Introduction

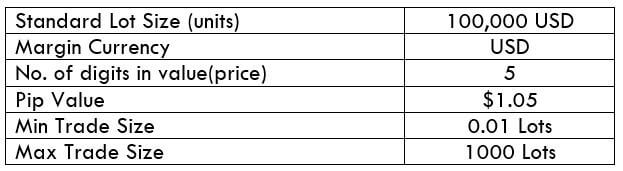

USDSEK, the US Dollar against the Swedish Krona, is an exotic currency pair in the forex market. USD is called the base currency and SEK the quote currency. Coming under the classification of exotic pairs, the volatility in this pair is pretty high.

Understanding USD/SEK

The value of USDSEK represents the quantity of SEK that is required to purchase one US Dollar. It is quoted as 1 USD per X SEK. So, if the current of this pair is 9.6123, then these many units of Swedish krona are required to buy one US Dollar.

Spread

Spread is the difference between the bid price and the ask price set by your broker. It varies from each broker. It also varies on how they execute the trade as well.

ECN: 12 pips | STP: 14 pips

Fees

There is some fee associated with each trade you take in the market. The fee, too, varies from broker to broker and the type of execution model.

Fee on ECN – 5-10 pips

Fee on STP – 0

Slippage

Slippage is the algebraic difference between the price needed by the client and the price the broker actually gave him. There is this difference due to the market’s volatility and the speed of execution of the trade. Note that slippage is quite high on exotic pairs.

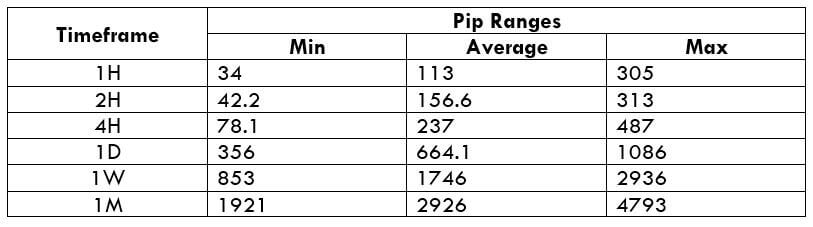

Trading Range in USD/SEK

The below table is the representation of the minimum, average, and maximum pip movement on the USDSEK pair. These values help us assess the gain that can be made or loss that can be incurred in a trade in a given timeframe.

Procedure to assess Pip Ranges

- Add the ATR indicator to your chart

- Set the period to 1

- Add a 200-period SMA to this indicator

- Shrink the chart so you can determine a large time period

- Select your desired timeframe

- Measure the floor level and set this value as the min

- Measure the level of the 200-period SMA and set this as the average

- Measure the peak levels and set this as Max.

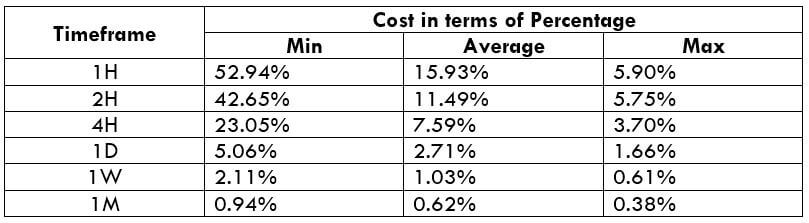

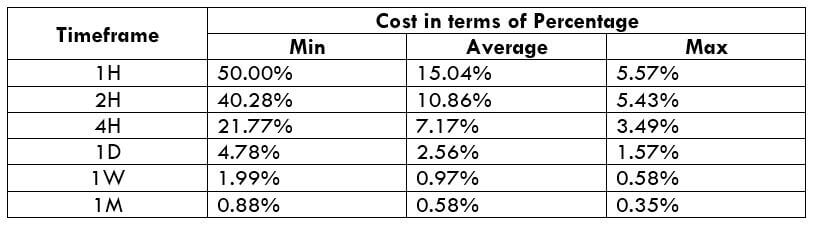

USD/SEK Cost as a Percent of the Trading Range

An application to the above table is the cost variation in a trade. By calculating the ratio between the total cost and the volatility values, we can determine the perfect times of the day to trade in the market. The comprehension of it is discussed in the upcoming topics.

ECN Model Account

Spread = 12 | Slippage = 3 |Trading fee = 3

Total cost = Slippage + Spread + Trading Fee = 3 + 12 + 3 = 18

STP Model Account

Spread = 14 | Slippage = 3 | Trading fee = 0

Total cost = Slippage + Spread + Trading Fee = 3 + 14 + 0 = 17

The Ideal way to trade the USD/SEK

Trading exotic currency pairs are different from trading major and minor currency pairs because volatility and volume are different. And when it comes to costs, the costs are higher in exotic pairs compared to major and minor pairs.

The magnitude of the percentage depicts the costs on the trade and is proportional to it. High values in the min column tell that the costs are high when the market volatility is low and vice versa.

To have sufficient volatility with affordable costs, one may trade those times when the volatility is around the average values.

Moreover, limit orders also help in reducing the costs by a significant amount. This is because only market orders have slippage, and limit orders don’t. Hence, cutting off slippage from the total costs will reduce the costs of the trade considerably.