Scalping is a type of trading strategy that revolves around profiting from many small price changes. A scalper focuses on making as many small profits as possible, rather than trying to win a large amount from a trade. Like every other strategy, the scalping method isn’t perfect. One of the strategy’s biggest downsides is that one large loss can wipe out all the smaller winnings that one worked so hard to make. Successful scalping involves having a higher number of winning trades versus losing ones, with the profit ratio equal to or higher than the losses.

Less market exposure limits one’s risks and reduces the chances that you’ll run into an unbecoming market event. There’s also more of a chance that a stock will move a few cents than there is that it will move a dollar or so. There are more opportunities for smaller moves than there are for larger ones and a good scalper can jump on these changes. These considerations make scalping a worthwhile strategy that can pay off. Of course, scalping involves making hundreds of trades, possibly per day. If you only have a limited amount of time to put into trading, this may not be the best method for you. Consider becoming a day trader or full-time trader if you’re ready to become a dedicated scalper.

Traders that don’t want to specialize in scalping may still find golden opportunities to use this strategy, like when the market is choppy or when there are no trends in the longer timeframe. Switching to a shorter timeframe can help one to see trends, so scalping can be beneficial here. There are several other ways that traders incorporate scalping into other, more long-term trading plans.

There are three main types of scalping strategies:

“Market making” is where the scalper tries to take advantage of the spread by putting out a bid and making an offer for a certain stock at the same time. This works best with immobile stocks that trade big volumes without any real price changes. It can be difficult to master this strategy as one would need to compete with market makers and the profit is small.

A trader purchases many shares and sells them for a very small gain on a price movement. The trader would wait for a move that is usually in cents and this requires entering and exiting 3,000 or more shares.

The more traditional strategy involves entering several shares and closing the position as soon as the first exit signal is generated. This would be around a 1:1 risk/reward ratio.

So, you may be asking yourself about the risks involved with scalping. One of the most crucial components of success involves having a strict exit strategy. If you don’t, then you’ll likely be one of those traders that loses all the money you worked hard to gain with one bad move. As we mentioned above, the “market-making” strategy can be difficult to pull off successfully, so it may be worth avoiding at first. Remember that scalping takes a lot of time and effort, as you’ll be glued to your computer screen making multiple small trades. You’ll need to be able to think and act quickly to master scalping successfully.

Tips

-Work with a direct-access broker for automatic instant order execution.

-Scalpers profit from the spread, so it is important to find a brokerage offering a tighter spread.

-Find a broker with competitive commission costs. Scalpers need to make many trades, potentially hundreds per day. Commission costs will add up quickly, especially unfavorable ones.

-Ensure your broker allows scalping and doesn’t impose restrictions that will hinder your strategy. Every broker isn’t scalper-friendly, but many are.

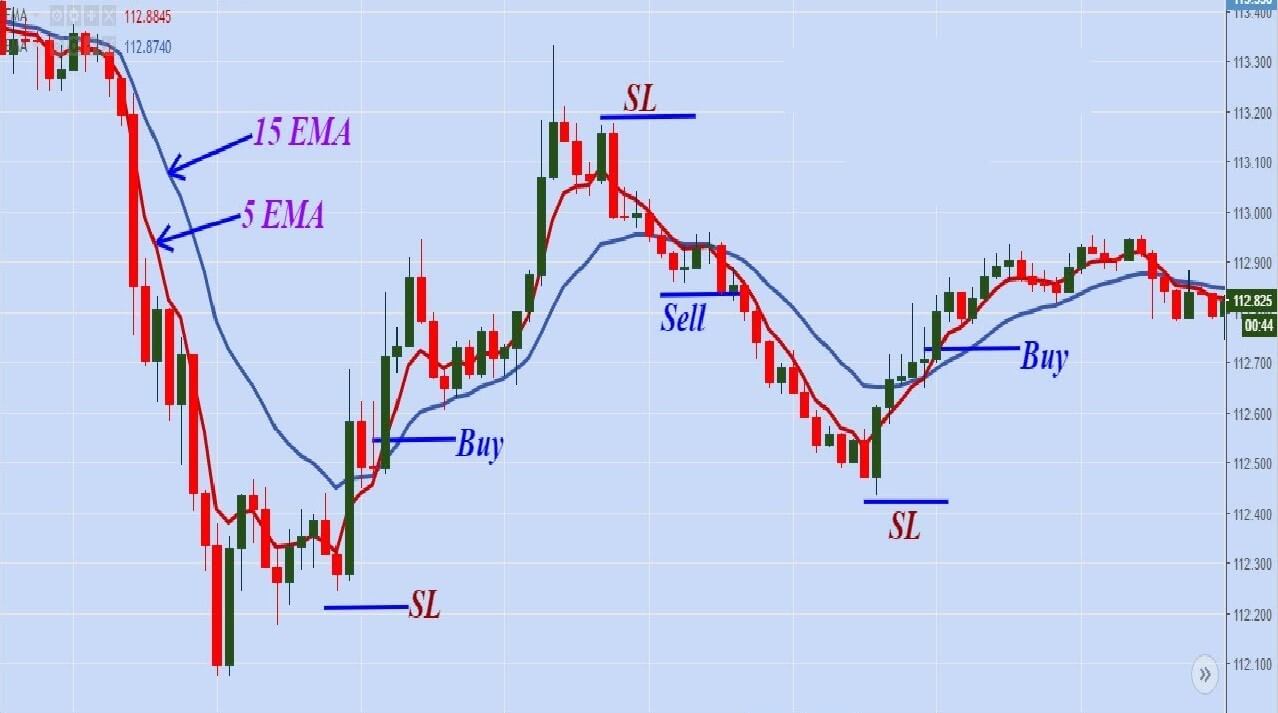

-It is important for scalpers to understand trading with the trend. Being able to identify a trend and momentum is important for successful scalping.

-You should be familiar with technical analysis, which involves looking at statistical data and charts.

-Most successful scalpers close out their trades at the end of the trading day and never carry them over to the next day.

Conclusion

Scalping can be a profitable trading strategy when it is used correctly, either as a primary or supplementary strategy. It does take a lot of time and dedication, along with a good understanding of trends, momentum, and technical analysis. If you’re a complete beginner, you’ll want to spend some time researching so that you understand these principals. It could also be a good idea for beginners to avoid the “market-making” strategy and to stick with the two more traditional scalping strategies. Scalping will likely continue to grow in popularity as many traders prefer the small profits in exchange for taking larger risks. This strategy isn’t for everyone, but it very well may be the key to success for those that understand how to do it effectively.