Introduction

GBPAUD is an abbreviation for the Great Britain pound and the Australian dollar. This cross currency pair is widely traded with high volume in the forex market. In this pair, GBP is the base currency, and AUD is the quote currency.

Understanding GBP/AUD

The value of GBPAUD in the market is the value of AUD equivalent to one pound.GBPAUD is quoted as 1 GBP per X AUD. For example, if the value of GBPAUD is 1.8505, then these many Australian dollars are to be given to receive one pound.

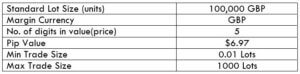

GBP/AUD Specification

Spread

The prices for buying and selling a currency pair are different. To buy, one must refer to the ask price; and to sell, one must refer to the bid price. The difference between the bid price and the ask price is called the spread. The spread varies from the type of account model.

ECN: 0.7 | STP: 1.7

Fees

Apart from the spread, brokers levy fee on every round-trip trade. This fee is fixed in for every trade. However, it varies from broker to broker. Usually, there is no fee on STP accounts. On ECN accounts, there is a fee of a few pips.

Slippage

Slippage is the difference between the price when the trader entered the market order and the price he was actually given. Most of the time, there is a variation in the prices. This difference could be in favor of or against the trader. There are two factors responsible for it. One, the volatility of the market, and two, broker’s execution speed.

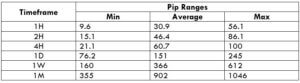

Trading Range in GBP/AUD

The trading range of currency pairs simply depicts the volatility of the pair in a different timeframe. In other terms, the trading range represents the minimum, average, and maximum pip movement in different timeframes. These values are helpful in assessing one’s risk, as well as making trades much cost-effective.

Procedure to assess Pip Ranges

- Add the ATR indicator to your chart

- Set the period to 1

- Add a 200-period SMA to this indicator

- Shrink the chart so you can determine a large time period

- Select your desired timeframe

- Measure the floor level and set this value as the min

- Measure the level of the 200-period SMA and set this as the average

- Measure the peak levels and set this as Max.

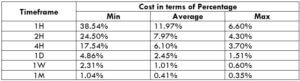

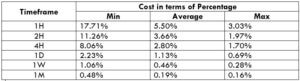

GBP/AUD Cost as a Percent of the Trading Range

Cost as a percent of the trading range is a very supportive tool in analyzing the cost of a trade, in different timeframes, and at different volatilities. This is done by finding the ratio of the total cost and volatility values and then expressing it as a percentage. The comprehension of the below tables shall be discussed in the subsequent topic.

ECN Model Account

Spread = 0.7 | Slippage = 2 |Trading fee = 1

Total cost = Slippage + Spread + Trading Fee = 2 + 0.7 + 1 = 3.7

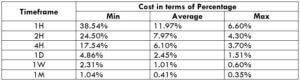

STP Model Account

Spread = 1.7 | Slippage = 2 | Trading fee = 0

Total cost = Slippage + Spread + Trading Fee = 2 + 1.6 + 0 = 3.7

The Ideal way to trade the GBP/AUD

Note that the higher the magnitude of the percentage, the higher is the cost of the trade. From the table shown above, we can observe that the values are highest on the min column and lowest on the max column. This means that the costs are higher when the volatility of the market is low and vice versa. Reading it horizontally, the cost gets lower as the timeframe widens. Hence, the ideal to trade when the pip movement of the currency pair is near the average values. This will ensure decent volatility by keeping the costs minimal.

Another effective way to reduce the total cost is by trading using limit orders, not market orders. Doing so, the slippage on the trade will shrink to zero. The following table shows the costs of the GBP/USD with no sleppage, for the same market conditions as on the preceding tables.

Total cost = Spread + trading fee + slippage = 0.7 +1 + 0 = 1.7

Hence, from the above table, it can be inferred that the cost percentages have a significant value.