In terms of popularity, the Japanese yen (sign: ¥, code: JPY; meaning: circle, round object) ranks third among the eight most traded currencies in the world, only preceded by the USD and the EUR. This currency forms some of the most traded crosses as well, such as the USD/JPY currency pair that holds an 11% volume of all trades worldwide. As such, the JPY is also one of the most liquid currencies and enjoys the status of a reserved currency in many countries around the globe.

Created in the late 19th century by the Meiji dynasty, the currency was part of the government’s goal of unifying Japan and modernizing the country’s economy. From the historical perspective, the JPY is not as old as the GBP, yet it has also undergone some tumultuous periods to this day. In particular, during the time of the Second World War, the Japanese official currency lost its value, which resembles what Germany had experienced in World War I. After the war ended, the YPY was pegged to the USD in the reconstruction period, as many European currencies before the EUR were (except for the GBP). Most currencies have at some point in history been tied to the USD especially because the fiat money’s worth is only of its perceived value since there are no hard assets to back it up.

Therefore, due to the post-war state of the JPY, the ability to exchange Japanese money for the USD generated some stability to the currency, which is what all other currencies pegged to the USD aimed for. At the time 360 JPY was enough to buy only 1 USD, yet it still transformed the JPY’s instability into a more stable state, which is probably why this fixed relation between the two currencies lasted for approximately 28 years. Upon the US leaving the gold standard in 1973, the JPY was left to trade freely. This led to the Japanese economy booming in the 80s and early 90s, which not only recovered but also became the top manufacturing country on the planet. Since 2009, yen coins of 1, 5, 10, 50, 100, and 500 have been used, whereas there are currently 1,000, 2,000, 5,000, and 10,000 yen notes in circulation.

Bank of Japan

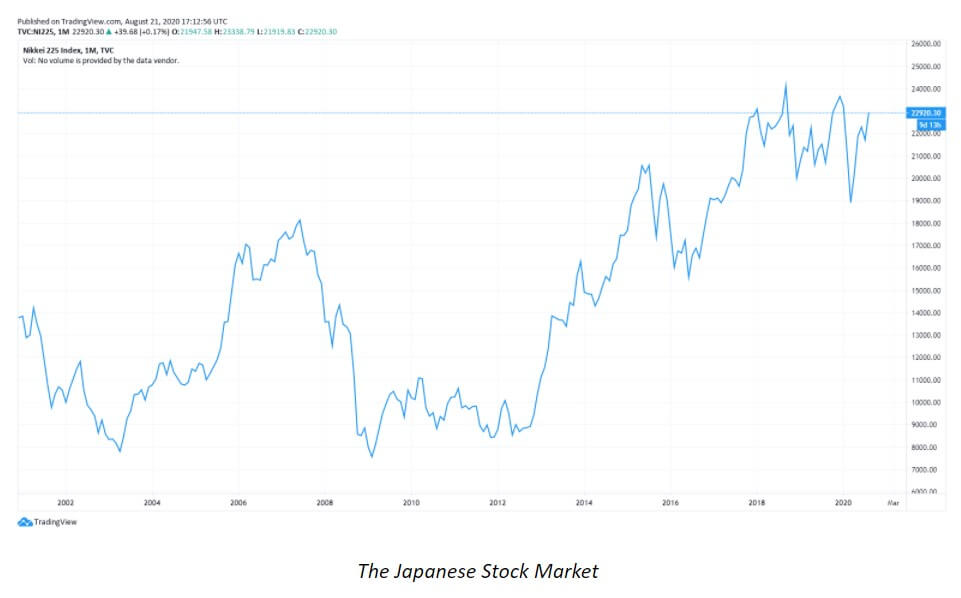

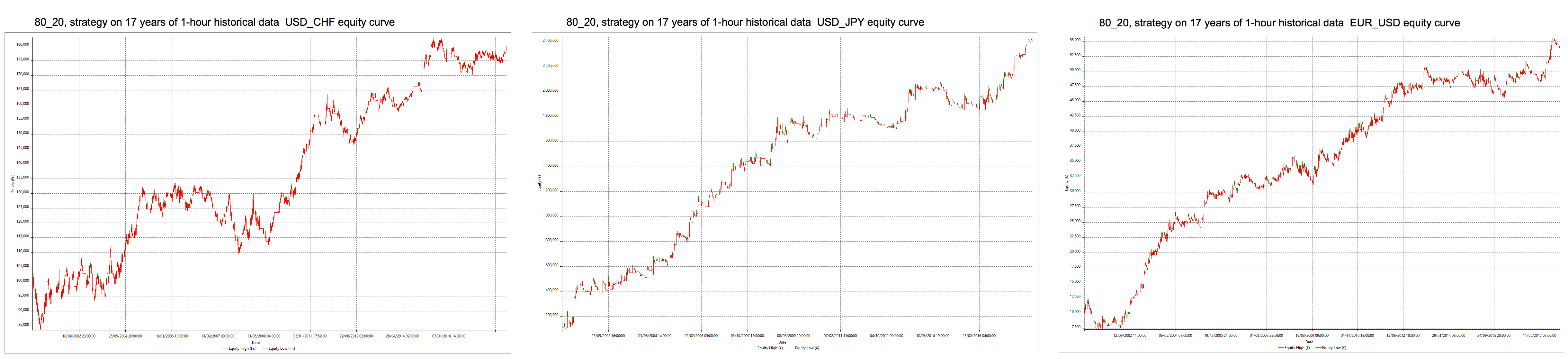

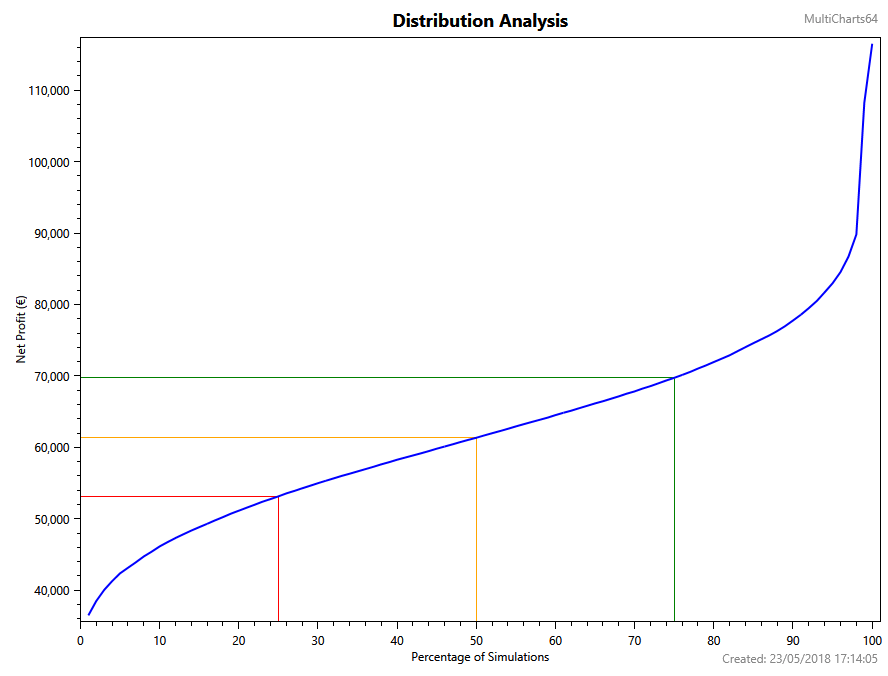

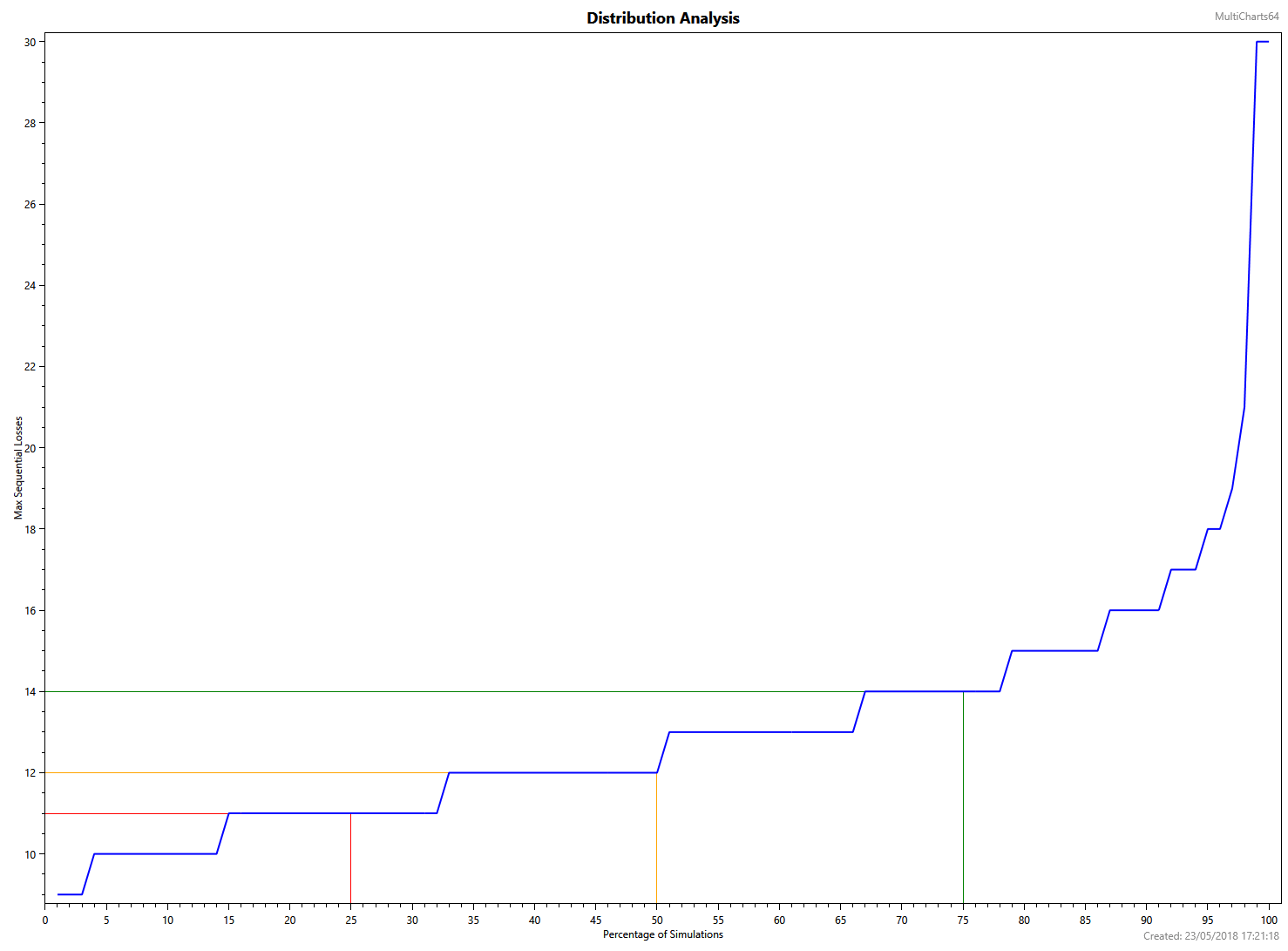

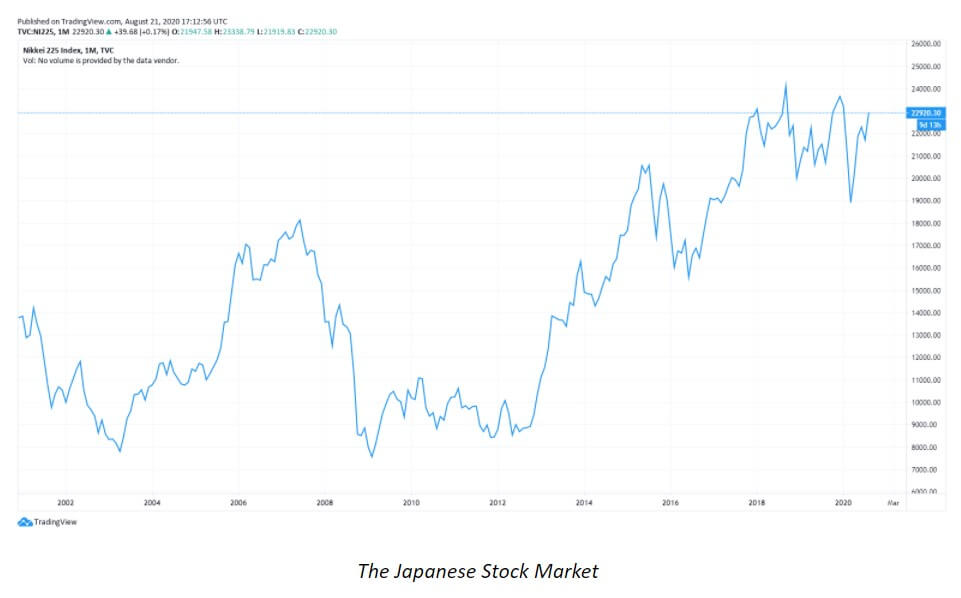

The central bank, called the Bank of Japan, has governed the currency since 1882. The bank consists of 30 members, whereas its Monetary Policy Board numbers 9 members who are responsible for managing interest rates. The governor represents the bank in public and has the tie-breaking vote. The current Governor, Mr. Haruhiko Kuroda, was appointed in 2013, replacing a conservative predecessor, Mr. Masaaki Shirakawa. The previous governor’s rule was marked by great dissatisfaction among the citizens due to the general lack of action, quantitative easing, and ideas to improve the economy and the currency since the 90s’ downturn. In the early 1990s, the Japanese stock market, Nikkei (or Nikkei 225) was 41,000 JPY. This bubble burst down to approximately 6—7000 JPY, and the market traded between 7 and 10 thousand JPY for more than 20 years after. Only after 2013 did Nikkei start to consistently exceed these values to now stand at a much higher level of above 20 thousand JPY (see the chart below) pointing towards tangible economic growth brought upon by the new plan. When the current (31st) governor was appointed, he was promised to bring about a change and propel the Japanese economy away from the several-decade-long sleep.

The investment of trillions of Japanese yen into the country’s economy, finally setting off inflation, jump-started the currency and the growth. The chart below also reflects how the financial crisis of 2007/2008 affected the Japanese market when a number of countries were running toward safe-haven currencies such as the JPY, which will be further discussed later in the text. Now, in the midst of the global pandemic, the Bank of Japan again took action to safeguard against the impact of the COVID-19 on the country and its economy. As of March, when we could see some larger drops not only in Japan but in other countries across the globe as well, the Japanese central bank enhanced monetary easing, implementing several measures to stabilize the economy. These measures have proved to be successful so far, with the country’s financial system maintaining the overall stability and functioning of financial institutions. Under the circumstances, the highest increase in the last 30 years was registered for bank lending in May, along with a significant increase in CP and corporate bond issuances as well as a decrease in the tension in financial markets.

Carry Trade

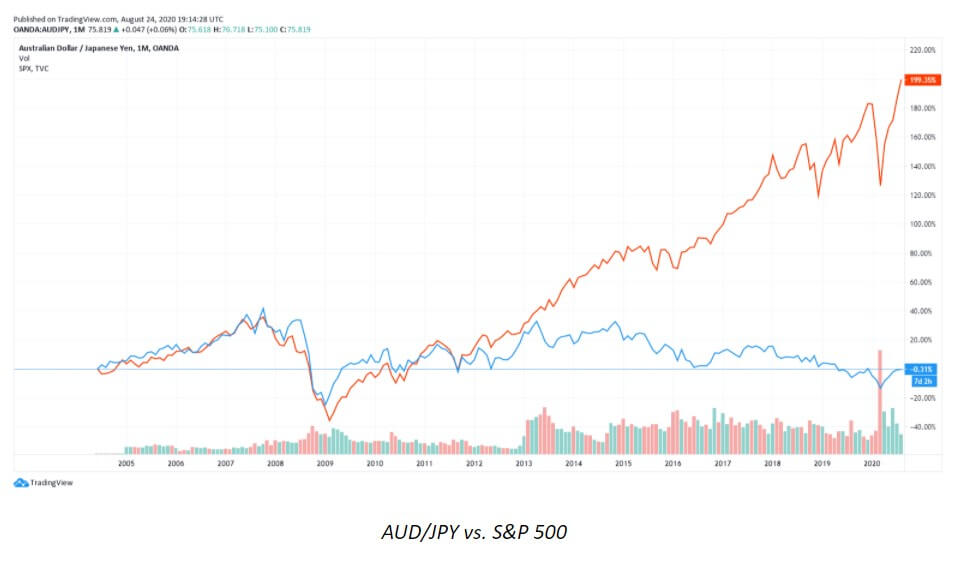

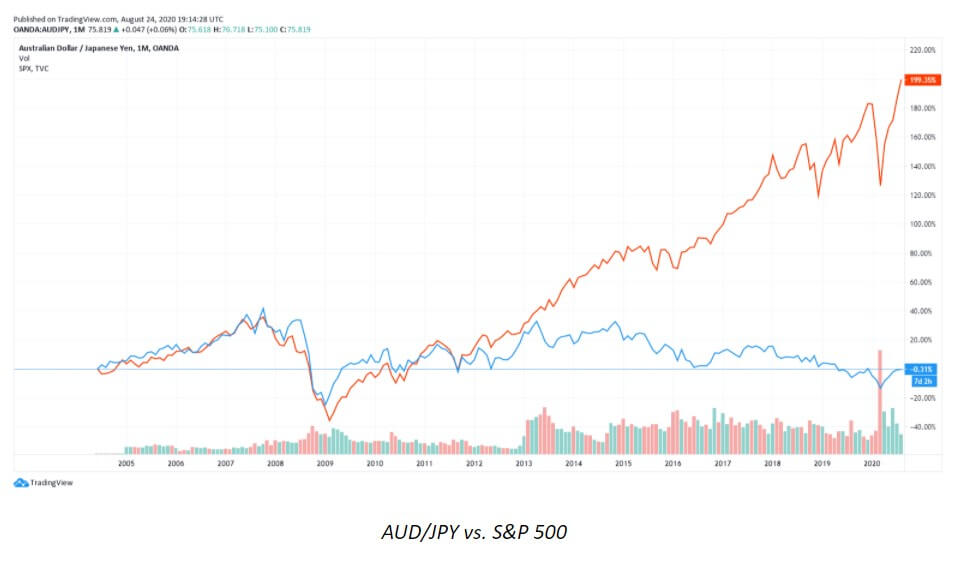

Between 2002 and 2007, the world experienced tremendous changes in economies, such as the one brought up by the expansion of the internet. Then in 2001, the S&P 500 value dropped by approximately 22% and the world economies seemed slightly unstable for a while. After 2004 and until 2007, there was a great boom in the economy, supported by massive moves in real estate as well as exorbitant prices of oil and gasoline. The JPY, however, weakened during the same time, making Japan the sole country unable to reflect the overall growth. Everyone seemed to be more interested in taking risks and, at the same time, great expansion was noticeable in Canada, Australia, and New Zealand due to their production of resources such as gold, silver, and copper, whose prices then started to increase.

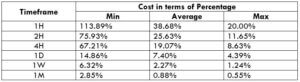

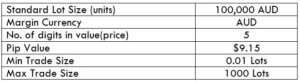

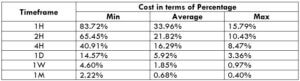

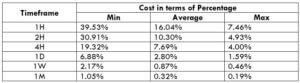

The trade between China and Australia was also a good example of how the exchange of the commodities connected two economies: Australian mining supported the Chinese infrastructure investments before the Olympics. During that time, the price of some commodities, e.g. copper, doubled and inflation was particularly high in countries such as Australia, whose central bank increased interest rates to almost 10%. Japan, however, whose economy was stagnant at the time, had its interest rates at 0.5%. This led to investors displaying the tendency to borrow low-yielding currencies and sell high-yielding ones, which only weakened the former. Currency pairs such as the AUD/JPY cross were interesting not for the sake of trading, but for the benefit of the swap.

Since one currency’s rate is 10% and one goes short on the currency that pays 0.5%, the swap rate would actually be 8% for the year with fees removed, which is an amazing return. As many found this to be a great opportunity, the massive interest in this pair caused the AUD to appreciate, and so did the CAD and the NZD, whereas the JPY’s value decreased and kept going down as a result. Once this entire bubble burst, the stock market did crash, but currencies suffered even more with an unbelievable AUD/JPY 55% plunge over a few months. Many JPY-based pairs reflected massive drops at the time which largely contrasted the previous growth.

The years between 2004 and 2007 seemed to be focused on building and, finally, 1 trillion USD was estimated to have been staked only in short yen carry trades. Many say that such movements in the currency market were unprecedented when traders were able to get around 500 pips In AUD/JPY trades in a single day. Carry trades are not single currency phenomena as they occur when there is a high-yielding currency and a low-yielding one, leading to trades lasting longer than expected because of mass interest in such pairs.

Key Economic Reports

Japanese economic reports seem to have had little impact on the movement of the country’s official currency in the past and there generally appears to be little interest in the economic numbers of Japan. While the US’s economic reports end up affecting all currencies, some other countries, e.g. Australia, do not have such a comprehensive, widespread influence. As opposed to Australia, however, Japan’s reports barely even influence its own currency. Even the Bank of Japan’s Outlook Reports and the meetings they hold in April and October prove to have little effect on the JPY.

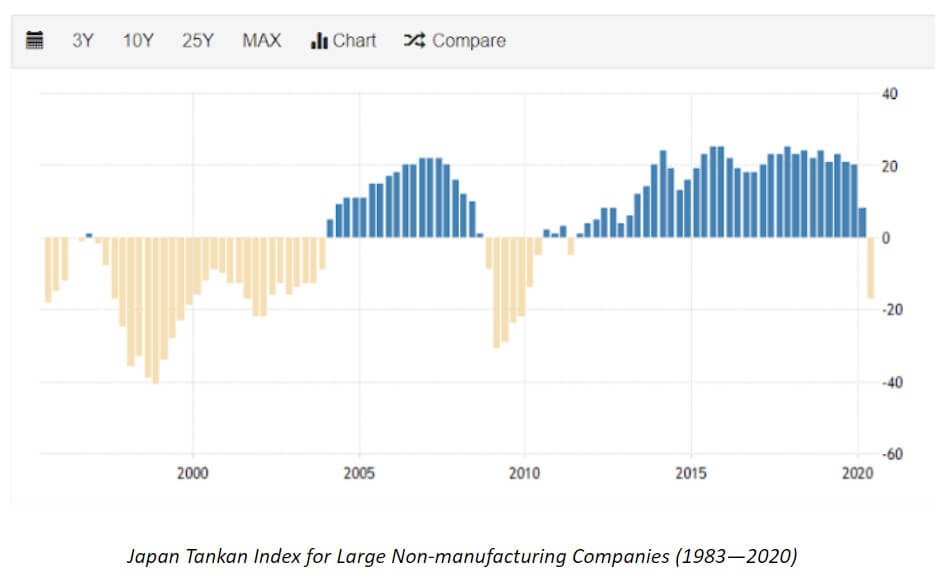

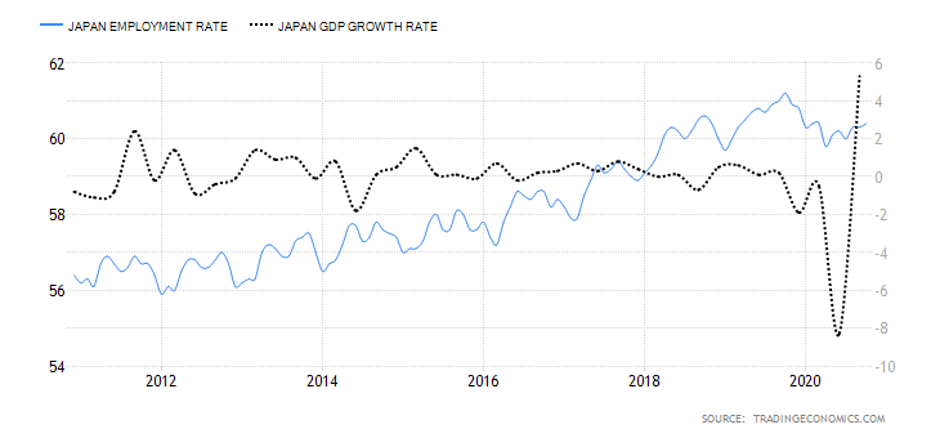

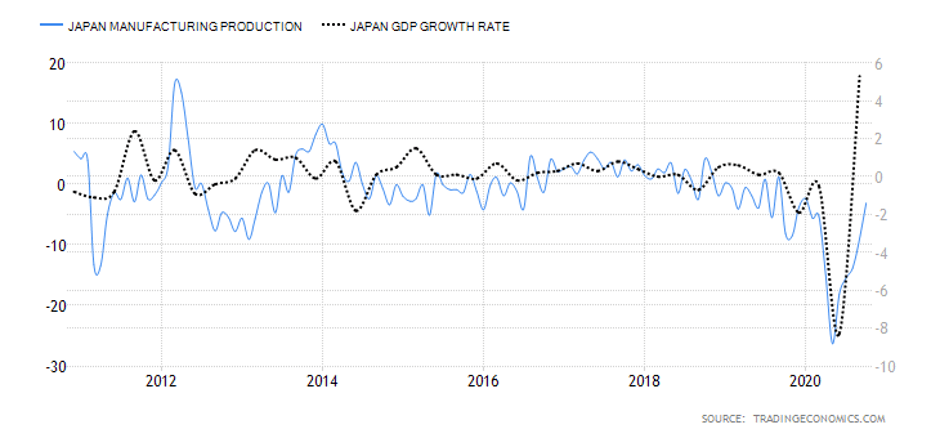

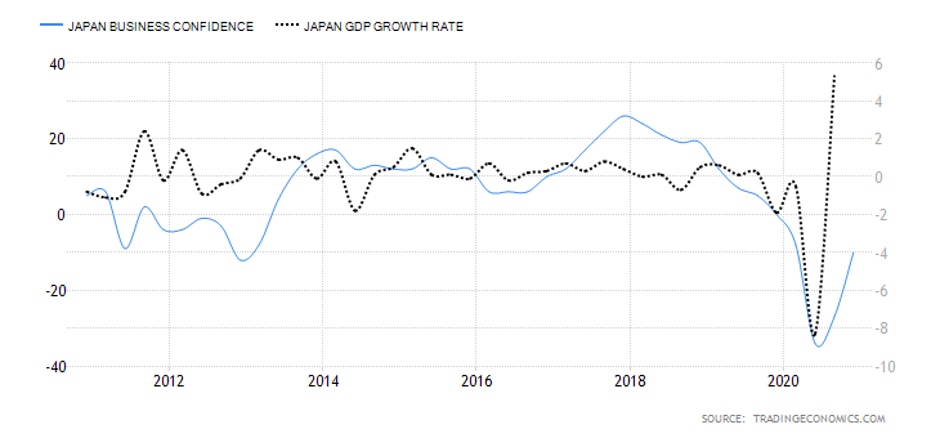

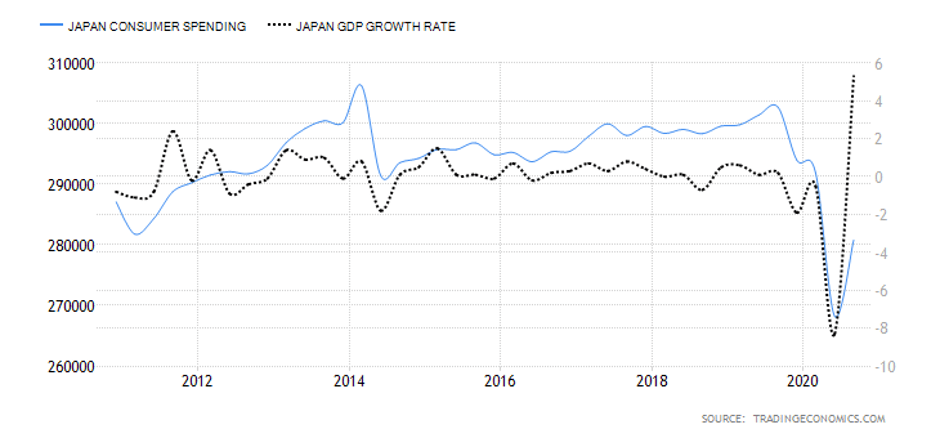

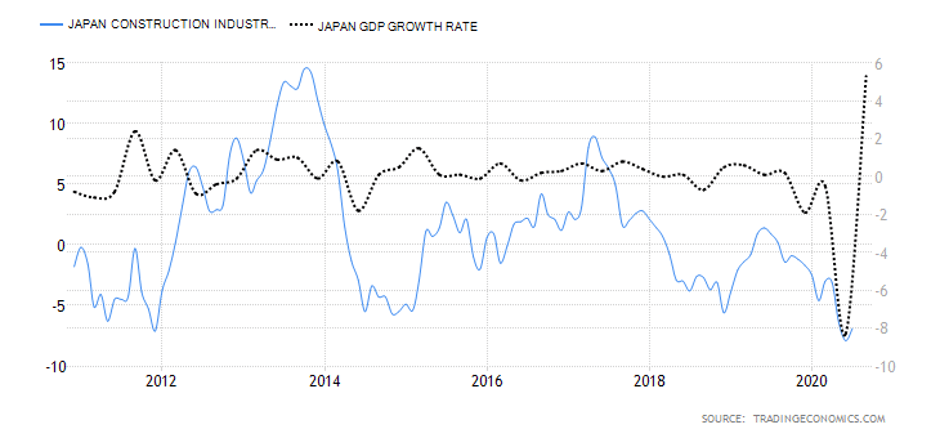

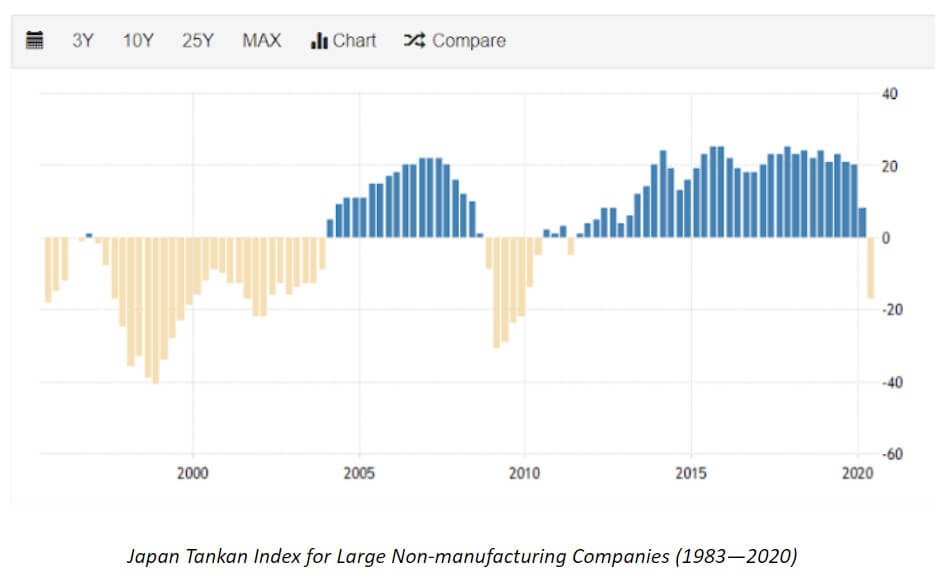

Despite the fact that the currency does not undergo massive or meaningful changes upon the release of these documents, traders should still be educated on some basic economic numbers that might have some impact on the currency. Some of the common reports that might concern forex traders are GDP, Retail Sales, Tankan Manufacturing Survey, and core CPI. Among these, the Tankan Manufacturing Survey, which is essentially a quarterly survey revealing the manufacturing strength of the Japanese companies, may be the most important document of all. In July this year, due to the COVID-19 pandemic, the report reflected the biggest low since the last quarter of 2009 when, for example, we could see this plunge in the currencies market as well (see the two charts above and below).

The Most Traded Pairs

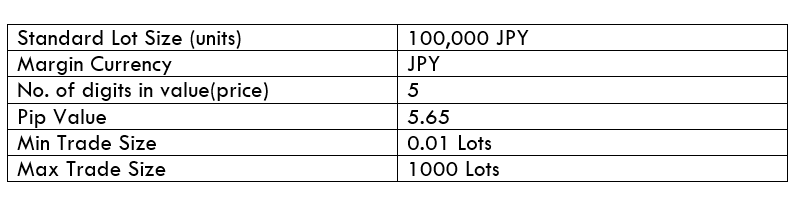

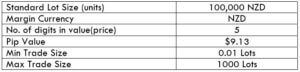

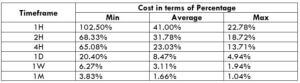

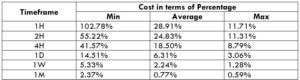

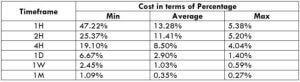

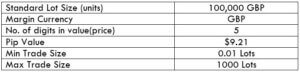

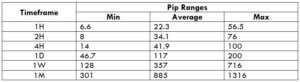

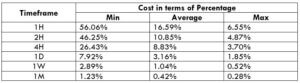

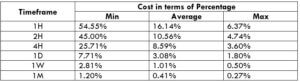

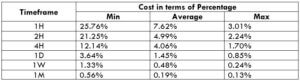

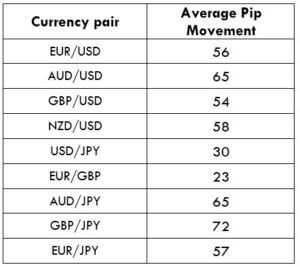

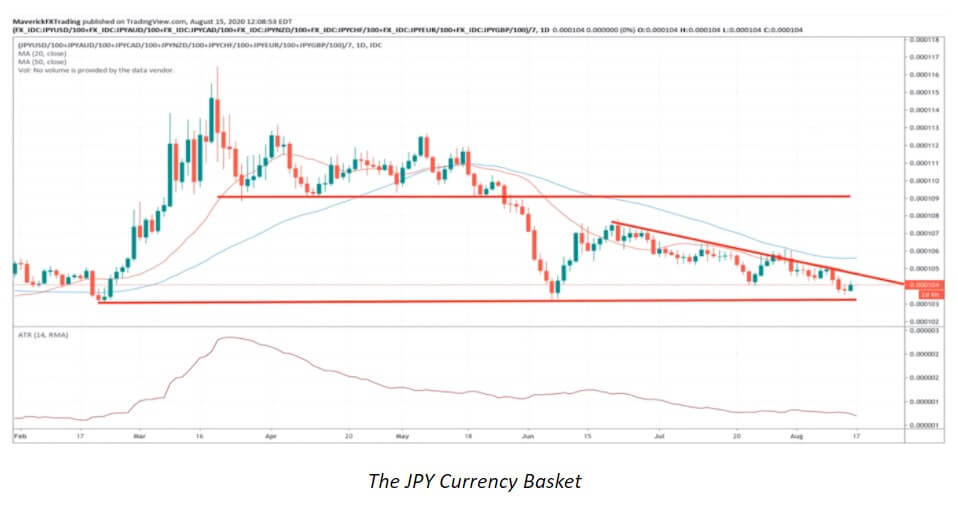

The most-traded JPY crosses are the following: USD/JPY, EUR/JPY, GBP/JPY, CHF/ JPY, AUD/ JPY, NZD/JPY, and CAD/JPY. The USD/JPY currency pair equals 11% of all currency trades across the world, preceded by the 37% volume of the USD/EUR cross. JPY crosses, unlike the USD/based pairs, for example, are specific in that the JPY is always the recessive currency, which implies that once paired, all other currencies are against the JPY. This allows traders to easily assess relative strength and weakness in all JPY crosses, which is often much more difficult with other currency pairs that do not involve the JPY. Just by looking at the currency pairs listed in the first sentence of this paragraph, we can immediately tell that the GBP/JPY is the strongest pair, whereas the AUD/JPY is the weakest, due to the other two currencies’ relation to the JPY.

How to Trade the JPY

The JPY is primarily seen as one of the safe-haven currencies due to its stable, exporting economy backed up by the possession of major reserves and trade surplus. Some other countries, such as the US and the UK, still seem to be battling trade deficit difficulties despite having strong (or stronger) currencies than Japan. The fact that Japan has more exports than imports influences its economy and brings more money into the country, preserving the status of the JPY as one of the favored reserve currencies. This stability of the country is believed to make the JPY withstand economic stress even better than the USD for example. Japanese interest rates have historically been some of the lowest ones in comparison to other central banks, currently standing at -0.10%. An interesting fact about the Japanese currency concerns the fact that inflation has never truly been a major challenge for Japan, whereas deflation has. As discussed above, the extensive exportation has led to a massive trade surplus, and even the current Governor’s goal was to surpass this issue and raise inflation to at least 2%.

Current Events

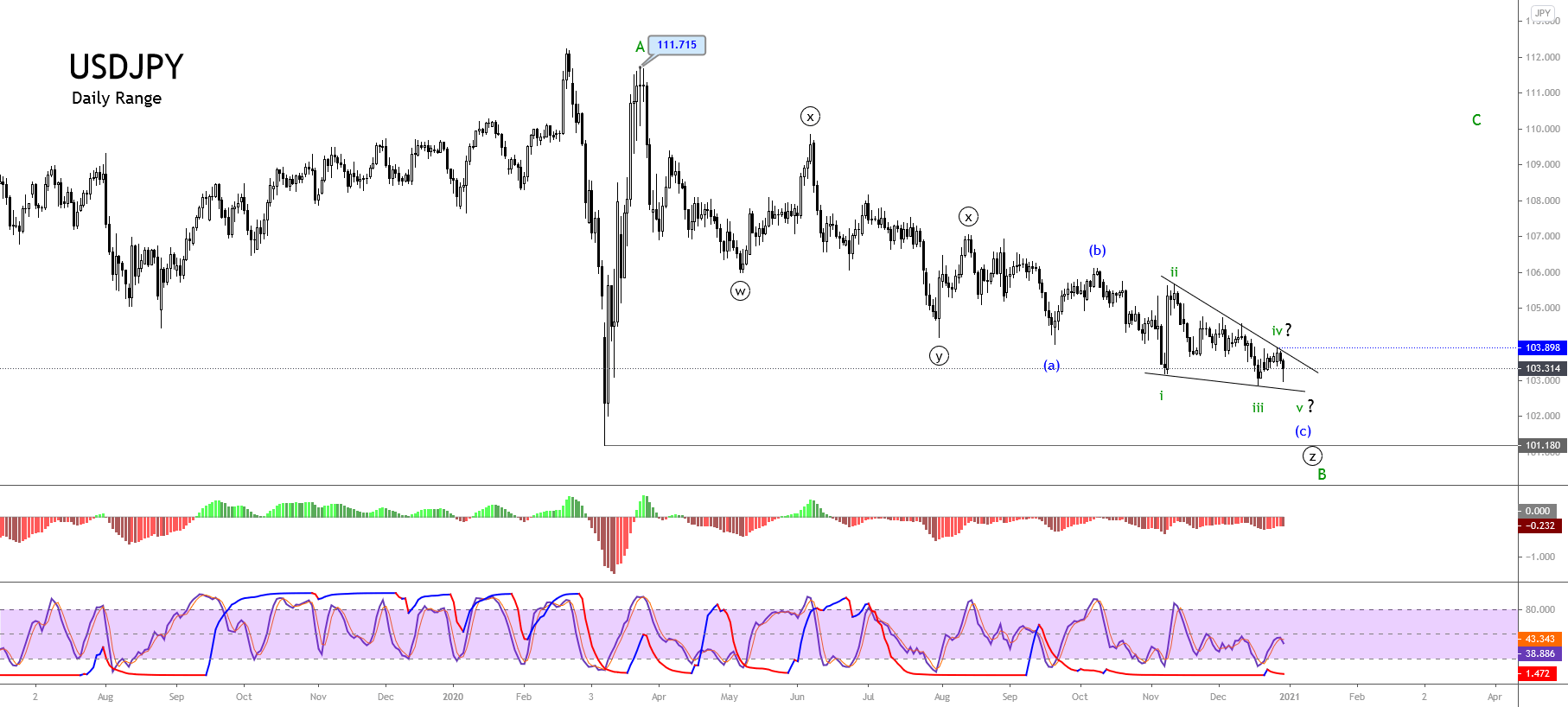

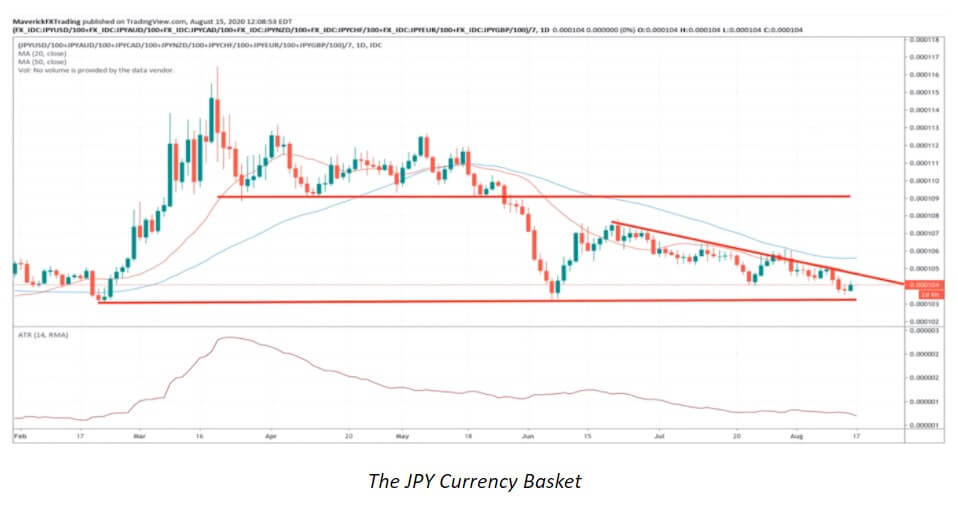

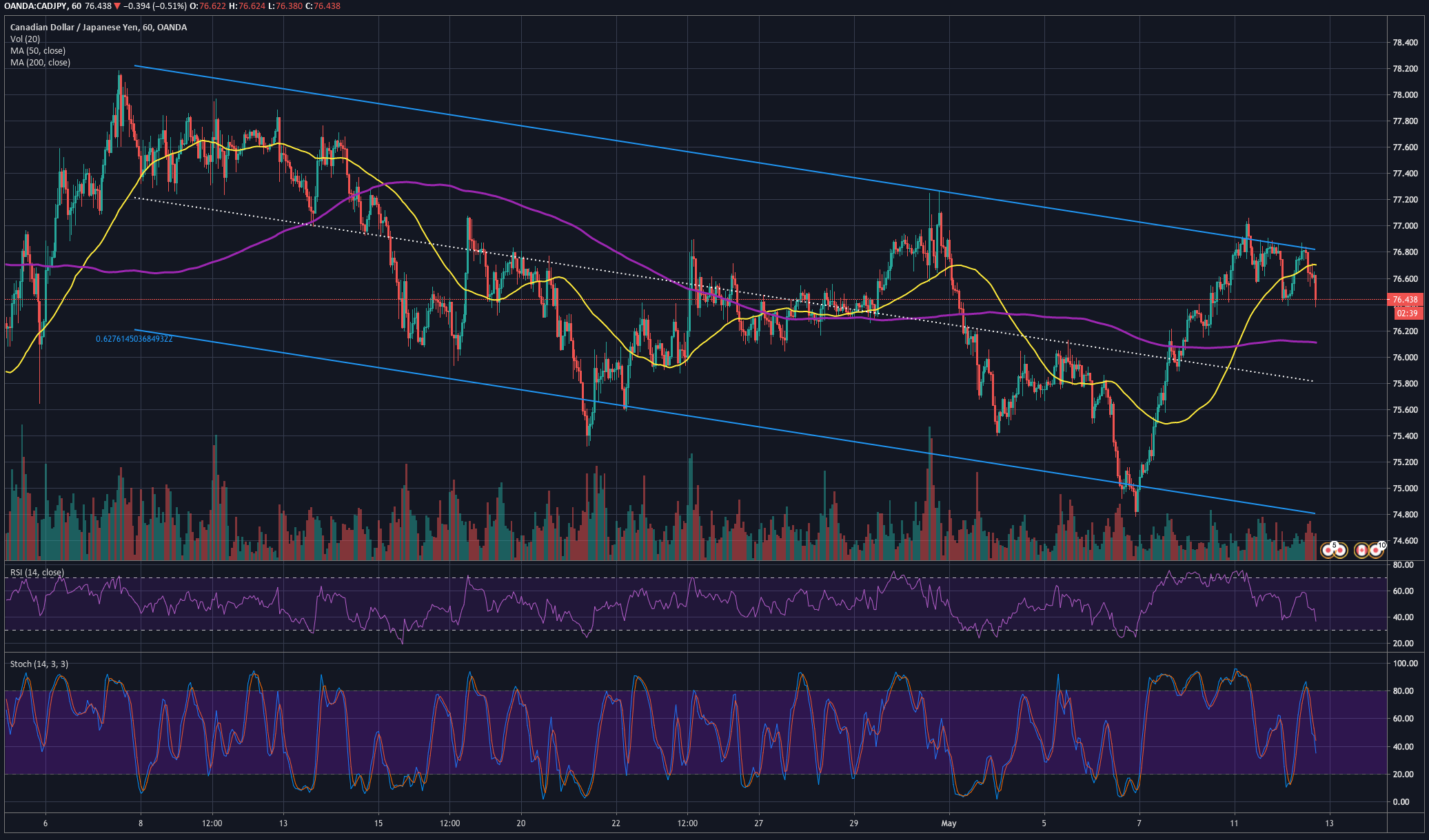

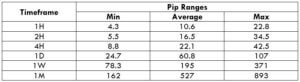

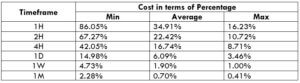

This currency has been moving downwards for a while now although it has not broken down yet. Some professional traders suggest that, should there be stimulation from the equities market in the form of a push upwards, the JPY could respond with a descending movement. The currency has been subject to volatility in previous weeks and a number of JPY-based crosses have come near major technical levels, putting longer-term trends at risk. Nonetheless, few actual breaks have been made with ranges remaining mostly intact. Should volatility still arise, traders may easily witness some price swings.

Just prior to the onset of the coronavirus pandemic, the Japanese economy experienced in 2019 the biggest plunge since the second quarter of 2014 of 6.3%. Following this biggest GDP contraction in more than five years, the previously discussed Tankan survey revealed the first drop into the negative after many years. The volatility peaked in March, yet has slowly drifted lower since in particular to the world central banks’ decision to inject great amounts of liquidity into the financial system. Geopolitical tensions and a slow global economic recovery may still affect the JPY in the following months. The country’s neighbor’s strained trade relation with the US may lead to a sustained risk aversion period, driving the JPY higher against other major currencies.

In order to help with the impact of the virus, the Japanese government put into effect a massive stimulus plan, amounting to the value of 20% of the nation’s economic output. With the estimated 60% debt issuance in 2020, the Bank of Japan may need to increase its purchases of Japanese Government Bonds due to a lack of global demand so as to be able to keep implementing yield curve control effectively. The interest rates are still way under the mandated 2%, yet the accommodative approach of the Japanese government and Bank of Japan may help the JPY withstand periods of volatility in the future and stop the currency from declining. Whenever there was any instability in the past, traders naturally diverted to the currencies with the greatest liquidity such as the JPY, which appears to still have the potential to keep the safe-haven status.