In this article, we will analyze the types of existing automated systems according to the duration of the trade. I’ll show you some interesting ideas and teach you how to apply a variety of duration-based Forex strategies.

Scalping

Perhaps the most famous method is the so-called scalping, which many of you have already tried. These are really short-term operations. Then the second group is called swing trading, mainly using higher time frames. This is my favorite approach and trading style, I use swing strategies, automated trading systems that make transactions in longer time frames. And the third group, which I also enjoyed working with very much recently, consists of long-term strategies, mainly in daily time frames. We will also consider this group because it has its own advantages that we must not forget.

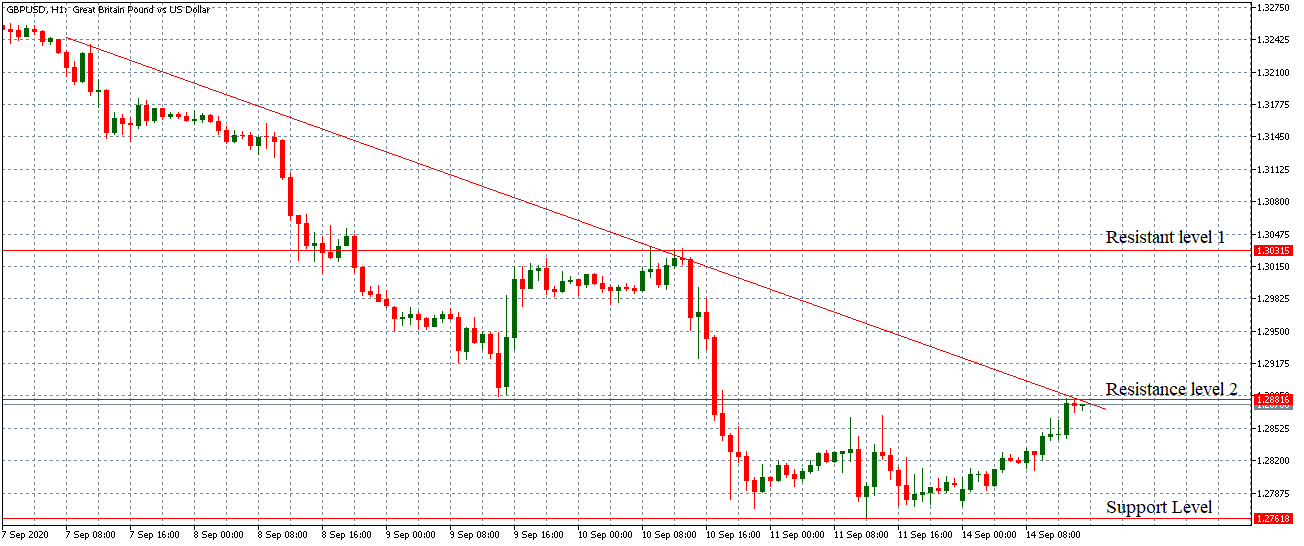

Scalping is a type of specialized trade taking profits on small price changes, usually shortly after a transaction has been entered and has become profitable. Automated scalping strategies can do dozens of operations during a day and most such trades last only a few minutes. These are very short trades and, therefore, that trading style has its own advantages and disadvantages. Let’s talk about them.

Scalping is a type of trade specializing in taking profits on small price changes, usually shortly after a transaction has been entered and has become profitable As a general rule, scalping strategies are marketed in short time frames using 1-minute candles. So the main advantage is the opportunity to make big profits in a very short time. These automated strategies can be very profitable, but at the same time very risky. Where there is great profit potential, there is also high-risk potential. And, as we said before, scalping has some huge disadvantages.

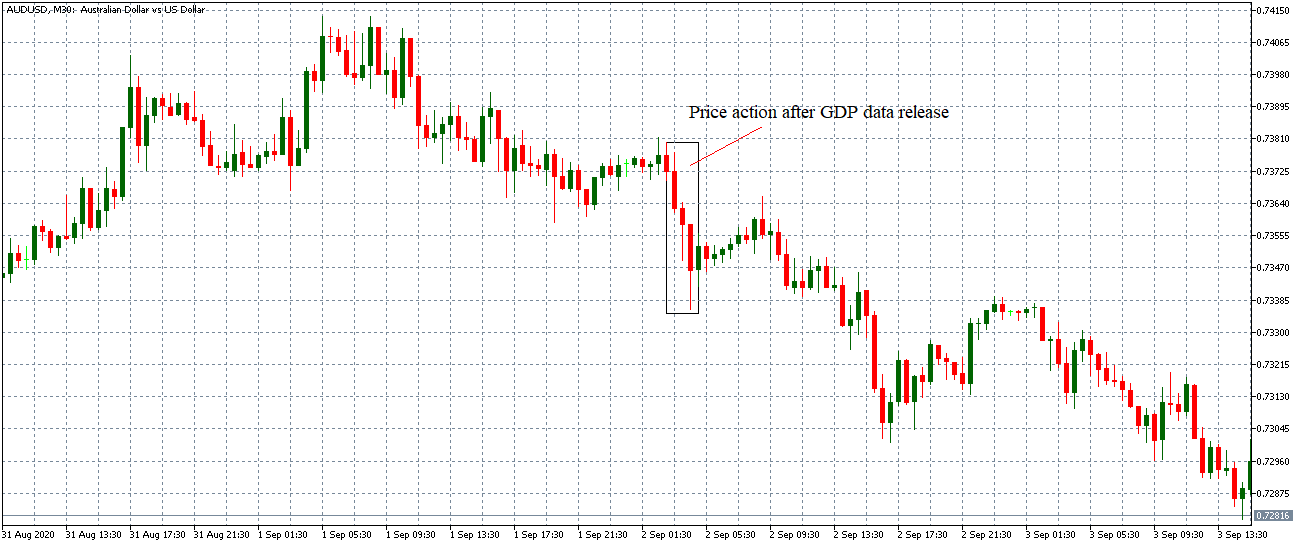

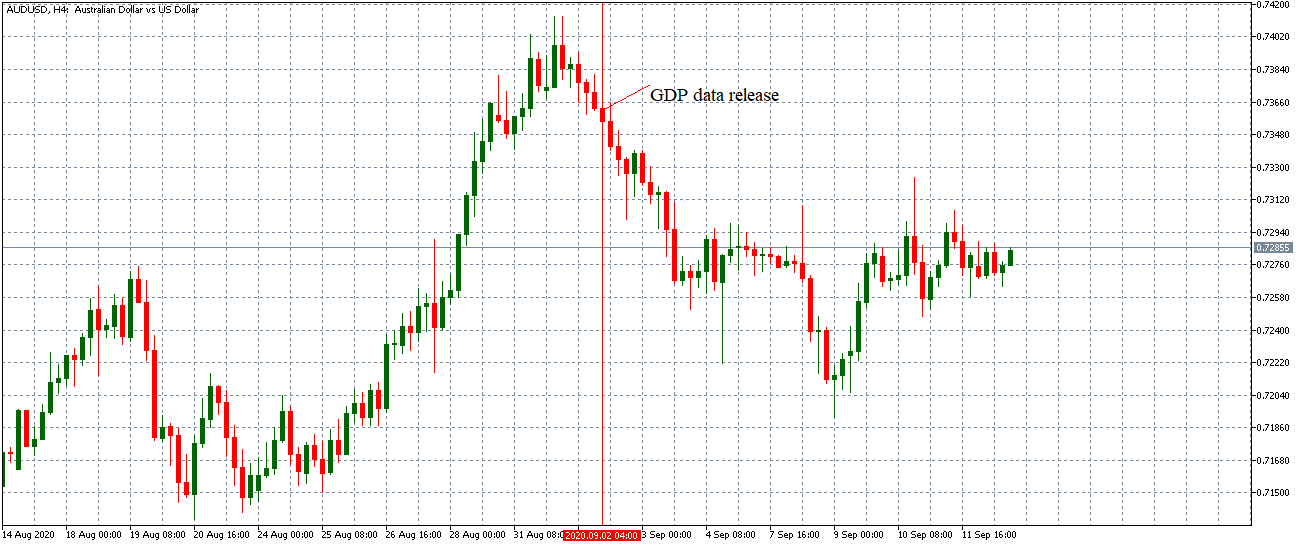

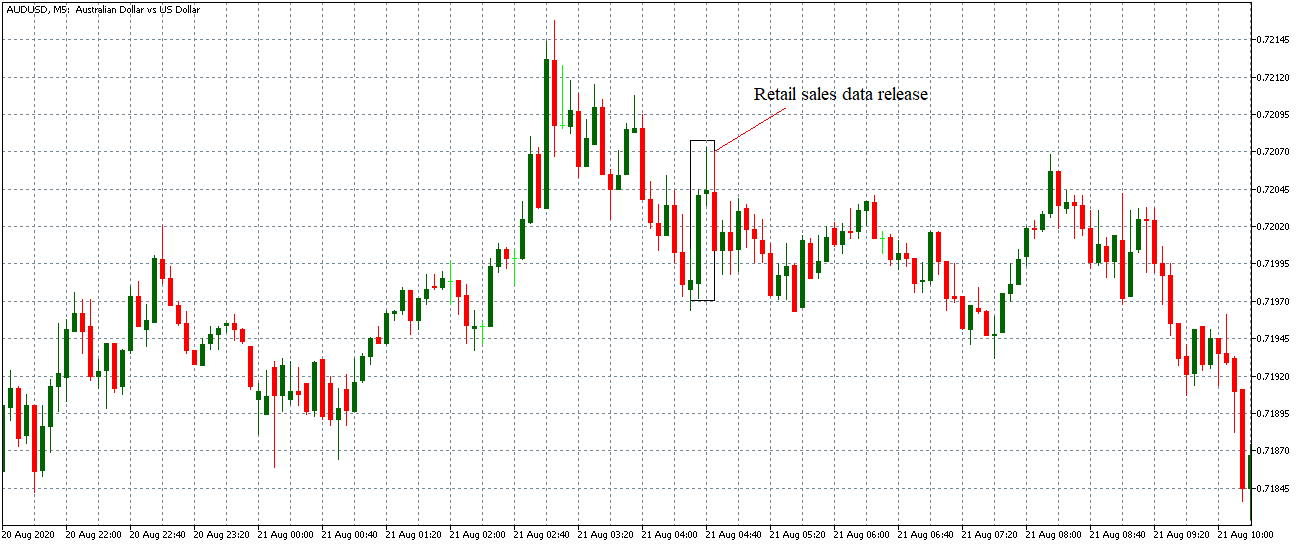

In general, automated scalping systems are potentially very risky and very sensitive to market conditions. This is because it is almost impossible to perform transactions in a one-minute time frame to simulate with historical accuracy. Then, it is not possible to elaborate an exact subsequent test. We can only backtest a strategy, how it should work in ideal conditions. However, there are situations in the market, when there may be a publication of some important macroeconomic news, for example, that the unemployment rate increased. As a result, the market makes a very strong price movement in a very short time and we may suffer a large slide, something that has not been taken into account in subsequent tests, and that will definitely worsen the results of our strategy.

Where there is great profit potential, there is also high-risk potential. So, in the world of scalping strategies, only one of those unfavorable circumstances can mean that one loss takes ten of our earnings, and this is what we can’t see in our subsequent tests. Therefore, it is very difficult to develop robust scalping strategies, and I personally do not even use them. In the past, I’ve worked with scalping strategies and gotten really good results, but at times, these were due to luck and being in the market at the right time.

The potential benefits can be really huge. However, scalping is so risky and so sensitive that it makes no sense to use it at all. I would not care too much about the complexity of developing such strategies if they are so risky. Here we see big risks that can’t be determined in advance, so if you’re just starting to operate, I don’t recommend scalping.

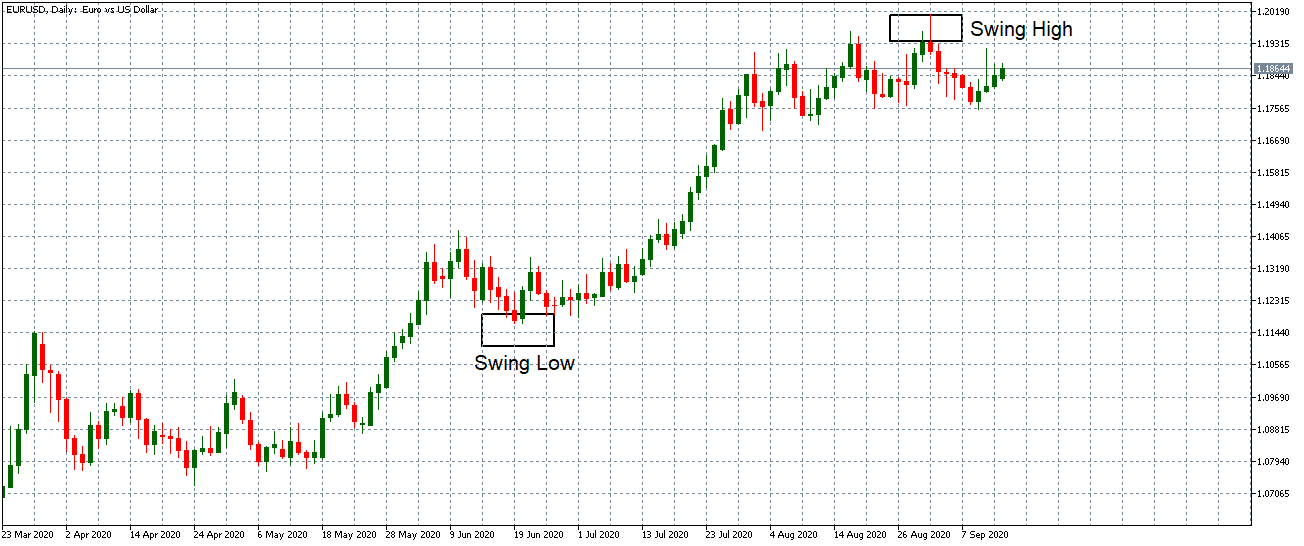

Swing Strategies

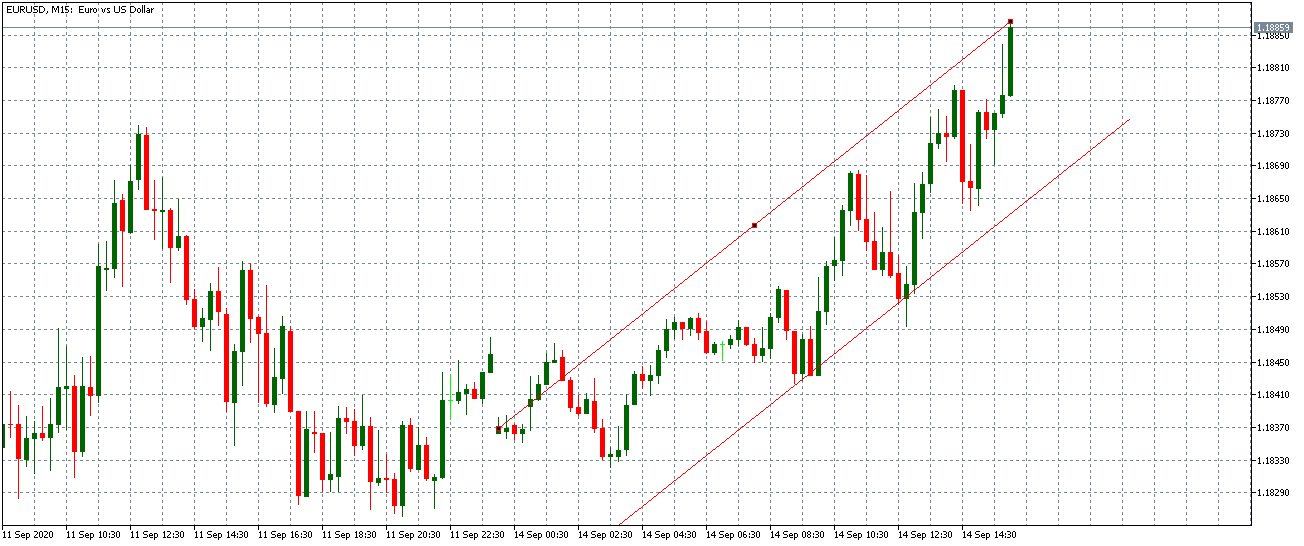

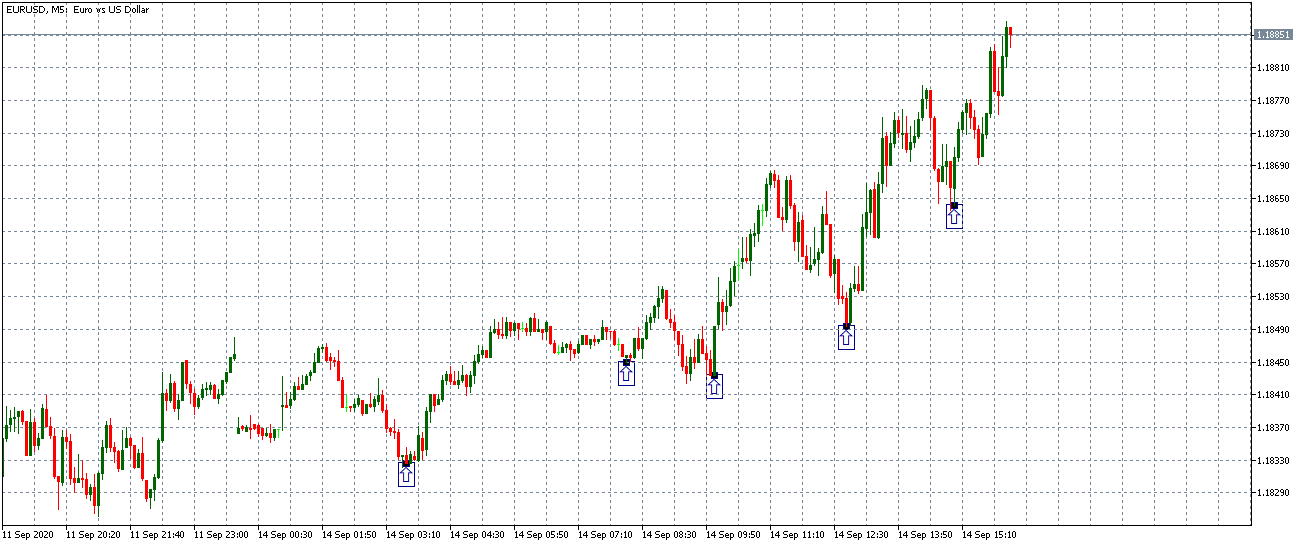

I recommend directing your attention to swing strategies. This is my favorite type of strategy, which is usually marketed in the H1 time frame. In 90% of cases, they will be within one hour, in exceptional cases in M15. If we want to talk about whether to use a time frame of one hour or fifteen minutes, we need to consider the type of strategy. In 90% of cases we will use a time frame of one hour, which has its own advantages, but of course some disadvantages as well.

Therefore, I have chosen it. The main advantage is that it allows you to perform longer operations. Usually, an average trade lasts about 24 hours, it can also take several days, but usually around 24 hours, and it is also one of the factors with which I am satisfied. Such trades are not as sensitive. The number of trades in a month is a maximum of 10, so such a trading style is not as expensive.

Usually, an average trade lasts about 24 hours, it may also take several days. When someone is scalping, they pay a lot of money just for commissions or for spreads. This is not the case with swing strategies, with which you only need to pay commissions for approximately 10 transactions per month. Such a fee is less important and does not have a significant impact on your account.

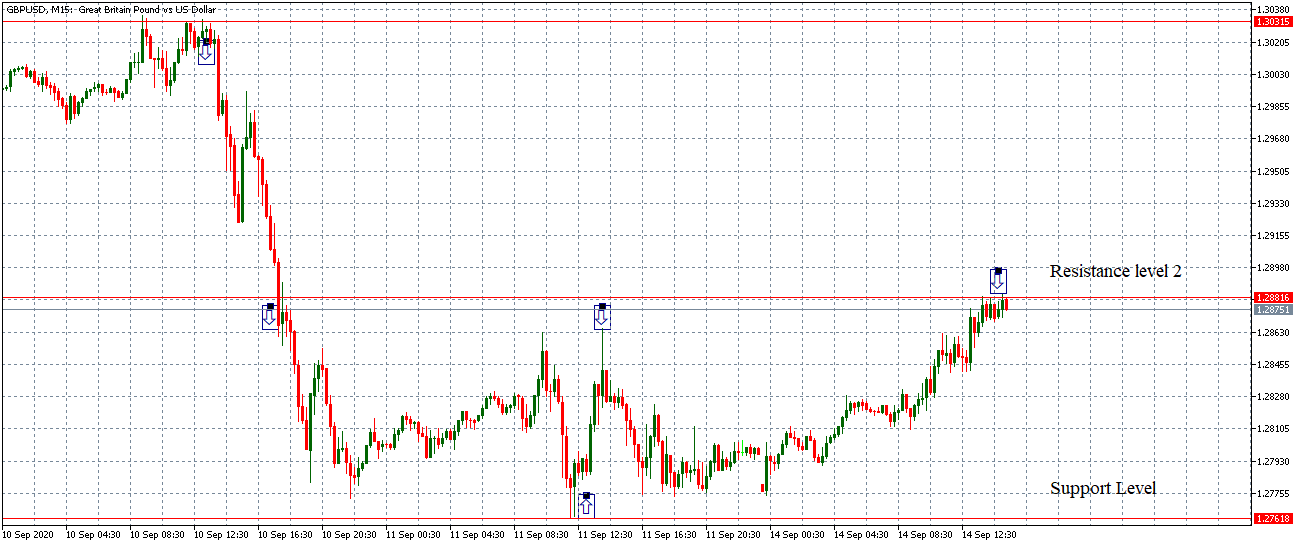

Of course, swing strategies are not as profitable due to the smaller number of operations that are performed in longer time frames. Therefore, a trader earns less, but with more stability. Because these strategies are not so sensitive, they are not so influenced by the unexpected news of strong market movements. For example, when publishing macroeconomic news, such as the decision of a central bank on rates, unemployment rate, GDP growth, etc. In those moments, we only risk an operation and we are not so afraid of a negative result because it is not a big problem for us. It will not result in a great loss.

Swing strategies help us deal with some difficult situations in the market, and we can also perform backtesting with more accuracy and reliability. This is the main advantage of swing strategies compared to scalping: it is easier to simulate real market conditions for backtests. These strategies, in my opinion, are the perfect combination of the number of trades and stability, and if you’re a beginner, the one-hour window is definitely a good choice.

Position Trading

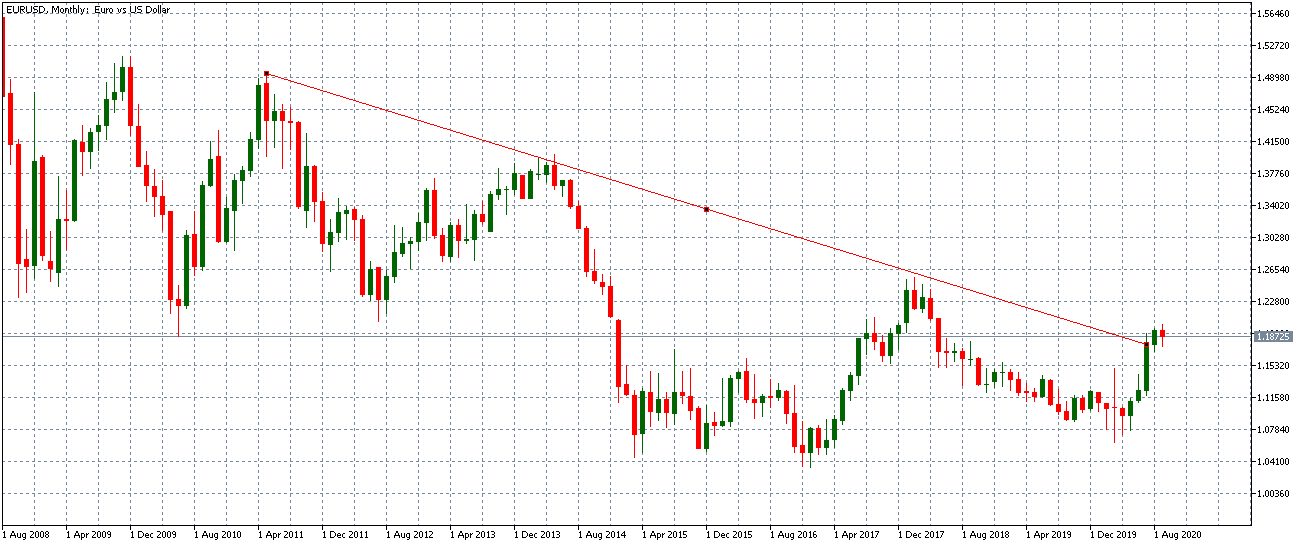

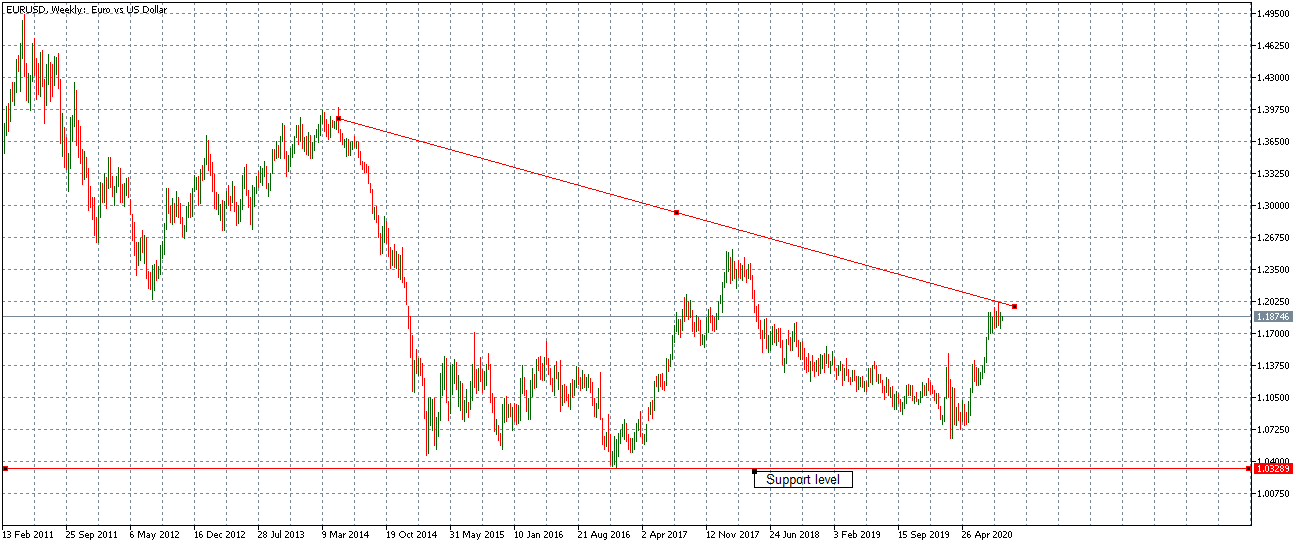

The third type of strategy is position trading. In general, these are strategies for long-term positions which, in some cases, can be maintained even for a few years. Basically, they are negotiated in daily or even higher time frames. I personally operate all position strategies in the daily time frame, and sometimes very interesting situations and transactions can occur.

The main advantage is that these positioning strategies are very stable, as they are usually used to take long-term trends. To take one example, in the past, we witnessed a crash in the oil market with a price that fell steadily for more than a year, so we could be in this position for a long time.

So position trading can be very stable because we are working with strong trends. I am satisfied with the positioning strategies in the daily time frames. Another advantage is that they can be tested very accurately because economic news has an absolutely minimal impact on their overall results. In many cases, it is only in the short term impact, and from the perspective of the daily time frame, this impact is not something we should fear.

Therefore, we can perform subsequent tests with a very high level of accuracy; however, these positioning strategies generally have lower yields. This third type of strategy has the lowest gains of all these types of strategies. It is necessary to note that position trading gives gains of ten to twenty percent. However, this can be achieved with great stability and can be re-tested with precision.

In addition, these positioning strategies generally work in a wide range of markets, so they can be used to trade indices, commodities, different currency pairs, as well as some exotic currencies such as the Polish Zloty, the Swedish Krona, or the South African Rand. We can do this because it operates on long-term trends, and you can even afford to operate in exotic markets.

This would not be possible when operating in lower time frames and with a greater number of operations; however, positioning strategies are connected with a low frequency of operations and therefore the costs are lower and Therefore, even the high entry costs in trades (usually very high spreads) are secondary due to the duration of our trades.