The EUR-USD cross is an intriguing one. With a total of 9.6 million traders in the world, approximately 37% of all volume at the global level is held by this currency pair alone. In fact, not only are the EUR and the USD two of the most traded currencies individually but they also comprise the most liquid pair.

Traders from all corners of the planet seem to love the EUR-USD because of tighter spreads and less slippage, but this currency pair is, at the same time, the Holy Grail for major players in the market.

There are no Coincidences

Forex is dominated by the Interbank Market, which is used by various financial institutions to trade currencies between themselves. Interestingly enough, 50% of this Interbank Market is controlled by the largest banks.

Out of approximately 25 000 banking institutions existing in the world, Deutsche Bank, Citi, JP Morgan Chase, and HSBC are some of the most prominent. And, you should know that their interest lies where yours does as well – profit.

How come?

Well, big banks love to manipulate the prices. Have you ever noticed how the price suddenly changed when everyone was certain that it would keep on going in the same direction? There’s the catch.

Big banks focus on the concentration of activity and they step in right where most traders are to take the cream off. To be specific, it is not just where traders are in the chart at that moment but where most of them are headed.

How the Big Banks Interfere

It is unfortunate what sentiment can do. Many traders keep using the same tools and indicators and they, logically, end up losing. We may not know the extent of tools the big banks use to maintain control and insight, but the same information is accessible to everyone through IG Client Sentiment Indicator or FXCM SSI.

While the big banks have the power to detect market activity, they cannot see your specific order. They can, however, discover if the majority of orders were long or short, based on which they can manipulate the price.

So, the more the orders push the market in a specific direction, the more likely are the banks to interfere and turn everything around.

USD is a Magnet

The choice of currencies can have an equally strong influence on the trade as well. As the USD is always in demand, it is more likely to be always on the big banks’ radar. Any news events concerning the currency will also stir up the market and set the ground for major turbulence.

The USD is, in fact, so prone to react to any news that any tweets of the previous US president, Donald Trump, caused a commotion in the market. Major US economic reports (GDP, employment, producer and consumer price index, retail sales, and trade deficit reports) are also perfect opportunities for the big banks to take their share of traders’ money.

The EUR is specific because the number of reports concerning the currency is higher due to the number of Eurozone member states. Although related economic reports (especially those of France and Germany) are valuable for traders, EUR pairs seem to do well even when they do come out.

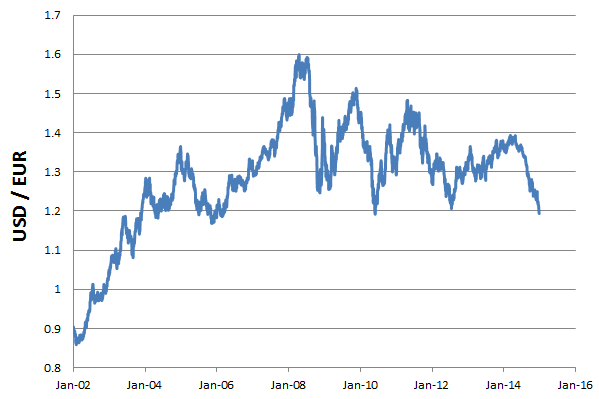

Since any currency combination is determined by both currencies, the EUR-USD (as the most traded and liquid pair) is that more monitored by the big banks.

The big banks’ involvement can be seen in other crosses involving this pair. For example, the EUR-USD pair has historically exhibited a high correlation with the S&P500 as they both involve the US economy. Interestingly enough, these major banking institutions have no significant dominance over precious metals, which typically dictate what will happen with the pair.

Manipulation at its Best

The number of individual orders, as we can see, does not have the power to drive the market. Individual requests cannot affect market movement per se. The only power that can create an imbalance between buying and selling orders is the big banks.

Anyone trading the EUR-USD can see these sudden changes in prices, which leave behind many unfilled orders on the supply or the demand level. The big banks will use any opportunity to cause such friction to have their orders filled after the price returns to the zone.

These are the reasons why some forex professionals advise beginners to start trading some other currency pairs that are less susceptible to such interferences.

Indicators’ Predicting Power

Many traders use the sentiment to predict future activity in the market, which is a highly volatile and unpredictable tool. While we cannot control the big bank’s involvement, we can limit their impact by not focusing on the number of orders in the market and avoiding circumstances that these major players deem inviting.

Any indicator is a result-oriented tool that has no power in predicting the future. News will come out and changes will occur in the world, but our task as traders is to adopt the skills that can raise us above the level of sentiment and provide us with stability.

Instead of focusing on the quantity of orders, supply levels, rather strive to determine the overall market direction and evade the banks’ radar as successfully as possible.

Own your Share of Responsibility

It is important to understand also that if big banks ever disappeared, the nature of this market would change entirely. Maybe the volume could change or forex might start to resemble the stock market. That is why it is important to shift the focus from losses and adopt an opportunistic and proactive mindset. How can you take advantage of the big banks’ existence?

The best solution to this challenge is building your own strategy and learning to trust that system. It should help you avoid the patterns the majority of traders keep repeating. This is a classic contrarian trader view of forex.

Trading currencies requires each trader to let go of the herd mentality. You need to become as independent as possible, especially when it comes to heavily monitored and liquid pairs such as EUR-USD. Your best bet is to invest in learning about trading psychology and letting go of the belief that individuals can impact the market.

Knowledge is Power

If you are still unconvinced that sentiment is not your point of reference, at least aim to use credible sources.

Twitter, for example, offers an excellent pool of information – you can explore updates about IG Client Sentiment Index on DailyFXTeam, learn about more SSI currency pairs on FXCM_MarketData, or discover some invaluable educational materials on www.forex.academy, and build your unique way of trading.

Finally remember that it is your skillset and toolbox that will allow you to trade the EUR-USD currency pair successfully – not the news, not the orders, and certainly not the sentiment. Use the traders’ sentiment only to see if there is enough “profit space” for you to take that contrarian trade direction. If 90% of traders are long on EUR-USD, it is hardly going to get higher, do not go into the wall. As the flow in the market is directly managed by external factors, you will primarily benefit from having a system in place that will guide you through any potential volatility caused by news events and the big banks.