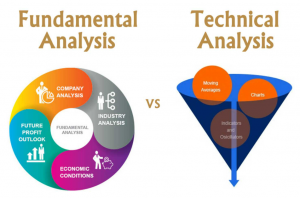

Traders make decisions about when and what to trade based on several different factors. Fundamental and technical analysis are two different methods that one can use to predict what will happen with any given instrument by looking at different types of data. As a forex trader, you’ll need to understand the differences between these key schools of thought so that you can make more informed trading decisions. Both fundamental and technical analysis can give you an edge in the markets, but you’ll need to decide which one sounds the most appealing or consider using both methods.

Fundamental Analysis

Fundamental analysis aims to measure the intrinsic value of a stock by looking at several different factors about the company. This method considers earnings, outgoing costs, assets, liabilities, the overall business model, the status of those in charge, and many other things about a company in order to get the best idea of where prices will go. Some of these things can be measured in simple numerical terms, while others can’t.

For example, you’ll find statistics and numbers when it comes to things like earning reports but evaluating the company’s business model is more of a personal interpretation. Real-time events can also affect the company evaluation. If a scandal goes down involving a certain company, for example, you can expect its revenue to fall. All of these things are taken into consideration when one measures the intrinsic value of a company through fundamental analysis.

Technical Analysis

Technical analysts exclusively consider a stock’s price and volume, with no need to calculate extra factors. Traders using this method look at charts in order to identify the history of patterns and trends for an idea of what they will do in the future. Some examples of the most popular forms of technical analysis include simple moving averages, support & resistance, trend lines, and other indicators. There are three main types of technical analysis – bar, candlestick, and line charts. Each of these is created using the same price data but will display the data in different ways. This school of thought believes in the idea that charts are great for predicting the past.

The Bottom Line

While fundamental and technical analysis both aim to predict where a stock’s price will go, each school of thought uses very different methods to come up with its prediction. Fundamental analysts aim to measure the intrinsic value of a company by taking several factors into account, including hard numbers and some personal interpretation. Technical analysts study charts from the past with the stock’s volume and price being the only information considered. While technical analysts look at more complex information about companies that affect a stock’s price in the present and future, technical analysts study charts from the past to get an idea of where the price will go in the future. Both methods have been proven to be effective, so one would need to personally decide which to use.