General overview

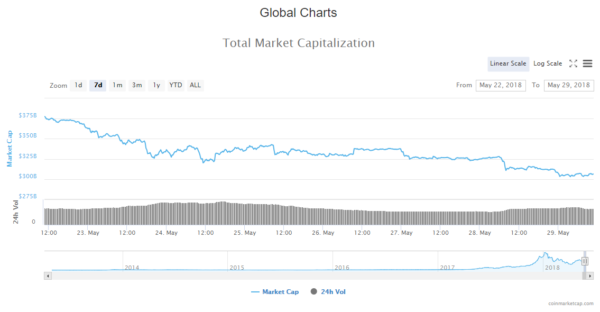

- Market Cap: $278,463,268,852

- 24h Vol: $15,188,740,539

- BTC Dominance: 48.0%

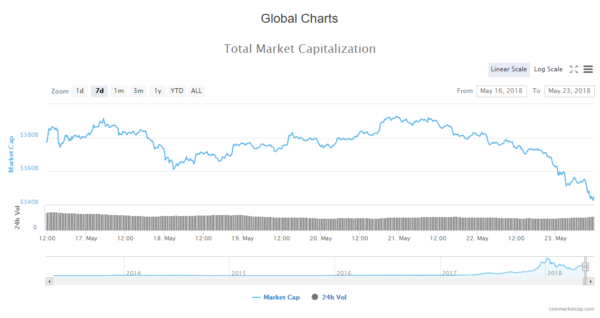

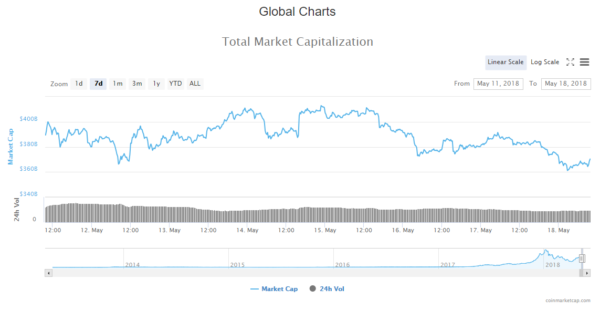

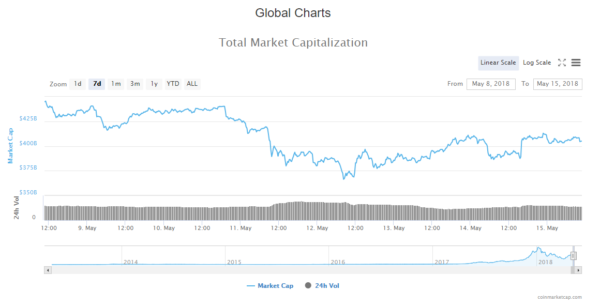

From yesterday’s high at $299B the evaluation of the cryptocurrency market cap has fallen by 23 billion, as today’s low was around $276B. This was expected as a triangle pattern formed on the global chart.

Consequently, the market is currently in red with an average percentage of change among top 100 coins ranging from 3-7%. The biggest loser is Pundi X with a decrease of 19%.

News

As the market experienced a decline in the evaluation, many headlines are analytical in nature. However, some significant headlines have come out in the last 24 hours.

Australian Government Awards Grant to Blockchain Project for Sustainable Sugar

The Australian government has granted A$2.25 million ($1.7 million) to the Sustainable Sugar Project, Foodnavigator-Asia reports July 30. The Sustainable Sugar Project, led by the Queensland Cane Growers Organization, will use blockchain technology to track the provenance of sugar supplies to Australia. The initiative known as the Smart Cane Best Management Practice (BMP) is part of a sugar industry push for better sustainability and traceability.

It isn’t the first time the Australian government has given a grant to a blockchain start-up. Power Ledger a blockchain based solar electricity solution received about 8 million dollar grant last year for further research and development.

Chamber of Digital Commerce Proposes Guidelines for ‘Responsible’ Crypto Market Growth

The Chamber of Digital Commerce Token Alliance has released a collaborative report of proposed guidelines for “responsible growth” of the cryptocurrency market, according to their July 30 press release. The document, entitled “Understanding Digital Tokens: Market Overviews & Guidelines for Policymakers & Practitioners,” is broken up into three sections: a regulatory overview of digital token markets in five countries, principles for those distributing digital tokens that are not intended to be securities, and economic coverage of the “global token landscape.”

It is an obvious attempt to provide the regulators more material on the cryptocurrency market as the SEC is more and more active in the regulation clamp down on the cryptocurrency space with little to no understanding of the underlying technology.

China: World’s Fourth Largest Bank by Assets Trials Blockchain Loans Backed by Land

The Agricultural Bank of China (ABC), the world’s fourth-largest bank by assets, has issued its first loan on blockchain, local news outlet Financial News reported July 31. State-owned ABC, which counts itself among China’s “Big Four” lenders, revealed it had issued a loan worth around $300,000 backed by a piece of agricultural land in the Guizhou province.

This headline is significant as China’s stance toward cryptocurrency was negative in the past, but it looks like they are switching the tone as they are getting more and more informed of the benefits that adopting blockchain and cryptos are carrying.

Major Swiss Online Bank Posts Soaring Profits After Offering Clients Crypto Investing

Online banking service provider Swissquote has seen a 44 percent surge in profits in the first half of 2018, an uplift attributed to the “crypto boom” earlier this year, local news outlet Finews reports July 31. In July 2017, the Swiss-based online bank was credited by many with becoming “the first” European online bank to launch Bitcoin (BTC) trading accounts for its clients.

Nobel Prize Winning Economist Paul Krugman Expresses Skepticism About Crypto, Predicts Collapse

Nobel Prize winning economist Paul Krugman has expressed his skepticism about the value of cryptocurrencies in a New York Times Opinion piece published July 31.

Source: cointelegraph

Analysis

BTC/USD

From yesterday’s open at 8265$ the price of Bitcoin has decreased by 6,21% and is currently trading at 7732$.

Looking at the two-hour chart, we can see that the price of Bitcoin has broken down the descending triangle and is currently sitting right on the 0,236 Fibonacci retracement level. This breakout to the downside of the triangle was expected and explained in yesterday’s report and because these current levels aren’t going to serve as strong support, so more downside is expected, maybe after some consolidation. If that happens and the price goes below the 0,236 Fibo level the next target would be the baseline support 2 (black dotted line) at around 7400$.

Market sentiment

Bitcoins hourly chart technical indicators are signalling a strong sell.

Pivot points

S3 7233.1 S2 7673.6 S1 7926.6 P 8114.1 R1 8367.1 R2 8554.7 R3 8995.2

ETH/USD

From yesterday’s high at 456,9$ the price of Ethereum has dropped by 5,2% and is currently trading at 433$.

On the 2 hour chart, we can see that the breakout was real and that the price has recovered a bit to the channels support line retesting it for resistance. It looks like the price is getting rejected by those levels which is why I would expect more downfall for Ethereum in the upcoming period.

Market sentiment

Ethreum’s hourly chart technical indicator signal a sell.

Pivot points

S3 411.23 S2 434.49 S1 445.57 P 457.75 R1 468.83 R2 481.01 R3 504.27

XRP/USD

From yesterday’s at 0,45548$ the price of Ripple has decreased by 5,31% and is currently trading at 0,431$

Looking at the 2 hour chart we can see that the price has broken out off of the ascending channel in which it was consolidating which is why more downside is expected from here.

Market sentiment

Ripple’s hourly chart technical indicator signal a sell.

Pivot points

S3 0.40185 S2 0.42371 S1 0.43485 P 0.44557 R1 0.45671 R2 0.46743 R3 0.48929

Conclusion

In yesterday’s report I have discussed the possibility of a breakout from the downside for the major cryptos as well as the global chart market cap evaluation. As that happened yesterday, in the upcoming days more downside is expected for the crypto market.

The current market sentiment for Ethereum is positive, meaning out of 133 mentions in total 77,44% were positive.

The current market sentiment for Ethereum is positive, meaning out of 133 mentions in total 77,44% were positive.

Overall, hourly chart signals a buy, however, there are also nine neutral signals.

Overall, hourly chart signals a buy, however, there are also nine neutral signals.

The current sentiment for Ripple is slightly positive meaning 62.71 out of 59 mentions in total are positive.

The current sentiment for Ripple is slightly positive meaning 62.71 out of 59 mentions in total are positive.

Overall hourly chart signals a buy.

Overall hourly chart signals a buy.

Overall, hourly

Overall, hourly

The current sentiment is positive, meaning 75% of 64 mentions in total are positive.

The current sentiment is positive, meaning 75% of 64 mentions in total are positive.

Overall, hourly chart signals a sell.

Overall, hourly chart signals a sell.