It is a huge decision, moving away from your secure day job in order to become a trader full time. It’s something that a lot of people aim for or join forex in order to try and achieve, so if you are at that stage in your trading career, you must be doing something right and well done so far. It is, however, a huge commitment, it should not be taken lightly and the consequences of it should not be underestimated, there is an awful lot that you need to consider.

As a quick overview, there are many things that will change, most notably will be your lifestyle and your finances, the way you work will need to be adapted to the new situation which could potentially throw your entire lifestyle out of synch. If however, you are coming from a position within the financial world, then you will start off with a little bit of an advantage, but it won’t have taught you everything that you need to know. Even coming from a part-time trading situation, that most likely won’t have prepared you fully for what you are about to undertake. Everyone’s approach to being a full-time trader will be different and everyone will have different abilities and requirements. The first thing that we have to consider is whether or not you are actually ready to become a full-time trader.

In order to work out whether you are actually ready to take the leap into full-time trading, there are a few things that you should consider. Think about a few simple questions, what makes you think that you are ready? Do you have enough capital to go full-time? Are you currently making more than your salary? And are your performances good enough? You

need to look back over an extended period of time in order to answer these questions, if you made one huge trade that made you more than your salary, it does not mean that you are ready, you need to be consistently making more, not just that once.

It is important that you get some form of experience before even thinking of going full-time. How long have you been trading part-time? We would not suggest getting involved full-time unless you have been trading part-time for at least six months, and the majority of those six months should be profitable and at a level that is similar to your current salary. You will need to have an understanding of different market conditions and how to trade within them. The markets are always changing, if you only know how to trade within a certain condition, then as soon as it changes, your income will dry up and you will begin to struggle. Be honest with yourself, think about what level you are at, there is no harm in staying part-time for a few more months while you hone your skills, just don’t jump into the decision before you are actually ready.

One of the things that we are all told is that we need to use a demo account before going live, this is certainly the case, but it is simply not enough if you are planning to start trading full time. It is great if you are consistently profitable on a demo account, but the only way that you can be sure that you are ready to go full time is to also be profitable when trading on a live account. The environments differ quite a bit between a demo account and a live account, so being able to trade on one does not mean that you will be able to trade on the other. Ensure that you have experience, and consistently profitable experience with trading on a live account, not just demo.

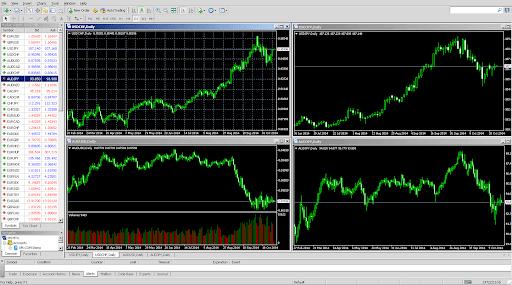

Next, think about whether you have the appropriate space to trade, if you are planning on doing it full time and to make a living out of it, then you can’t be trading from a laptop while sitting on your living room couch. Get yourself a dedicated space that you can use for trading. A room within our house which is there for nothing but trading, if you do not have the opportunity to do this, then hire out a one-man office somewhere and set that up as your trading room. The space needs to be free from distractions, it needs to only have in it the things that you require to help you trade, and nothing else. When you are in that room, you are there to trade, not to mess about, or watch TV. When you have finished trading for the day, leave that space and do not return to it, keep it completely separate from your family or social life. Also, make sure you have a decent internet connection wherever it is that you are trading, the last thing you want is to lose connection mid-trade.

Next, think about whether you have the appropriate space to trade, if you are planning on doing it full time and to make a living out of it, then you can’t be trading from a laptop while sitting on your living room couch. Get yourself a dedicated space that you can use for trading. A room within our house which is there for nothing but trading, if you do not have the opportunity to do this, then hire out a one-man office somewhere and set that up as your trading room. The space needs to be free from distractions, it needs to only have in it the things that you require to help you trade, and nothing else. When you are in that room, you are there to trade, not to mess about, or watch TV. When you have finished trading for the day, leave that space and do not return to it, keep it completely separate from your family or social life. Also, make sure you have a decent internet connection wherever it is that you are trading, the last thing you want is to lose connection mid-trade.

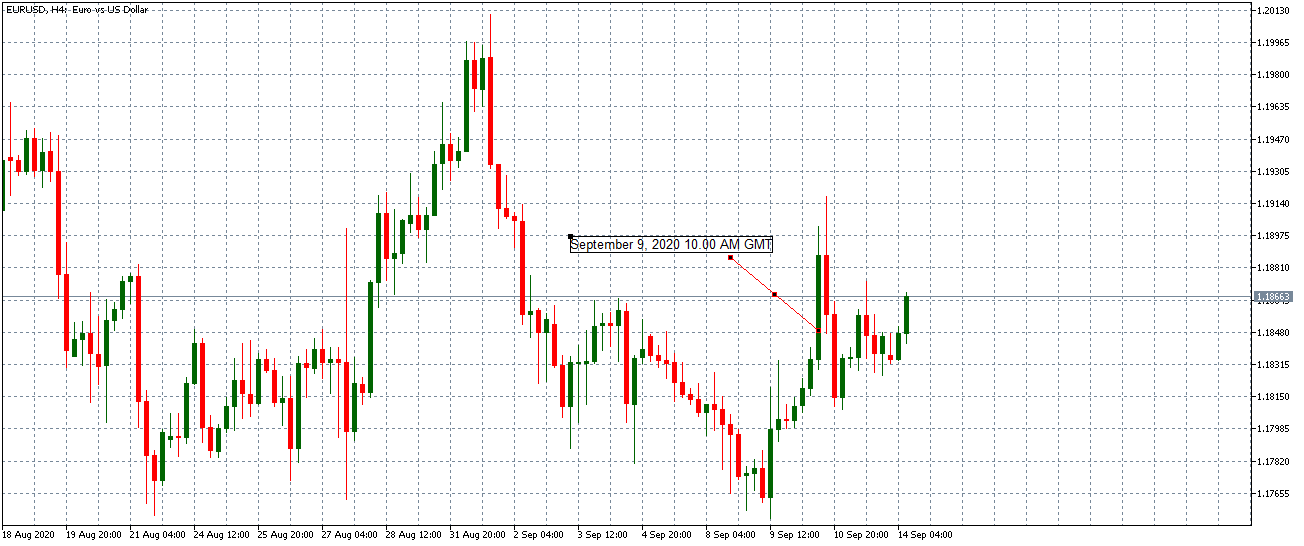

Routine is vital if you want to be consistently successful, one of the issues with working from home is that it can be very tempting to simply trade and work when you want to work, you are now your own boss, but even bosses need to stick to a routine. Without one, there is a good chance that you could end up becoming a little lazy or spending that extra hour in bed each day. Take a look at your strategy, some strategies have certain periods of time where it is best to trade if yours does, then set your routine and schedule around that, for many strategies, this is around the overlaps of the markets. However you also need to consider where it is you live and the time zone that you are in, do not set a routine to get up in the middle of the night in order to trade, you will begin to despise it and let it slip. Be organized, and be consistent.

You also need to set yourself achievable goals, if you are setting yourself goals to make 20% per week, you are simply setting yourself up to fail, the risks that you will be putting yourself and your account under in order to achieve that are not realistic at all. However, if you were to set 20% for the year, that is something that is a lot more achievable. You will be a lot less stressed, but you will need a larger capital to live off. Try not to set your goals too short term, the markets are not always friendly, but over a longer period of time, you should be able to achieve through consistency.

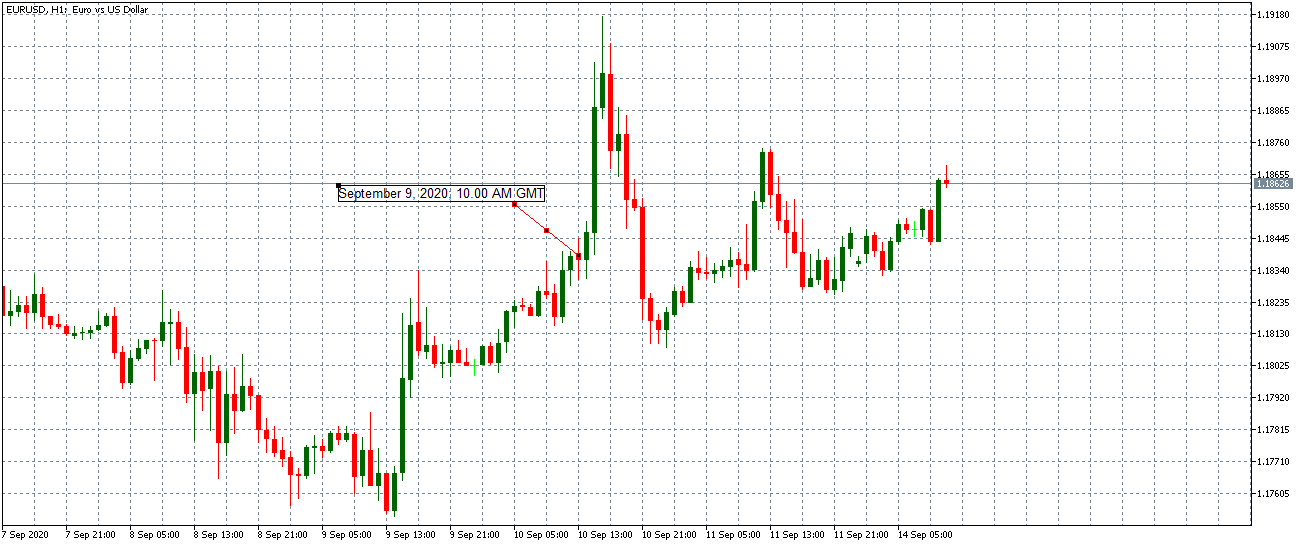

One aspect of your life that will see a lot of changes is your expenses. You are entering a period of your life where you don’t have the job security that you had before. You need to now learn how to manage your money properly and how to cut back and potentially budget. Before you decide to go full time and quit your day job, take note of exactly what you are spending money on, there are bound to be a number of them that you do not actually need, subscriptions that you have set up that you are no longer using, try to remove as many as you can. This will also give you an idea of how much you will be required to earn each month in order to survive. Separate your living expenses from your trading account, you will need a nice capital sum for trading, do not mix up your living balance with your trading balance. When withdrawing, ensure that you are withdrawing what you need to survive, but also ensure that you have enough in your trading account to continue to trade.

One aspect of your life that will see a lot of changes is your expenses. You are entering a period of your life where you don’t have the job security that you had before. You need to now learn how to manage your money properly and how to cut back and potentially budget. Before you decide to go full time and quit your day job, take note of exactly what you are spending money on, there are bound to be a number of them that you do not actually need, subscriptions that you have set up that you are no longer using, try to remove as many as you can. This will also give you an idea of how much you will be required to earn each month in order to survive. Separate your living expenses from your trading account, you will need a nice capital sum for trading, do not mix up your living balance with your trading balance. When withdrawing, ensure that you are withdrawing what you need to survive, but also ensure that you have enough in your trading account to continue to trade.

Depending on how you have set up your trading space, there may be some additional costs, especially if you have set up an office somewhere away from home, this needs to be covered by the profits from your trading, if you can get it on a 6 months deal, try to pay it all off when you can, this way you can concentrate on the trading without having to withdraw each month or to worry about covering the costs. The same goes for the internet, phone, and anything else that you require within the office. Just remember to try and budget and to cut back on the expenses that you do not actually require.

One thing that people like about working for yourself and working from home is the fact that you are going to have a lot more free time, this does not however mean that you should be spending hat free time going out and having fun, of course, you can do that a bit but you need to be using a lot of your new-found free time to learn. There Is always more to learn, no trader knows everything about what it is that they are doing or what there is to know. Of course, take some extra time away, if you are consistently profitable, then you deserve a little time away, but just don’t take the added free time for granted.

Think about where you are psychologically. How do you feel when you have a loss at the moment? If it bothers you, you need to consider that when you have a loss on an account that you are depending on the money from, it will hit you 100 times harder. The money you are losing will be what you need to live off, this also increases the amount of stress that you are trading under, if you do not deal well with stress then you may struggle here. Also, greed, do you often get the urge to want more or to place larger trades? If you do, then this is not a good place for you, as this is something that you just cannot do when trading full time and trading for a living. Ensure that you are able to deal with these emotions and that you are able to remain calm and focused even when going through hard times. This also goes for accepting losses, when you have one, which you will, accept it and move on, do not let it swap you and do not dwell on it, accept and move on.

Think about where you are psychologically. How do you feel when you have a loss at the moment? If it bothers you, you need to consider that when you have a loss on an account that you are depending on the money from, it will hit you 100 times harder. The money you are losing will be what you need to live off, this also increases the amount of stress that you are trading under, if you do not deal well with stress then you may struggle here. Also, greed, do you often get the urge to want more or to place larger trades? If you do, then this is not a good place for you, as this is something that you just cannot do when trading full time and trading for a living. Ensure that you are able to deal with these emotions and that you are able to remain calm and focused even when going through hard times. This also goes for accepting losses, when you have one, which you will, accept it and move on, do not let it swap you and do not dwell on it, accept and move on.

You will then begin to find some new friends, your current circle of friends are great, but they probably don’t know much about trading and when you try to talk to them about it, it is most likely a one-way conversation. You will need to find some new friends and a circle of support that understands trading and are traders themselves. This will give you an avenue to communicate, to ask for help, and to see how you are doing with honest feedback from people who know what they are talking about. Join some communities and get involved, the information and knowledge within them can be invaluable to your progress and career.

The last thing that we will talk about is the importance of having a contingency plan, something that you can fall back on should things go wrong. If you were to suddenly lose your capital, what would you do? If you didn’t quite make enough each month, how would you survive? This is something that only you will be able to answer, so you need to be able to consider your own circumstances and come up with a couple of plans on what you would do should things not go right.

Those are some of the things that you will need to consider should you decide to go into the world of full-time trading, it is not an easy thing to do, a lot of people take the plunge and then find that it is not quite right for them. Have plans in place and ensure that you are ready and you will be in a good position to be successful as a full-time trader.

Next, think about whether you have the appropriate space to trade, if you are planning on doing it full time and to make a living out of it, then you can’t be trading from a laptop while sitting on your living room couch. Get yourself a dedicated space that you can use for trading. A room within our house which is there for nothing but trading, if you do not have the opportunity to do this, then hire out a one-man office somewhere and set that up as your trading room. The space needs to be free from distractions, it needs to only have in it the things that you require to help you trade, and nothing else. When you are in that room, you are there to trade, not to mess about, or watch TV. When you have finished trading for the day, leave that space and do not return to it, keep it completely separate from your family or social life. Also, make sure you have a decent internet connection wherever it is that you are trading, the last thing you want is to lose connection mid-trade.

Next, think about whether you have the appropriate space to trade, if you are planning on doing it full time and to make a living out of it, then you can’t be trading from a laptop while sitting on your living room couch. Get yourself a dedicated space that you can use for trading. A room within our house which is there for nothing but trading, if you do not have the opportunity to do this, then hire out a one-man office somewhere and set that up as your trading room. The space needs to be free from distractions, it needs to only have in it the things that you require to help you trade, and nothing else. When you are in that room, you are there to trade, not to mess about, or watch TV. When you have finished trading for the day, leave that space and do not return to it, keep it completely separate from your family or social life. Also, make sure you have a decent internet connection wherever it is that you are trading, the last thing you want is to lose connection mid-trade.