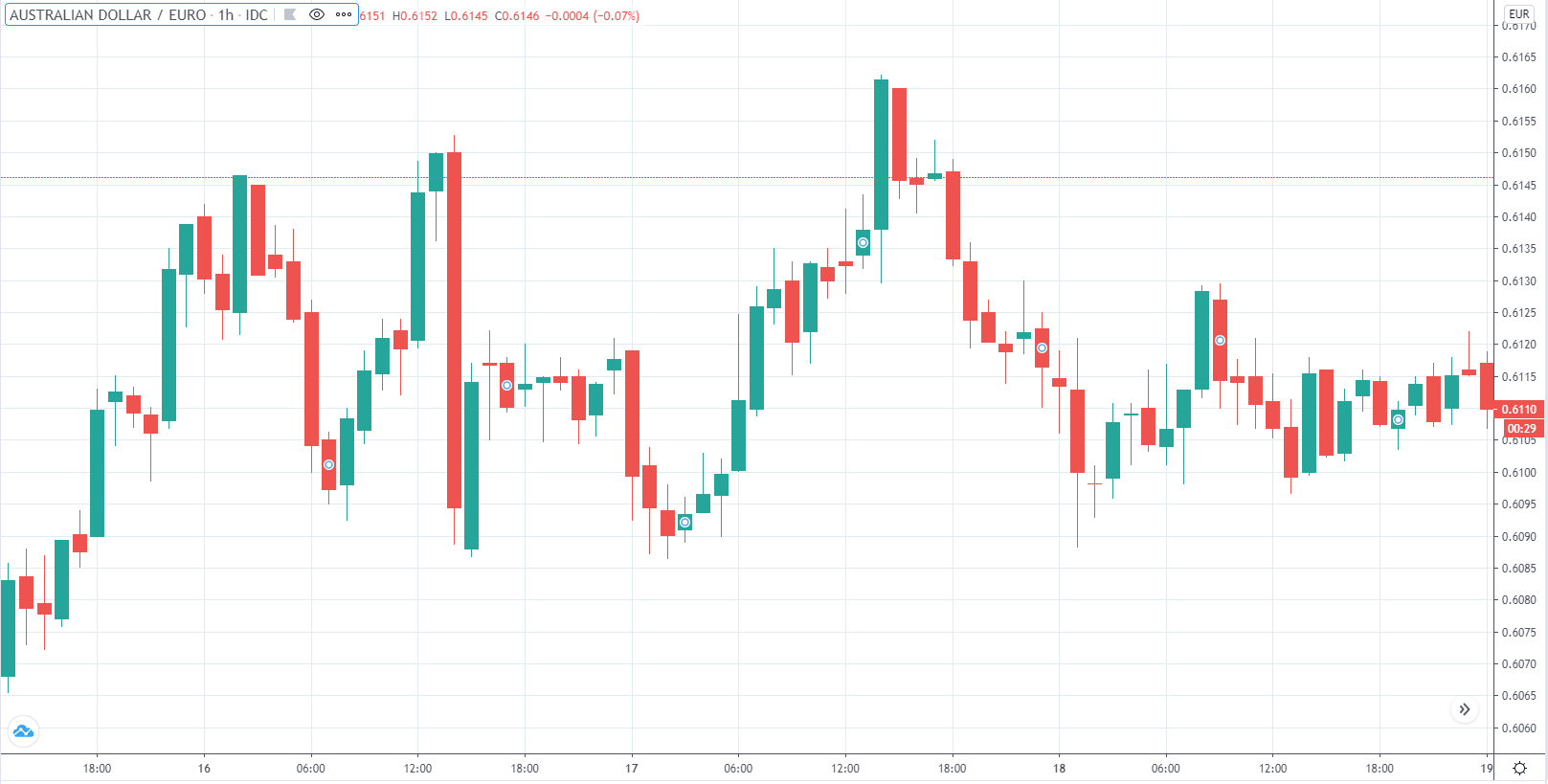

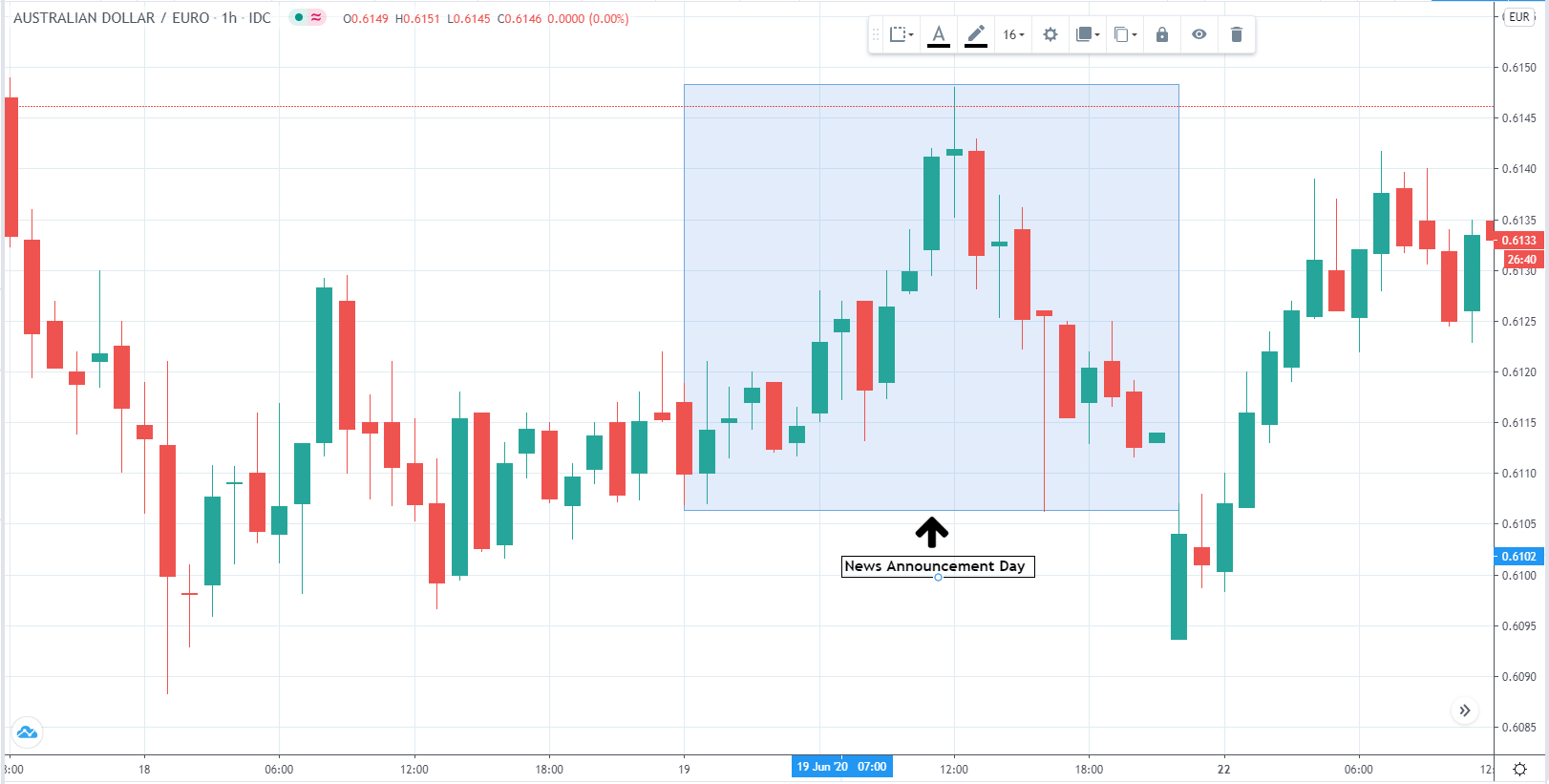

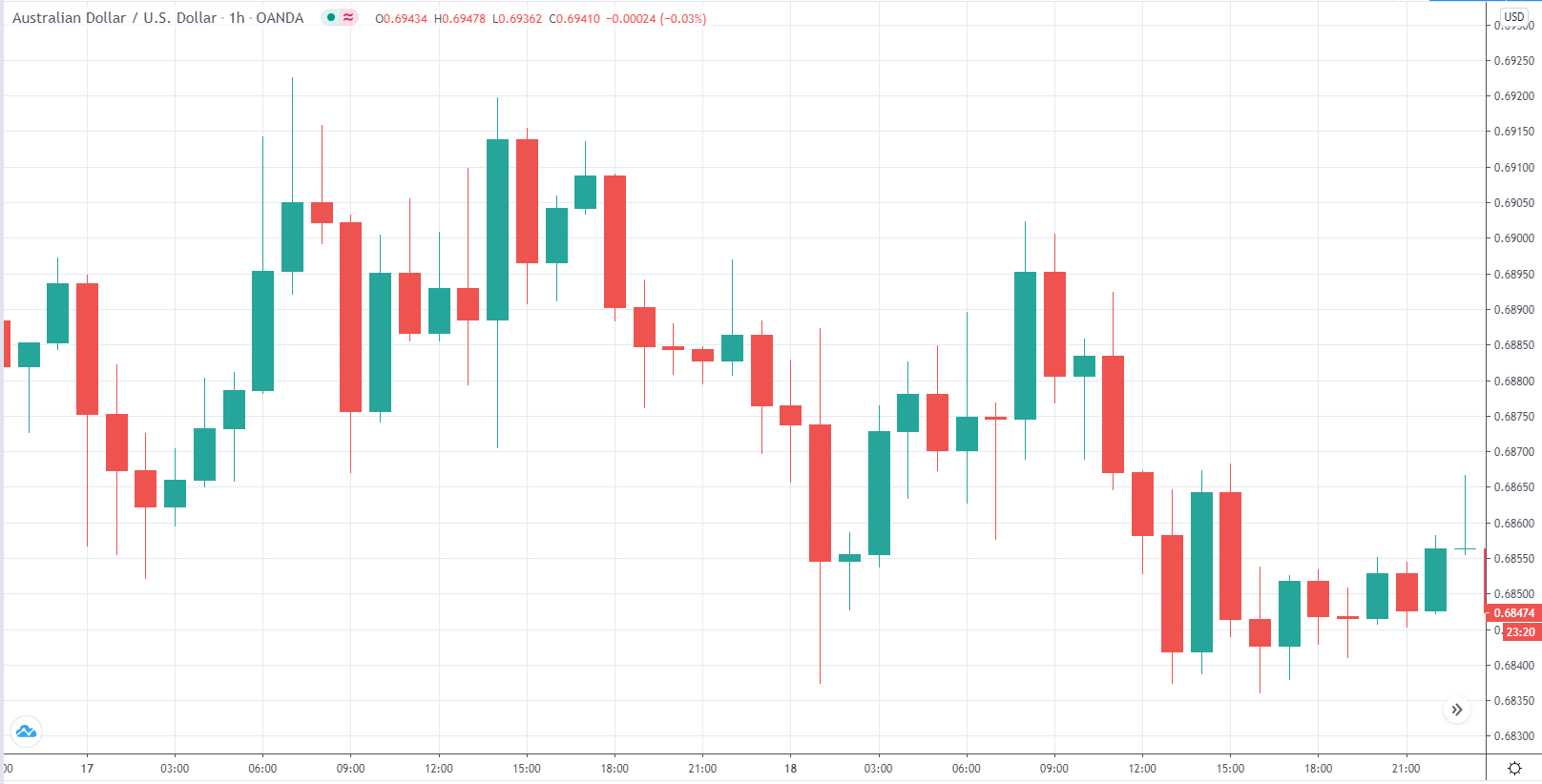

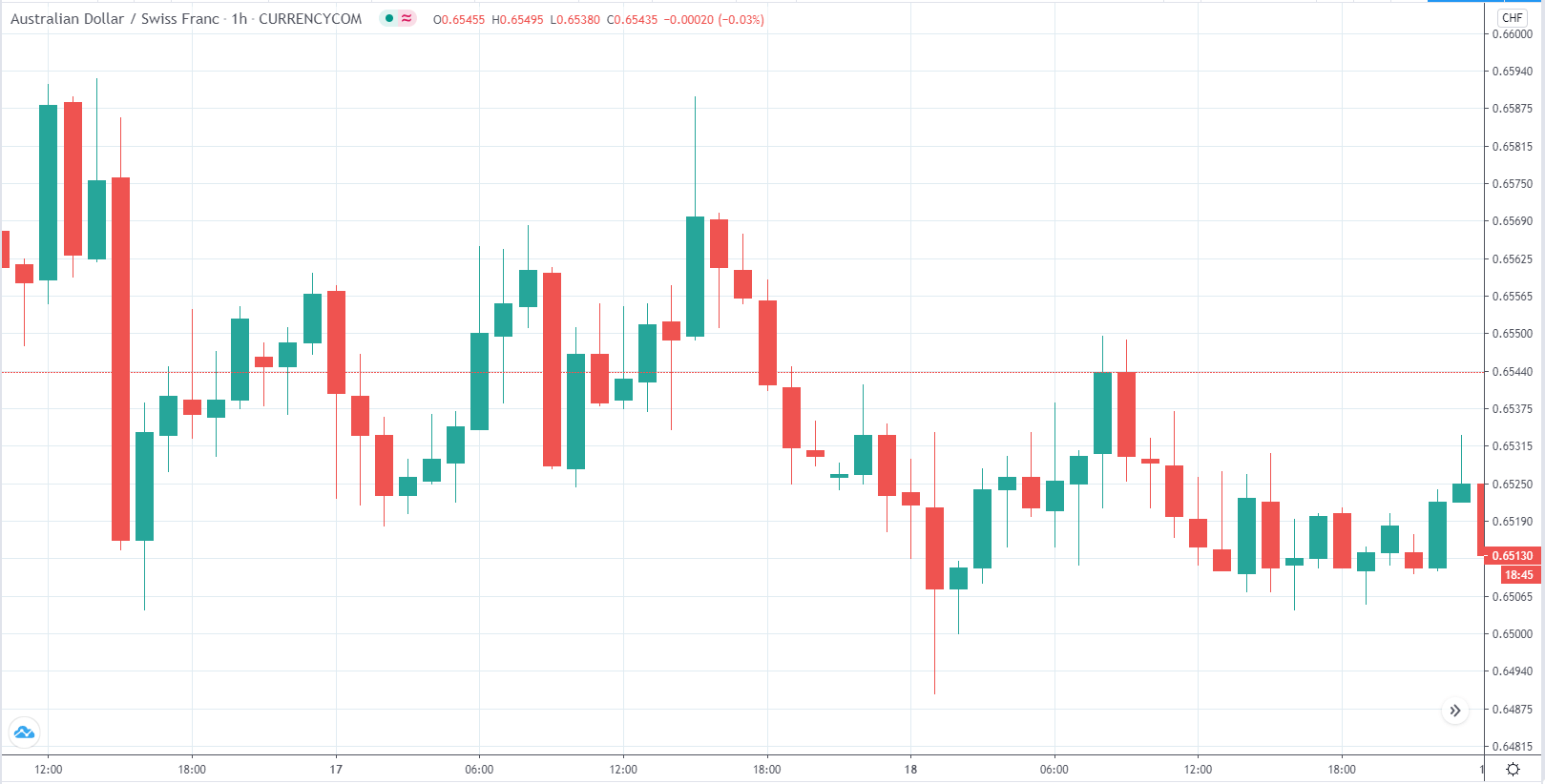

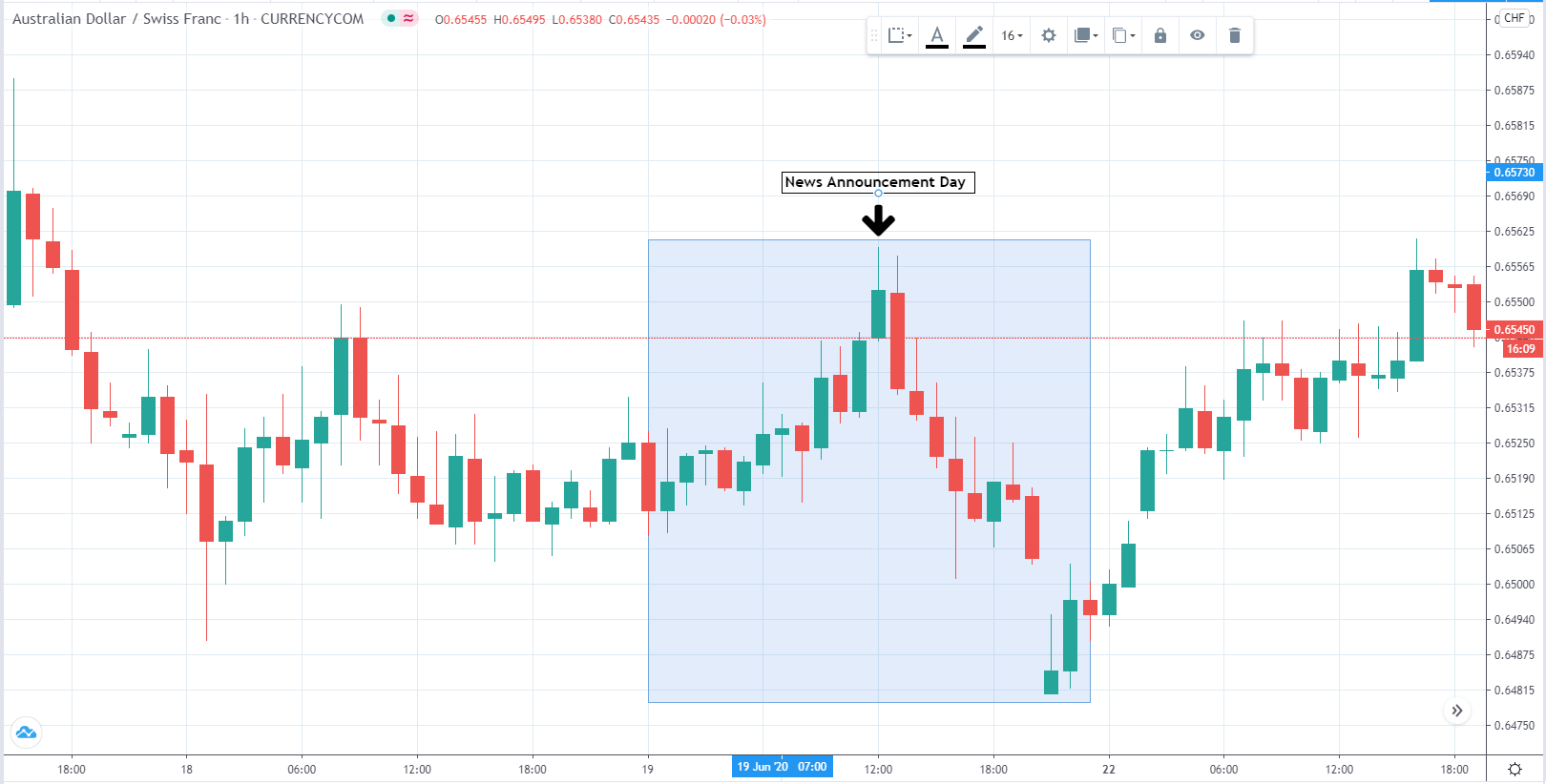

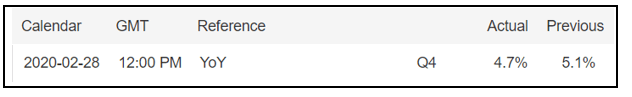

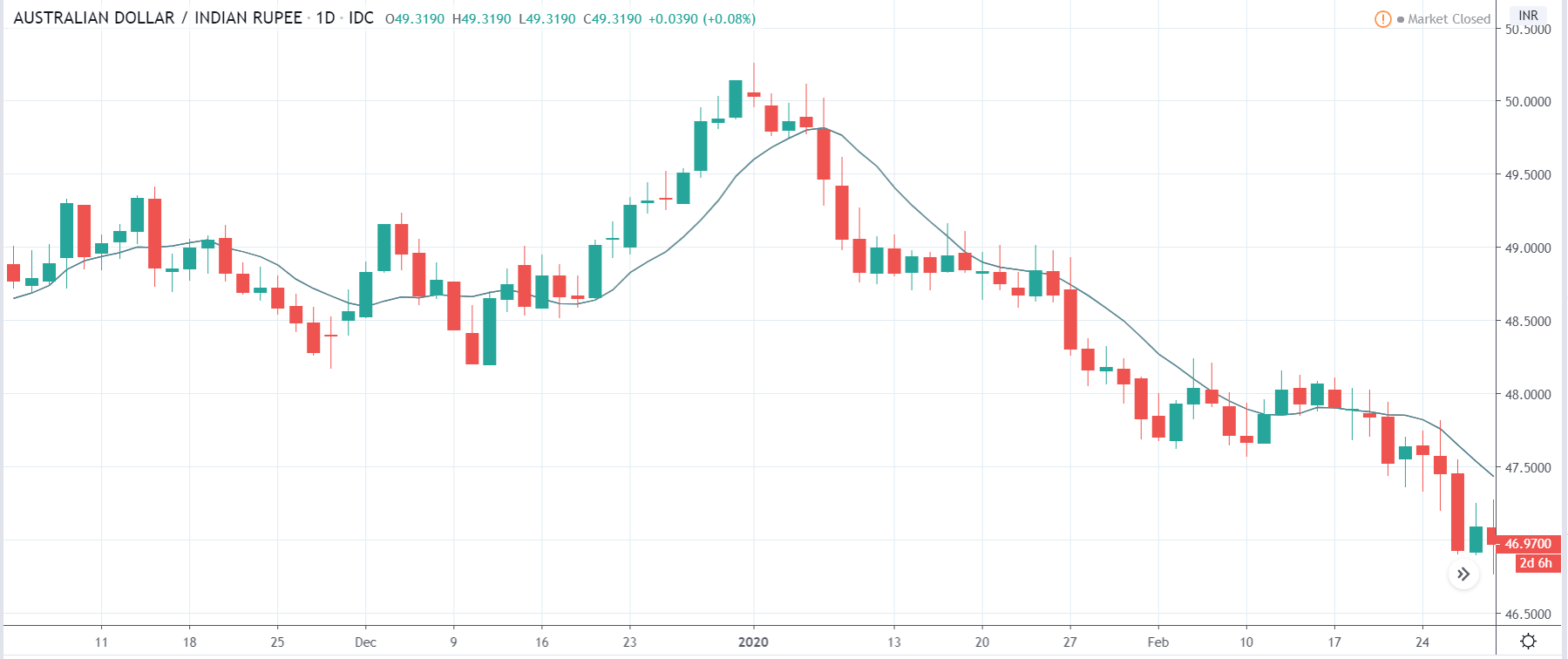

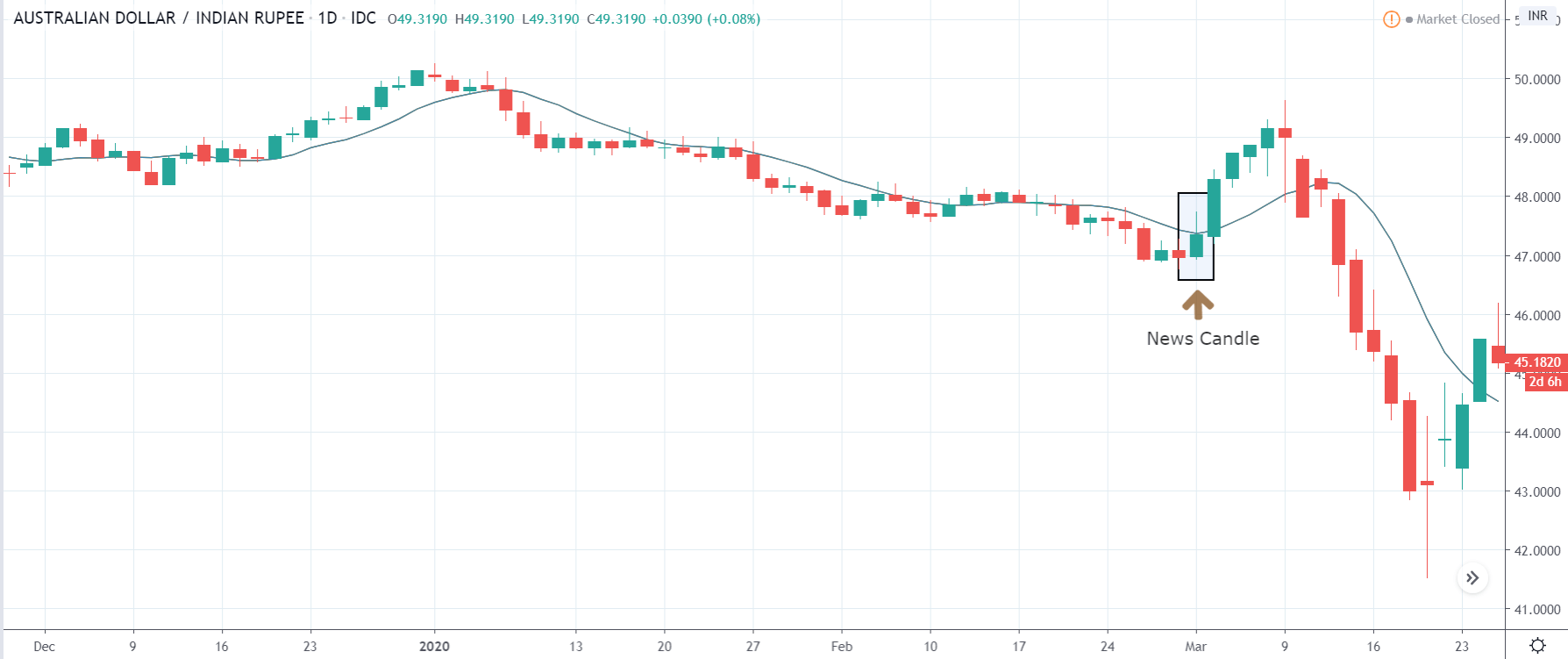

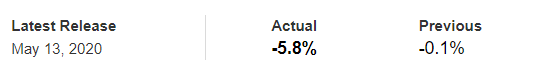

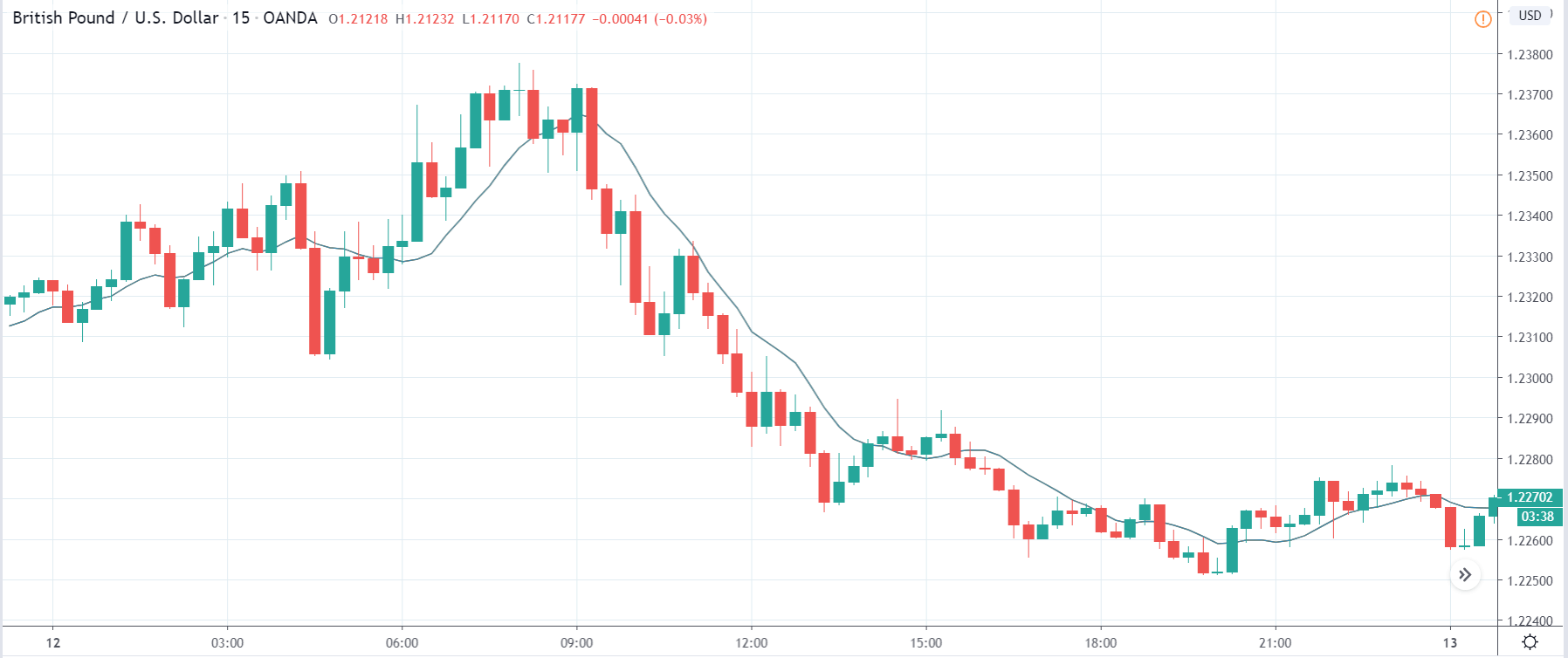

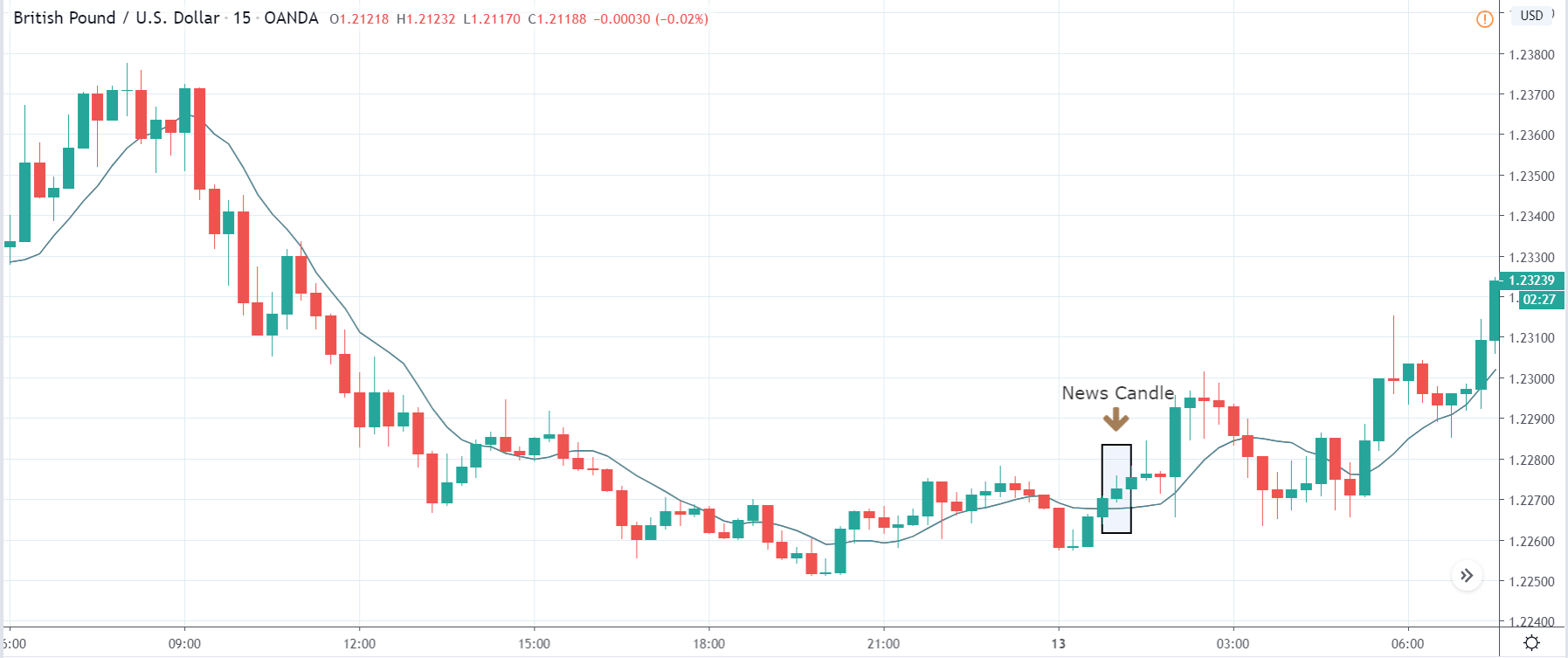

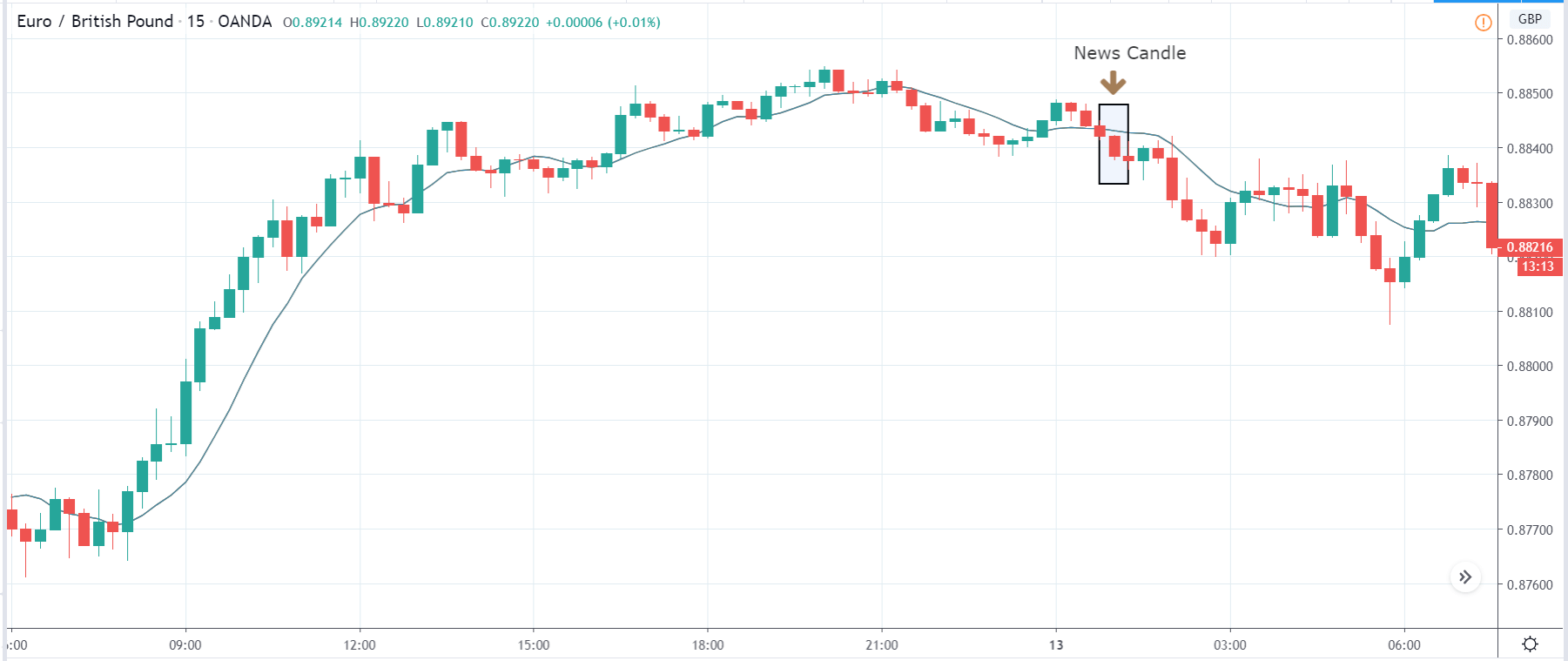

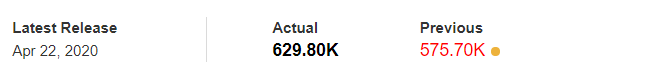

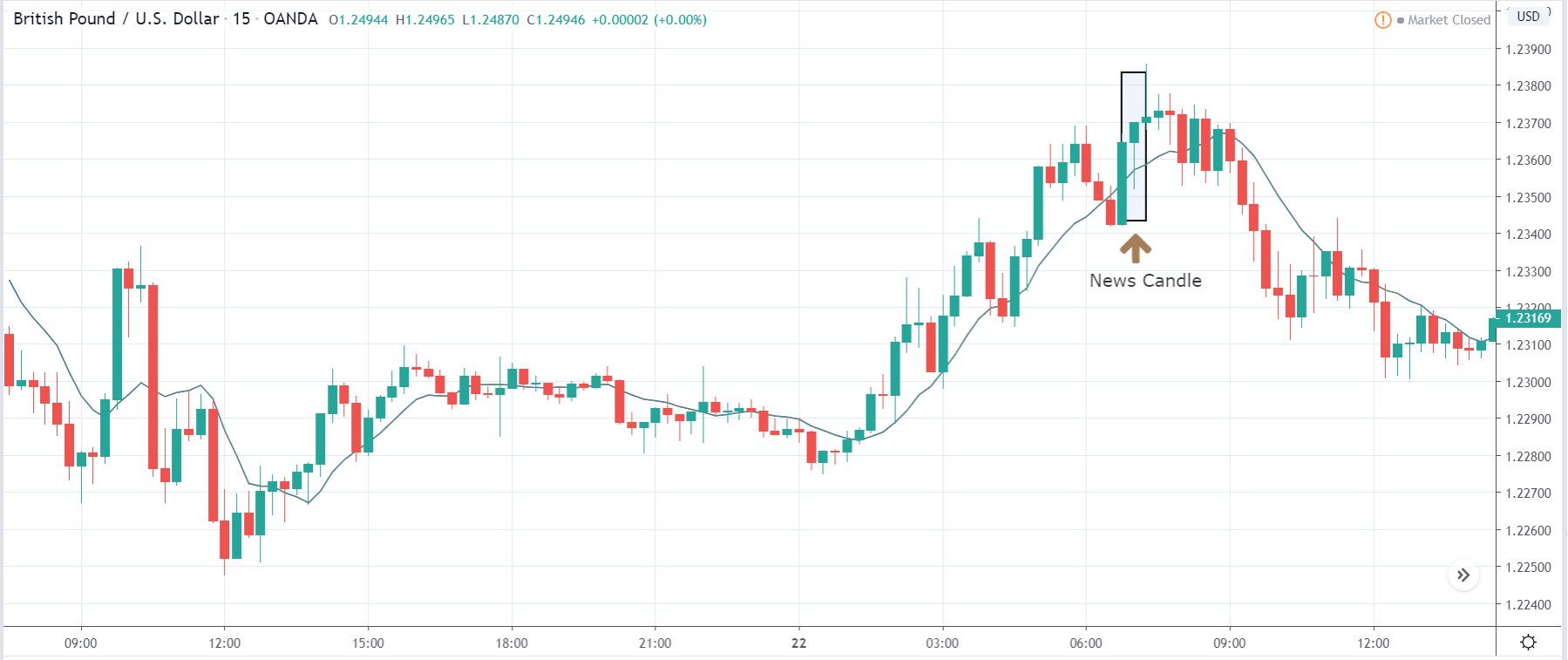

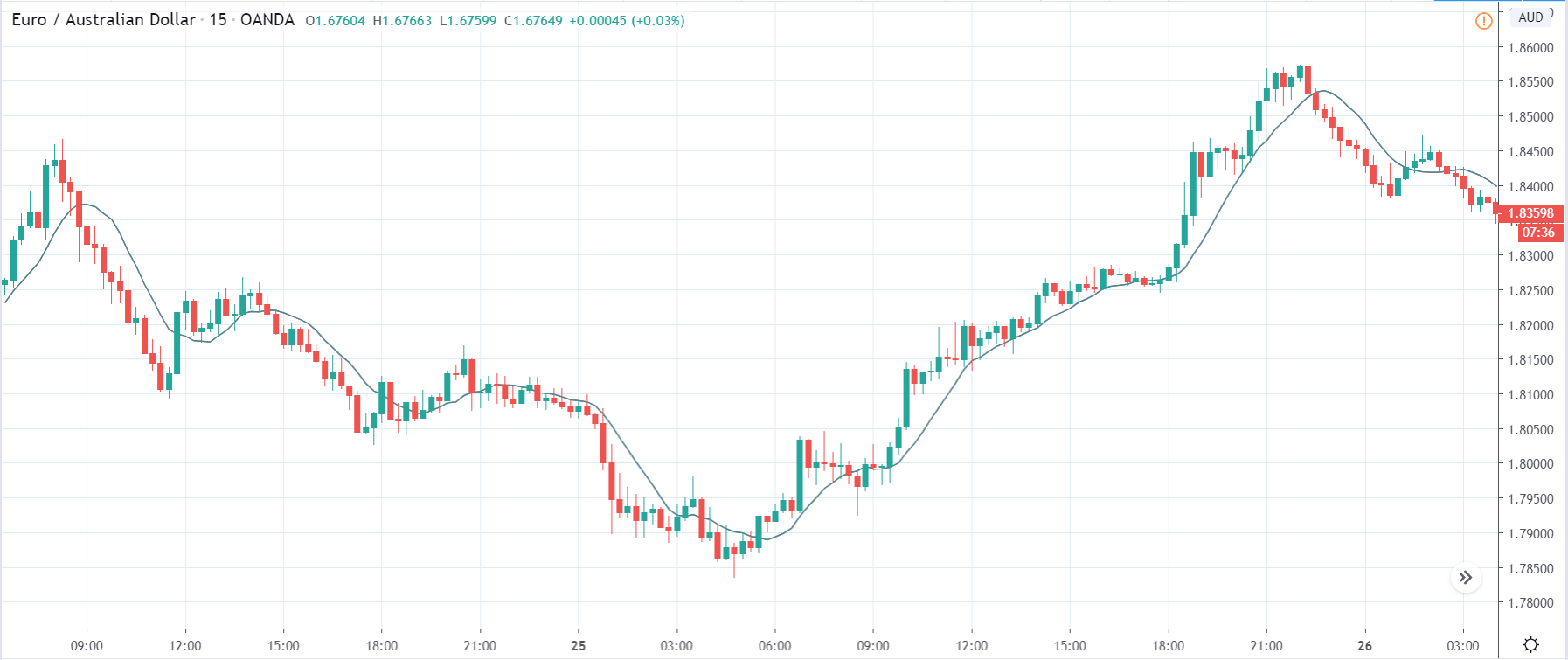

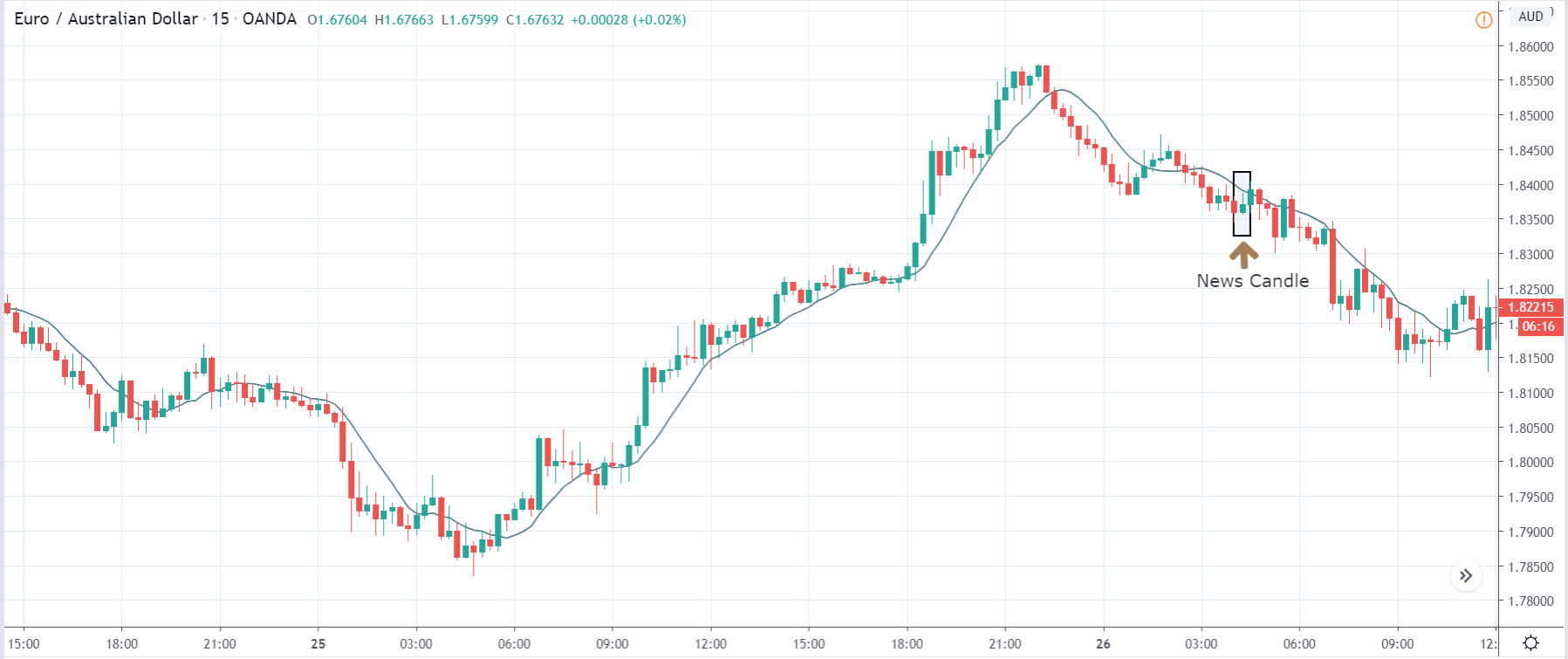

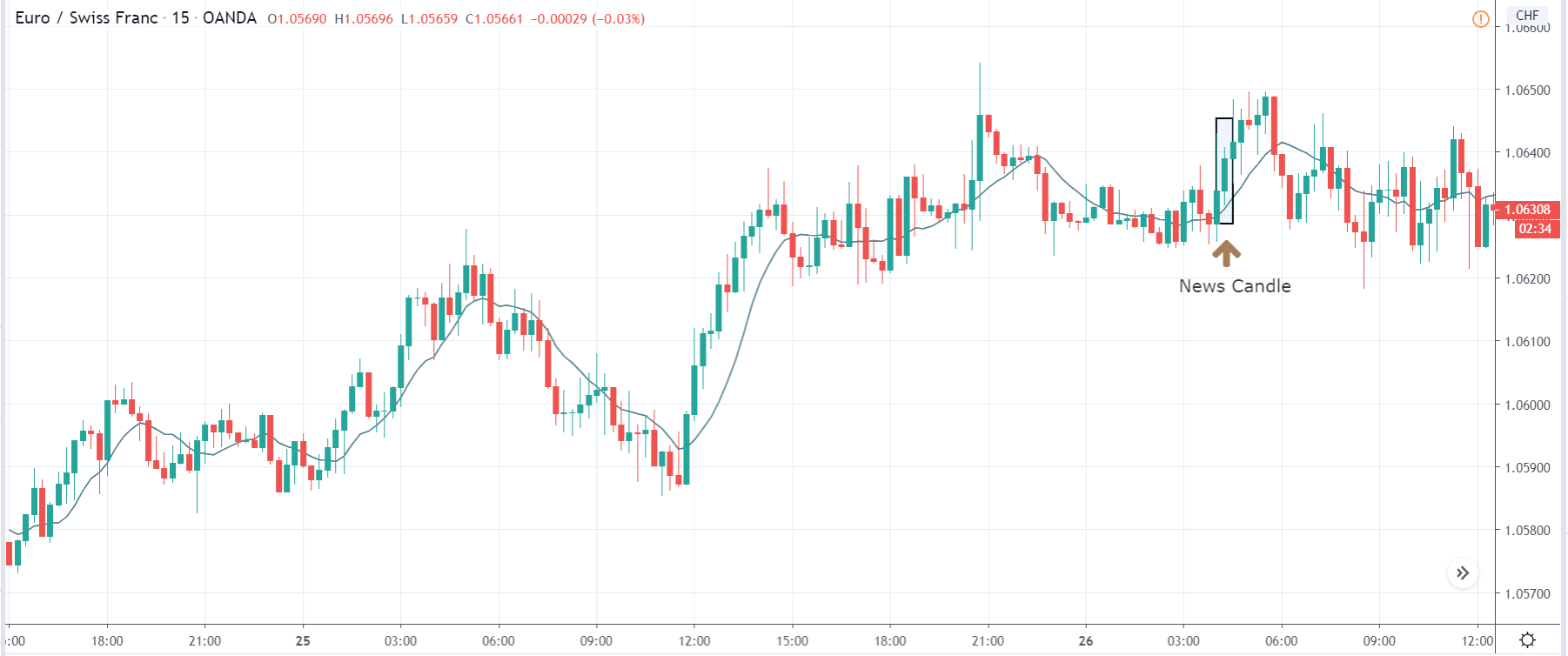

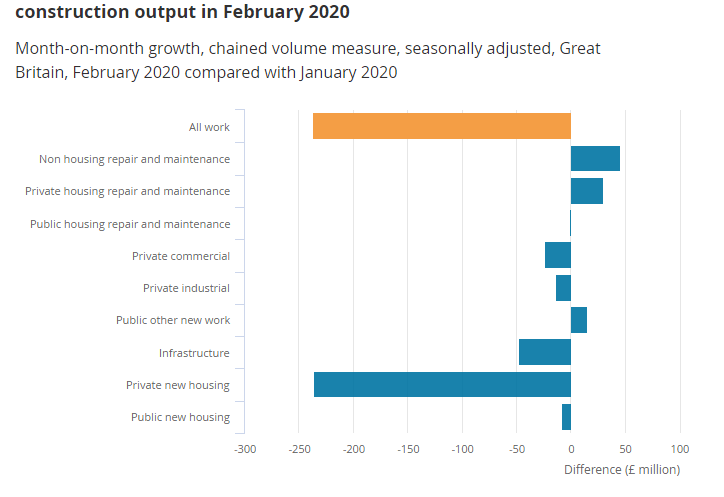

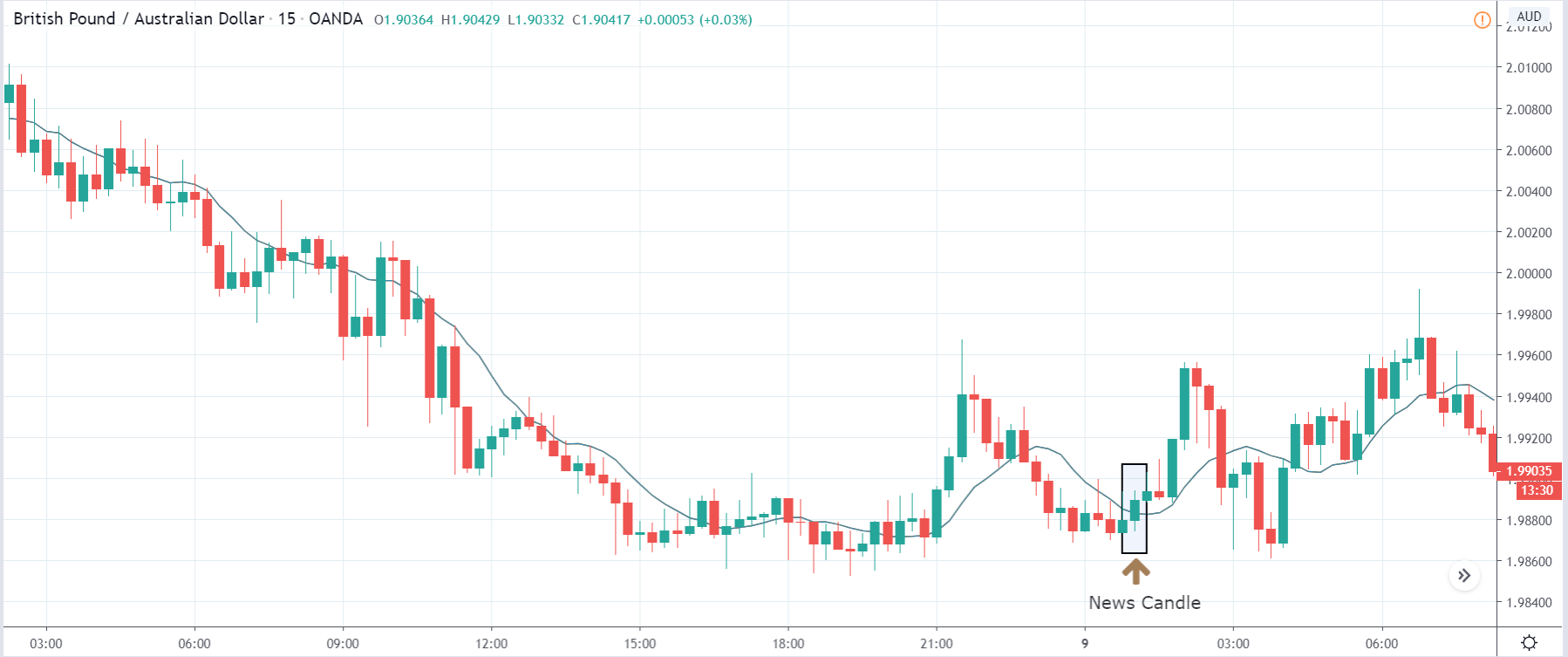

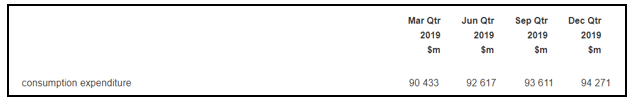

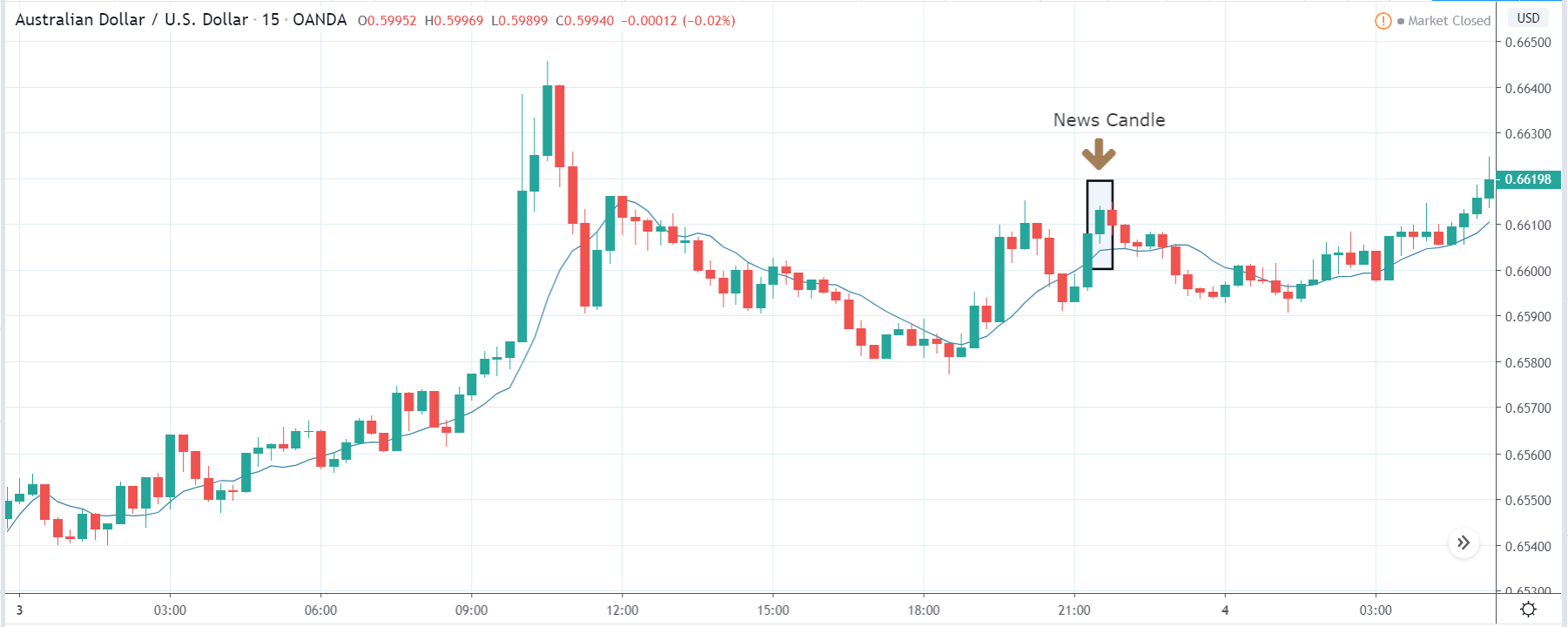

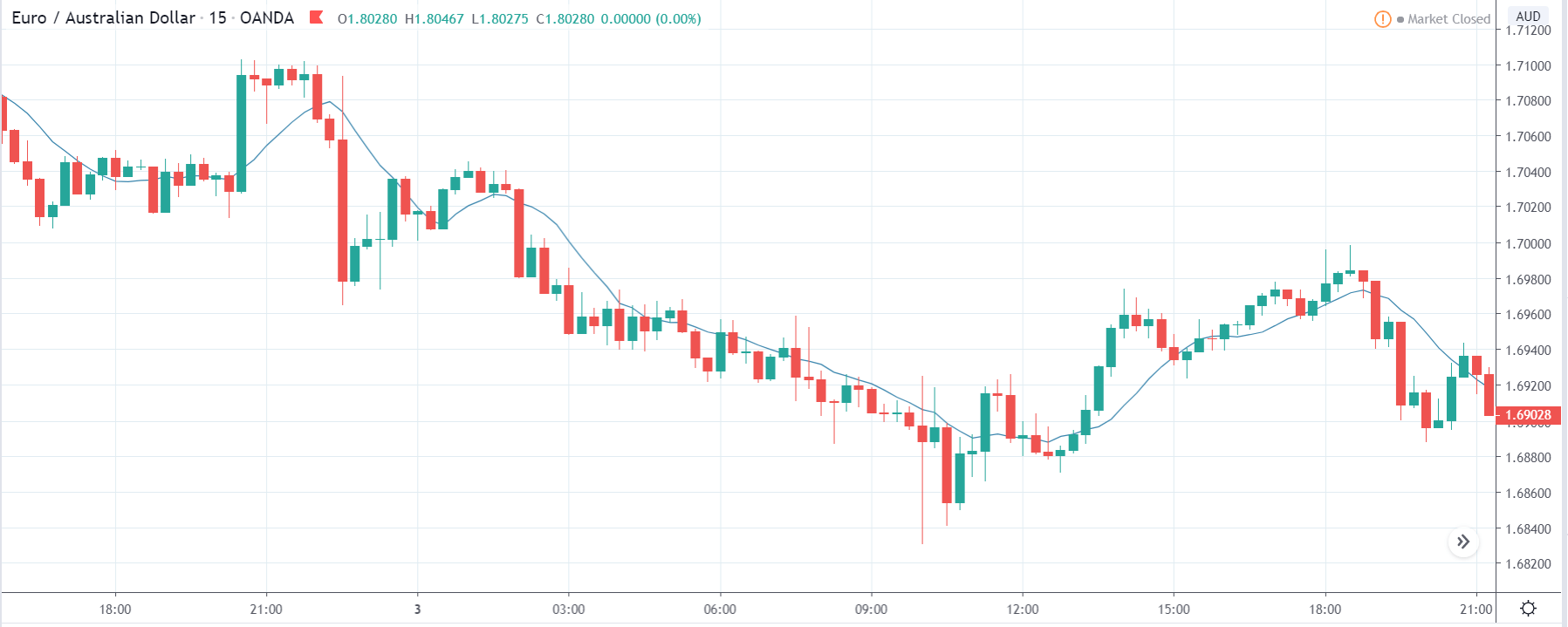

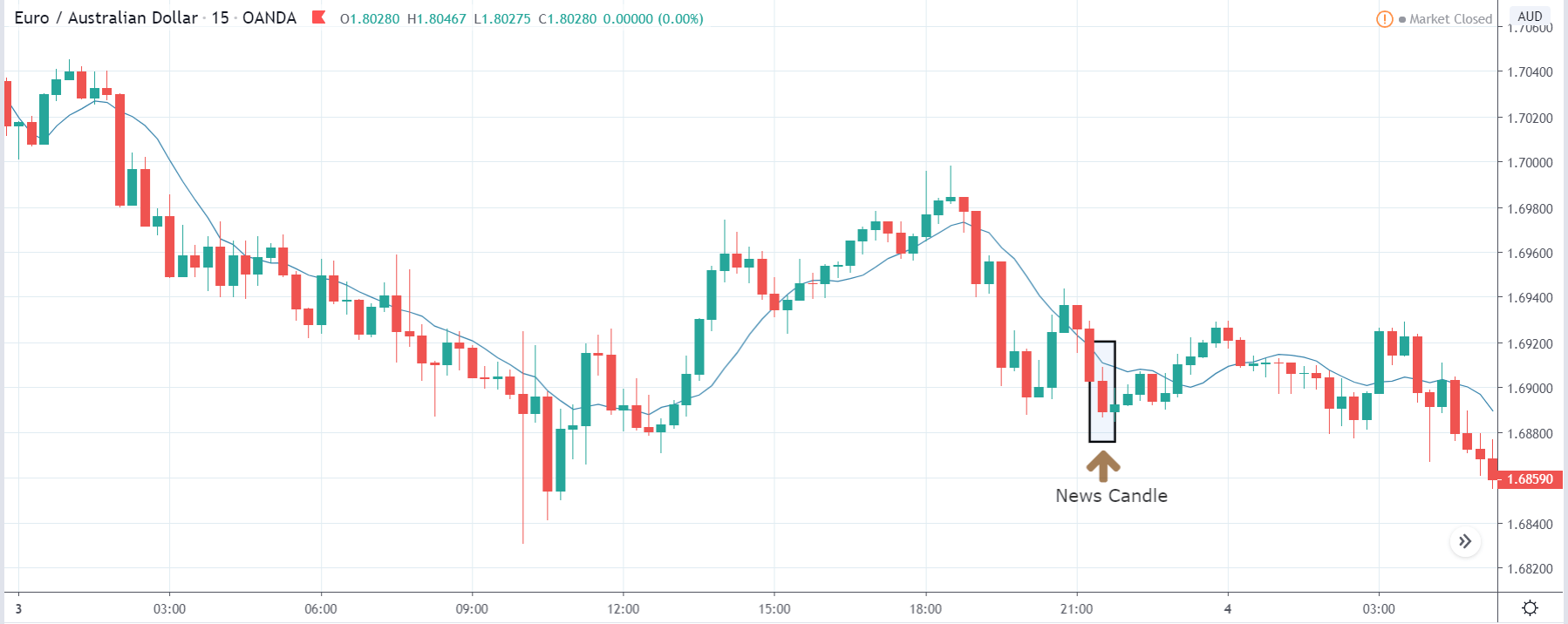

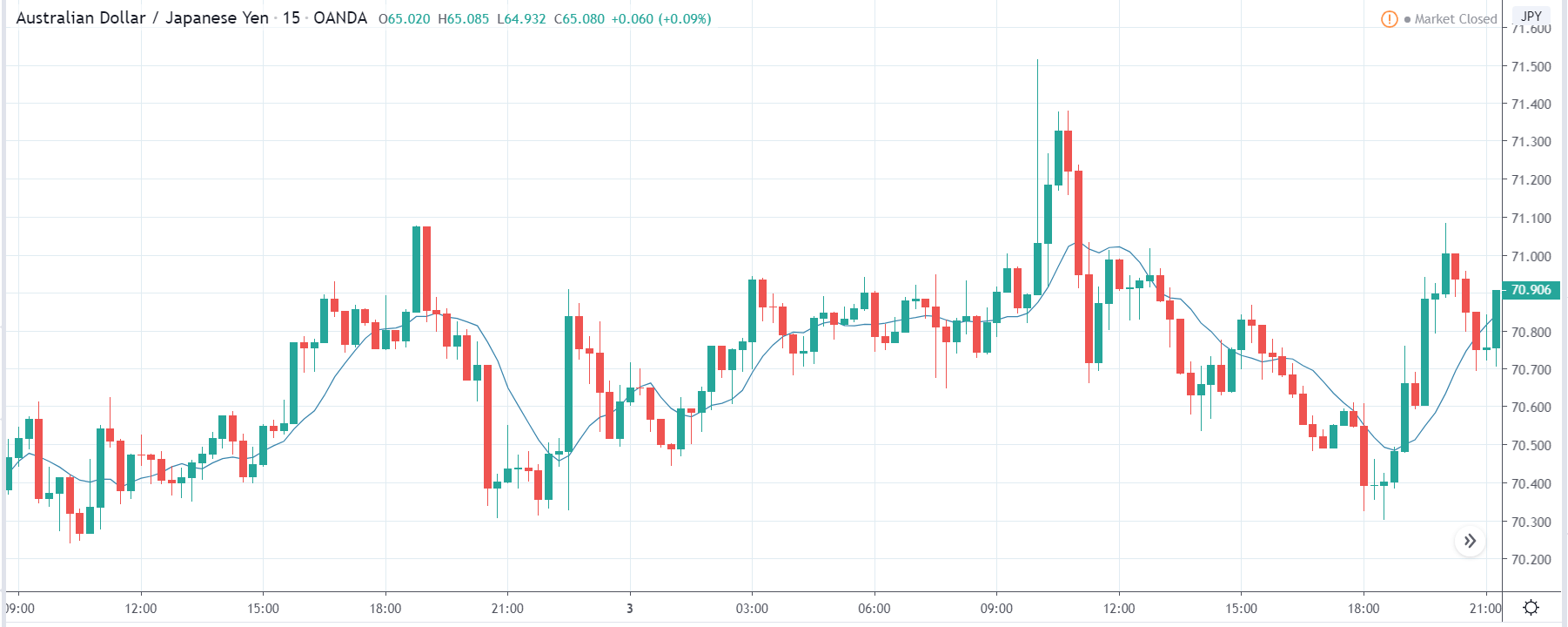

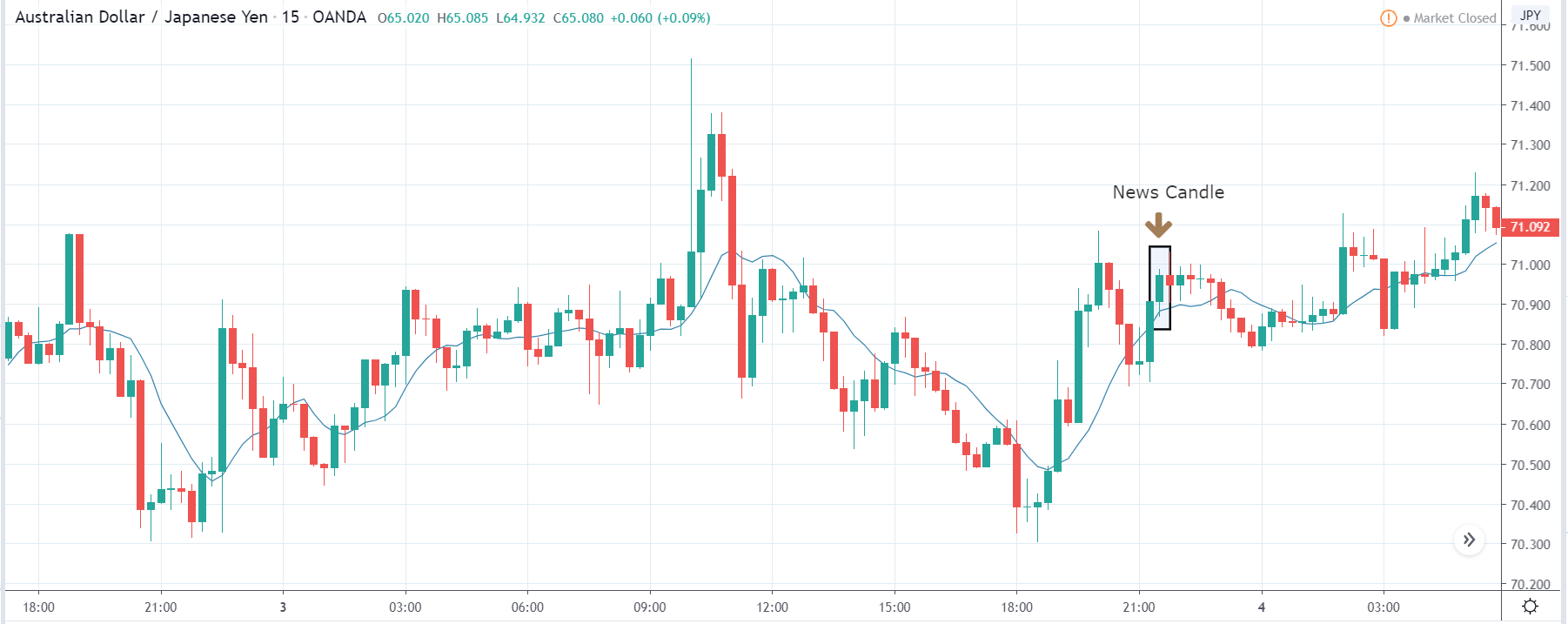

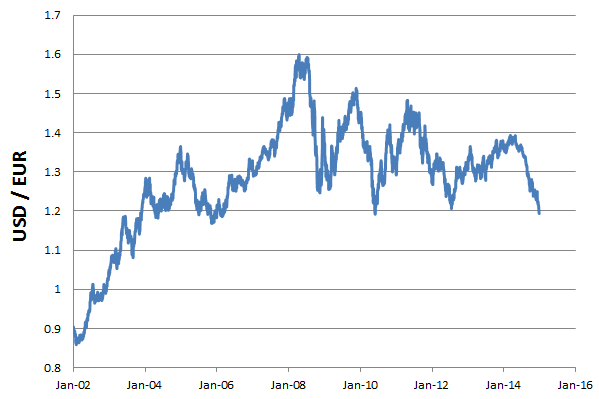

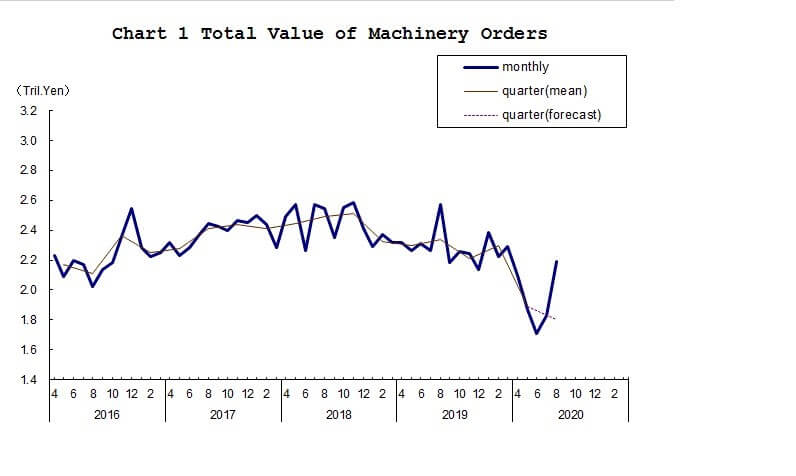

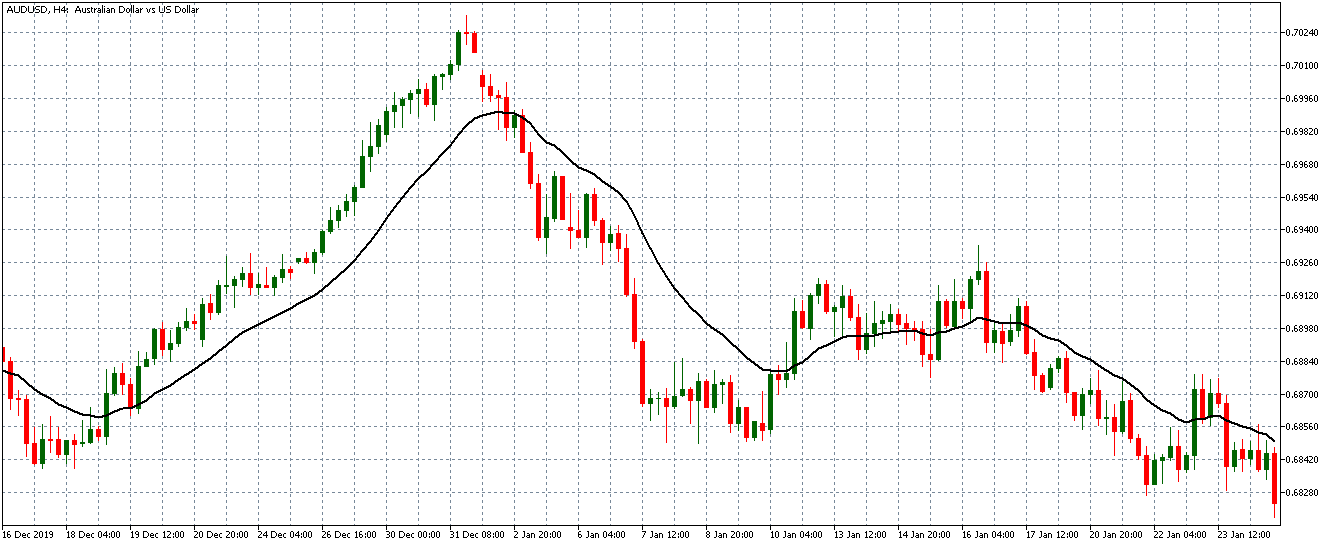

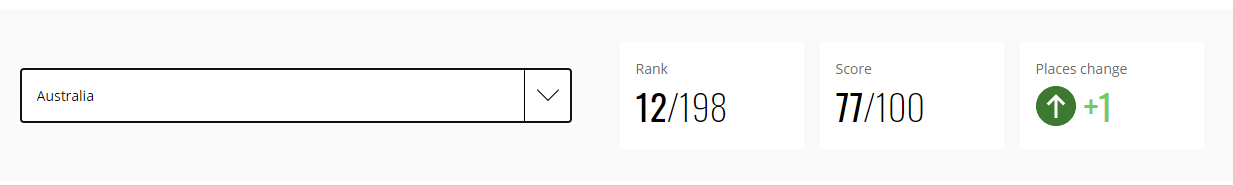

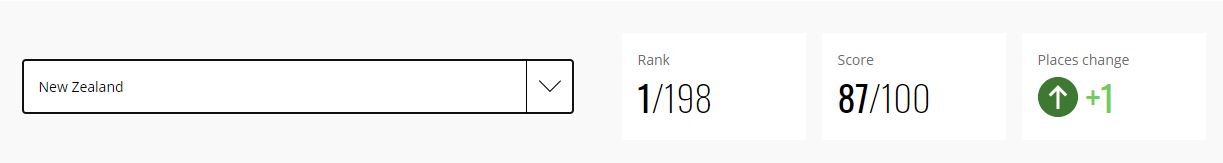

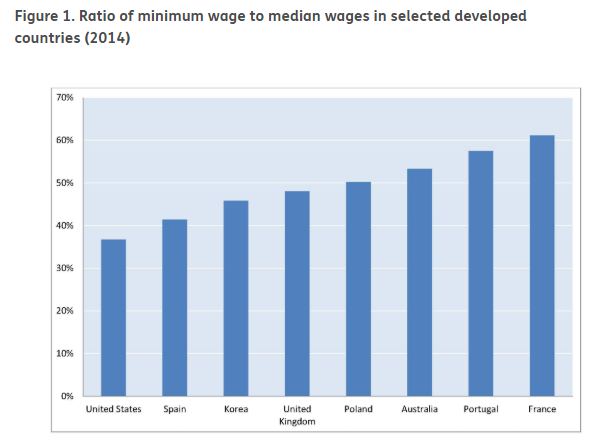

The below image shows that the weekly wages were increased for Australian employees in 2020. Although the difference is not huge, it still is a positive step taken for the daily wage workers. Looking at the data, we should not expect significant volatility in the currency pairs during the announcement.

The below image shows that the weekly wages were increased for Australian employees in 2020. Although the difference is not huge, it still is a positive step taken for the daily wage workers. Looking at the data, we should not expect significant volatility in the currency pairs during the announcement.