You may have been told in the past that trading is a game of probabilities, and this is true when aligning a lot of things into account, what it does not mean however is that placing a lot of small trades quickly will give you the probability of profits.

Newer traders are now coming across scalping, a method of looking to take just one or two pips out of the markets quickly, usually along some sort of trend or pullback, it can be a powerful strategy, and sometimes trades can stay open for a matter of seconds only. It can also make vast amounts of money, so why aren’t we all doing it? We aren’t all doing it because it takes patience, a lot of risk management and most importantly, it can go horribly, horribly wrong if you do not know what you are doing. So, let’s look at a few things you need to consider before you start scalp trading.

Costs

Each broker that you see will have its own payment structure, some of them have it as an additional spread on the trades, others will charge a commission. You need to know exactly how your broker will be adding these costs to your trade. Scalping is all about taking small profits from lots of trades, if your broker is adding an extra pip on top of the natural spreads and you take a 1 pip profit, then how exactly are you benefiting? In fact, you may be making a small loss, the same can go for commissions, if you are using a broker with an added $10 per lot traded, then it may not be worth it at all, however, if you commission of $2 per lot treaded then it may be far more valuable to scalp with them. Just remember t outlook at both the commission and the spreads, combine the costs to see whether or not it is worth scalping with that broker.

Capital Requirements

How much capital do you have? You find a broker that offers you an entry point of $10, it is fantastic that they are allowing you to open an account with such a small amount and this makes it very accessible. However, you will struggle to have any sort of risk management or money management plans in place with such a small amount. You cannot go into forex thinking you will turn that $10 into $1,000,000 with small trades. Not only will the profits be very small but you also need to think of the margin requirements of trading, you may get to a point where you cannot actually open any more trades due to your margin levels which can also result in blowing (losing all money in an account) an account.

Psychology issues

Traders who trade short term trades can often be under a lot more stress than those that go for longer trades, it is a much more fast-paced affair when scalping, having to quickly analyse, work out positions, place trades and then maintain them. Due to this, you need to ensure that your risk management is pretty solid and consistent before trading any real money, putting on these quick-fire trades can also result in more losses than you may see on a longer-term trading account, but that is a part of scalping, if you cannot handle them, you should not be attempting it.

Strategies

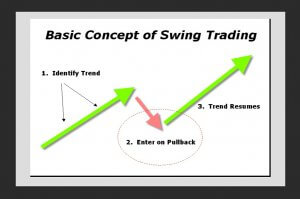

There are a number of different strategies for scalping, some are following trends, some are looking for breakouts, there are plenty of them out there. You need to get one that suits your own style and preferences. If you like trends, there is no point in trying to trade breakouts and vice versa. Finding the strategy along with the indicators that suit your own style is vital, no one has funt reading someone else’s’ strategy.

So those are a few of the considerations to take on board before you start scalping, there is no doubt that it can be profitable. In fact, it can be very profitable and satisfying as the trades are ina nd out quickly, but it takes a lot of practice and if the risk management in place is not solid and consistent, it can also be very expensive.