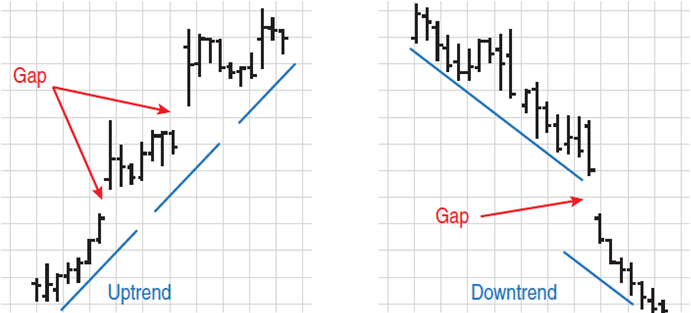

Price gaps are not something that many traders want to see, they do not happen every single day but they are a pretty easy concept to understand. A price gap is simply an empty area on the charts, thymus the name of a gap. They take place when the opening price of a candlestick is not the same as the price of the previous closing candlestick. They aren’t as common on the forex markets as they are on the stock markets, but they do still happen, mainly due to the reason that the forex markets close over the weekends but is still active of operations by international banks, having said that, they can happen in the middle of the trading day when volatility is really hitting the high levels.

Gaps in the markets are something that every single trader will experience at some point in their trading career. As we mentioned they occur when the opening price of a candle differs from the closing one prior to it. Over the weekends, when the price moves up or down but our retail clients to do an update over the weekend, so when they open once again on Sunday evening (UK time) then the opening candlestick will differ to the one that closed on Friday evening, this is especially prevalent when there has been a significant even in the world or news over the weekend.

We mentioned that they can also happen in the middle of the trading day and not just at the weekends, this can happen when a significant news event takes place which brings in a lot of interest from traders, this large spike can widen the bid and the ask spread wide enough for there to be a gap on the next opening of a trade. Price gaps can give you a good idea as to what the market sentiment is from other traders, if the markets gap uup, then it can be an indication that people do not want to sell and when it gaps down it will show that traders do not want to buy, they can be used as an additional indicator to how the markets may behave.

There is also something known as trading the gaps, this is where people take advantage of these little gaps in order to make a little profit. Gap trading is considered to be easy, reliable, and pretty profitable by a number of traders, or very risky by others.

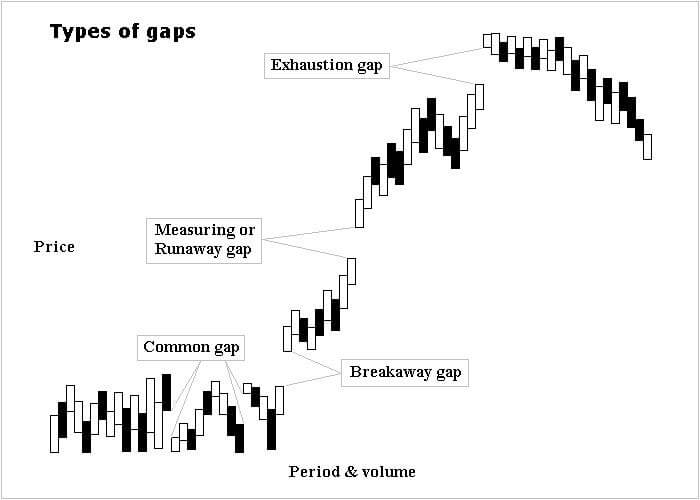

So let’s take a quick look at what the different gaps are, there are four main ones that we will be looking at now.

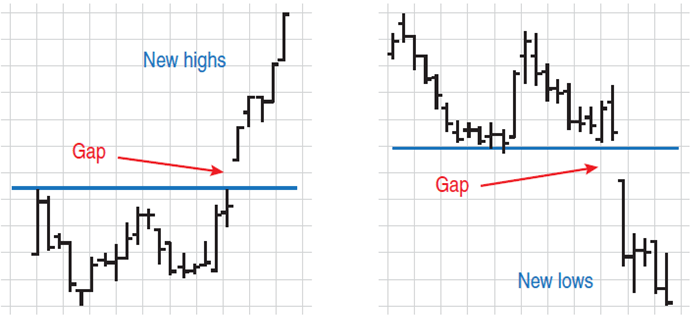

The Breakaway Gap:

The breakaway gap occurs when a price action comes to an end and when a new trend begins. This type of gap indicates that the price has broken out and then starts moving up or down leaving a gap. This sort of movement is often caused by a news event or breaking news, hence the name breakout gap. This process often causes a new trend and is then considered as not very trade-friendly.

The Runaway Gap:

The runaway gap is a formation that can form within a trend and they often indicate that the trend is continuing in the same direction. Runaway gaps are considered to be quite tradable and are one of the safest ways to trade with gaps due to the fact that the gap is simply indicating that the trend is most likely going to continue in the same direction. They can often combine trading with runaway gaps with other price action tools to help with even safer trading conditions.

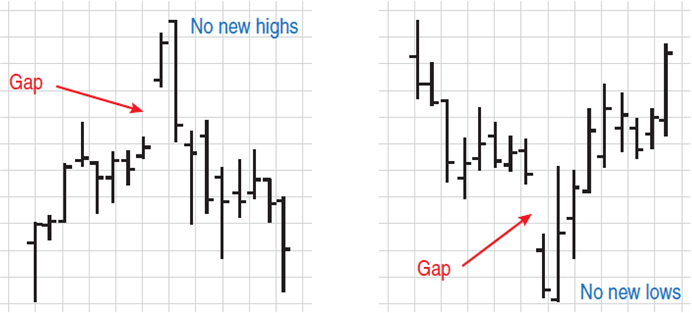

The Exhaustion Gap:

These sorts of gaps are very common on the stock markets, but they can also occur on the forex markets too, they just occur a lot less often. These sorts of gaps often form towards the ends of a previous trend and can help to indicate the final moment before the price begins to reverse. This means that you are able to trade these gaps, however, you should only do so after you have already identified them and you start trading with the new trend once it has been formed.

The Common Gap:

The common gap as it sounds is one of the most common types of gaps that you will find and is also often the most tradable type of gap and due to this is the most widely used style of the gap that is traded. These sorts of apps often appear late Sunday evening and early Monday mornings shortly after the markets have just opened and are appropriate for short term trading as they tend to be filled within a few price bars. It Is best to look for these sorts of gaps at midnight when the markets open, they can also occur after a holiday or when a major news event has been announced.

You may have come across something called filling the gap, this is basically when the price moves back to the initial level before a full gap appears The price will always fill the ap at some point or another, the question that we need to work out is just how long it will take to do it. When the gap is filled within the same trading day it is known as fading, but this does not happen every single time with gaps. You also need to calculate just how many pips it will take to fill the gap, as it may not actually be feasible for trading if it is too large or too small, but the fact that the markets will always fill the gap at some point is what makes it so tempting and interesting for traders. It is not really that hard to work out that if the markets gap downwards then it will need to move back up in order to fill that gap, the problem with trading, especially when the markets have just opened up is that the spreads can make it not so profitable, so unless you get in and out at the right place with the right spreads, it may end up costing you even when the gap does fill.

There are of course risks when trading the gaps, so we need to work out how it is that we can minimise those risks. The primary thing to do is to simply have some sort of knowledge on trading and understanding the fundamentals behind how the markets move and how and why the gaps have been formed. A few other things that you can do are to always watch and keep up to date with a real-world event that could be affecting the markets, using an economic calendar, use a broker that has lower spreads, preferably an ECN broker which offer straight-through processing, always use a stop-loss. This should be pretty obvious but a lot of people trading the gaps forget it, and it can of course continue the wrong way before closing the gap, so be sure to add in a stop loss in order to protect your account.

So the main thing that you need to think about is whether or not you want to trade the gaps, it is not the most common thing for people to be trading. Make sure that you read up on it. If you are planning on it then make sure that you learn about the different gaps and how to trade them, ensure that you are up to date on world events, and learn the basics of both fundamental and technical trading and analysis. Use proper risk management and then practice with lower best, you may not get gaps on a demo account so may need to practice on a live one, but do so using small trade sizes in order to mitigate a bit of the risk involved.