While reversals are deemed to be extremely useful in some other forms of trading, some successful forex traders go as far as to say that they could prevent you from becoming a professional in this market. Whether you have vast experience dealing with fiat or you have yet to get to that level in your trading, you probably understand how crucial having a stable foundation for your trading career is. On one of the key topics for thinking and development in this respect includes the question of what forex is essentially about – reversals or trends. Even if you feel that you already know the answer, you may find some new perspectives and information in today’s discussion, which can help you become a better trader earning a greater profit more quickly. There are essentially two ways to do trade with one being easy and the other one difficult, and today you can learn why this topic is believed to be so vitally important for everyone wishing to reach the pro level.

A number of individuals trying their luck in this market believe that trading reveals is the right approach to discovering lucrative opportunities. Nevertheless, the answer to the question of whether you should be doing reversal trading or trend trading is considered to be the exact opposite of what the majority of forex traders generally do. Most traders, who are either at the beginning of their trading careers or moving from another market to forex, typically rely on the buy low, sell high method, placing their focus on tops and bottoms. This tactic may have even lead to some profitable investments, making you feel that you are on the right track.

Naturally, the odds of choosing the bottom in this thriving market are stacked against anyone attempting to grow their trading strategy based on this approach, which is why, despite some beginner’s luck, it can be severely detrimental to traders from the long-term standpoint. What this essentially means is that one lucky win can instill flawed thinking which can make you put all your eggs in one very unstable basket, waiting on that second win like a slot-machine player hopes for the next winning combination. This can inevitably make you lose focus of your trading account, which can ultimately lead to three most probable scenarios – you can either reach your break-even point, barely earn some profit, or most likely experience a complete downfall at the end of the year.

The reason why so many traders seem to fail at forex trading often lies in the fact that they misinterpret currencies as stocks, commodities, or equities that, unlike fiat currencies, actually have real values. When you think of stocks, you naturally think of assets, balance sheets, and products, which all play a part in determining a stock’s price. Due to a large amount of downright inaccurate and misleading information, terms such as overbought and oversold are frequently incorporated in trading in the forex market while, in reality, they have little to do with currencies. Currencies are simply not affected by the factors which may be relevant for other markets as they are directly influenced by the big banks, which can alter the price whenever and however they want.

The greatest actors, which are nowadays considered to be Citibank, Deutsche Bank, Chase Bank, and HSBC, have the ability to control and move the prices up and down, which only supports the statements provided above. Even with big news events, it is always the big banks that have a final say on the direction and time of every price change, further highlighting the insignificance of individual impact. Interestingly enough, if we look at the comparison between the stock and the spot markets, we can conclude that a large money influx will always determine where the stock prices will go, while the opposite is true for currencies. The big banks have a vast array of information at their disposal, which helps them assess where the money is concentrated and how it should be directed. More often than not, to act in their best interest, these major players decide to take the price the opposite way. What this implies is that the money they take is redistributed into the market, which is essentially how prices go up and down in this market.

While reversal trading is not what most professional traders would recommend doing, it is what allows big banks to manipulate the prices. In reality, whenever there is a currency pair that has been trending down long, it naturally implies that quite a few reversal traders never ceased trying to call reversals all the way down. Interestingly enough, the reversals will not occur until the moment every reversal trader decides to stop. To put theory into practice, we are going to use an example of the USD/JPY pair which really happened a few years ago.

As you can see from the image above, this currency pair experienced quite a long downtrend only to go right back up, which only happened because the money kept going in the opposite direction. The traders in this case would not stop picking the bottoms, which basically left room for banks to keep bringing the price down. To provide additional proof for this statement, we are going to use the sentiment indication available at dailyfx.com, which can help us see the balance of short and long positions of all the traders for the particular asset.

The blue line in the chart stands for all (reversal) traders, whereas the price exemplifies where the money went in reality. As the task the big banks have is to grasp where the money is headed and whether those positions are long or short on any currency pair, we can see at the very onset of this chart how the traders tried to go long when the banks recognized this tendency and decided to go short. However this did not stop traders from attempting to do reversals and they kept going long, and the discrepancy between these traders’ activity and the money’s actual direction is clearly demonstrated by the divergence of the two lines in the chart above. Going further along the chart, we can see how these price whipsaws all the way, which only proves how banks carefully follow each step traders take and do exactly the opposite.

Reversal traders are always on the loss because their money is constantly exploited due to their lack of knowledge or understanding of how trends function. There will always be a vast number of individuals trying to pick tops and bottoms who will actually help the banks secure themselves better. Of course, they will be allowed to have their single occasional wins so as to keep investing more, but these traders will always be losing more and more money because this approach is simply not sustainable and it does not benefit anyone but the big banks. You may try to rely on some indicators, such as Stochastics, RSI, Bollinger Bands, or CCI, hoping that this will help you win the game.

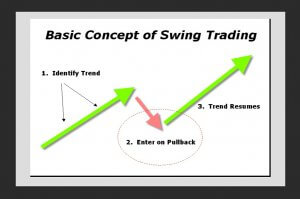

Unfortunately, you will find that even the best reversal tools available at the moment will only do you a disservice as the house always wins. Therefore, in order to make consistent money, you should invest in understanding trends and learning how to interpret market activity. By relying on trends, not reversals, you can actually secure a much more stable profit and save yourself from being another pawn in the big banks’ game, which should altogether be the best motivation for anyone wishing to trade in the forex market.