Everyone who ever desired to become successful trading in the forex market understood how relevant getting proper education is. At times, we may watch videos or listen to podcasts, while some other times we might prefer blog posts or switch to some other media outlet. What we all understand is that forms of education are numerous and that in this day and age we can enjoy the luxury of being able to find the material that suits our needs, preferences, and most importantly our personality.

The choice of books can possibly best reflect these fine differences that exist among forex traders since everyone will eventually have their personal favorite according to the degree of the storyline or the message resonates with their own intentions, experiences, and goals. Many traders put extra effort into consuming as many facts as possible, which is understandably one way to go if you want to succeed. However, if you were to recommend a book to a complete newbie, which one would it be? Also, what would you base that choice on – technical aspect, indicators, success stories, or something entirely different? Today, we are diving into the pool of forex books in an attempt to offer a different perspective as opposed to what we commonly come across in terms of education in the general forex community.

- Attacking Currency Trends by Greg Michalowski

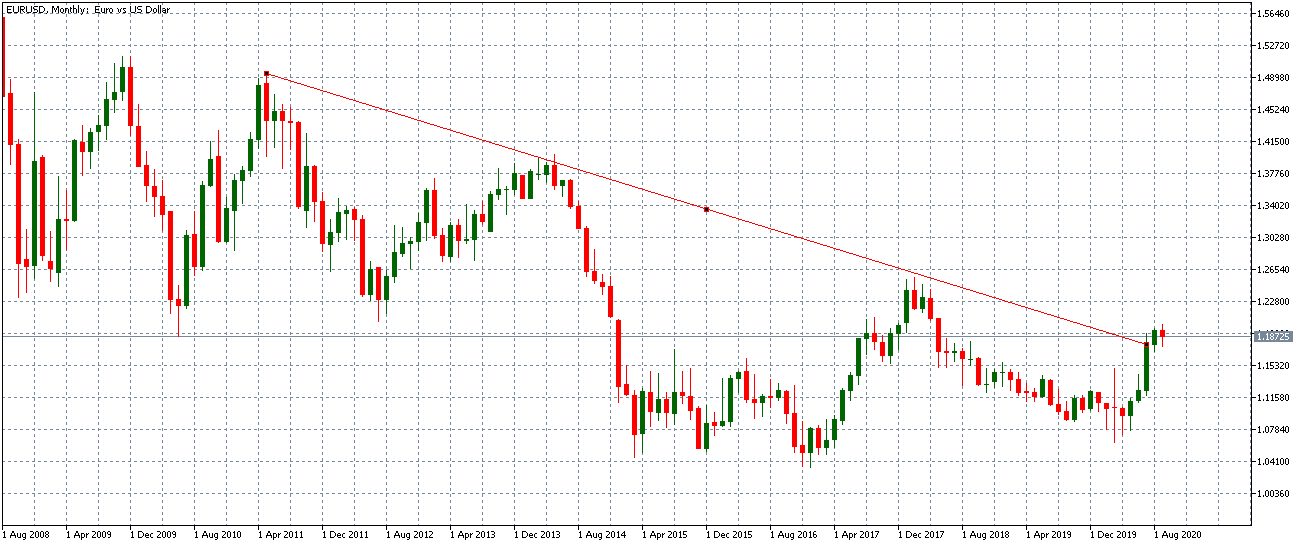

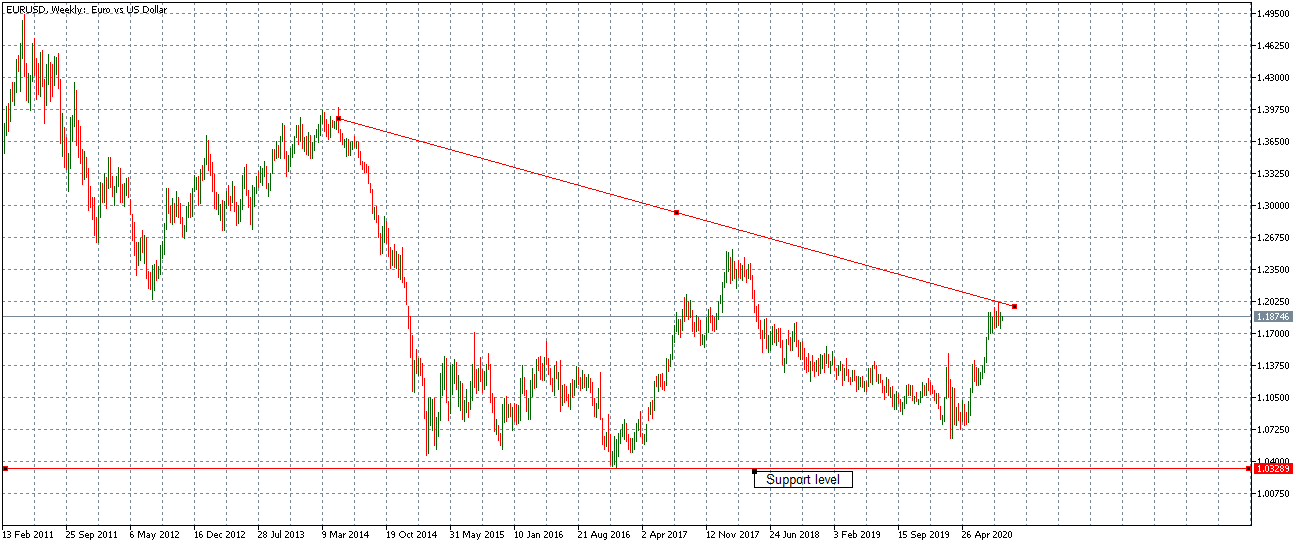

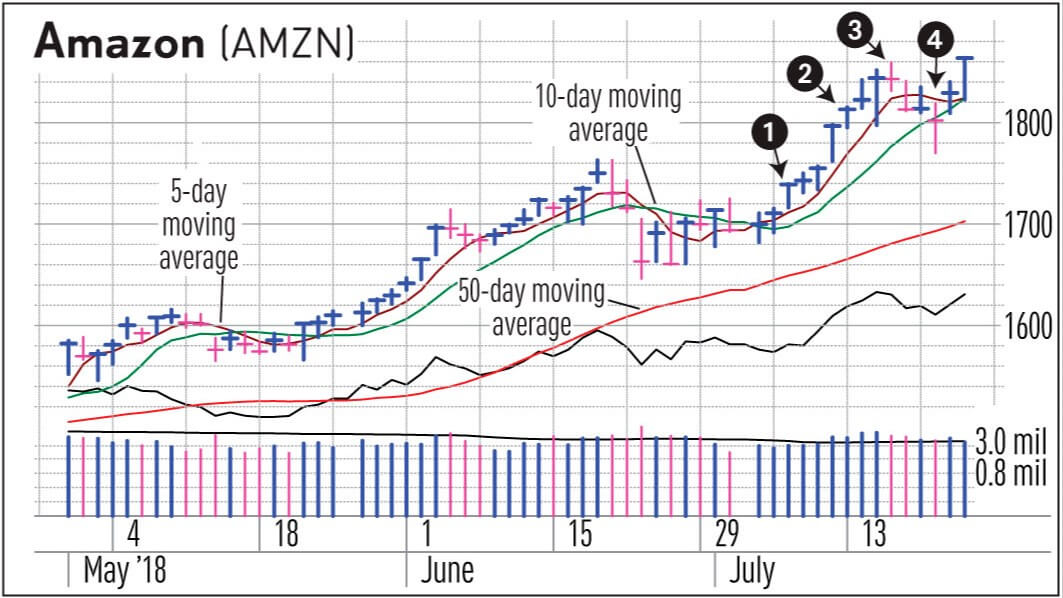

One of the first factors we need to include in the book selection process is the existence of a wide variety of trading styles. Some may be more popular, whereas some others might not be as widely advertised thus creating a minority in the forex market. If you happen to feel passionate about support and resistance lines, price action, supply and demand, or fundamental analysis, among others, then the first book we are offering as a suggestion today is possibly the best material you can find on this approach to trading. The book’s author, Greg Michalowski, defines what makes a successful trader, defining some vital steps everyone should take to become a professional in detail. You may learn about the best techniques to enter and stay in trends as well as the manner in which you can manage your position or exit any trade.

One of the first factors we need to include in the book selection process is the existence of a wide variety of trading styles. Some may be more popular, whereas some others might not be as widely advertised thus creating a minority in the forex market. If you happen to feel passionate about support and resistance lines, price action, supply and demand, or fundamental analysis, among others, then the first book we are offering as a suggestion today is possibly the best material you can find on this approach to trading. The book’s author, Greg Michalowski, defines what makes a successful trader, defining some vital steps everyone should take to become a professional in detail. You may learn about the best techniques to enter and stay in trends as well as the manner in which you can manage your position or exit any trade.

This book is the most suitable choice for individuals who are keen on trying out different time frames, as the writer claims to use even the five-minute chart. One of the most unusual strategies he recommends is to move from the five-minute chart to the hour chart only to switch to the daily chart afterward. This, however, is not always possible from all locations because in some areas, such as Vegas, for example, it would require traders to stay awake from midnight until 10 a.m. Again, if you are keen on trying out this method and if you accept to include resistance lines, moving averages, and smaller time frames in your trading, this may be an interesting experience.

The book above is, unfortunately (or fortunately), not a good fit for those who prefer a less popular approach to trading, avoiding the majority-like decision-making and the big banks. Due to the existence of so many high-quality forex-related materials online and the general lack of materials on psychology and mindset, the following recommendation of topics will chiefly boil down to the latter. Having a trading mindset and the right attitude can profoundly alter a trader’s experience. The right book choice can move a person from suffering from a scarcity mindset to seeing abundance in every step in and out of trading experiences. Everyone is different in so many ways – from trading to living, but we can all find some common grounds where the search for materials that can help us grow and further explore our options come in place. Many people are happy with what they have got at the moment, but nobody can tell you that you cannot do better.

Books can be such eye-openers even, or especially when, they do not concern some of the most discussed topics. The problem is that many traders, and particularly those who failed countless times, assume that technical knowledge or facts about strategies and methods of trading are the only items of knowledge that one needs to possess. Such an assumption is, however, entirely faulty, as trading, especially in this market, is a very unique package that, in addition to forex-specific technical knowledge, needs to consist of money management skills and trading psychology as well. Some experts even claim to owe their levels of success to the right choice of mindset books, which is why you can at least try reading one of the books below and see the impact it may have on your personal and professional lives.

- Think and Grow Rich by Napoleon Hill

Dubbed the predecessor of all motivational books, this 1937 masterpiece is the place to start growing your mindset. Naturally, all forex traders dream of becoming wealthy, affluent individuals, who wish to stop spending long hours working behind the desk. Luckily, the book is focusing on an extensive study of people who have accumulated a lot of wealth, based on which it provides a list of key principles to live by. If you are a career-driven professional and you feel passionate about expanding your opportunities, Think and Grow rich may just open a new window in your mind. Media all around the world praises the book to the extent that it even provided scientific evidence of how some of the suggestions from the book can truly and tangibly alter your everyday life.

Dubbed the predecessor of all motivational books, this 1937 masterpiece is the place to start growing your mindset. Naturally, all forex traders dream of becoming wealthy, affluent individuals, who wish to stop spending long hours working behind the desk. Luckily, the book is focusing on an extensive study of people who have accumulated a lot of wealth, based on which it provides a list of key principles to live by. If you are a career-driven professional and you feel passionate about expanding your opportunities, Think and Grow rich may just open a new window in your mind. Media all around the world praises the book to the extent that it even provided scientific evidence of how some of the suggestions from the book can truly and tangibly alter your everyday life.

As a uniquely philosophical, verging on the spiritual piece, you may find it to be a light material even if you have previously never had experiences with mindset work. If you are willing to test this book out, make sure that you apply the advice consistently as some of these pieces of advice are timeless but they do require some effort on your behalf. Even if you are not really interested in psychology, you may still want to give this road a try, at least just to be sure that this is not something you truly want to be doing in your life. Even though it is an entry-level read, you will find that Think and Grow Rich can proudly enjoy its nickname.

- Rich Dad, Poor Dad by Robert Kiyosaki

This is such a profoundly unique piece that many different people of various backgrounds still praise it. Written in the 90s, the book was such a revelation and is still one of the most captivating reads you will ever get to experience. Some traders vigorously claim that their entire lives completely changed purely after reading Rich Dad, Poor Dad as it covers topics very few people can see at this depth and level of understanding. The book discusses a road less traveled, or a path that we are typically not taught in our households or school systems, and helps its readers to see live from an entirely different standpoint.

The mindset Robert Kiyosaki describes is exactly what a forex trader should aim to incorporate in his/her trading toolbox. If you are a beginner or an experienced trader, this book can help you feel like the potential to be the most successful trader in the world. After finishing the book, many people started seeing the world in a different light because they finally found a way to get rid of the weight of constant self-doubt and anxiety, which traders are quite prone to. Naturally, we do not always need the same advice or strategies, but you owe it to yourself to at least read the book and see whether and to what degree it affects you. Unlike anything you have ever read before, Rich Dad, Poor Dad will surely leave a mark in your lives and your trading as a result.

- The 4-Hour Workweek by Tim Ferriss

A natural successor of Rich Dad, Poor Dad, this book is a logical continuation for anyone who has given work hours and schedules a thought. If you are keen on changing your daily routine and ready to take on new challenges, be prepared to be astounded by some amazing facts. While the title of this piece may invoke feelings of disbelief or doubt, it does not fall short of its name. You can learn from the author’s personal experience of growing his finances from $40,000 per year and 80 hours per week to $40,000 per month and 4 hours per week. This approach is particularly important for forex traders since we, as people, tend to try to copy the same type of mindset (e.g., belief that you need to work hard to earn more money) onto trading currencies, which need not be the case.

A natural successor of Rich Dad, Poor Dad, this book is a logical continuation for anyone who has given work hours and schedules a thought. If you are keen on changing your daily routine and ready to take on new challenges, be prepared to be astounded by some amazing facts. While the title of this piece may invoke feelings of disbelief or doubt, it does not fall short of its name. You can learn from the author’s personal experience of growing his finances from $40,000 per year and 80 hours per week to $40,000 per month and 4 hours per week. This approach is particularly important for forex traders since we, as people, tend to try to copy the same type of mindset (e.g., belief that you need to work hard to earn more money) onto trading currencies, which need not be the case.

Moreover, if you are trading long hours and cannot seem to see any difference from the previous 40+-hour week, this book will provide invaluable advice in the form of creative solutions that you can start applying today. The book’s review points to its excellent use even in times of an unpredictable economy, which is another reason why forex traders should consider this book as a creative and practical assistant. Last, as you can find some prominent forex traders who feel passionate about this book because of the changes they witnessed upon reading it, the time you will put into reading this should be viewed as a smart investment.

- Choose Yourself by James Altucher

Another more recent mindset masterpiece, Choose Yourself, combines the lessons you could learn from the previous two books we mentioned above. The book is often described as a source of refreshment and motivation, which everyone in this market needs – be it at the beginning of a forex trading career, after a major loss, or upon spending many years trading the same way. The book is particularly good in describing how in this world full of changes the only thing we can control is ourselves. The economies, retirement plans, governments, and even our age can change, but it is the perspective we adopt that will determine the quality of experience we get to have.

Another more recent mindset masterpiece, Choose Yourself, combines the lessons you could learn from the previous two books we mentioned above. The book is often described as a source of refreshment and motivation, which everyone in this market needs – be it at the beginning of a forex trading career, after a major loss, or upon spending many years trading the same way. The book is particularly good in describing how in this world full of changes the only thing we can control is ourselves. The economies, retirement plans, governments, and even our age can change, but it is the perspective we adopt that will determine the quality of experience we get to have.

Are we putting available tools to good use in the times we live in? Are we exploring any creative solutions to alter reality and generate more happiness and health? Is our internal world in accordance with the external one? Are we getting the financial rewards we believe are rightfully ours? These and many other questions are discussed in detail in Choose Yourself along with numerous practical advice which stems from a plethora of real-life case studies and interviews. If you want to learn how to let go and properly enjoy your life, James Altucher has the remedy you need.

- Discipline Equals Freedom: Field Manual by Jocko Willink

As the name suggests, Jocko Willink’s book discusses the topics of discipline and preparedness to be patient. The author’s immeasurable quality and variety of experience have been cleverly focused in such a way that you will never feel like you are reading a mindset book alone. If you are the type of person who is not a big fan of so-called self-help books, this one will teach you something you may not learn anywhere else. We can at last read about how a well-organized and orderly style of living can bring about the positive changes we aspire to see. No longer are people told to only visualize positive outcomes or a windfall of money because now we have a clear and straightforward instruction based on what constitutes a successful person. Human beings are heavily prone to procrastination, fear, and weakness regardless of their chosen profession.

As the name suggests, Jocko Willink’s book discusses the topics of discipline and preparedness to be patient. The author’s immeasurable quality and variety of experience have been cleverly focused in such a way that you will never feel like you are reading a mindset book alone. If you are the type of person who is not a big fan of so-called self-help books, this one will teach you something you may not learn anywhere else. We can at last read about how a well-organized and orderly style of living can bring about the positive changes we aspire to see. No longer are people told to only visualize positive outcomes or a windfall of money because now we have a clear and straightforward instruction based on what constitutes a successful person. Human beings are heavily prone to procrastination, fear, and weakness regardless of their chosen profession.

Forex traders have had the opportunity to witness the same in their lives as well. Nonetheless, the same vortexes of turning off the alarm (whether figuratively or literally) can now stop with the help of this down-to-the-point yet light read. Traders do need to adopt some healthy everyday habits and routines because it will not only help them manage their trades more peacefully and successfully but will also improve their ability to discern when they are acting upon their impulses and weaknesses instead of using skills and tools. Furthermore, if you are someone who is currently working two jobs, with forex trading being your second endeavor, this book will teach you how to achieve the level of organization that such lifestyle and level of responsibility required.

The concept of stoicism implies the endurance of any hardship and acceptance that both good and bad with all the in-between shades that exist in this world. This Greek school of thought originates from the third century BC and the book cleverly and practically covers the thought patterns that many great minds have incorporated in their daily lives to this day. Traders are often compelled to do exactly what the majority does, without feeling the right to make any changes due to the fear of being different and experiencing losses as a consequence. This book, however, will show you how it is not what is happening on the outside that you should be worried about, but your own reflection of it. This crucial idea is key for surviving and being on top of situations, such as negative news or other external events that traders inevitably face quite a few times in their careers.

The concept of stoicism implies the endurance of any hardship and acceptance that both good and bad with all the in-between shades that exist in this world. This Greek school of thought originates from the third century BC and the book cleverly and practically covers the thought patterns that many great minds have incorporated in their daily lives to this day. Traders are often compelled to do exactly what the majority does, without feeling the right to make any changes due to the fear of being different and experiencing losses as a consequence. This book, however, will show you how it is not what is happening on the outside that you should be worried about, but your own reflection of it. This crucial idea is key for surviving and being on top of situations, such as negative news or other external events that traders inevitably face quite a few times in their careers.

In addition, through this read, Ryan Holiday will teach us to look within and discover what motivates us to take a certain action. If you are ready to really let go of some unhealthy patterns that you have been clinging to, this book will shake you to the core not leaving any stone unturned. Traders in the spot forex market can finally enjoy a book that can teach them about principles of motivation, shed light on some personality traits they may not be aware of, and, most importantly, provide a long-term strategy that will prevent compulsive reactions which are both reckless and dangerous for this type of business. Last but not least, if you decide to go on this 365-day-long journey, you will learn how to stop being concerned with the things you cannot control (e.g. elections, news, big banks, etc.) which is one of the most important lessons a forex trader should constantly bear in mind.

- Principles by Ray Dalio

One of the richest men on this planet wrote a book about the importance of understanding the relationship between cause and effect in analyzing some existing patterns in life. The book so skillfully elaborates on the topic of life principles, covering many different points that traders may at times disregard as irrelevant. Concepts such as humility and open-mindedness are dexterously combined with practical tips on how to reach the level of success you desire. Traders who mostly sit at their computers may find some ingenious lessons on people in this book as it points to the belief that all industries inevitably fall on individuals. Although the forex market appears to be made of people making individual decisions, the chart often shows how the majority acts in the same way with everyone losing their money at the same time.

One of the richest men on this planet wrote a book about the importance of understanding the relationship between cause and effect in analyzing some existing patterns in life. The book so skillfully elaborates on the topic of life principles, covering many different points that traders may at times disregard as irrelevant. Concepts such as humility and open-mindedness are dexterously combined with practical tips on how to reach the level of success you desire. Traders who mostly sit at their computers may find some ingenious lessons on people in this book as it points to the belief that all industries inevitably fall on individuals. Although the forex market appears to be made of people making individual decisions, the chart often shows how the majority acts in the same way with everyone losing their money at the same time.

The book can also help you give meaning to your every day steps and discover a new sense of peace upon making a mistake. Through this unbelievably human and humane rhetoric, Ray Dalio can inspire traders to maintain control over the progress while constantly investing in growth. Principles will easily motivate you to think of the ways in which you can adapt to some circumstances or changes. What is more, if you are an experienced trader, this book will effortlessly encourage you to keep searching for ways to improve your trading. This is another important lesson for beginners who have yet to learn how forex is an ever-changing market that requires the preparedness to keep exploring both as a routine and as a way to salvage your account. Open yourself to the potential of learning from this successful individual who managed to evolve from an everyday medium-class family to a wealth exceeding 150 billion USD and enjoy the changes you experience in your trading as a result.

As we could see from the selection above, many self-made people do not fear delving into the depths of their personalities because they understand that technical and theoretical knowledge can get them only that far. Numerous excellent books can provide these other types of information, and if you feel inclined, do take time to do additional research on the aspects of trading you personally feel passionate about. Today’s choice of materials was inspired by a story of a trader who decided to leave his well-paid job and a 70-hour week upon reading one of the books we discussed today. This individual never looked back, and as Greg Michalowski shared in one of his interviews, neither should you. The choice and the determination to trade in this market do not shield you from making (many) losses, but your attitude and your readiness to keep fighting will help you wait for the success that will result from learning.

If you are in the middle of the process of completely tuning to forex trading, rest assured that the patience of postponing your vacation times, car purchases, and other enjoyable activities other people are having at the moment to a later time will double your chances to succeed and grow your finances. The lessons that come from withstanding hardship and investing in psychology will get you to the point where you wake up feeling elevated and ready to take on the world all on your own. You will feel confident and at peace with your decisions and your daily life and proper education can only make this path quicker.

Many of the books we discussed today are seen as the reason behind some traders’ success. The knowledge and wisdom contained in these pieces are the very constituent parts of these professionals’ approaches to trading. Whatever you resonate with and incorporate in your trading, whether it is a tool or some belief, will have an impact on your trading. The more you allow yourself to accumulate, the greater your vision will be. With a comprehensive and deep overview of oneself and the market, any trader can enjoy the perks that come from trading currencies. While many materials share the same pieces of information and go into too much detail, it is your task to cover as many sources as possible and continuously employ your critical thinking and analytical skills.

Even though you will often come across some overused words and phrases, try to not limit yourself to only what is popular. In addition, you may find that even though some people do not support your choice of literature, they can still share the same values and viewpoints concerning life and work. Having written that, we do insist that learning can come in many shapes and forms. An individual who is more of an audio learning type may prefer podcasts and videos, while someone else might choose written content over anything else. Some of the main hubs for learning about the forex market nowadays are YouTube and Twitter although many websites offer coaching materials as well. Whichever path you choose, aspire to grow as an independent trader capable of making impartial decisions. Whether you choose to read books only or you make a selection of various materials and advice, this choice will reflect on your career, as it will mold you into a forex trader. The knowledge you accumulate will always interact with your personality, and together they will make your personal system or approach to trading.

If you desire to be successful, go deep in exploration of what this word means to you and how you can make daily changes to get to that place. The work you put in education and mindset will always reflect you alone and besides being an inherent task attached to one’s desire to become a forex trader, it is also an art of choosing the right puzzle pieces to create a final masterpiece.

In case you are facing a similar problem, the best step you can take is to withdraw from trading, start all over again, and learn more about this market. This is such a specific situation and such an important signal that some traders should consider moving on to some other markets or businesses. Having this outcome directly indicates that a trader has not developed the necessary mindset which this particular market requires. Both reckless trading and the timid one may equally endanger your account because the risk can never be too high or too low in the forex market. Even if you managed to increase your account by 4% in a single year, it would still not be good enough if you had to go at great lengths to achieve this. Traders need to find that right balance and also think of some other factors, such as time, effort, and profitability, because there may be a safe but much easier, faster, and more lucrative way to seeing your finances grow.

In case you are facing a similar problem, the best step you can take is to withdraw from trading, start all over again, and learn more about this market. This is such a specific situation and such an important signal that some traders should consider moving on to some other markets or businesses. Having this outcome directly indicates that a trader has not developed the necessary mindset which this particular market requires. Both reckless trading and the timid one may equally endanger your account because the risk can never be too high or too low in the forex market. Even if you managed to increase your account by 4% in a single year, it would still not be good enough if you had to go at great lengths to achieve this. Traders need to find that right balance and also think of some other factors, such as time, effort, and profitability, because there may be a safe but much easier, faster, and more lucrative way to seeing your finances grow.

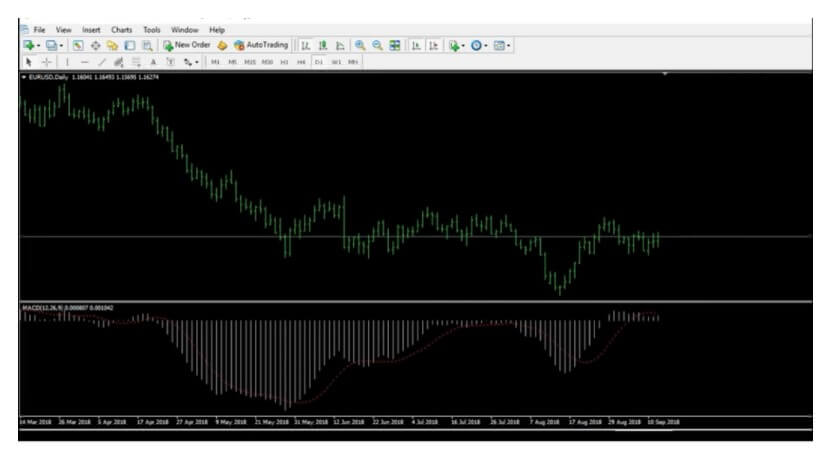

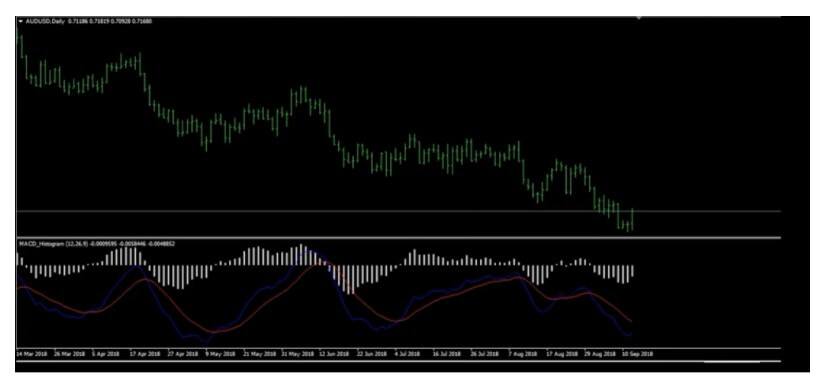

In short, it needs to tell you whether there is enough volume to trade. Think of it as a stoplight. If it’s green (and all your other trade signals align), go ahead and enter the trade. If it’s red, however, that’s your cue to pull out of the trade. A good volume indicator will do both of these things. Another thing to keep an eye on is indicator lag. Some lag is inevitable – all indicators lag to a greater or lesser extent – but you don’t want your volume indicator to lag too much so watch out for that when searching for and testing volume indicators.

In short, it needs to tell you whether there is enough volume to trade. Think of it as a stoplight. If it’s green (and all your other trade signals align), go ahead and enter the trade. If it’s red, however, that’s your cue to pull out of the trade. A good volume indicator will do both of these things. Another thing to keep an eye on is indicator lag. Some lag is inevitable – all indicators lag to a greater or lesser extent – but you don’t want your volume indicator to lag too much so watch out for that when searching for and testing volume indicators.