Regardless of what they trade, be it gold, corn, stocks, or forex, all winning traders share one key skill that sets them apart from all the other people testing their luck in their respective markets – the most successful individuals always take a portion of their profit off at some point in each winning trade. Termed scaling out, such a maneuver is a distinctive feature of all major players who have figured out their priorities, unlike the majority of participants in the market. As a strategy that each forex trader needs to adopt if they desire success and profit, scaling out can truly be perceived as the crossroads that separates two very different futures for each trader entering the market.

Naturally, if you are a beginner, you should first learn about several other topics which will help you understand forex trading better, notably ATR (which is one of the best indicators that can help traders with money management), risk management (which is a prerequisite for scaling out), and ratios (which will prevent you from falling for the same trap as everyone else). What is more, as a beginner, you should strive to look for real examples of people trading, where they explicitly describe each step of the way and test all methods and strategies yourself in a demo trade. Learning how to scale out is therefore a natural next step after learning how to calculate your risk and it is a level-up topic that requires a certain amount of effort on your behalf to adopt knowledge and information about forex beforehand. Due to the fact that scaling out is such a crucial step in developing one’s account and trader portfolio, we are going to discuss why and how you should incorporate this strategy in your trading. Note this guide is specific to technical swing trading strategies applied to the daily timeframe, but it can be applied to similar trading concepts.

The number one reason why anyone should consciously decide to scale out concerns the psychology of trading, which is distinctly different from betting or casino mindset. In fact, you can read quite a few stories about successful traders who had to learn the hard way what they should and should not do. One story even talks about a trader who experienced a lot of luck in the first trade to the extent that this led to some unrealistic expectations and, almost immediately, failure. Deciding not to learn how to scale out is what a blackjack player does when investing $100 to get $1000 only to lose it all at the end of the night. A similar phenomenon was noticeable in the crypto market not long ago, when a great number of traders were so captivated by the market’s tendency to grow that they did not take any profit off, believing that they can earn more profit this may. They failed to grasp the fact that they would still earn quite a big amount of money, pay off their mortgages, buy cars, and have a really great life even if they had reduced the initial amount they had invested. This story exemplifies the mindset of the majority where individuals always exhibit a hunger for more wealth without taking anything off the table.

These people do not understand that any system, regardless of how successful and functioning it may seem at a particular moment, can collapse in no time. Greediness is emotional and the forex trading market leaves no room for emotions and reckless reactions. The trader from the above-mentioned story believed that buying and holding forever is the best strategy, which is, however, a lesson that such traders have to pay a high price for sooner or later. Forex trading requires a calculated and precise approach that is not governed by emotions, and never getting satisfied by the level of your achievement is the exact opposite of the attitude this market can support. If a trader just keeps expecting more, they are inevitably waiting for the price to go down and one’s unwillingness to accept the state of the matter is no different from losing all your money at a poker table.

Withdrawing a certain amount of profit is the safest approach which entails that you have previously set your stop loss. What many traders fail to include here is the necessity to define their win limits as well. Every trader should know when and how to take a portion of their profit and knowing your limits can help you do this effectively. Therefore, you should consistently decide to take half of your profit at a particular point in your trade and run until your exit indicator or your trailing stop tells you otherwise. Any different approach would just make you a statistic or one of many who thought they could outsmart the system. Moreover, if you expect a price to jump from $0,02 to $25, you should know that this an unrealistic expectation and, as some traders have been waiting for this dream to come true for several decades, you may want to give yourself the freedom to learn faster. Funnily enough, even if such a scenario played out, you would probably have to lose so much down the road that no win could ever compensate for the extent of the financial disaster you put yourself through. While the rose-colored glasses cannot get you far, professional traders around the world can.

Since no expert trader enters or exits a trade without scaling out, we should really focus on what has proved to be successful in forex trading and start applying these first in a demo and then in real trades too. To make use of most tips and tools pertaining to scaling out, you are going to need to get acquainted with the ATR indicator, which has become an essential part of most expert’s algorithms. In addition to its multifaceted nature, this indicator helps traders achieve the same results as with the complex method when the ATR is used as the point of taking off half of the trade for each and every currency pair. Nevertheless, to get to this point, each trader needs to already be aware of several other key concepts and strategies.

If you are wondering how to enter a trade, you must know that you should first determine your risk or how much profit are you willing to lose before deciding to exit. This step also includes the question of how much money per pip you are actually putting at risk and ATR can be of great assistance here. Unfortunately, not all brokers automatically scale out at a certain point, so you should know how to use the numbers and information you came by without missing the price hitting your specific mark just because you are sleeping. If ATR is 80 pips, you may want half of your trade off the table at this point, but despite how successful a trade is, if you are away for any reason, any winning trade can go right back down. Since professional trading implies getting most of the winning trades, how can we bypass this annoying step? The key to resolving this issue is (for MT4 platform) in entering two half trades with one closing automatically owing to the take-profit point and the other still running. Therefore, after you enter the two trades, you will immediately insert your stop losses and put in your ATR value as your take profit, on one of them. This strategy will help you preserve half of your trade regardless of the circumstances, while the other one can run as long as necessary.

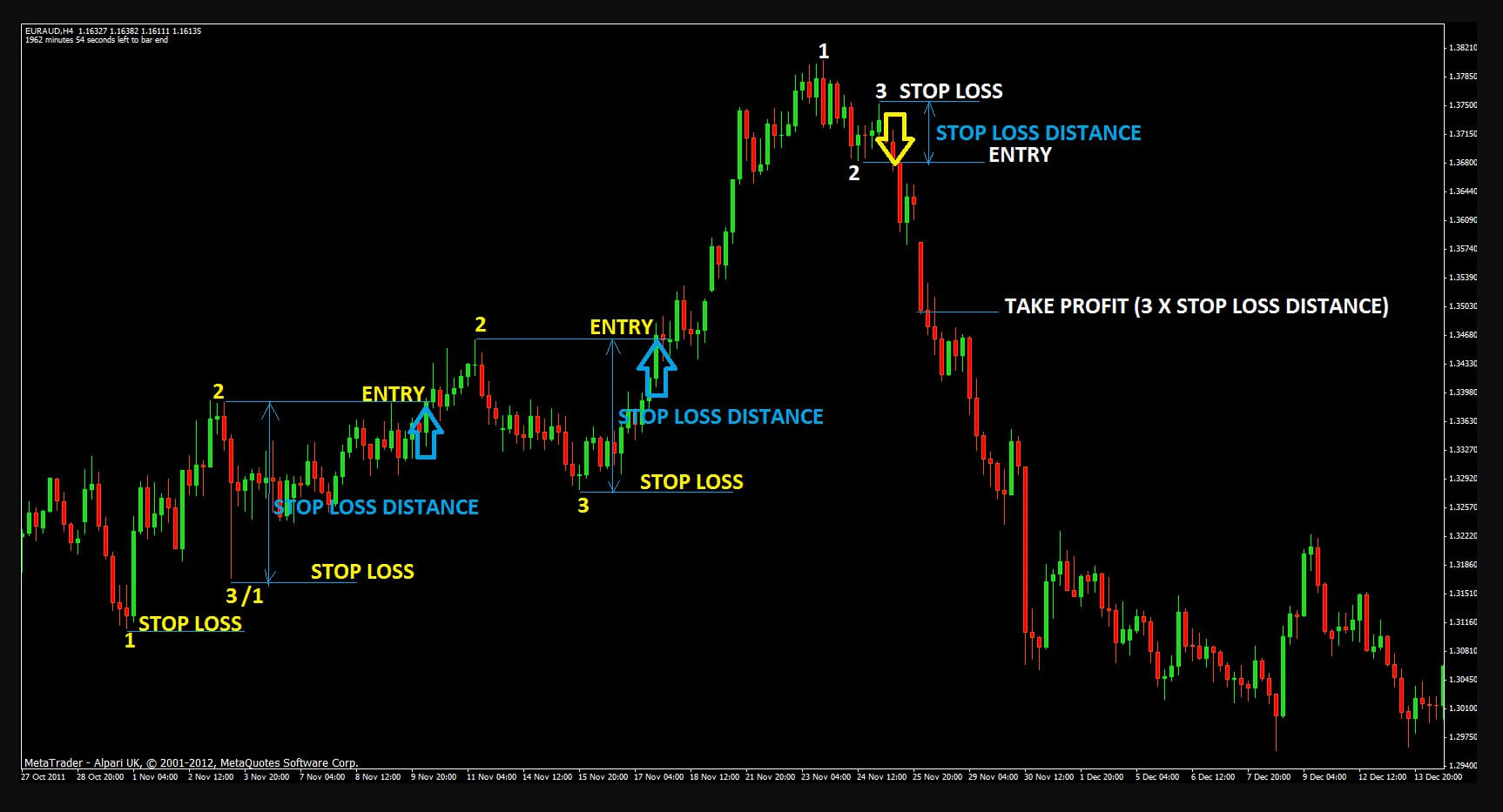

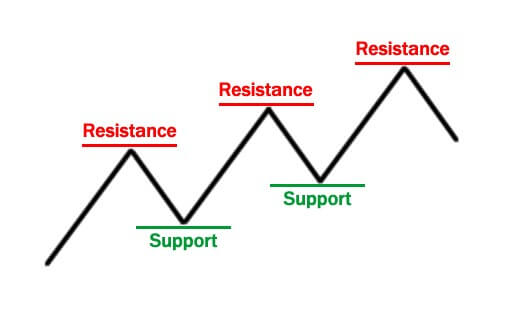

To see how this approach functions in real trading, you can look at the NZD/CHF dally chart below, which shows the ATR of 60 pips. Based on this value, we can immediately know that the stop-loss point is going to be at 90 pips (1.5xATR) whereas the take-profit point is going to be at 60. The next step would be to calculate the amount of risk, which is generally advised not to exceed 2% of traders’ entire trading accounts on each trade, and to see how much per pip we are in fact risking. The amount per pip, in this case, would be $11.60, which would equal $5.80 once split into two trades. At this point, you should insert all of the necessary information (please see the second image below) and ether your two trades. The only thing a trader should do now is to wait and avoid checking up the trades so as not to make any unnecessary move based on some emotion, e.g. impulsively exiting a trade too soon. By following these steps, you will secure yourself so that some minor losses do not impact you in the long run.

While the beginning of every trade is of vital importance, you should take several other actions the moment the price hits your take-profit level. Primarily, you should move your stop loss (90 in the example) to your break-even or, in other words, to the level you entered in the currency pair in the first place. Once the price has hit the take profit, you can rest assured that the trade in question is a winner and you cannot lose it any longer. The only question here is how much you can benefit from that particular trade. At this point, you should make use of some other tools, such as Heiken Ashi, exit indicators, and trailing stops, among others, to assist with your trade. These tools can be of great help with your second trade for as long as it runs, especially since knowing when to exit is one of the crucial elements of professional trading. No matter how well we use any tool, the time is the sole factor you should consider at this point and the only one which can grant you whether your trade will be a big win or a minor one.

In the stock market, for example, a 10—11% return is considered to be a really good result because it mirrors the stock market average. Should you be able to increase this percentage in time, you will become one of the few elite traders who are able to successfully manage hundreds of thousands to get such returns. If you are considering a specific benchmark to hit, this may as well be a great reference because these trading skills are not only ever-lasting but also in high demand. Warren Buffett for example, one of the most prominent figures on the investment scene in America, makes a 20% return per year and he surely has not achieved such success without continuously using an elaborate approach to trading and knowing how to allocate his funds effectively.

Scaling out, as we can see, is no longer optional once you decide to be good at forex trading or trading in general. You do, however, need to commit yourself to follow this system religiously, without feeling compelled to constantly micromanage your trades. Even if you encounter an unfavorable period or take a loss at some point in your trade, be patient and refrain from reacting impulsively because your stable and consistent approach to trading will even out any transient imbalance in the end. Accompanied by money management skills, scaling out is the one way you can avoid the blackjack scenario and be smart about your finances. The ability to take in all these pieces of information and apply them in a diligent and disciplined manner will only further support the development of a healthy trading mindset.

Learn how to estimate risk and make sure that all your trades are winning in a certain capacity. Rely on ATR in every step of the way and incorporate some additional tools to improve your trading skills whenever possible. If you have already taken the advice, done all necessary calculations, and enter the two trades, it is time to let go, relax, and allow time to run its course. Although this may seem like a great quantity of data, understand that after a while you will be able to make all assessments and enter a trade in as little as 15 minutes. However, whatever you do, never forget to scale out and persistently envision what your final goal in this entire endeavor is.