Introduction

USDJPY is the abbreviation for the currency pair US dollar against the Japanese yen. This currency pair is very liquid and volatile. It is classified as a major currency pair. Here, USD is the base currency, and JPY is the quote currency. The currency pair shows how many JPY are required to purchase one US dollar.

Understanding USD/JPY

The exchange rate of USDJPY represents the units of JPY equivalent to one US dollar. For example, if the value of USDJPY is 109.550, then these many Japanese yen are required to buy one US dollar.

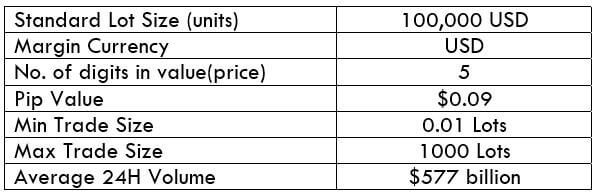

USD/JPY Specification

Spread

Spread is simply the difference between the bid price and the ask price. It depends on the account type. The average spread for ECN and STP account is shown below.

Spread on ECN: 0.5

Spread on STP: 1.2

Fees

The fee is basically the commission charged by the broker on each trade. Typically, the fee on STP accounts is nil, and there is some fee on the ECN account. There is no fixed fee on the ECN account and varies from broker to broker.

Slippage

Slippage is the difference between the price needed by the trader and the real price the trader was executed. Slippage happens when orders are executed as market orders. The slippage is usually within the range of 0.5 to 5 pips.

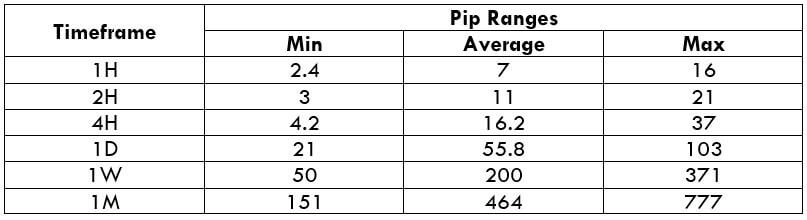

Trading Range in USD/JPY

The trading range is the representation of the minimum, average, and maximum volatility on a particular timeframe. It shows the range of pips the currency pair moved on a given timeframe. These values prove to be helpful in assessing a trader’s risk and controlling their cost on a trade.

USD/JPY PIP RANGES

Procedure to assess Pip Ranges

- Add the ATR indicator to your chart

- Set the period to 1

- Add a 200-period SMA to this indicator

- Shrink the chart so you can assess a large time period

- Select your desired timeframe

- Measure the floor level and set this value as the min

- Measure the level of the 200-period SMA and set this as the average

- Measure the peak levels and set this as Max.

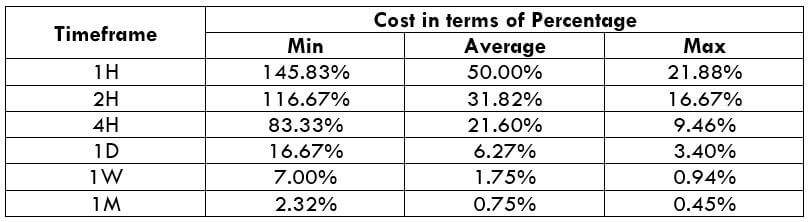

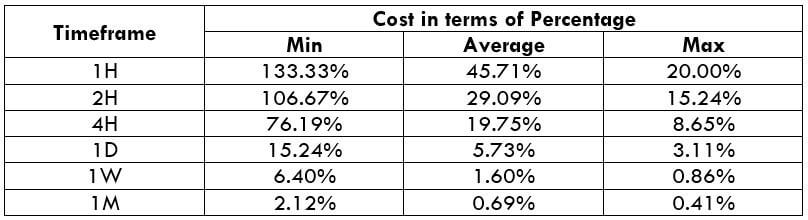

USD/JPY Cost as a Percent of the Trading Range

Just knowing how many pips the currency pair moved is pointless. To bring it some value, it is clubbed with the total cost to understand how the cost varies based on the volatility of the market. It shows cost and volatility are dependent on each other.

The relation between Cost and Volatility

Cost and volatility are inversely proportional to each other. When the volatility of the market is low, the costs are high; and when the volatility is high, the cost is low. More on this is discussed in the subsequent section.

ECN Model Account

Spread = 0.5 | Slippage = 2 | Trading fee = 1

Total cost = Slippage + Spread + Trading Fee = 2 + 0.5 + 1 = 3.5

STP Model Account

Spread = 1.2 | Slippage = 2 | Trading fee = 0

Total cost = Slippage + Spread + Trading Fee = 2 + 1.2 + 0 = 3.2

The Ideal way to trade the USD/JPY

The above two tables are formed by finding the ratio between the total cost and the volatility. It is then expressed in terms of a percentage. Comprehending the values is simple. It is based on the relation between cost and volatility. If the percentage value is high, then the cost is high for that particular volatility and timeframe. It can be inferred that the min column has the highest values compared to the average and max column. This simply means that the costs are high when the volatility of the market is low. Hence, it is recommended to open/close positions when the volatility is at or above the average mark.

Furthermore, apart from volatility, the cost is heavily affected by the slippage. As mentioned, this happens due to market order executions. Hence, to reduce your cost by up to 50% on each trade, it is recommended to trade using limit orders and not market orders.