Every trader might have individual goals – but we all have the same major goal at the end of the day: making a profit. There are a lot of different strategies and methods that traders use to try to accomplish this goal. Some prefer scalping, naked trading, breakout trading, using pivot points, and so on. Two of the most popular trading methods are day trading and swing trading. While traders using these methods have the shared goal of making profits, they go about this in very different ways. If you’re going to become a trader yourself, you’ll need to know about these popular strategies.

Day Trading

Day traders make multiple trades per day, and almost always close out every single trade before the end of the day. In order to be considered a day trader, you’d need to make at least four trades per every five days. This trading style requires more attention than some other methods, with many traders becoming professional day traders in lieu of working a regular 9-5 job. This is because you need to actively monitor the market so that you can open and close your trades during the day. Day traders tend to make decisions based off of some of these factors:

- Price discrepancies

- Fundamentals

- Quantitative reasons

As you can see, day traders often consider hard numbers when making decisions. If you want to be a day trader, you’re going to need an impressive account balance. In order to follow the “pattern day trader rule”, you’ll need to maintain a minimum account equity of at least $25,000 each day that you plan to trade. This is probably one of the main disadvantages of day trading, as many traders won’t be able to meet that requirement. You could always trade with less, but it may be difficult to open and close enough trades to truly be considered a day trader, or to make enough profit for a substantial living.

Swing Trading

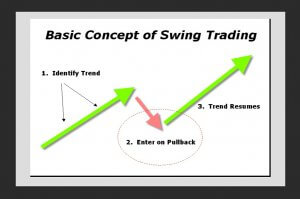

Swing trading is essentially the opposite of day trading. It involves buying securities and holding them for longer than a day, oftentimes for days or even weeks before selling. Many swing traders make decisions based off of:

- Graph patterns

- Technical analysis (this involves looking at a price’s past history on charts)

- Macroeconomics

Swing traders often look to graphs and technical analysis, although some numbers and other factors can be considered as well. This type of trading doesn’t require as much time and attention as day trading, making it a better option for those that don’t have the time to monitor their trades as often. Swing trading also doesn’t require a large starting deposit, unlike with day trading. One of the downsides to choosing this method is that is can lead to overtrading and it produces less in returns than long-term buy-and-hold investors make. You’re also apt to pay more fees and commissions for holding your trades overnight.

The Bottom Line

Should you become a day trader or swing trader? Here’s a quick summary to help pinpoint which style is right for you:

- If you want to be a day trader, you’ll need an account balance of around $25,000. If you can’t possibly come up with this or don’t want to, swing trading is the way to go.

- Swing traders will wind up paying more fees to their brokerage.

- Many day traders trade full time instead of working a regular job, as it requires your attention multiple days a week and trades must be actively monitored. Swing trading is better for those that might work a regular job or whom just don’t have that much time to spend trading in a given day.

- Day traders typically make decisions based on numbers and fundamentals, while swing traders focus more on graphs and technical analysis. You might already have experience with one of these types of research.

You might feel drawn to one of these methods, but if you don’t, then that’s okay too. There are a variety of other trading strategies out there and the best thing to do is to familiarize yourself with as many of them as possible. If you do decide to become a day trader or swing trader, we’d highly recommend performing a lot more online research to be sure that you completely understand how to perform the strategy successfully.