The two currencies, the Australian Dollar and the New Zealand Dollar are quite highly correlated, which is why this article will deal with them both at the same time. Here, we’ll cover their historical backgrounds, economic impacts, correlation, recent market activity, and much more.

Historical Background

Australia was populated by the British in an attempt to alleviate the overcrowded capacity of British prisons and grow the British Empire. The new colony grew to the extent that they created their own government in the end. The Australian Dollar, which is also known under the ISO symbol of AUD, is one of the top 10 currencies in the world. When compared to the country’s size, as well as that of its population and economy, the official currency of Australia is truly impressively ranked among other world currencies. This currency replaced the Australian pound in 1966 and is now considered a proxy for some vital strategies in the currency market. As opposed to the EUR/USD or USD/JPY crosses, which entail a number of goods and services trades that get intertwined with currency trades, the AUD’s privileged position mostly stems from forex trading alone.

Apart from the name and the symbol, the currency is nowadays also referred to as $A, $AU, or Aussie. Similar to the AUD, the New Zealand Dollar (ISO symbol: NZD) is one of the most traded currencies worldwide, which is again an interesting fact considering the quantity of goods and services exchange between New Zealand and the rest of the world. Another manner in which the NZD resembles the AUD is the impact of forex trading on currency strength. The other terms the NZD is also known by are NZ dollar, kiwi, or $NZ.

Most Traded Pairs

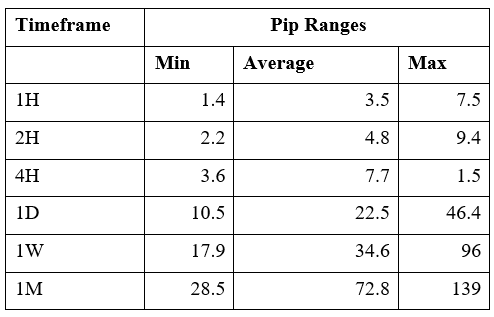

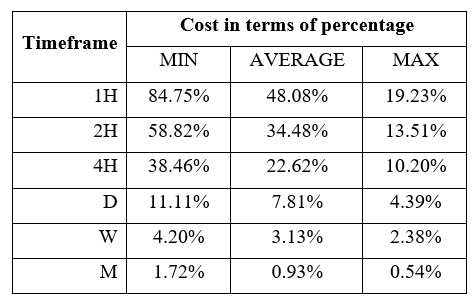

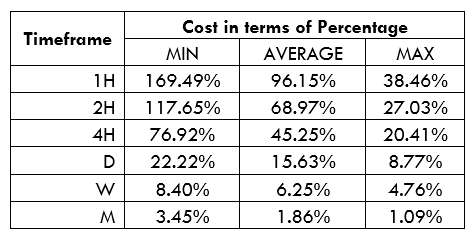

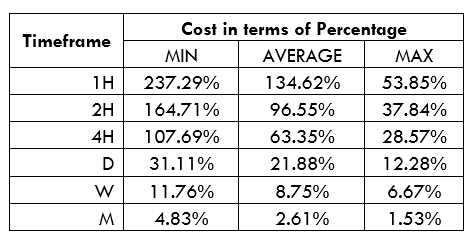

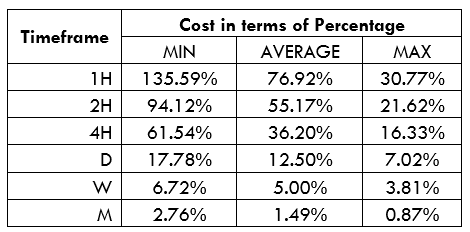

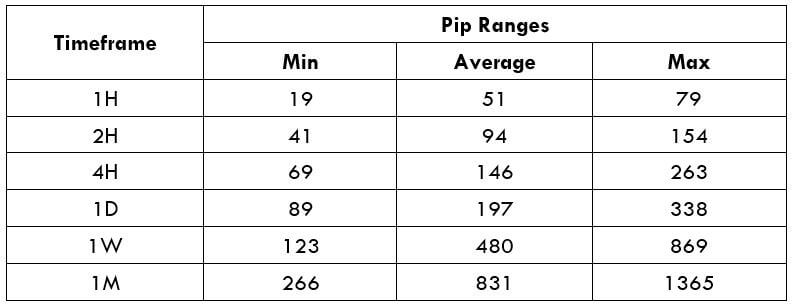

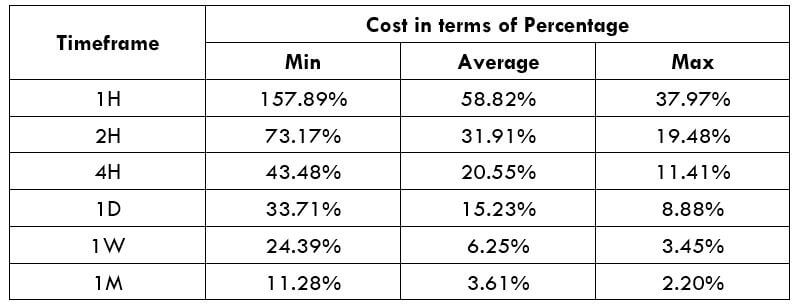

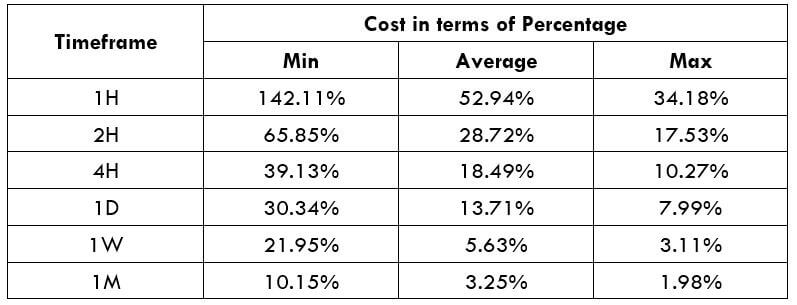

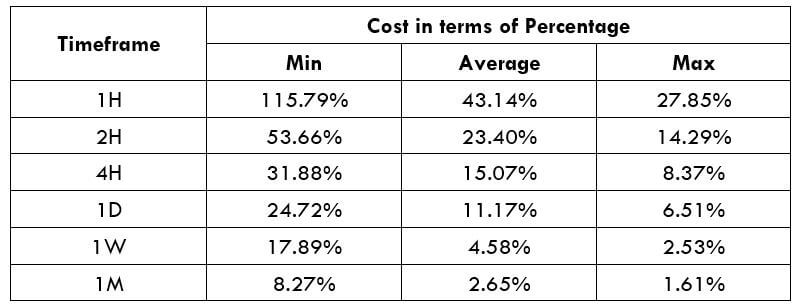

The most traded pairs are the two currencies against other major currencies, in particular against the USD, JPY, EUR, and GBP. Most liquidity of these two currencies and their most common pairs is generated from trading. Compared to the EUR/CHF cross, which is influenced by the goods and services (money) exchange between Europe and Switzerland, the liquidity in AUD and NZD pairs is an important difference. Currency pairs such as AUD/CAD or NZD/CHF involve very few trades of goods and services, so the money exchange mostly comes from traders, who are also not so great in numbers when it comes to these crosses.

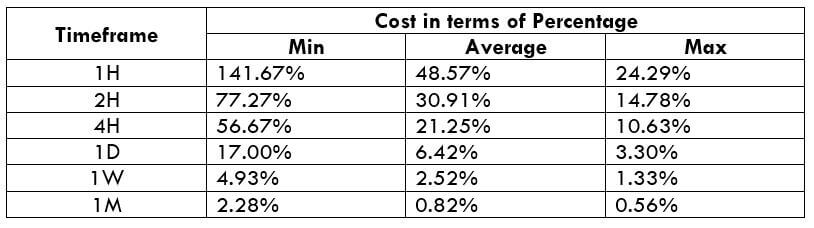

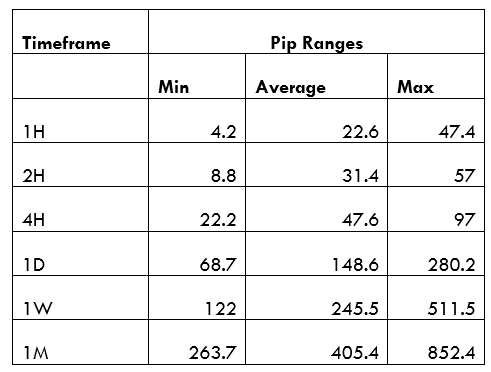

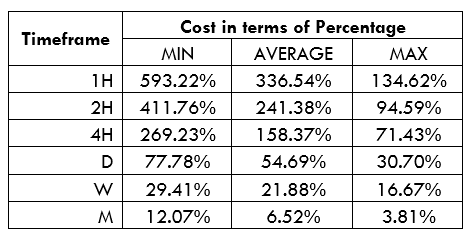

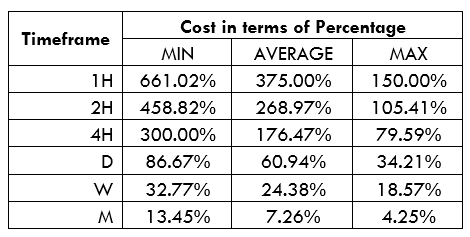

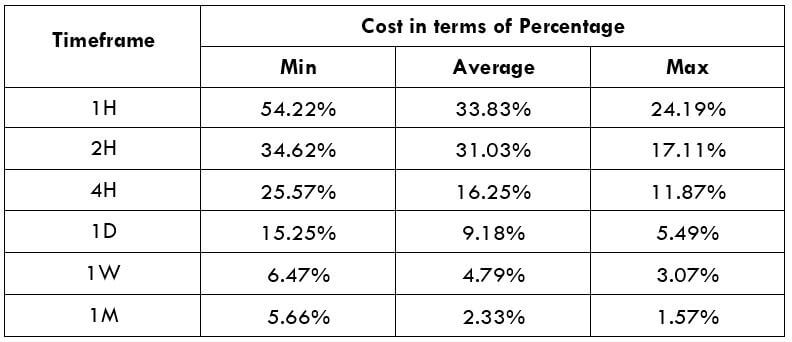

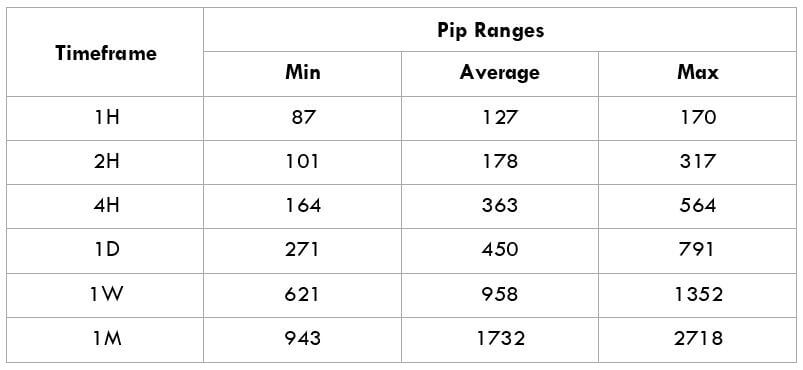

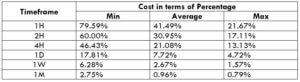

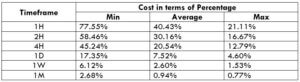

Whenever liquidity is low, traders are faced with wide spreads and increased volatility especially with regard to news events. News announcements greatly impact the currency market’s trades of NZD and AUD, which is why crosses such as AUD/CHF and NZD/CHF are considered dangerous around the time any news comes out. Therefore, the most important question in terms of trading these two currencies is liquidity, which is why professional traders mostly focus on the crosses including the USD, JPY, EUR, and GBP.

Central Banks

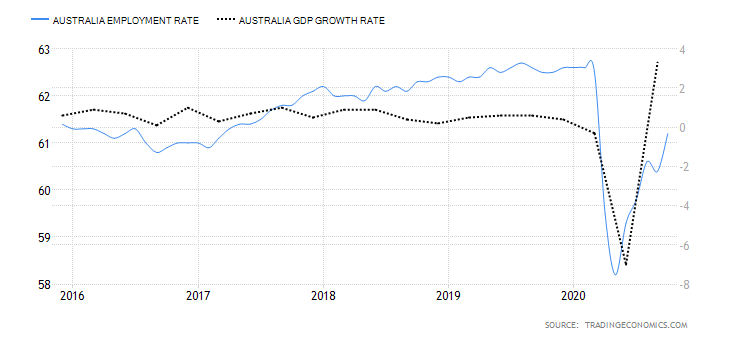

Before the establishment of Australia’s central bank, the Reserve Bank of Australia (RBA), in 1960, the country relied on the Commonwealth Bank of Australia to issue the currency for the country. This task was moved away from the private bank into the government, which is responsible for the monetary policy at present. The RBA numbers nine employees who are all appointed by the government. The current Chair of the RBA is Mr. Philip Lowe, who took over the position from Mr. Glenn Stevens in 2016. The RBA holds 11 meetings per year on the first Tuesday of the month (all except January) when traders can expect announcements will be issued. The bank has a trifold mandate, with the stability of the currency, i.e. price stability and fighting inflation, being their primary goal. Their second aim is to maintain employment across the country, whereas the last one is the economic prosperity and welfare of people in Australia.

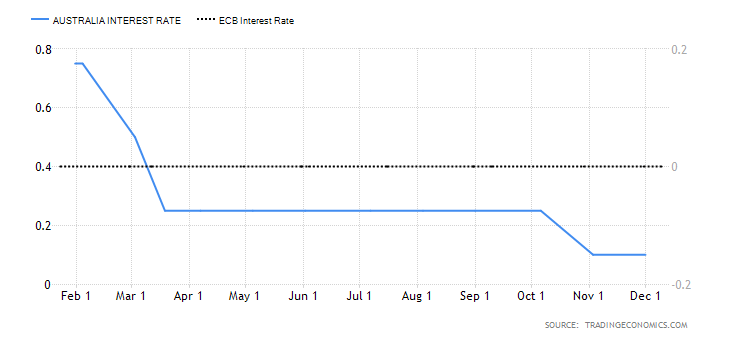

Unlike the ECB, whose mandate is more singular (inflation), the mandate of the RBA is quite wide. This comprehensive list of goals and tasks enables them to be rather flexible with regard to monetary policy. Australia and New Zealand are generally likely to show similarities in terms of economic policy. New Zealand’s central bank, the Reserve Bank of New Zealand (RBNZ), was established in 1934. The RBNZ comprises 10 members/governors who meet eight times a year. As of 2016, Professor Neil Quigley has been working at the position of Chair of the bank. The bank has a single mandate – price stability, yet unlike the ECB, the RBNZ seems to be more flexible.

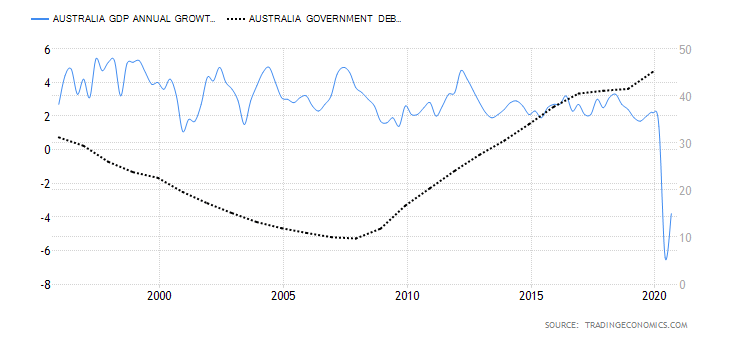

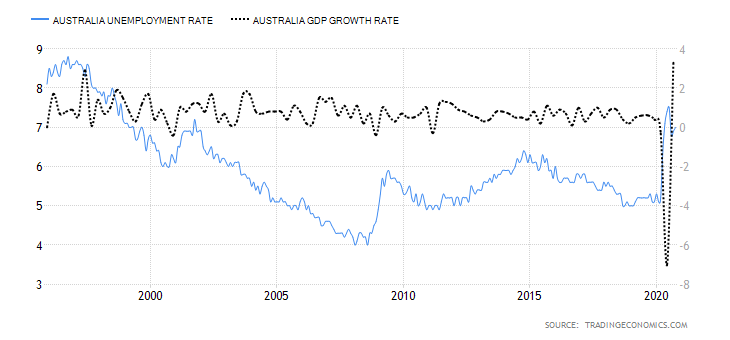

Economies

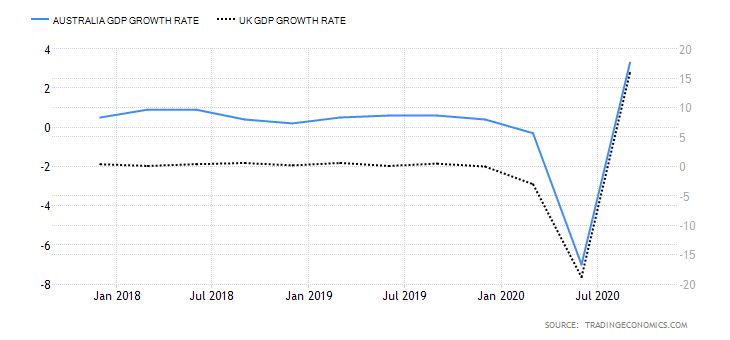

Australia, the 10th largest economy in the world, is strong in mining and agriculture, which make more than half of the country’s exports. Australia is a major commodities (iron, gold, etc.) exporter to Asian countries. Australia’s largest trading partner is China, which is an important fact for the currency market traders. The Chinese yuan (CNY) is, like the Indian rupee (INR), not allowed outside the country, which is why Australia and New Zealand are the means to get to this currency. This is why there is so much volume in these currencies despite the fact that they are not the largest economies in the world. Traders interested in the AUD are always advised to think of the strength of mining in Australia, commodity prices, and China. New Zealand’s economy is slightly behind Australia, ranked 16th in the world. Their economy is mostly focused on agriculture, which is why the country largely exports food and textile. New Zealand’s largest trading partner is China as well.

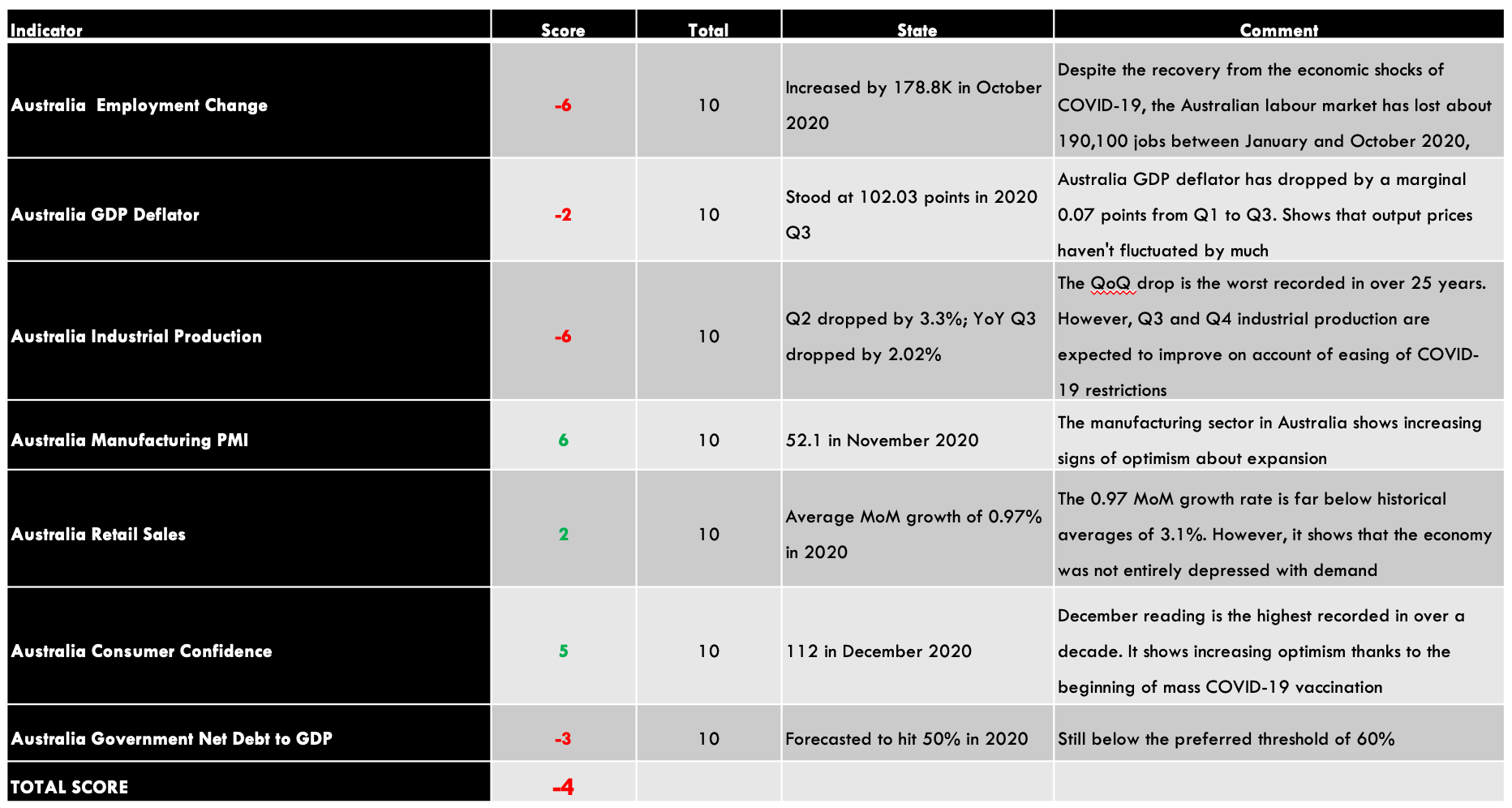

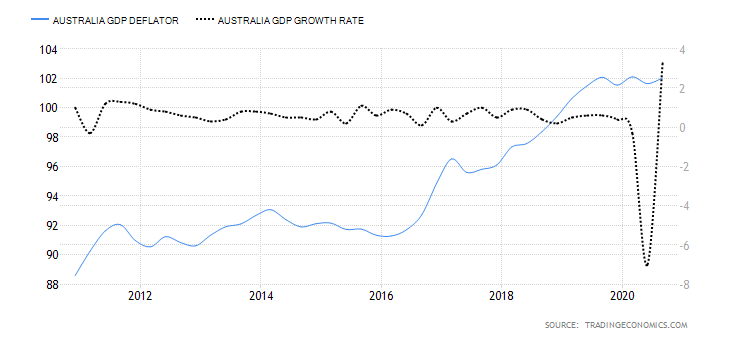

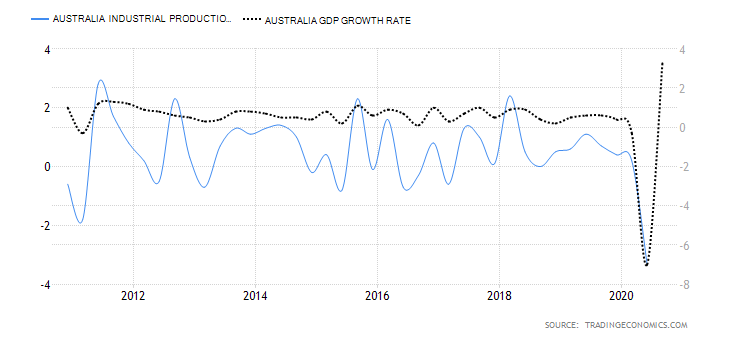

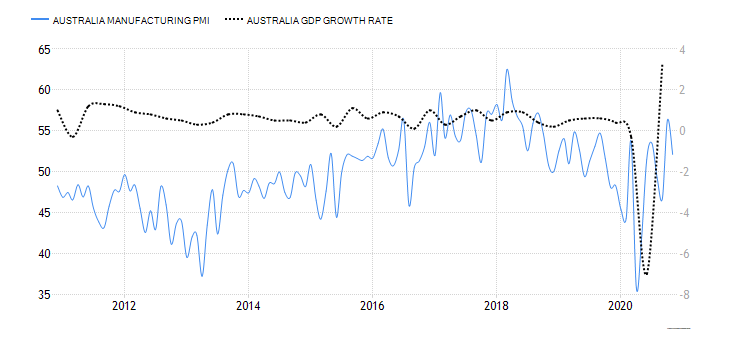

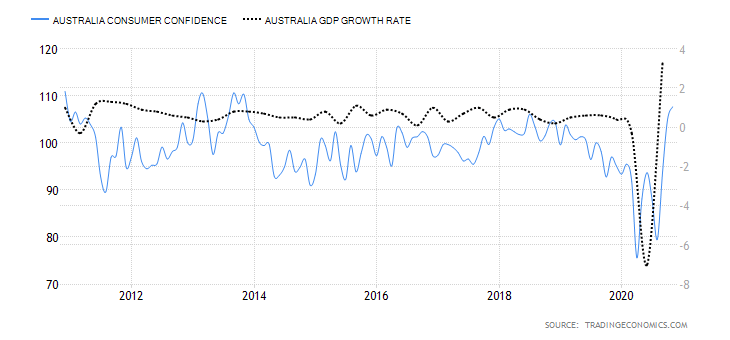

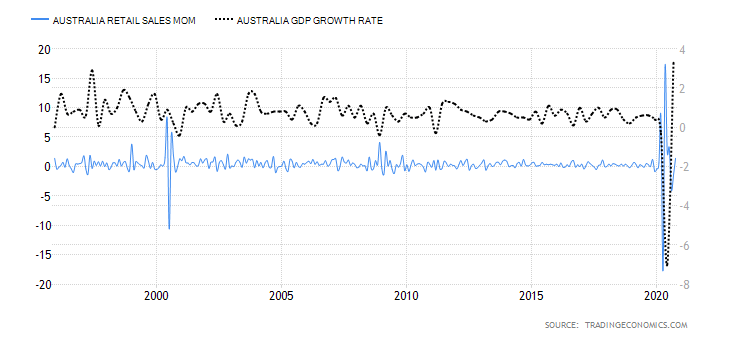

Economic Reports

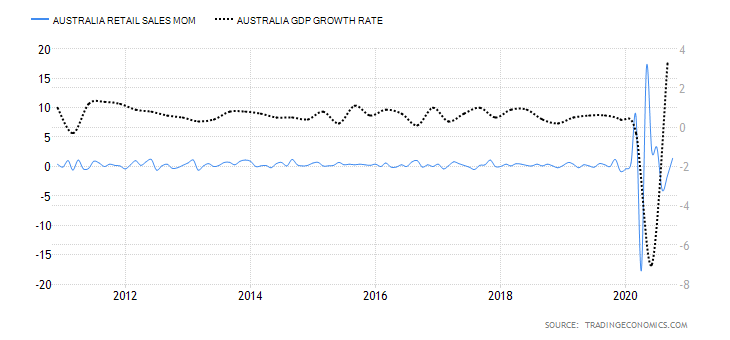

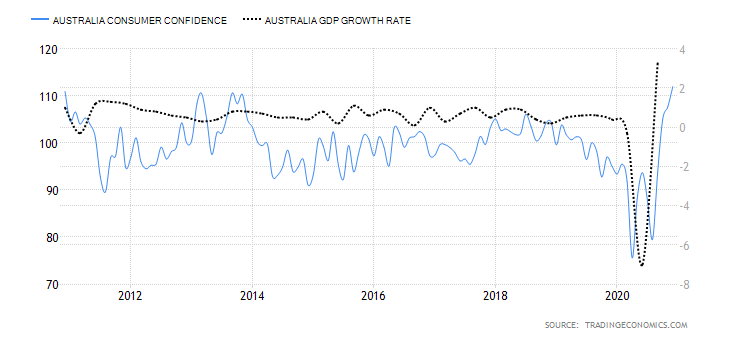

The reports traders should focus on are rather similar to those of the United States: quarterly GDP reports, monthly Employment Report, Retail Sales, and Producer and Consumer Price Index (CPI and PPI) for both the AUD and the NZD, including Westpac Consumer Sentiment for New Zealand.

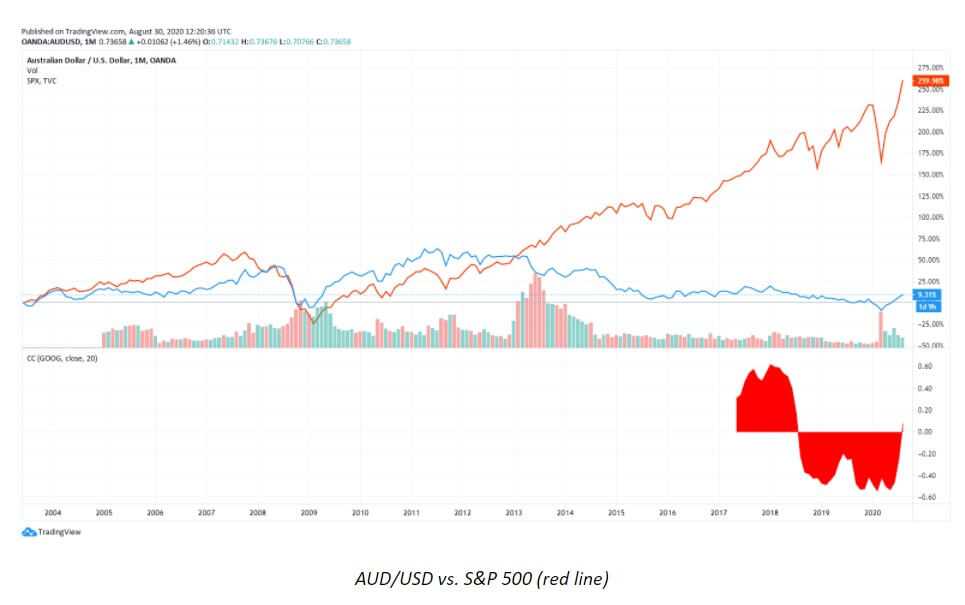

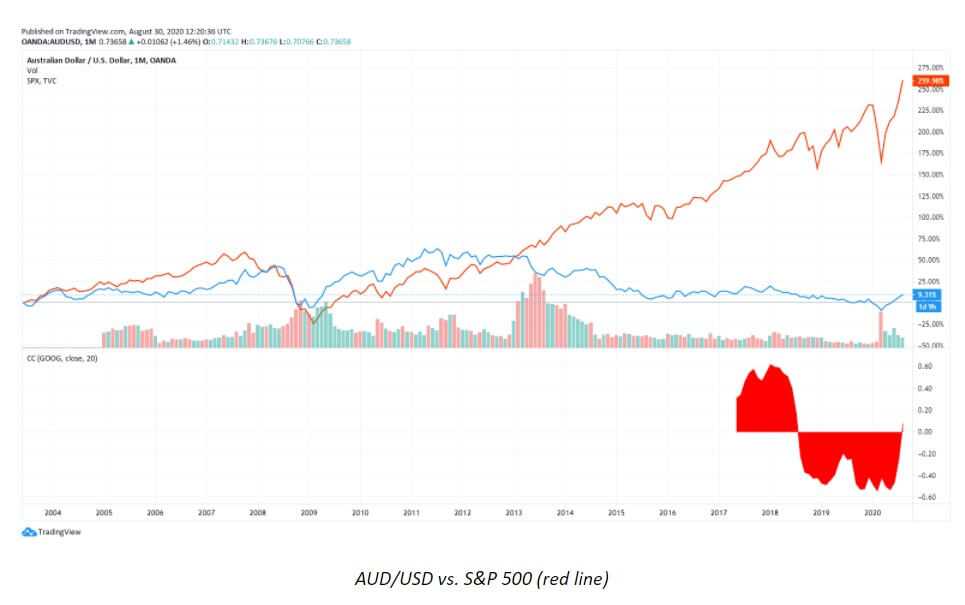

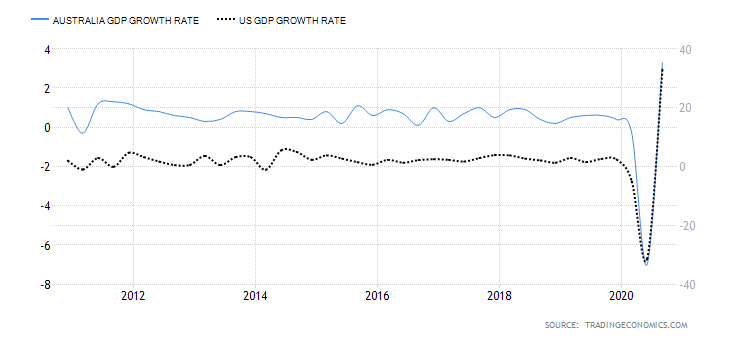

The AUD/SPX Correlation

Australia is not the biggest economy, but the AUD is used extensively in the currency market as a proxy for growth. If economies are growing, there will be a demand for natural resources, causing the Australian exports to be strong and the country’s relationship with China, as one of the greatest economies in the world, comes into place here as well. Some of the greatest correlations we can see are found between the AUD and the USD as well as AUD and the S&P 500. Since the AUD is perceived as a proxy for growth, if traders assume that economies are going to grow, this will be bullish for the equities market and the currencies such as the AUD. As we can see from the chart below, the nature of this correlation has changed, but it is still quite high, exceeding 50%. Correlations can in general vary in strength during different periods; however, the AUD/SPX correlation can allow traders to draw some conclusions and expect changes in the prices of the AUD should the price of equities increase.

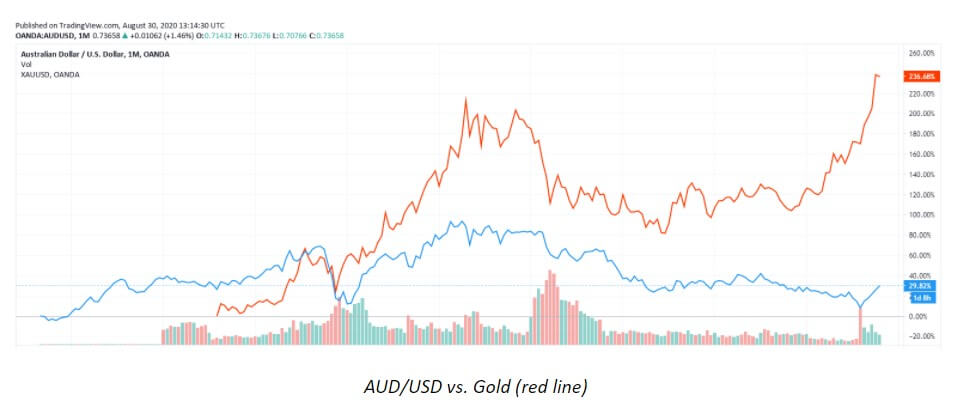

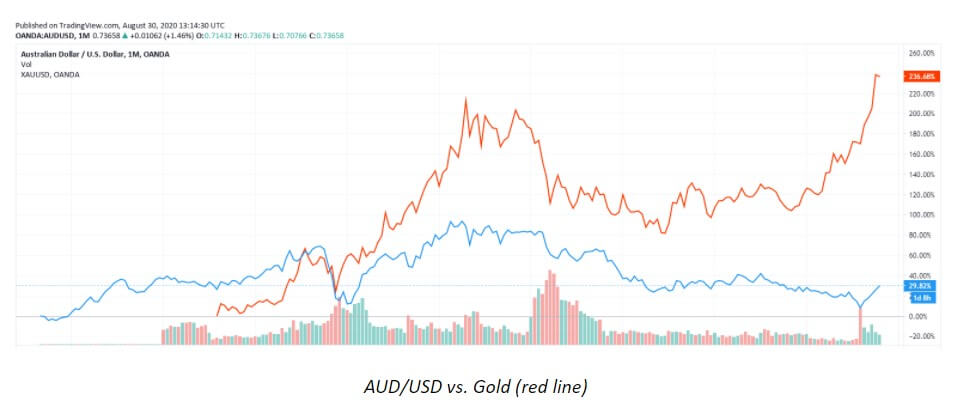

Another important AUD/USD correlation concern is gold, which has historically been one of the most prominent correlations. Therefore, the increase in the price of gold has traditionally been bullish for the AUD. Any decrease in the price of gold is then bearish for the AUD.

With regard to the NZD, one of the strongest correlations exist between the AUD and the NZD, which is why many young traders make the mistake of going short on one and long on the other. Although the two tend to move in different directions at times, these currencies are still highly correlated. Therefore, due to their strong correlation, the insight into what is happening with the NZD should provide information on what is happening with the AUD and vice versa.

Owing to the similarities described above, if equities prices start to move up, this change will likely be bullish both for the AUD and the NZD. Should you come to the conclusion that a change in the price of gold is going to be bearish for the price of the AUD, the same conclusion can be applied to the NZD as well.

Trading the NZD and the AUD

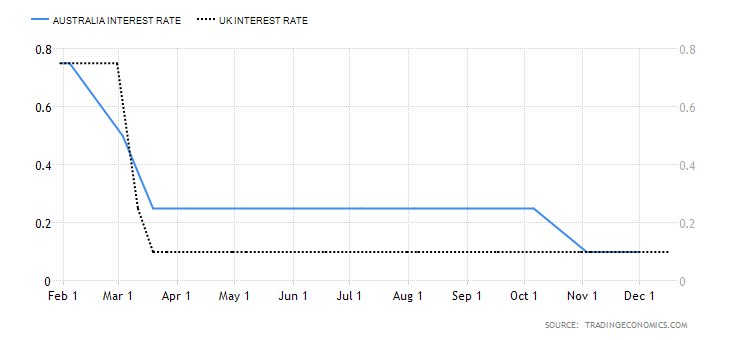

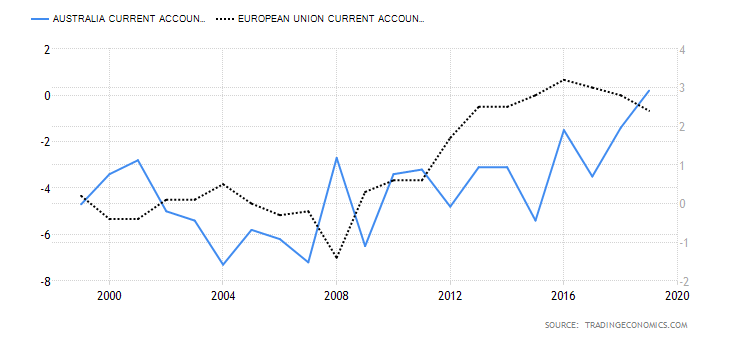

Both currencies require traders to take liquidity, proper selection of crosses, and avoiding news events into consideration. Currency pairs such as GBP/NZD can be great for traders, but they tend to get really volatile around the news announcements, leading to unpredictable moves and wide spreads. It is also important to remember that both New Zealand and Australian economies are focused on commodities and Asian countries. Concerning interest rates, both Australia and New Zealand keep their rates at 0.25%, which places them right in the middle among all major currencies’ central banks. Inflation in both countries tends to vary according to CPI and PPI reports. The two countries typically do not have any challenges with the trade deficit, as they are large exporters that typically carry a surplus. What is more, as these two currencies are tightly connected with global growth, commodity prices are important factors that determine what is happening to the AUD and the NZD.

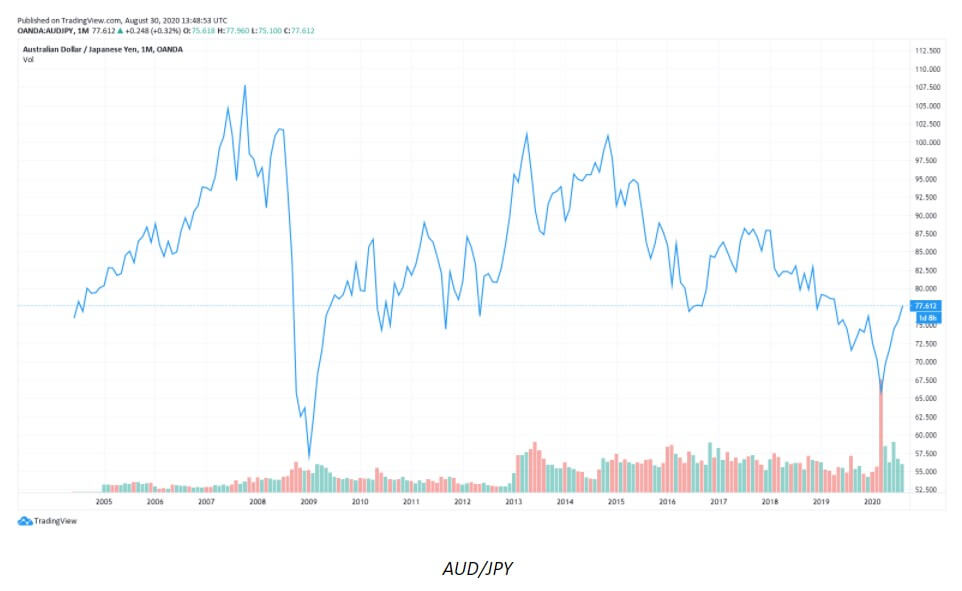

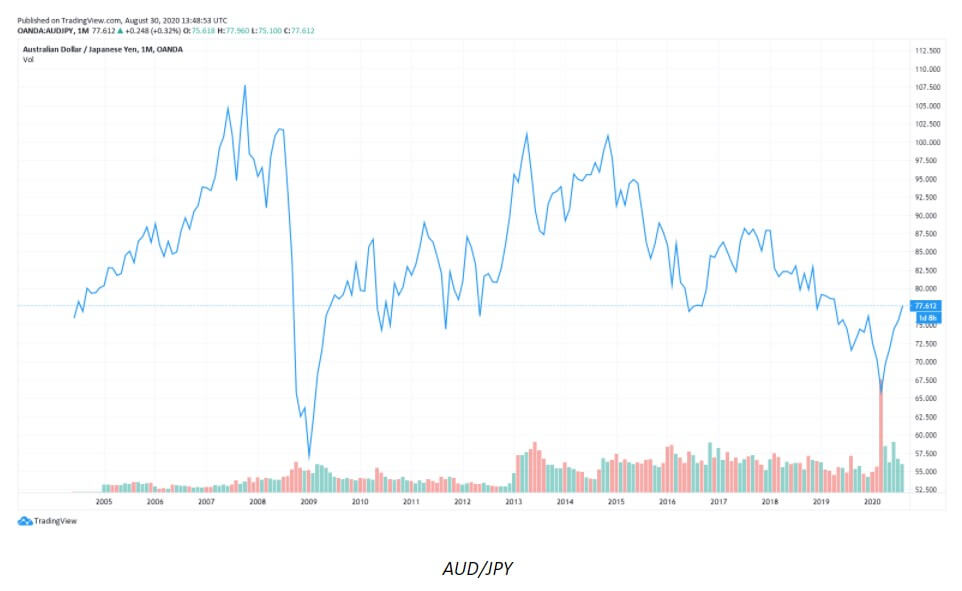

As a proxy for global growth, the NZD and AUD pairs will reflect any global panic. The 2008 AUD/JPY chart below reflects a large drop (a 50% loss) in the midst of the crisis that was affecting the entire world. Traders use these currencies to trade growth as well as to short and sell when there is a recession.

Recent Market Activity

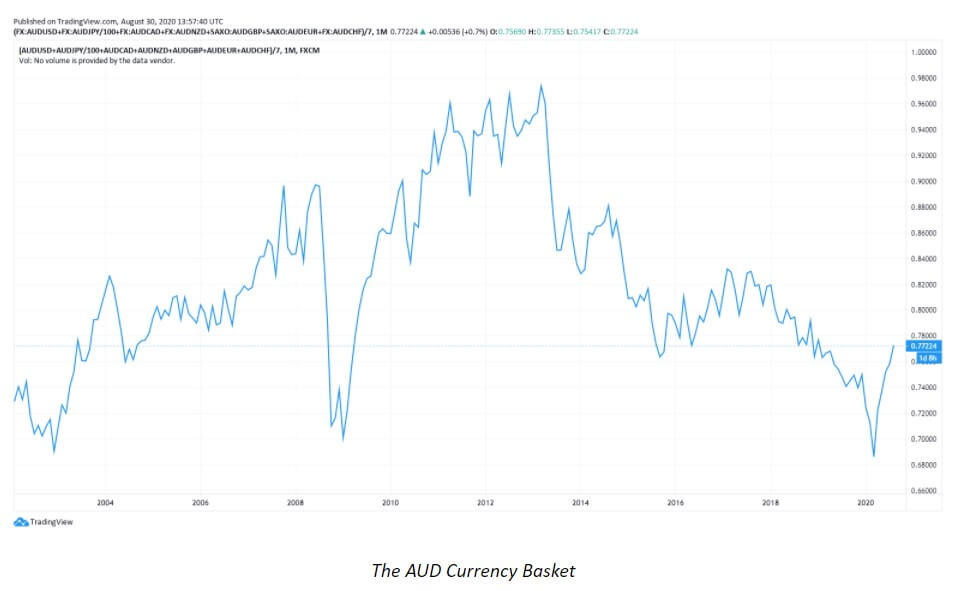

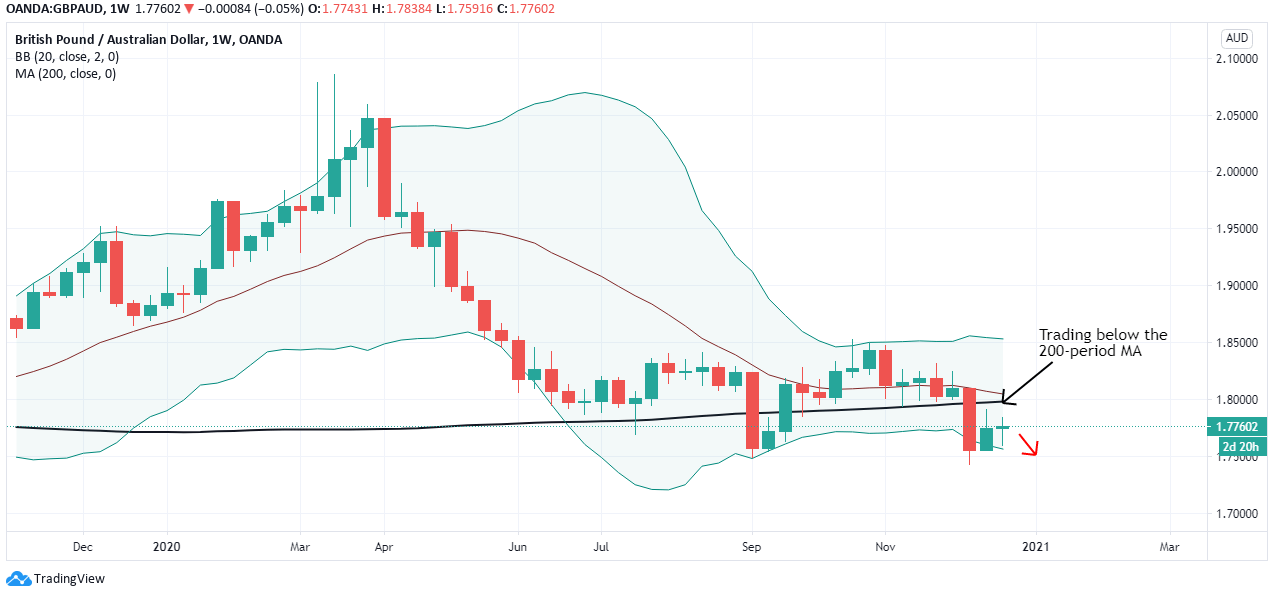

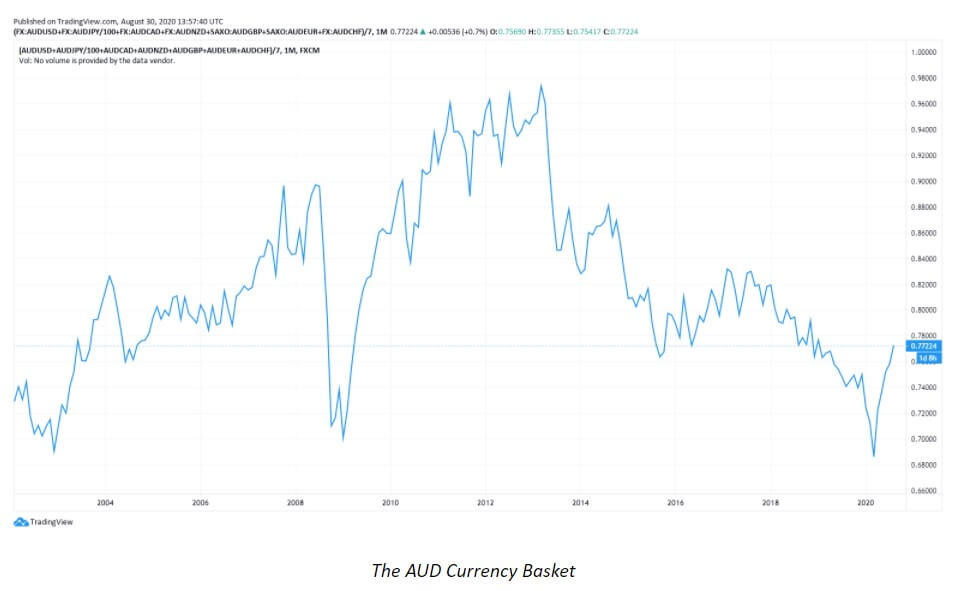

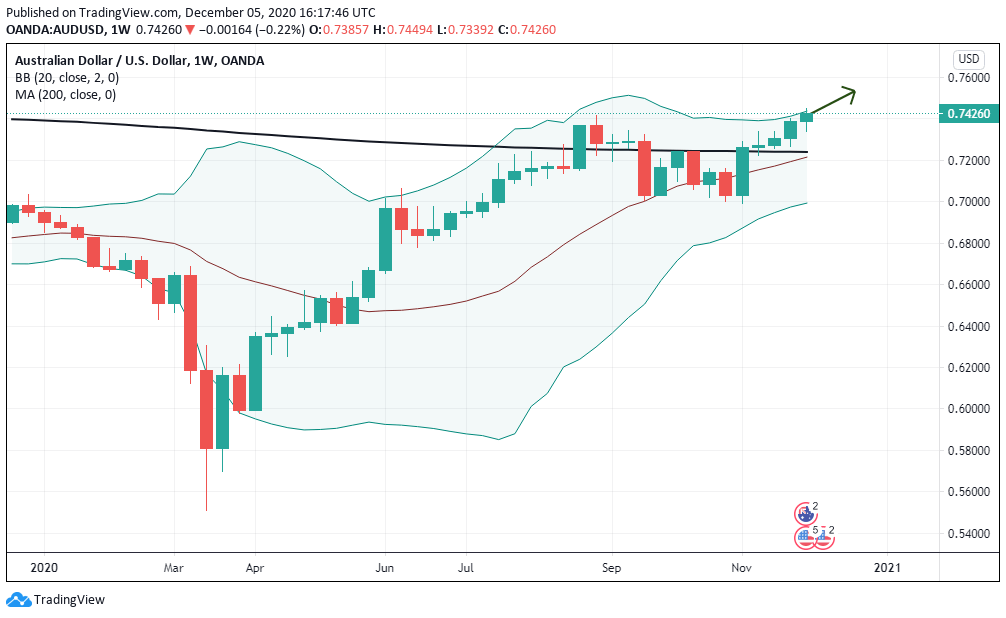

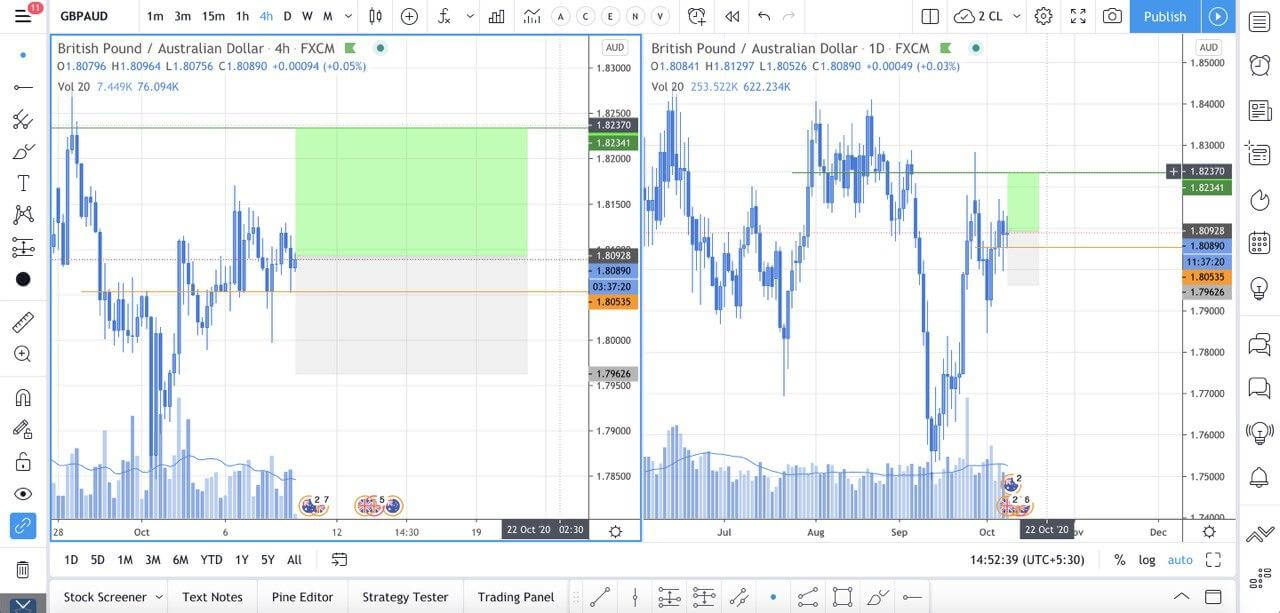

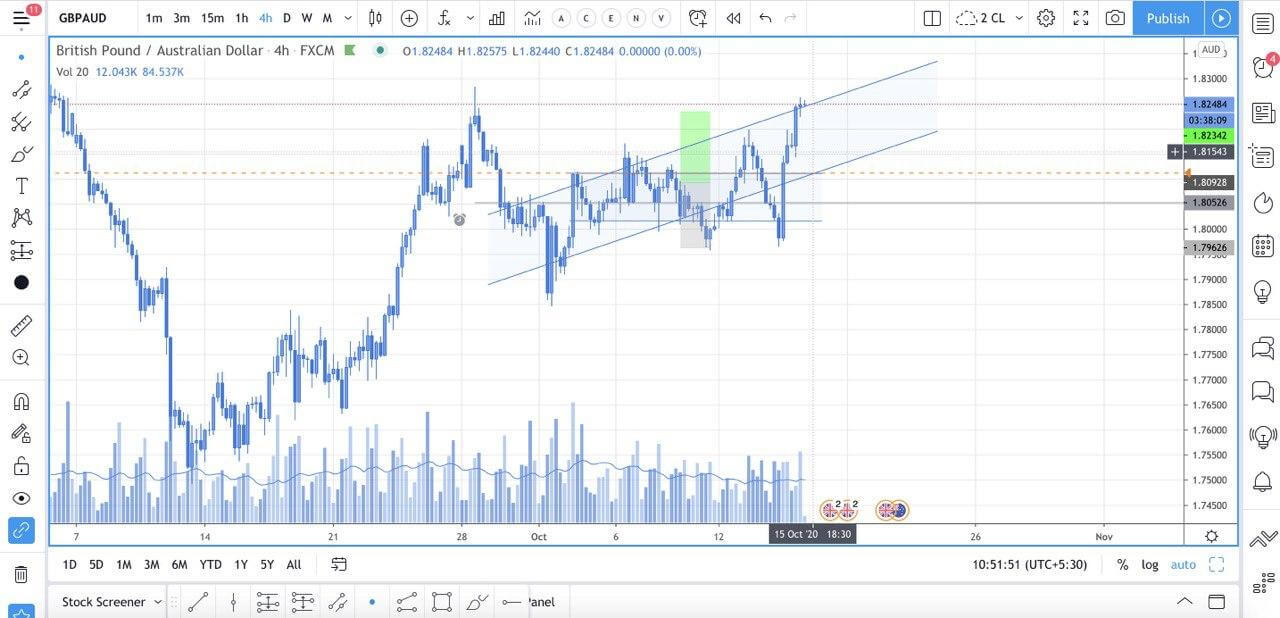

The AUD has been quite resilient lately with the price action slowly building up towards the end of the chart. While the chart did give a few breakouts in several places, they would simply fall. What is more, as we can see from the chart below, the past three months the price has been consolidating and this consolidation is likely to break out sometime soon. However, the CAD for example has shown how the breakdown itself is not as relevant, since the price of the Canadian dollar did break down for it to go up the very next day. The near future of the AUD may reveal similar tendencies, with the price either going straight up and growing even more or, on the other hand, going up and then pulling back in the opposite direction.

The longer the consolidation, the more difficult for the trader to assess the chart’s future movement as much resistance has been building up. Likewise, the shorter distances do allow the price to break out more easily, and the break-out and pull-back tendencies are generally much more often in such cases. The chart below shows how the currency has been doing well lately in 2020 from the technical point of view, with its strength supported by the equities and gold markets experiencing all-time highs, strong risk-on sentiments, and a weak USD. The end of the August 2020 chart reveals how the current trend should be bullish, but it is not, so it is a sign that something is wrong at the moment and that the currency should be handled with care.

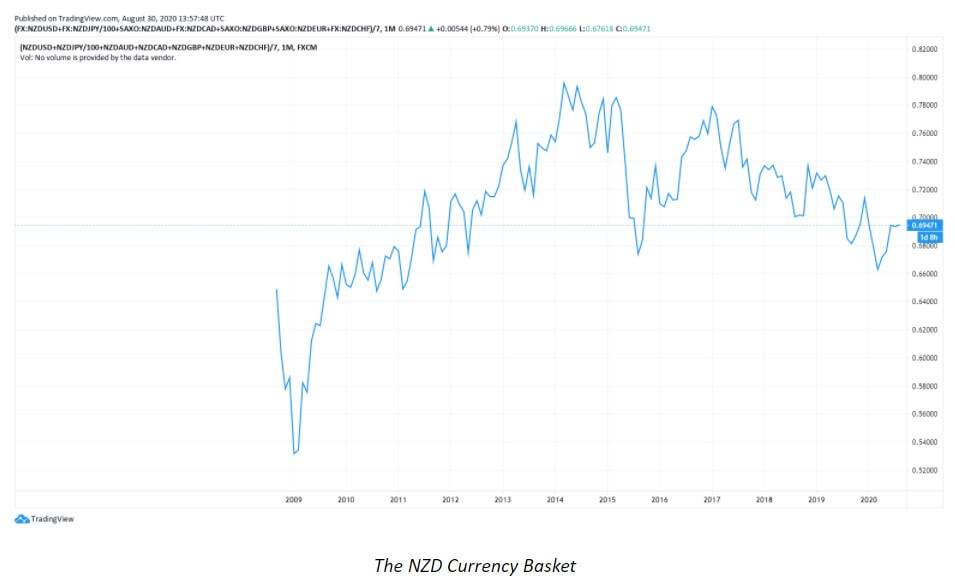

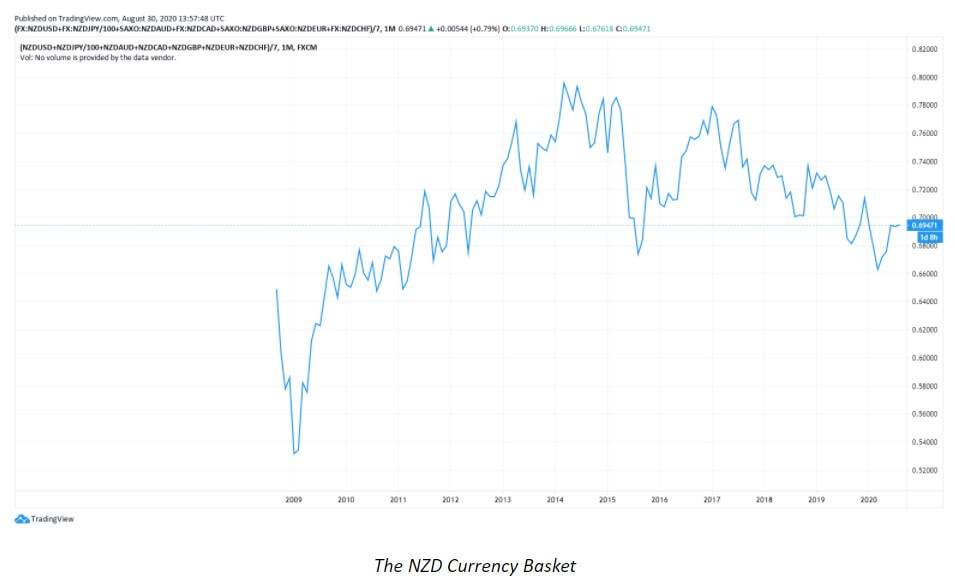

As the chart below reveals, the volatility seems to be on the low when it comes to the NZD lately. Compared to March, for example, the volatility level is much lower now. The NZD lost its momentum going upwards and in August 2020 started moving steadily in the opposite direction. The big move down may easily reach the bottom end, i.e. the support line, which would require a change in the overall outlook on behalf of traders.

Traders have been able to see some divergence with the AUD/NZD pair in the last few weeks. If traders are thinking of whether to go short on one or the other currency, the NZD is currently a much better pick. The AUD and the NZD are similar, but if they break the level they have been approaching for a while now, traders might be able to witness a more significant divergence happening. Should traders encounter a slowdown, the AUD may turn out to be a better choice after all. Owing to the current progressions, traders are advised to pay close attention to this currency pair in the time coming.

So, what does the future hold for these two currencies? It’s tough to know, the same as with any currency pair, as there are simply too many factors that determine how the market moves. What we can say with certainty is that at this time the pair is delivering some excellent trade opportunities if you only know where to look.

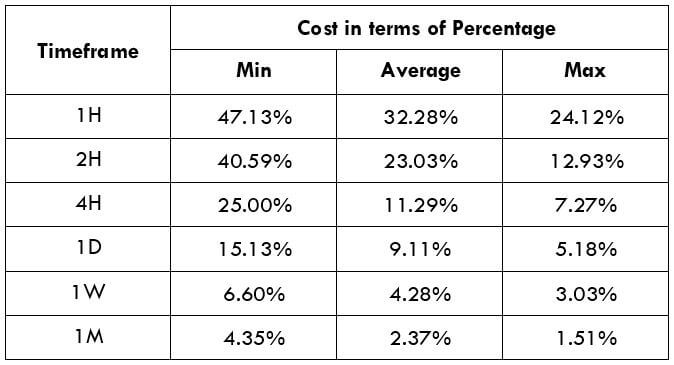

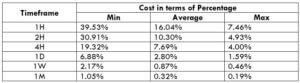

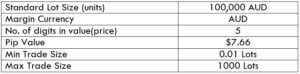

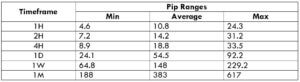

The Ideal way to trade the AUD/CAD

The Ideal way to trade the AUD/CAD

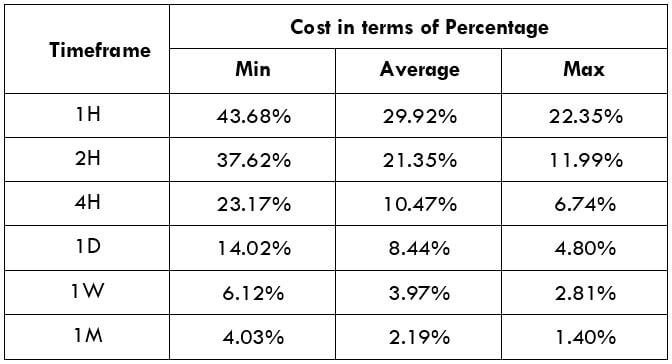

The Ideal way to trade the AUD/NZD

The Ideal way to trade the AUD/NZD