Introduction

In the previous article, we discussed a strategy that was in the European session. However, there are a fair number of traders who prefer the U.S. session as they feel the market tends to be more exciting and thrilling. These traders consider the Asian session to be boring and quiet most of the time.

Many part-time retail traders based in the United States and Europe miss out on opportunities in European and U.S. sessions because of work and other business commitments. The only time they are left with happens to fall in the apparent boring and quiet Asian session. Therefore, it becomes necessary to come out with a strategy that is exclusively meant for the Asia session.

The strategy we will be going to discuss today is suitable for trading during the early-morning Asian hours. This time period has numerous opportunities for traders in different time zones across the world, whether they are part-time or full-time traders. We hope that the strategy will greet everyone like the bright morning sun.

Time Frame

The good-morning Asia strategy works well on the 4-hour time frame. This means each candle represents one day of price movement.

Indicators

This strategy is based on pure price action, and hence no indicators will be used during the process.

Currency Pairs

This strategy applies only to the AUD/JPY currency pair.

Strategy Concept

Opening hours of the Asian market begin a couple of hours after the U.S. market closes. The Asian market direction tends to take its cue from the previous day’s movement during the U.S. session because the U.S. market is the largest economy of the world, and most of the institutional banks are located in the U.S.

It is observed that when the U.S. market closes with the bullish sentiment, the Asian market usually starts the day bullish. If the U.S. market closes with the bearish sentiment, the Asian market remains bearish throughout the day.

During the early morning Asian hours, the best currency pair to take advantage of this phenomenon is none other than the AUD/JPY, as the Japanese Yen and the Australian dollar are the most active currency during the Asian session.

Looking at the price action, we take an entry right after the U.S. market closes at 05:00 PM. The first requirement of the strategy is that we need a ‘range’ or a ‘channel’ before the U.S. market closes. Depending on the position of the price and where the candle closes before the U.S., we take an entry. There are many rules that we need to follow before we can use the strategy profitably.

Stop-loss is placed above or below the technical levels, which is the easiest part of the strategy. The risk-to-reward ratio for this strategy is anywhere between 1.5 to 2, which is quite good.

Trade Setup

For this strategy, the closing of the 4-hour candle corresponding to 5:00 PM New York time is crucial for the strategy. Here are the steps to execute the strategy.

Step 1

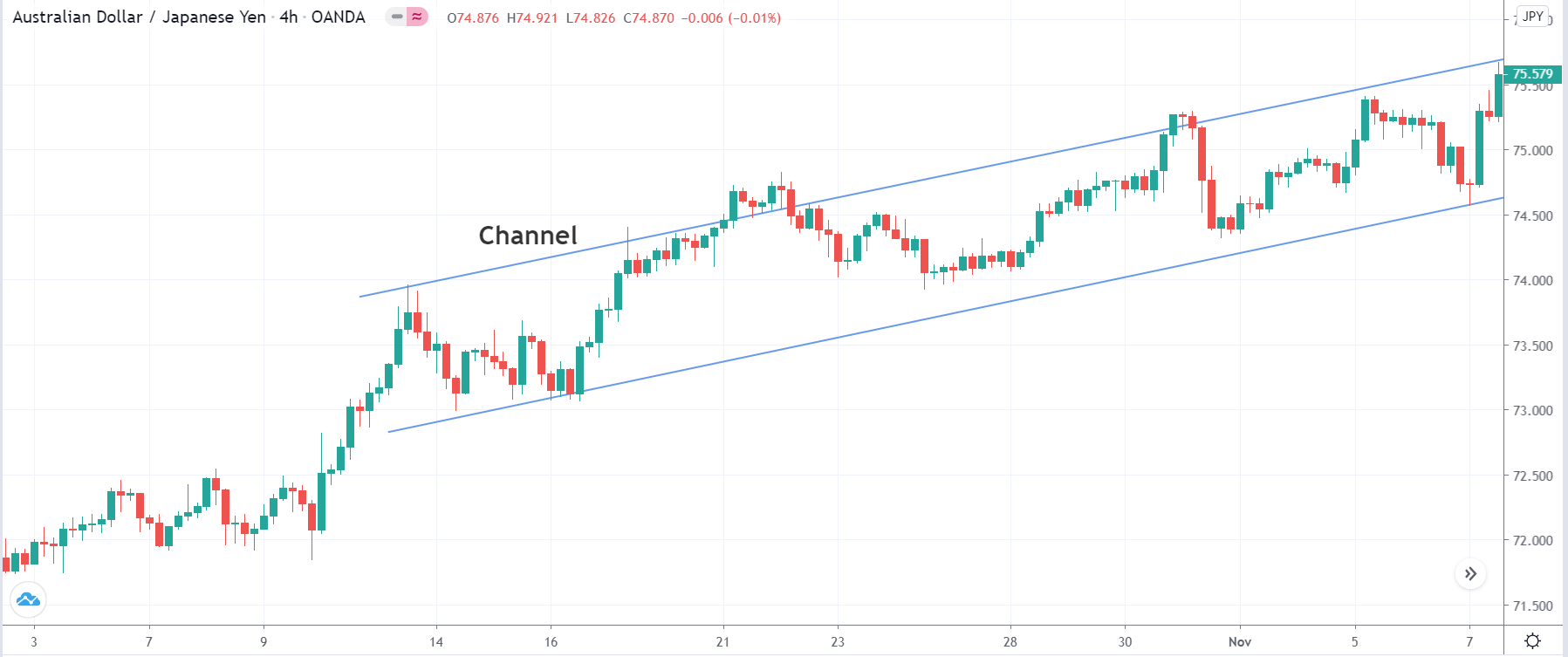

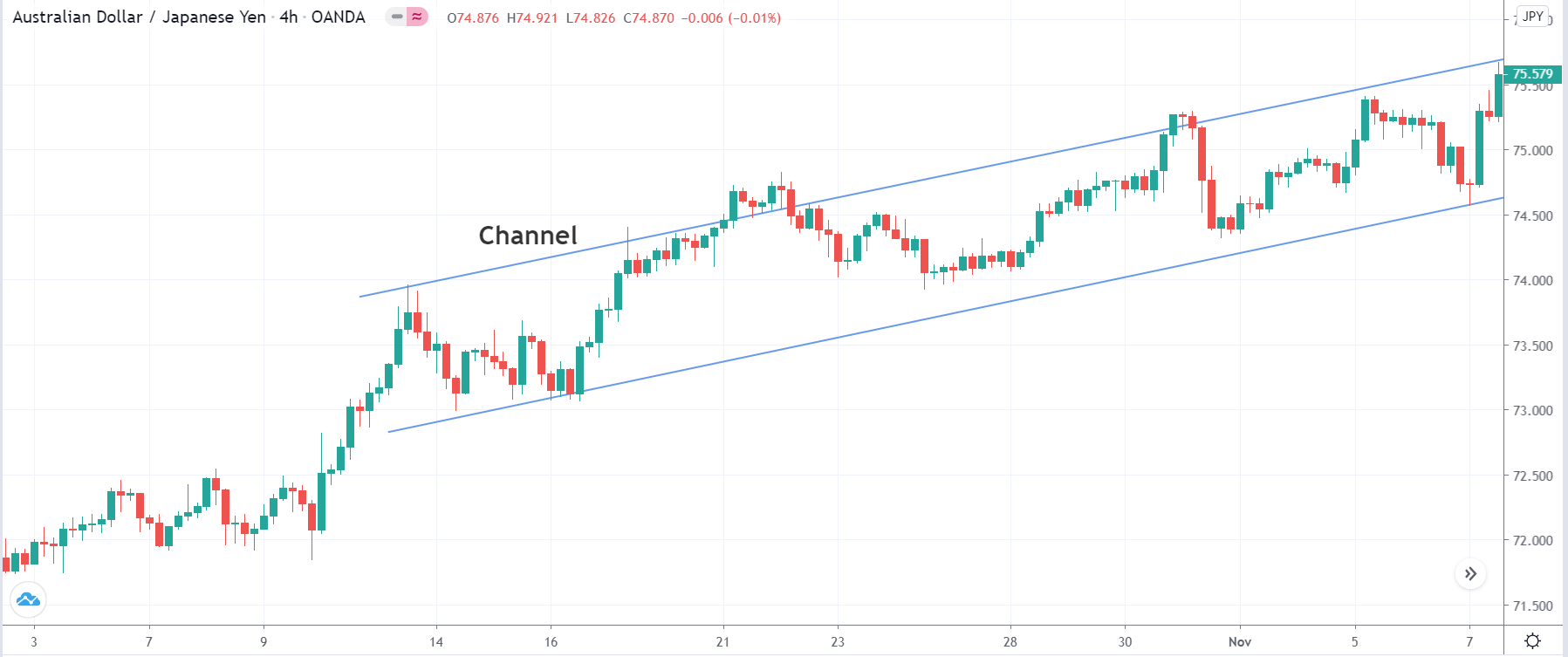

Firstly, we need to identify a ‘range’ or ‘channel’ on the chart of AUD/JPY. This becomes our trading region, where we will be carrying out all the trades. A ‘range’ or ‘channel’ is confirmed only if the price has reacted and reached the other end at least twice after touching the extremes.

We have considered an example of a trade where we will be applying the rules the strategy step by step. The below image shows the 4-hour time frame chart of the AUD/JPY pair, where we identified a ‘channel’ with multiple touches on either side.

Step 2

In this step, we need to pay close attention to the position of the price and the closing of the U.S. market. The most important part of the strategy is looking out for the price action taking place at the end of the range, which should be occurring at the close of the U.S. market. Depending on the signal we get from the market, we will take an appropriate currency pair position.

At the close (U.S.) if the price closes as a bullish candle from the support, we will enter for a ‘buy’ at the opening of the subsequent candle. If the price closes as a bearish candle from the resistance, we will enter for a ‘sell’ at the opening of the subsequent candle.

Step 3

In this step, we take an ‘entry’ with a suitable size and determine the stop-loss and take-profit for the trade. As mentioned earlier, we will enter for a ‘buy’ or ‘sell’ right after the U.S. market closes, and the next candle opens. This ensures that the risk to reward will be higher.

The stop-loss for the trade is placed a few pips below or above the key technical level of support or resistance. To increase the risk to reward ratio, we can also place it just above or below the previous candle. This would require some experience of using the strategy over a long time. The ‘take-profit’ is set at the other end of support or resistance. We can have a larger ‘take-profit’ if we are trading with the trend of the market. The ‘take-profit 1’ ensures that we lock in some profits if the trade goes against us.

Strategy Roundup

This strategy is suitable for traders with little time to trade. Furthermore, it does not require complex market analysis. It does have some strict rules which might reduce the creation of the trade setups. The ‘entry’ time of the trade is fixed at every morning. Since Japan and Australia are the first countries in Asia where markets open, there will be ample liquidity in the market that will allow traders to execute ‘long’ and ‘short’ positions very easily. All the best!