How to read a volatile chart: EURUSD Price Analysis for 13th August 2020

Thank you for joining this forex academy educational video. In this session, we will look at one of the most frustrating things that a trader will find and about a complete turn in price action, which does not necessarily go with technical analysis.

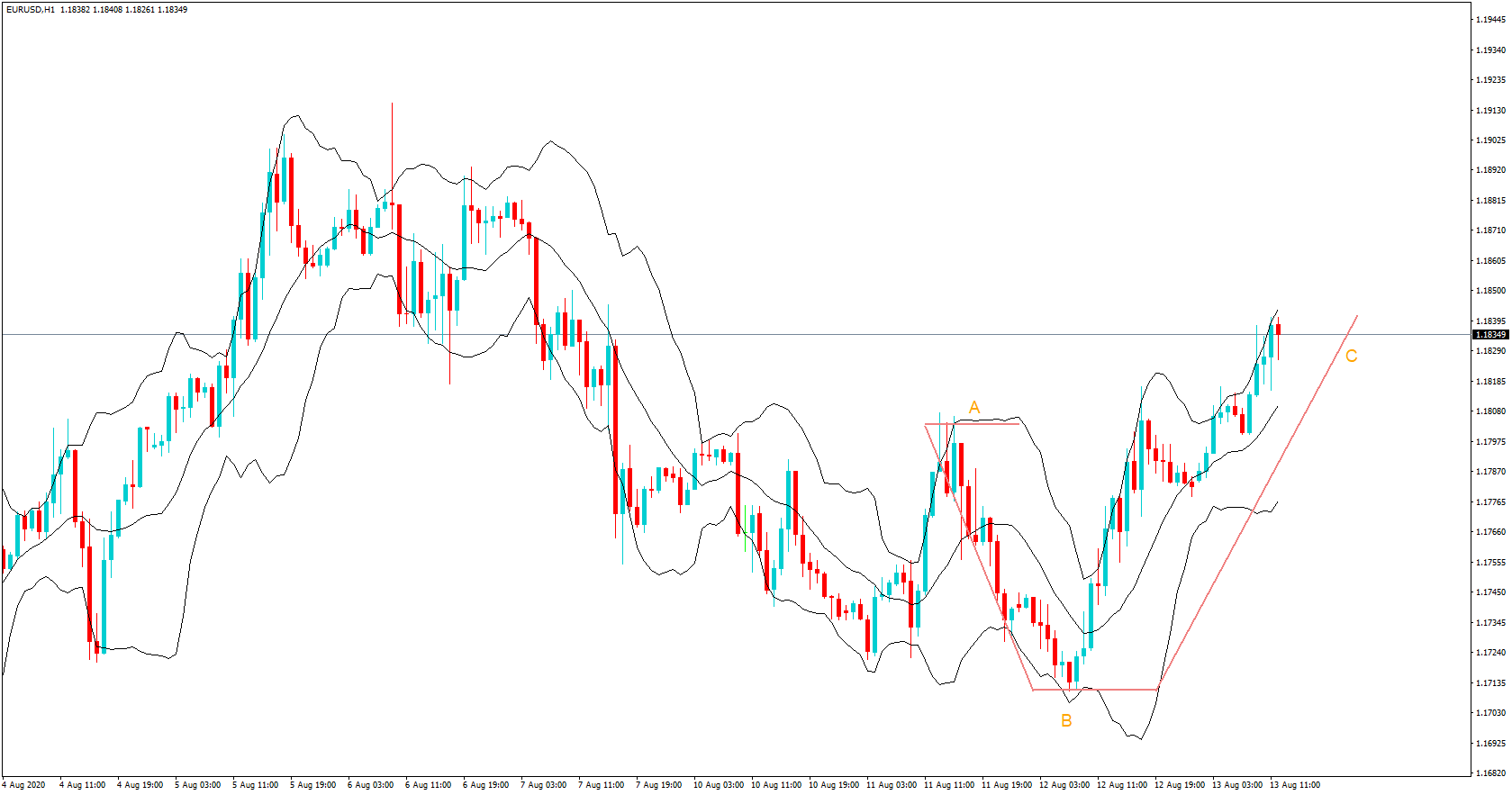

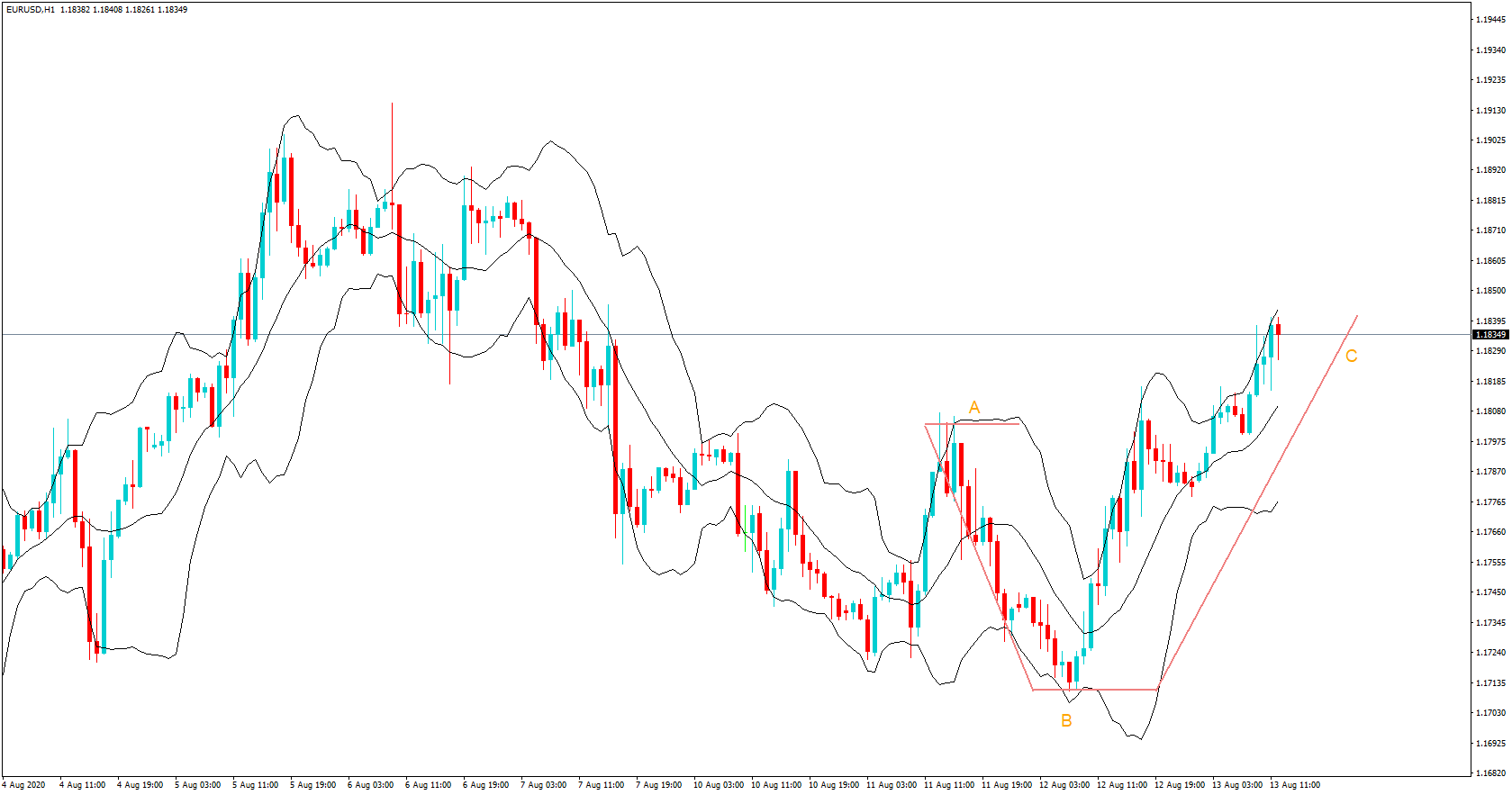

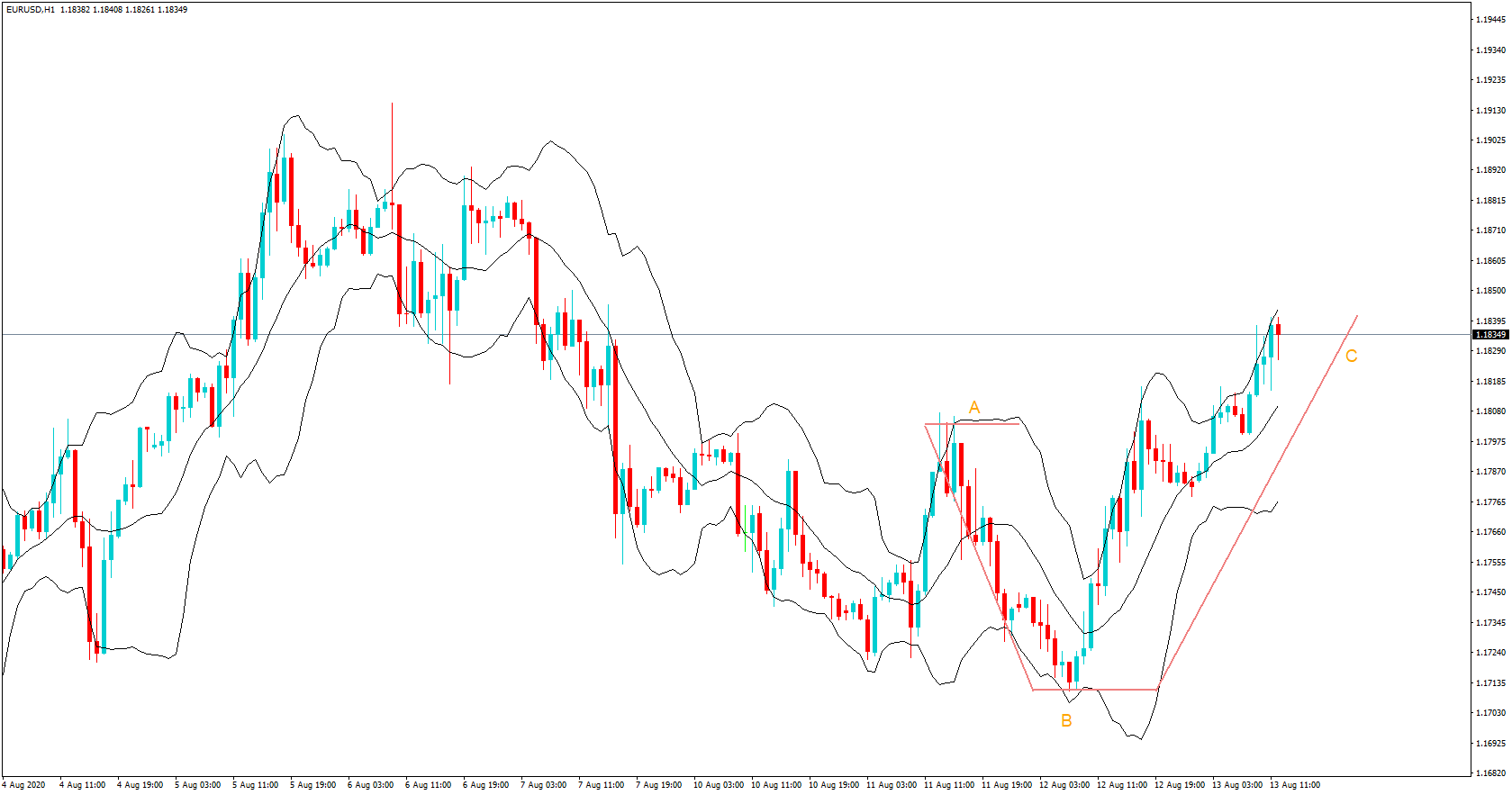

This is a one-hour chart of the euro US dollar pair, and I’m interested in the period between the 12th and 13th of August.

We can see that at position A, on the 11th August, the price action high, is at the same level as on the 10th of August, suggesting a price action double top reversal formation, and indeed the market reacts accordingly, and price action begins to fade back to position B, which breaches the previous lows going all the way back to the beginning of August, suggesting that the bears were in control of the pair, and price action might continue lower into the high 1.16’s

However, frustratingly for those sellers, the price could not be maintained in the downward direction and then completely reverses, retesting the high at position ‘A’ and finally breaching it to the upside, and where now we might expect a retest of the 1.19 level.

So, what is going on here where our chart suggests the bears are in control, and then all of a sudden, during the Asian session on the 12th of August, things just completely reverse, and the pair is driven higher?

One of the main factors to consider during the current economic crisis throughout the world caused by the global covid pandemic is the continuous change in sentiment for one country against the next, which at the moment is causing such a volatility and where the market can turn for no apparent reason with regards to technical analysis.

This pair was simply unable to bridge the 1.1700 key level, and this became a significant turning point. Key level trading such as round numbers can often reverse an exchange rate in its tracks, and that is what happened on this occasion. However, we must also take into account market sentiments, and a critical component of this reversal was the continuing spat between the democrats and republicans of the United States Congress who have so far not been able to come to a solution with regard to the continuation of the covid relief fund, which expired the previous Friday, leaving millions of Americans wondering how they are going to cope financially without the support that they had been relying on in the last few months.

Until such time as the Americans have got their act together and implement extra financial relief, we can expect more market volatility and a weakening United States dollar. Watch out for key number reversals and spikes in price action, where technical analysis must be used in combination of market sentiment while keeping fundamentals in the background and remembering that these are not the key market drivers during the continuing crisis. Keep informed with up-to-date news, especially pertaining to the United States covid relief status. And Keep stops tight.