There are so many ways to fail with forex trading but so many ways to improve on. Each trader is unique in how he is playing the long forex game, however, common techniques are applied in various forms that make a huge difference to the trader’s psychology and other trading aspects. Such techniques are not always on the scene, frankly, we think most of the good stuff is not in plain sight. This article will try to provide techniques everybody can apply but a few know about.

#1 Use Personality Tests

You will certainly find trading techniques not applicable to you or your lifestyle. Every trader has inherited advantages and disadvantages related to forex trading. Now, it is very rare to connect your results from popular personality tests with forex trading. Did you know you can use these tests to see where you will be great and where you will fail in trading, regardless of the strategy you choose? This is a secret only experts talk about or prop firms when registering new members. It may be a good idea for you to research this topic, however, we will give you some examples. Personality tests are there to help you, so you should answer them honestly, they are just describing your personality after all. We will use 16 personality types created by Isabel Myers and Katharine Briggs.

- If you are an extrovert, you are likely happy to start trading right away, opportunities are never missed, you like to take action. All this eagerness, on the other side, is dangerous. Overtrading is a common mistake with these traders, they also get emotional quickly. They should work on rules that will prevent them from overtrading, such as going to the gym, reading sessions, or similar, just away from their trading platform.

- Introverts are great strategists, planners, strategy engineers. On the downside, they miss opportunities because of too much information. Another drawback of such traders is their hesitation to talk about their trading that could produce a great idea.

- Your lifestyle is how you look at the world and this also defines how you look at fore trading. If you are perceptive, for example, you do not like plans, rigid constructs that tell you what to do exactly. Even though such traders are curious and open-minded, they may lack conviction or confidence. Accepting a decision system solves this, provided a trader follows it to the letter even though he dislikes it in the beginning. More on the personality test is found in our dedicated article.

#2 Achieve Consistency With Indicators

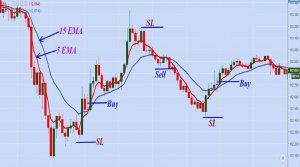

Indicators are a way to go for beginners especially. If your trading is already advanced and consistent you do not have to mess with indicators. Beginner traders need guidance, and indicators are tools just made for that. However, consistency could not be achieved just by plugging random indicators, you will need a system. Indicators are great decision-makers, but you need specialized ones. To be precise, each indicator has its role, what they measure, how they serve best. You will rarely find a good indicator that is universal if that is even possible. Use specialized ones and arrange them to have a system you can follow, do not rely on your instincts, at least not until you build experience.

Your instincts and your psychology do not do well when you start losing. Each time you experience a loss from a gut feel trade, there will be self-doubt. Continue to do so and you might quit trading altogether. By using an indicator system, and following it, you create a foundation where you can relax. On a proven system you know you have a winning formula, drawdown will not shake you as much. Many adverse factors on your consistency will be eliminated this way, forget all the videos about trading that do not implement indicators. Find special Moving Averages for trends, volume indicators for gauging market conditions, and even use indicators for money management. To some, this might not be any secret technique, yet you will be amazed how many beginners do not know the true value of trading systems.

#3 Custom Formulas

Did you know you can use a formula to make your index or a currency basket? Tradingview is a popular platform that allows you to do this. Indicators for MT4 that represent a currency basket, for example, are very rare, but in TradingView, you can make your own by typing one in the symbol box. Currency strength meters are not quite good replicas because you cannot see price action and you cannot factor in or out assets you want. This is still possible for free on the mentioned platform. You can use this formula for the Euro against the other 6 majors:

(EURUSD+EURJPY/100+EURAUD+EURCAD+EURNZD+EURCHF+EURGBP)/7

You can also use inversion (1/X) which is needed for correct chart presentation, such as for the USD basket:

(USDJPY/100+USDCAD+1/EURUSD+1/GBPUSD+1/AUDUSD+1/NZDUSD+USDCHF)/7

On a basket chart, you can analyze, draw lines, put indicators like on any other. This is a secret technique currency basket traders adore, however even if you do not follow that strategy you can use it for a scoring system. If a single currency is trending up then you know to avoid selling it and mark it +1 point if you are looking to buy. This is just one secret from using custom formulas, we leave the rest for you to find out or create one of your own.

#4 Have a Schedule

Did you know trading is not only reading about strategies and ways to win trades? Professional traders have their routines and do not deviate from them. The reason for this trading technique is that it fosters their pros and encloses their drawbacks. It is what makes them have their trading “mojo”. We have mentioned indicators but professionals retain the edge with a routine, especially if they do not have a strict technical trading system.

Take any trading book and you will see a lot of charts and setups, however, rarely about what really makes a professional trader. If you want to use a daily, weekly, or even monthly time frame, your trading schedule is much easier. Lower time frames require your presence but without a schedule, you can mess up your trading big time. If you find yourself looking at the charts for fun, to see what is going on in the middle of the night or similar, this is a sign you need to work on your schedule. FOMO is an unreasonable fear, there is always another opportunity with trading, chasing them is actually bad.

Daily timeframe trading requires very little screen time. Basically, just 30 minutes to check if you want to trade and the news. Each period is one day so you only need to take a look once the candle closes. Set and forget for the next 24 hrs, easy. Lower time frames, on the other hand, require a plan in line with the sessions and the strategy. Execute this plan to the letter and then close the charts, do something else. You will be glad you did.

#5 Using Volume and Volatility

Did you know the trend following strategies are the most successful compared to everything else? Try to develop one with this special ingredient. So, if you are not totally new to trading then you have heard about volatility and volume. But have you noticed very few traders use these measurements? Too bad for them but now you know the secret of trend riding. To connect the two, trends rely on energy that pushes them further, and that energy is measured with volume/volatility indicators. This is a secret once again because rising volume or volatility alignment with the trend start makes such a big impact on trading. Whatsmore, such indicators are not common, which makes them even more special. Incorporate one as a rule for your trading, there are some to be found on the MetaQuotes portal for MT4 or ForexFactory.