Forex currency movements may look random but when we take a pair, we can notice statistical characteristics. Your trading system is certainly going to have favorites, simply it will be more successful on some than with other currency pairs. Sometimes if you tweak your system based on narrow pair set backtesting, you may find other pairs are not as good. But you should aim to have a universal trading system.

We have presented a few pairs, how and why they might be great for technical swing trading systems as they have peculiarities, unlike some currency pairs that are harder to analyze due to their “ordinary” nature. USD/CAD is one such pair. The USD is the most used currency and has a lot of action moving the trends, traders commonly say it is the currency that drives the bus. This means trends on USD pairs may be suddenly interrupted, false breakouts are often and even president tweets create havoc you simply cannot predict regardless of how good your system is.

Whatsmore, big banks’ attention is on the most traded pairs, and these are, again, the USD pairs. When we mix in the CAD, the United States and Canada are neighboring economies, they have extreme similarities and some professional prop traders even dare to say CAD pairs have made more losing trades than any other major crosses. Still, your system should be profitable here too and you will make a lot of trades on this pair throughout your trading career. So, we go a bit deeper to understand this tricky pair.

In the fundamental articles, you can understand the drivers of the USD and CAD currencies separately. Economies, countries, or currencies that are close, like the AUD/NZD, EUR/GBP, and USD/CAD can be characterized as in positive correlation. Using the basket trading methods, when comparing the currency baskets, traders seek to trade negatively correlated currencies, or when they diverge in value and prioritize them for trading. If history has shown AUD and NZD are mostly positively correlated, some traders will just avoid AUD/NZD pair just based on this analysis. Yet, according to contrarian swing traders, AUD/NZD is the best performing playground for their systems.

USD/CAD pair belongs to this category. When you have economies that run together, you do not have to worry about two event sets for each economy (currency) that may break down your analysis. Also, the news and economic reports are almost copied to Canada from the US. They come out at the exact time and formulated the same way. Non-farm payrolls and employment reports almost always come out on the same day. The importance and effects of these events are widely familiar with traders.

Now, if you are trading on the daily timeframe, the USD/CAD has a “double” event for each currency in the pair on the same day. This means that one candle can be packed with activity. It is suggested that your system should have a 48 hours decision buffer before this event. This means if your system has a signal to enter a trade 2 days before the NFP report or other major event, you should just ignore it. Typically major news events effect is unpredictable, regardless if it is positive or negative for the currency. It is up to the big banks, how and when they will react to this report.

Consequently, this is uncertainty you want to avoid 24 hours before. The USD/CAD pair typically has one candle (day) of calm activity before these reports. So your system or trade will not even have a move to gain from for that day if you have a signal. This is why you should implement a 48 hours rule to avoid trading before the major event for the USD/CAD. It is unlikely your Take Profit target will be reached in one day (Wednesday) before the event.

One popular research and method that attracts traders is the comparison of the Canadian Oil price with the USD/CAD. The correlation of the Oil price to the CAD can be spotted as positive. When this analysis is carried over to the USD/CAD one could see periods where it holds and other periods there is no correlation at all, be it positive or negative.

This is easy to test, take a look at the comparison charts. If we compare years, some correlation can be found, but this is not particularly useful to traders. On lower timeframes, months, weeks, daily, correlation is nonexistent. Still, a lot of traders have read some news or articles claiming this correlation, but all you have to do is open two charts. Do this to other CAD pairs or baskets, you will find this analysis does not provide any information you can confidently use for trading.

Similar is for the AUD and Gold, correlation analysis is just not precise enough and not consistent to be useful. As technical swing traders say, you can even ignore every correlation analysis since your system should show proper signals regardless if the correlation truly exists.

Traders that use higher timeframes than the daily can be classified as investors. They do not trade often, their trades are held for months and are just not what you would define as a forex trader. The investor analysis is heavily fundamental. Does it mean investors’ analysis cannot be applied to day traders? If you are a technical trader, you may ignore long term fundamental analysis right away, if you are open-minded, there are a few tricks some day traders use from the fundamental analysis of the CAD.

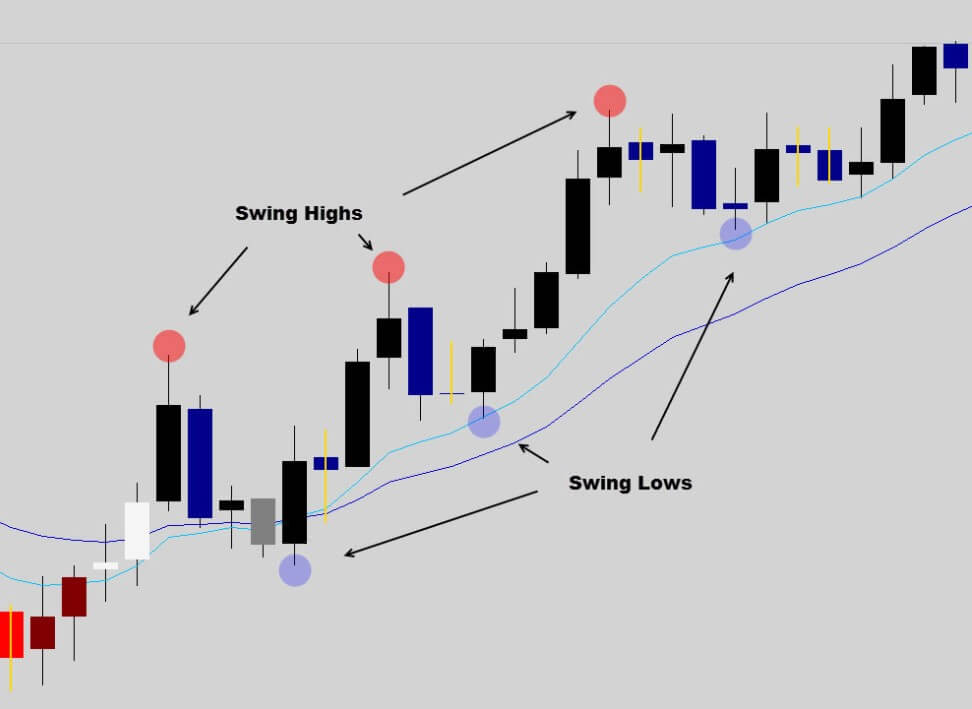

From time to time, political events on a smaller impact scale have a critical effect on a currency that just goes unnoticed. In the long term, this can cause a major trend. This trend can be seen on higher timeframes, but your system is probably not accounting for these long periods. According to some traders, movements in the direction of this major trend on the USD/CAD are sudden, extreme in volume, and are very consistent. If you remember the importance of the continuation trades or major trend resume trades, your system should ignore small corrections and take just one direction signals. These signals can be the most frequent type of swing strategy. The weekly chart is the best choice in this case for the USD/CAD, even though it is too high for usual trading.

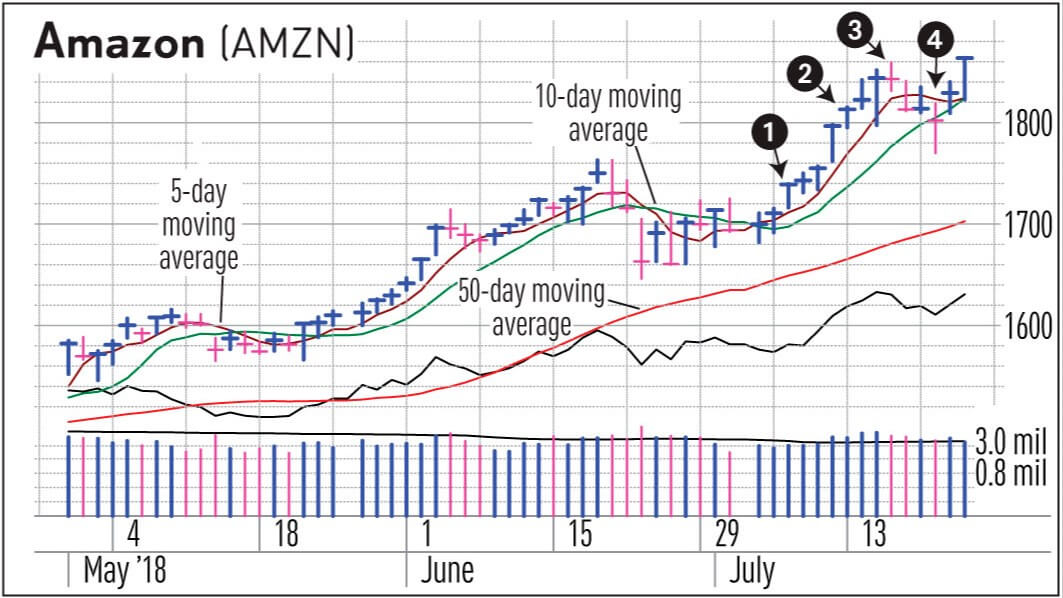

Take any of the trend continuation indicators from your system and plug it on weekly. Trade only aligned directions with your system on the daily timeframe and you will notice consistent good trades. After the CAD minister elections in 2015, the USD/CAD took the opposite direction, long direction. Now, regardless of your political affection, trading should not be based on your opinions, ever. If we take economic management knowledge of this particular Canada minister elected in 2015, many would agree he is not the “money guy”. Interestingly, Trump’s election pushed this trend even harder. Trump would want a weaker dollar so this idea is not very logical. However, it was not until the beginning of 2016 the USD/CAD started to correct.

These continuation trades remained consistent as winners even today in 2020 according to professional prop traders. You can take this tip even if you are a purely technical trader and use the advantage of long term fundamentals that seem to reveal some of the best trades on a not so great currency pair to trade.

Keep your eyes open for any fundamental analysis or events that are affecting forex in a hidden way. The combination of these and your system will be long term cooperation you will enjoy. If we take the Euro or the EU, for example, many analysts think the union is on fragile legs, any new country to join is a bad idea to them. Well, try to use this information and test it in a similar way using a higher timeframe continuation indicator. Fundamental events or opinions by the investors is not always beneficial, so you will have to test as always. Note that you should not try this right away.

First, you need to master trading the way you like, using a swing trading system or some other strategy. Only once you have consistency year after year you can seek out new markets and new exploits like this one for USD/CAD. Whatsmore, thinking outside your typical trading way could lead to a life-changing discovery. Traders do not have to just follow other experienced traders, more often than not your original research will be more effective.

To conclude, the USD/CAD, as well as other currency pairs have hidden fundamental gems, but similarly to the popular indicator, popular analysis like the Oil/CAD correlations are not useful. There are better things not in plain sight. If everybody can see the correlations and trade the same way, know the big banks will be hunting for the majority. The example above is just one way how your trading can evolve and should evolve throughout your trading career.