In the course of 2017, the projections of the Federal Reserve almost did not change due to the good performance of the labour market. Good figures in the creation of jobs added to a modest but solid economic growth throughout the year. This article will present the macroeconomic projections that the Federal Reserve had for 2017 and for the following years, and how some of these were modified during the meetings.

At the September meeting, the Federal Open Market Committee (FOMC) decided to keep the interest rate unchanged at 1.25%. It was decided to leave the rate unchanged in order to continue encouraging the accommodative policy and for the labour market to continue strengthening. In addition, inflation did not show positive behaviour throughout 2017 so the committee decided to wait to see if inflation accelerated in the last quarter of the year.

Also at the September meeting, it was decided to start the normalisation policy of the balance sheet in October, reducing the securities holdings by the bank in a gradual and predictable manner so as not to affect the market.

According to Yellen’s statements in September the committee observed a moderate but solid growth of the US economy, a labour market with very low unemployment rates that boosted household wealth, which translated into good consumption figures. Business investments accelerated in the third quarter and exports showed strength in September, having a good performance reflecting the good economic conditions of 2017.

The committee was aware that the results of the third quarter were going to show a slight deceleration due to natural disasters occurring mid-year, but after the third quarter, a rebound was expected in economic activity. This would be due to the resumption of activities of industries in the affected districts. In August the unemployment rate was 4.4%, core inflation excluding volatile goods such as food and energy categories was low and far from showing signs of complying with the inflation rate of the committee.

However, the committee believed that the causes that kept inflation low were transitory as competition in mobile telephony or in general, globalisation that generated fierce competition and therefore prices in many markets had a downward trend. Hurricanes, despite having caused material damage and affecting the population in several districts, were a boost for inflation because fuel prices increased due to damage to refineries and platforms.

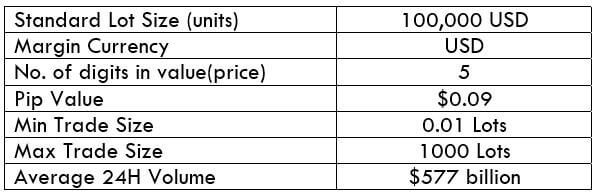

In September, the projections that the Federal Reserve had for 2017 were:

- Real GDP: 2.4%.

- Unemployment: 4.3%.

- Inflation 1.6%.

Compared to the June projections, the committee slightly changed the projections of real GDP due to the greater strength of the economy, but inflation projections were reduced because it softened its behaviour in the second quarter and beginning of the third quarter.

In the following graph you can see the projections for 2017 and for the next three years:

Graph 46. Economic projections of Federal Reserve Board members and Federal Reserve Bank presidents under their individual assessments of projected appropriate monetary policy, September 2017. Retrieved 19th January 2018 from https://www.federalreserve.gov/monetarypolicy/files/fomcprojtabl20170920.pdf

As you can see the expected economic growth in 2017 is above the long-term growth estimated by the reserve. The unemployment rate is below the long-term natural rate, but there were no changes compared to the estimate in June and inflation is below the 2% target, and was revised downwards due to its weak performance during 2017.

In Yellen’s comments, it was stated that the 1.25% interest rate was below the projected interest rate to be long-term, so it remained an expansionary rate. The average rate expected by the committee on federal funds was 1.4% at the end of 2017, 2.1% for 2018, 2.7% for 2019 and 2.9% for 2020.

From October through to December, the committee expected to reduce its holdings of securities to a ceiling of $6 billion dollars per month for treasury bonds and $4 billion per month for agencies. These specified ceilings were taken as a restriction for investors to accommodate their expectations in accordance with the normalisation of the balance sheet.

Finally, the committee commented that its main tool to modify the monetary policy was the intervention of the interest rate of the federal funds. The normalisation of the balance sheet was not seen as an active reserve tool, but, if it was observed, a deterioration of the economy they could reverse or limit the normalisation of the balance sheet.

At the December meeting, the FOMC decided to raise the interest rate up to 1.5%. The decision was made after seeing a very good second and third quarter of the economy in contrast to a first quarter where the activity was slow. Household spending, business investment and exports were important aspects of economic activity in order to have this positive behaviour. The committee expected that the tax cuts would encourage economic activity in the future, but the magnitude and exact timing of the macroeconomic effects of the tax reform was not clear.

The unemployment rate stood at 4.1% in November and was below the expectations of the committee and the expected long-term rate. The committee expected that positive behaviour throughout the 2017 labour market, with a high number of jobs created and improvements in salaries due to the narrow job offer. In the future, it was expected that the behaviour would continue to be positive but not at such high rates due to the increase in interest rates, and the normalisation of the balance sheet, policies that would remove liquidity from the economy in general.

Despite this positive performance of the economy and the labour market, inflation remained below the 2% long-term goal of the committee. Core inflation in October was 1.4%, so it was far from the target, but the committee still believed that the causes of low inflation was transitory and had nothing to do with anything structural in the economy.

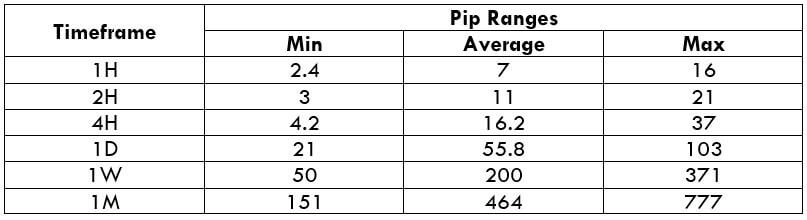

The following graph shows the projections that the Federal Reserve had and its modifications with respect to those that were in September.

Graph 47. Economic projections of Federal Reserve Board members and Federal Reserve Bank presidents under their individual assessments of projected appropriate monetary policy, December 2017. Retrieved 19th January 2018 from https://www.federalreserve.gov/monetarypolicy/files/fomcprojtabl20171213.pdf

Compared to the September projections of the real growth of the economy, projections rose not only for 2017 but also for the next three years. The unemployment rate change saw its projections reduced, moving away from the long-term figure. The projections of inflation remained almost unchanged, but showing that not until 2019 would it reach the goal of the Federal Reserve. For most of the members of the committee, it is clear that the tax reform will boost economic growth, but the magnitude was still unclear due to the fact that there is much uncertainty in most macroeconomic variables after this reform.

With these expectations on the growth of the following years, the committee guaranteed several increases of the interest rate in these following years, but specify that there is not much room left to have neutral rates because historically the current rates are lower, so it is not far off for the neutral level in the rates. That is, in the long term the committee expected to have lower rates than the rates that have been historically established. The projections on the interest rate are 2.1% for 2018, 2.7% for 2019 and 3.1% for 2020.

Additionally, the committee stated that the normalisation of the balance sheet was in progress since October. For Janet Yellen, the president of the Federal Reserve system has only the January meeting left when she will be relieved by Jay Powell, so December’s was the last scheduled press conference by her.

In conclusion, we see an economy growing solidly during the last three quarters, with a healthy job market and good salaries. The only negative aspect that has been observed in the meetings is the behaviour and the projections that they have on inflation because it has softened its trend in recent months, which shows that it is probably not transitory causes that have low inflation. It cannot be ruled out that the causes are structural, affecting in the future the projections of the monetary policy of the United States, so the reserve should be cautious in its next meetings.