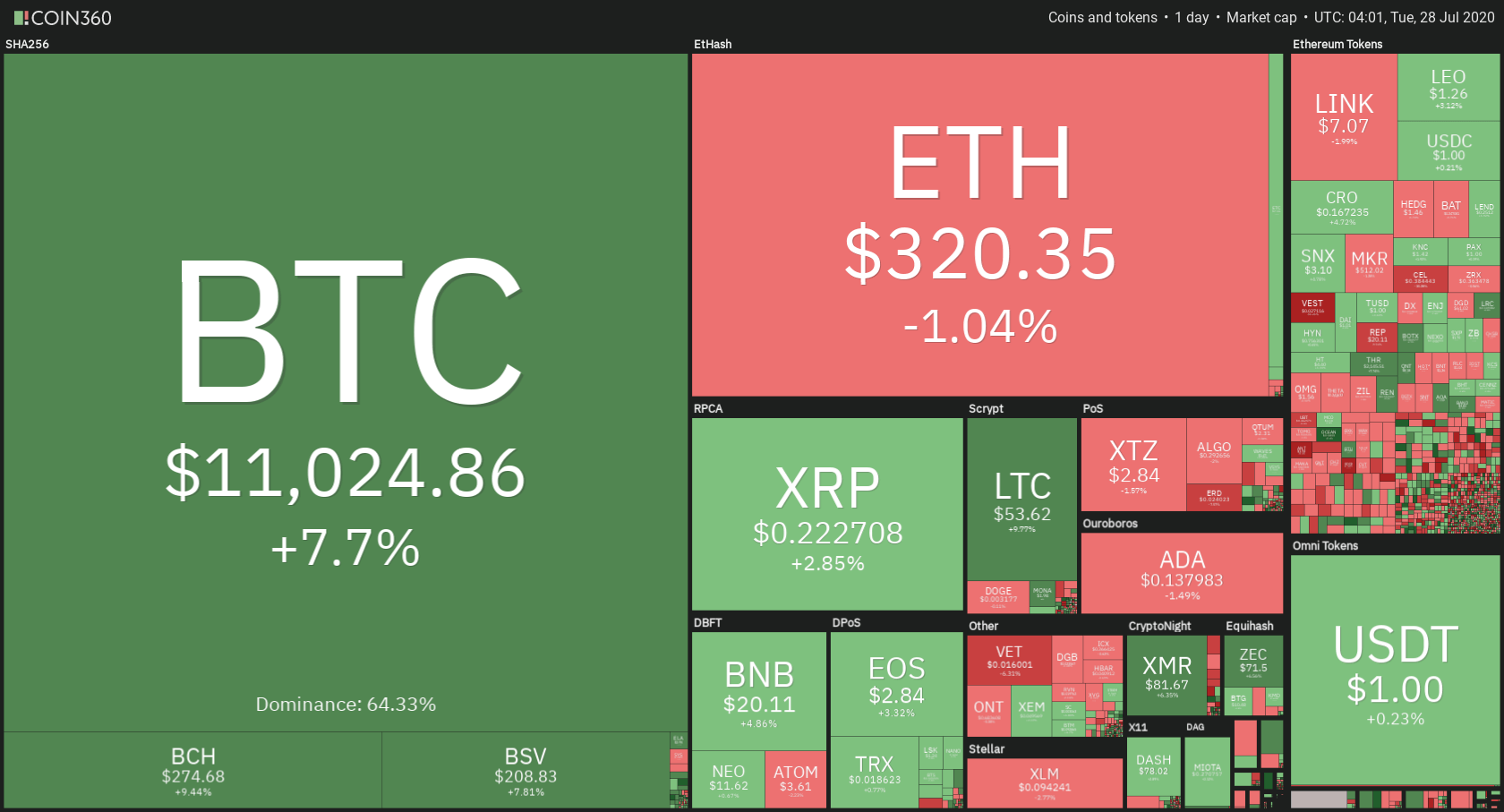

The cryptocurrency market spent made yet another boom as Bitcoin passed the $11,000 benchmark. Bitcoin is currently trading for $11,024, which represents an increase of 7.7% on the day. Meanwhile, Ethereum lost 1.04% on the day, while XRP gained 2.85%.

Daily Crypto Sector Heat Map

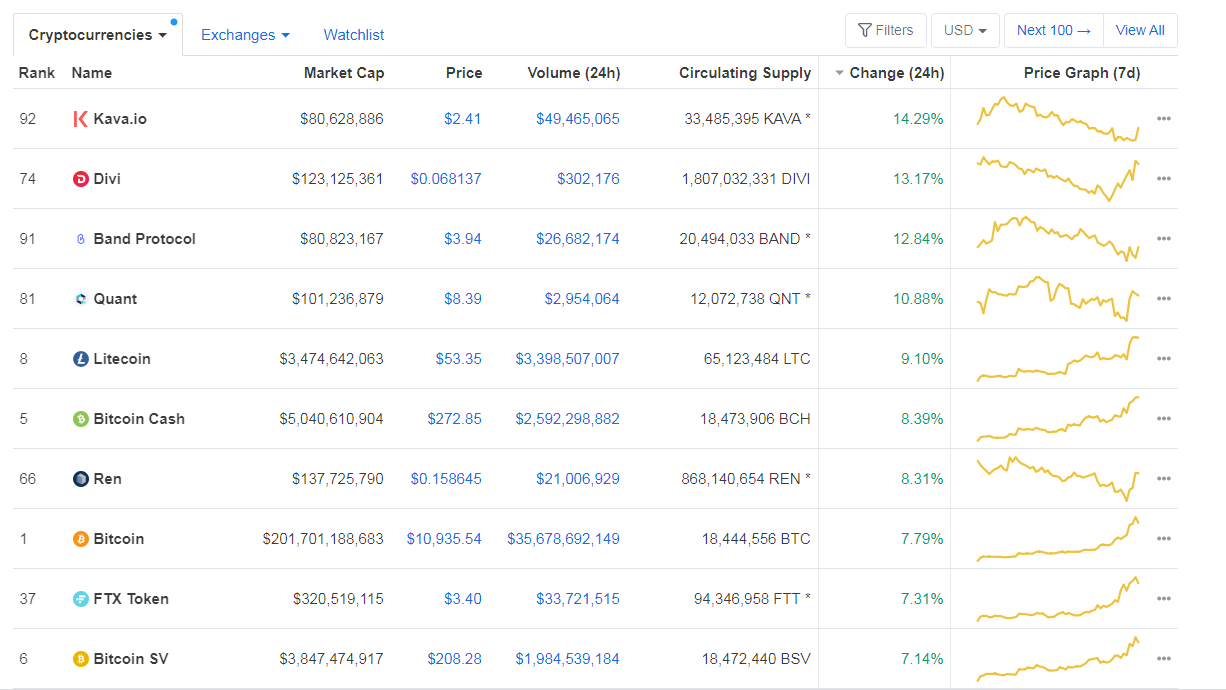

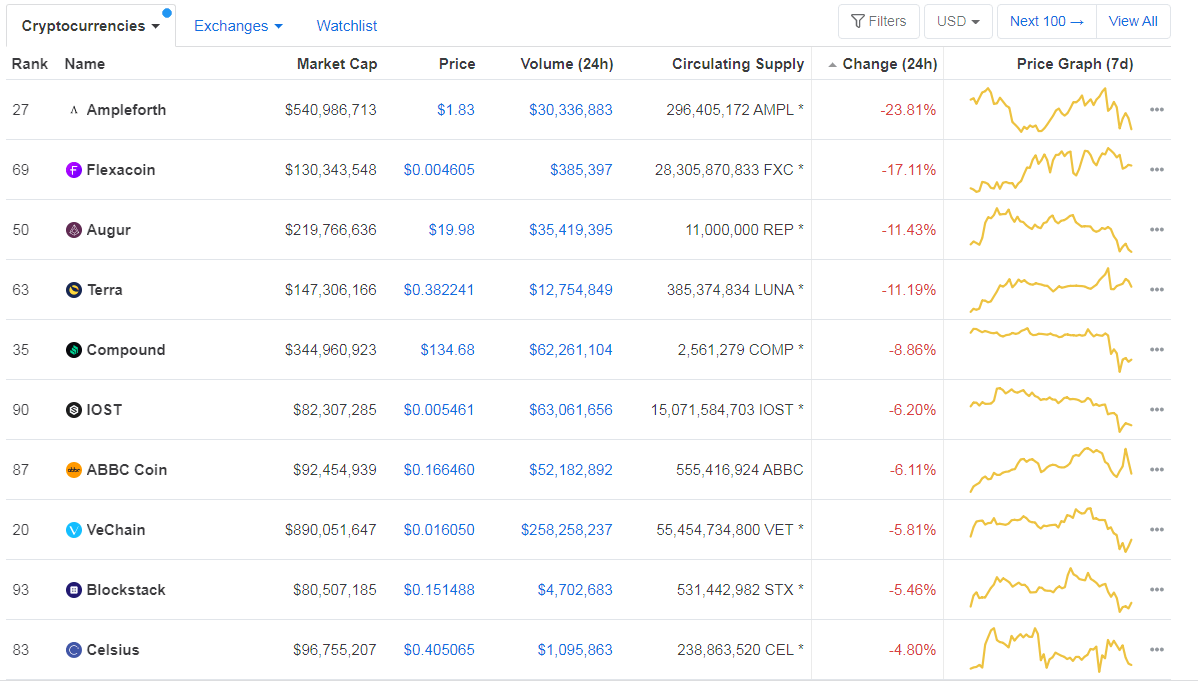

When talking about top100 cryptocurrencies, Kava.io gained 14.29% on the day, making it the most prominent daily gainer. Divi (13.17%) and Band Protocol (12.84%) also did great. On the other hand, Ampleforth has lost 23.81%, making it the most prominent daily loser. It is followed by Flexacoin’s loss of 17.11% and Augur’s loss of 11.43%.

Top 10 24-hour Performers (Click to enlarge)

Bottom 10 24-hour Performers (Click to enlarge)

Bitcoin’s dominance level increased since we last reported, with its value currently at 64.33 %. This value represents a 2.78% difference to the upside when compared to yesterday’s value.

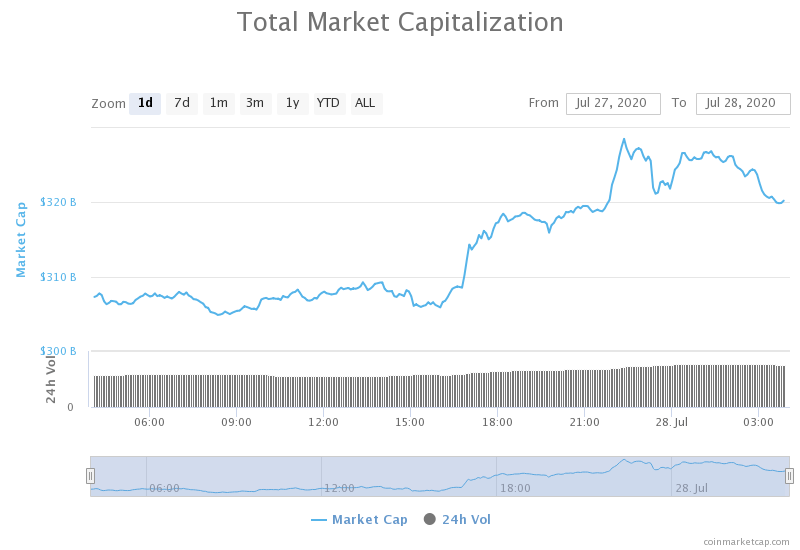

Daily Crypto Market Cap Chart

The cryptocurrency market capitalization skyrocketed and now confirmed its position above the $300 billion mark. Its current value is $320.99 billion, which represents an increase of $20.52 billion when compared to the value it had yesterday.

_______________________________________________________________________

What happened in the past 24 hours?

_______________________________________________________________________

- Bitcoin’s explosive rally liquidates over $300M; Strikes major blow to bears (Cryptoslate)

- As Ethereum skyrockets, 71% of ETH addresses are now in profit, setting a two-year high (Cryptoslate)

- Crypto fund expecting “99%” Chainlink (LINK) drop remains controversial (Cryptoslate)

- Coinbase CEO: Exchange Won’t List XMR Due to ‘Issue With Regulators’ (Cointelegraph)

- Ransomware Victims Are Fighting Back Against Their Attackers and Winning (Cointelegraph)

- Huawei Files for a Storage-Related Blockchain Patent (Cointelegraph)

- Tetras Capital Shuts Down Crypto Hedge Fund After 75% Loss (Coindesk)

- Cardano Plummets Ahead of Shelley, Rebound Expected (Cryptobriefing)

- Fueled by bitcoin’s rise, Bakkt reports record high volumes for its bitcoin futures market (The Block)

- ‘It’s a great time to be a bitcoin banker’ says Silvergate CEO during earnings call (The Block)

_______________________________________________________________________

Technical analysis

_______________________________________________________________________

Bitcoin

It’s safe to say that the largest cryptocurrency by market capitalization had another amazing day as it broke a major benchmark of $11,000 and reaching a final price of $11,394 before cooling down. The moment Bitcoin broke $10,000, on-chain activity registered a great increase in exchange inflow, which ultimately led to this fast price increase. During the process, Bitcoin managed to liquidate over $300 million in sell orders.

BTC traders should look for a trade opportunity either with another move up (aggressive) or when the price cools down slightly and makes a top (safer).

BTC/USD 4-hour Chart

Technical factors:

- Price is currently above its 50-period EMA and its 21-period EMA

- Price is slightly below its top B.B.

- RSI is in severely overbought territory (84.33)

- Volume greatly increased

Key levels to the upside Key levels to the downside

1: $10,855 1: $10,505

2: $11,090 2: $10,015

3: $11,630 3: $9,870

Ethereum

Ethereum looks like it has found its top at $330 after rising in price for the past 6 days. The final move brought the second-largest cryptocurrency by market cap to the highs of $333 before cooling off a bit. Ethereum now seems like it will (if nothing major happens to Bitcoin) possibly head towards the nearest support level to test it.

Ethereum traders should look for a trade opportunity in Ethereum’s pullbacks and confirmations.

ETH/USD 4-hour Chart

Technical Factors:

- Price is above the 50-period EMA and the 21-period EMA

- Price is below the top B.B.

- RSI elevated (64.32)

- Extremely high volume

Key levels to the upside Key levels to the downside

1: $340 1: $302

2: $362 2: $289

3: $278

Ripple

The third-largest cryptocurrency by market cap had quite a stable day as it confirmed its path above $0.214. XRP then bounced up and tried to make a break above the $0.227. However, the move was unsuccessful due to the wall of sellers present. XRP will most likely continue to trade within a range, bound by $0.214 to the downside and $0.227 to the upside.

XRP traders can look for an opportunity within the range XRP is currently trading in.

XRP/USD 4-hour Chart

Technical factors:

- XRP in a mid-term descending trend (though it broke the trend in the short-term)

- Price above 21-period and the 50-period EMA

- Price is below the top B.B.

- RSI is elevated (61.27)

- Average/slightly higher than average volume

Key levels to the upside Key levels to the downside

1: $0.227 1: $0.214

2: $0.235 2: $0.205

3: $0.245 3: $0.2