The U.S. dollar retreated for a second straight session, with the ICE Dollar Index slipping 0.1% to 99.02 on Wednesday. The euro climbed 0.3% to $1.0961. The top five economic think-tanks in Germany lowered their 2020 German GDP forecast to 1.1% from 1.8% previously, citing shrinking manufacturing production. And they said the economy could fall into a technical recession in the third quarter this year.

Economic Events to Watch Today

Let’s took at these fundamentals

EUR/USD – Daily Analysis

The EUR/USD currency pair flashing red at the level of1.0955, also the pair got a rejection near the 1.0967 (38.2% Fib Retracement of 1.1110/1.0943).

The EUR/USD currency pair took a buying at lows below 1.09 on Monday after the negative United States Manufacturing data propped the U.S. economic slowdown fears. As we know, the EUR/USD pair reached the recovery range above 1.0950 on Tuesday, ahead of unexpectedly lowest US ADP Employment data.

The United States’ ten-year treasury yield dropped by 3-basis-points and 4-basis-points on Tuesday and Wednesday, individually, and hit a bearish level of 1.578% in the Asian session. By the way, it’s one of the lowest levels since September 09.

However, the currency pair failed to hit the level of 1.0967, due to the decision by the United States President Donald Trump that to impose tariffs on $7.5 billion in European imports starting October 18.

At the data front, the U.S. non-manufacturing data scheduled to release at 14:00 GMT is anticipated to compensate for worse than expected manufacturing PMI activity during September. The PMI is expected to issue figures at 55.1 against 56.4 during August.

Massive slip in the U.S. economic data will prop the United States slowdown concerns, eventually supporting the EUR/USD pair to hit higher to 1.10. Moreover, the chances of a 25-basis-points rate cut by the Federal Reserve during this month have already increased from 40% to 84% this week. Whereas, if the data beats the expectations, then the EUR/USD pair could decline back below the 1.09 level.

Daily Support and Resistance

S3 1.0823

S2 1.0883

S1 1.0921

Pivot Point 1.0943

R1 1.0981

R2 1.1002

R3 1.1062

EUR/USD – Trading Tips

A day before Non-farm payrolls, the EUR/USD is trading a bit muted, as traders are staying out of the market due to a National holiday in China and Germany. Despite that, the EUR/USD may trade bearish below 1.0964 to target 1.0915 area. On the other side, the bullish breakout of 1.0960 can lead EUR/USD 1.1020.

USD/JPY – Daily Analysis

The USD/JPY currency pair consolidates in the narrow range of 107 handle, due to the greenback falls out of favor with investors. Moreover, the USD/JPY currency pair struggles to hit the high-level of107 handles while the Asian equities and Treasury yields trade lowest.

As we know, the greenback continues to drop since the start of the week. The dollar has the weakest start of a 4th-quarter since 2008 after following a slump in the 3rd-quarter range.

The United States stocks continued their decline due to more dismal data. The downward risk sentiment is increasing, and the global economy is slowing down, which was again evident in the U.S. data that pushed the U.S. benchmarks lower. The Dow Jones Industrial Average, DJIA, dropped around 344 points, or 1.3% during the previous session.

Moreover, the S&P 500 index fell by 52.64 points, and the Nasdaq dropped by 123.44 points. The ADP data showed just 135,000 new jobs against forecasted figures of 140,000. With this, the traders are pricing in weaker Nonfarm Payrolls which is due on Friday.

The greenback and Treasury yields need support at this position. The United States’ two-year treasury yields dropped from 1.55% to 1.48%, and the ten-year dropped from 1.66% to 1.59%.

Daily Support and Resistance

S3 105.7

S2 106.53

S1 106.86

Pivot Point 107.37

R1 107.69

R2 108.2

R3 109.04

USD/JPY – Trading Tips

The USD/JPY has formed tweezers bottom on the 4-hour timeframe which is suggesting odds of a bullish reversal. The USD/JPY pair may find support at 106.90, and below this, it can go after 106.400. On the upper side, resistance stays at 107.450.

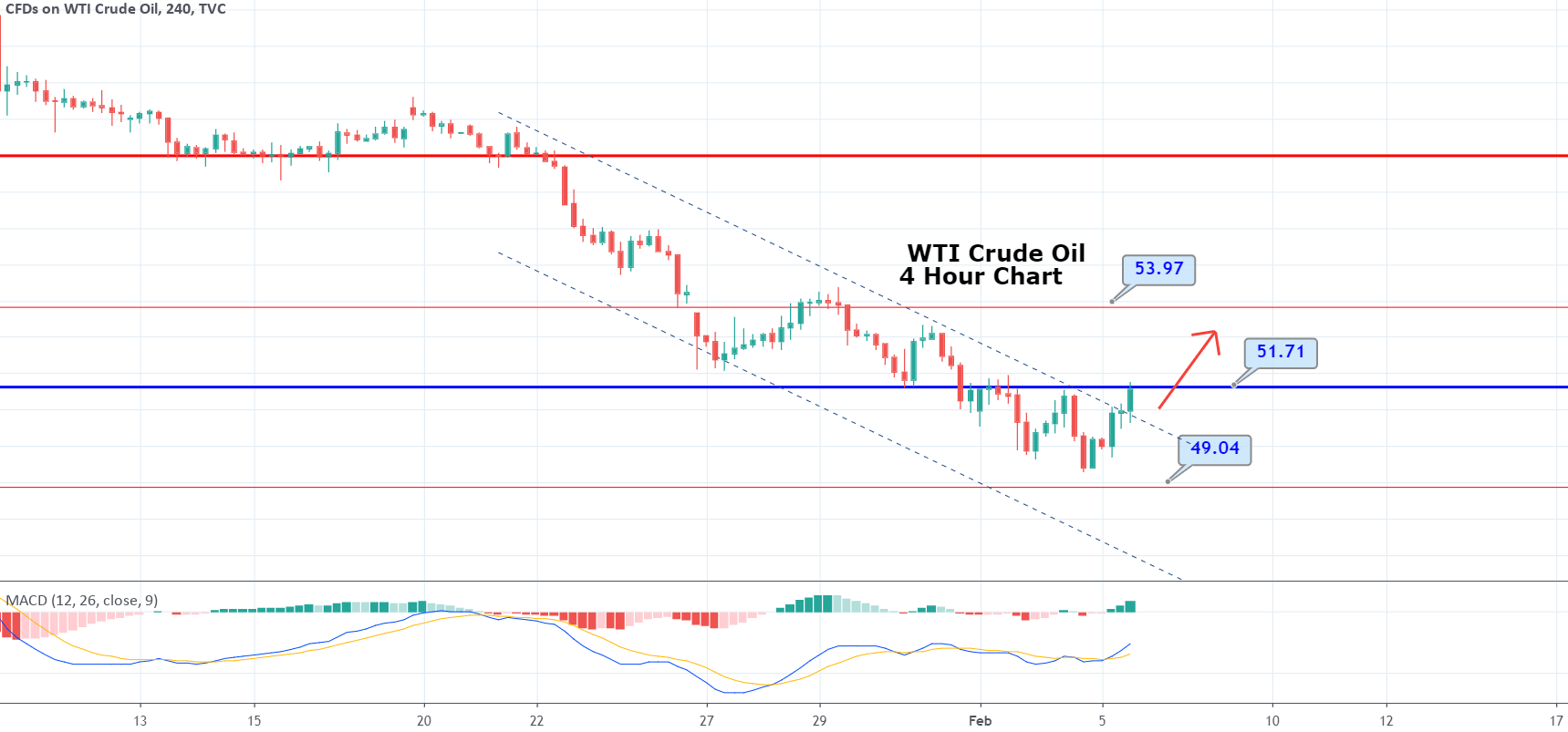

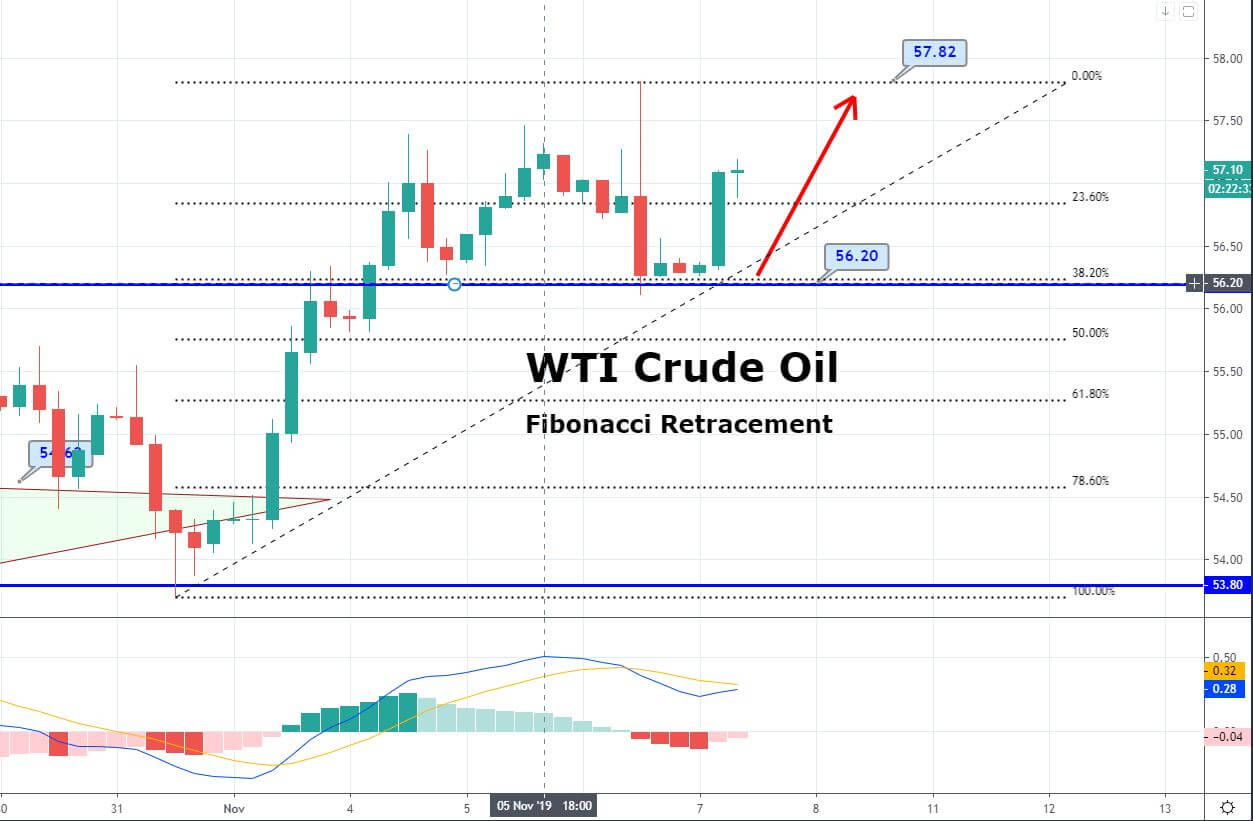

WTI Crude Oil – Daily Analysis

The WTI crude oil prices found on the recovery track, due to concerns of the worsening global economic outlook. The economic outlook hit crude oil prices very hard during the previous trading session as traders are pricing in the probability for development in solving the on-going trade war between the United States and China. The U.S. West Texas Intermediate (WTI) crude oil futures were up 23 cents, or 0.4%, to $52.87 a barrel, after sinking by 1.8% on Wednesday.

On the other hand, the global equity benchmarks found on the lowest level in a month on Wednesday. That came due to a sign of a recession in the United States economic growth. Secondly, the weaker economic data in Europe also distributed fears the global economy could fall into the slowdown.

There was a hurting sentiment in the previous trading session from the Energy Information Administration, which reported a surge of 3.1 million barrels in crude oil inventories in the last week.

It should also be noted that top oil exporter Saudi Arabia is planning to lift the cost for crude oil it sells to Asia during November. The sentiments came following the drone attack on Sauida Kingdoms, and its oil production has also started to spike in the Middle East.

Daily Support and Resistance

S3 48.53

S2 50.77

S1 51.65

Pivot Point 53

R1 53.89

R2 55.24

R3 57.48

WTI Crude Oil – Trading Tips

The WTI crude oil is finishing the Asian session in a bearish mode, falling from 53 to 52.70. Crude oil is facing significant resistance at 53 levels today. The MACD and RSI are bearish as both of them are holding under their crossover levels of 0 and 50 respectively.

Consider staying bearish on crude oil below 53 to target 52.65 and 51.80 levels. All the best!