Hot Topics:

- NZD – Kiwi falls 0.46% waiting for PPI data release.

- AUD – Making a triangulation expecting RBA Minutes.

- JPY – Nikkei rises and pull the USDJPY.

Main currencies daily performance.

NZD – Kiwi falls 0.46% waiting for PPI data release.

In the Oceanic Session, the Statistic New Zealand (Stats NZ) will release the Producer Price Index (QoQ). The analyst consensus expects a fall in the PPI input from 1% to 0.3%, and in PPI output from 1% to 0.4%. This PPI forecast is aligned with the last CPI (QoQ) that reached 1.6% in Q4, below the 1.9% registered in Q3.

In the pair NZDUSD, we are observing the minimum recorded in the last session, which coincides with the weekly pivot point (0.73538). If the Kiwi falls below the weekly pivot, we will look for short positions up to the first weekly support level (S1 = 0.72707), which is a potential profit of approximately 80 pips.

AUD – Making a triangulation while expecting RBA Minutes.

Today the minutes of the last meeting of the Board of the Reserve Bank were announced, they decided to keep the interest rate unchanged at 1.50%. The Aussie in the hourly chart is developing a triangulation structure; in case of falling below 0.78912, it could get to drop to 0.77943. On the contrary, if it breaks higher, the objective would be 0.80097.

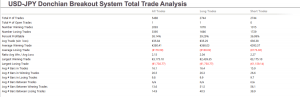

JPY – Nikkei rises and pull the USDJPY.

In the first session of the week, the Nikkei 225 index rose by 0.48%, and by inverse correlation pulled the USDJPY pair. The decorrelation between both instruments was commented on in our Daily Abstract on February 16th, where we mentioned that “this divergence in the correlation between the Nikkei Index and the USDJPY should be eliminated again” to converge in favour of the major trend of the indexes.

In the short-term, we will maintain long positions if the USDJPY climbs above 106.906 with the objective at 108.26 and a maximum extension at 110.

© Forex.Academy