Introduction

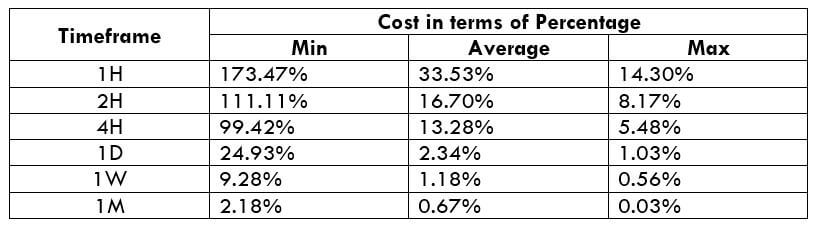

USDTRY, an exotic currency pair, is the abbreviation for the US Dollar against the Turkish Lira. One can expect high volatility in these pairs. Here, the US Dollar is called the base currency and TRY the quote currency.

Understanding USD/TRY

The value of USDTRY depicts the value of TRY equivalent to one USD. It is quoted as 1 USD per X TRY. So, if the market value of this pair is 5.9878, then 5.9878 Liras are required to buy one US Dollar.

Spread

Spread is the difference between the bid price in the market and the ask price in the market. These prices are set by the brokers. Hence, the prices from each broker differ. Moreover, it varies from the type of execution as well.

ECN: 12 pips | STP: 14 pips

Fees

The commission that you pay to your broker for taking a position in a currency pair is a fee on the trade. This, too, depends on the type of execution model. There is typically no fee on STP accounts. And on ECN accounts, there are a few pips of fees.

Slippage

Slippage is the difference between the trader’s requested price and the broker’s executed price. It depends on two factors, namely, the broker’s execution speed and market volatility.

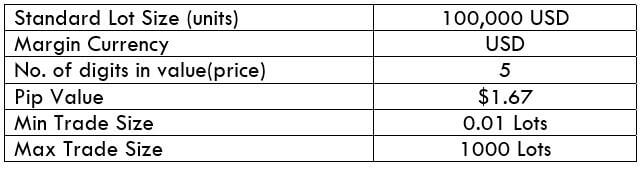

Trading Range in USD/TRY

The trading range is the range of the pip movement in a currency pair on different timeframes. With it, traders can determine their minimum, average, and maximum risk on a trade in a specified time frame.

Procedure to assess Pip Ranges

- Add the ATR indicator to your chart

- Set the period to 1

- Add a 200-period SMA to this indicator

- Shrink the chart so you can determine a large time period

- Select your desired timeframe

- Measure the floor level and set this value as the min

- Measure the level of the 200-period SMA and set this as the average

- Measure the peak levels and set this as Max.

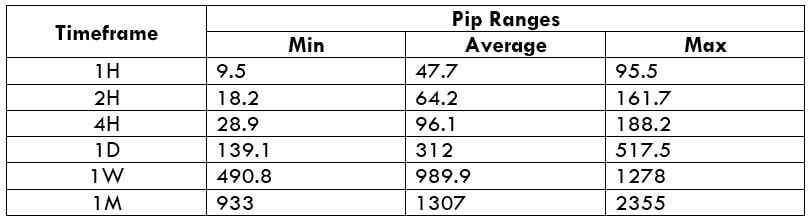

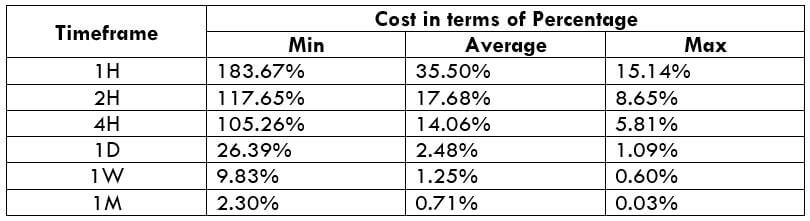

USD/TRY Cost as a Percent of the Trading Range

Apart from knowing how many pips the market moves in a given timeframe, it is also necessary to understand the total cost variation in a trade. And below are two tables (for ECN and STP) that will help determine the best time of the day to trade in the currency pair with reduced costs.

ECN Model Account

Spread = 12 | Slippage = 3 |Trading fee = 3

Total cost = Slippage + Spread + Trading Fee = 3 + 12 + 3 = 18

STP Model Account

Spread = 14 | Slippage = 3 | Trading fee = 0

Total cost = Slippage + Spread + Trading Fee = 3 + 14 + 0 = 17

The Ideal way to trade the USD/TRY

The costs on major currencies are pretty low, and the volatility is great. So it is ideal to enter any time in the market to trade these pairs. But, when it comes to exotic pairs, the volatility, as well as the costs, are quite high. Hence, one must be aware of when exactly they should trade these currencies.

The percentages in the above tables are directly proportional to the volatility of the market. Hence, we can conclude that costs are when the volatility is low and vice versa.

To determine the ideal times of the day to trade, you must glance at the volatility table and check if the current volatility if nearby the average values mentioned in the tables. If they are more or less in that range, you are good to trade that currency pair because this will assure a balance between both volatilities as well as costs.

Also, another simple way to reduce costs is by getting rid of the slippage on the trade. This can be done by executing orders using limit orders instead of market orders. In doing so, the total costs will reduce by a significant amount, and so will the cost of the trade.