Weekly Update’s Hot Topics:

- JPY – BOJ KEEPS THE MONETARY POLICY UNCHANGED, AND INFLATION CLOSE TO TARGET.

- DOLLAR – DESPITE THE DEAL TO STOP THE SHUTDOWN THE GREENBACK HAS CONTINUED FALLING.

- EUR – EURO EXCEEDS 1.25 HELPED BY DECLARATIONS OF DRAGHI.

- AUD – EXPECTED VOLATILITY DUE TO INFLATION DATA RELEASE.

This week, the best performer was Crude Oil <USOil> with a rise of 4.48%. WTI has reached $66 (US)/Barrel, the highest level since December 2014. Despite the strikes deal between the Republican and Democrat US Senators to stop the Government shutdown, the Dollar <DOLLAR> cannot take a breath and continued falling 1.56% this week.

JPY – BOJ KEEPS THE MONETARY POLICY UNCHANGED, AND INFLATION CLOSE TO TARGET.

The Bank of Japan (BoJ) decided to keep the monetary policy and the economic stimulus unchanged. Kuroda (The Bank of Japan governor) has signalled that the BoJ might be nearing the start of policy normalisation: but not so fast. The BoJ’s members voted 8-1 to keep its interest rates and asset purchases at current levels. Also, Kuroda said inflation expectations had stopped falling. The BoJ’s perspective is that the economy will grow 1.4% in the fiscal year starting in April, with an inflation of 1.4% over the same period.

The inflation data (YoY), excluding the food component, released this week has reached 0.9%. Kuroda, speaking at the World Economic Forum in Davos has said that “there are some indicators that wages and some prices have started to rise”. Also added that “there are many factors that make reaching the 2% target difficult and time-consuming, but we are finally close”.

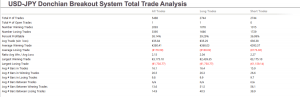

Technically, the USD-JPY is completing a sideways consolidation macro-structure. Our vision is, if we expect the price to fall to 108.16 to 107.18, the yen could find buyers again.

USD-JPY Daily Chart ( click on the image to enlarge)

DOLLAR – DESPITE THE DEAL TO STOP THE SHUTDOWN THE GREENBACK HAS CONTINUED FALLING.

This week the Republicans Senators have struck a deal with the Democrats to temporally stop the US Government shutdown which lasted for three days, the first shutdown since 2013. In this agreement, Democrats have accepted to vote for the bill while they will continue negotiating immigration legislation for “dreamers” (children that migrate illegally to the US). This agreement has as a deadline February 8.

The week has ended with the US GDP (QoQ) data release. The US economic growth is at 2.6%, that is lower than the expected 3% in the fourth quarter. Although the fourth-quarter GDP has been slowed, in 2017 the economic growth has gained momentum from the 0.9% reported in March 2017.

Technically, the US Dollar Index has broken down in the past week to the 88.9 level. Our vision for the next week is a limited downward turn to the 87.85 to 87.1 area, and then for it to make a potential reversal pattern to reach 91.03 level.

US Dollar Index Daily Chart ( click on the image to enlarge)

EUR – EURO EXCEEDS 1.25 HELPED BY DECLARATIONS OF DRAGHI.

This Thursday the common currency has raised to over 1.25, the highest level since December 2014. In the last Monetary Policy Decision ECB Conference, President Mario Draghi has maintained the accommodative policy and the interest rates will remain well beyond the end of the QE.

Regarding forex risk, Draghi signalled that “now, we have downside risks relating primarily to geopolitical and especially foreign exchange markets. But by and large, the risks to growth are balanced.”

On the technical side, once the Euro reached the weekly Fibonacci level F(38.2), it has started to make a corrective move leading the pair to the 1.24235 level. Our central vision is that the Euro could start a new bearish cycle, where our first target is 1.16845.

EUR-USD Daily Chart ( click on the image to enlarge)

AUD – EXPECTED VOLATILITY DUE TO INFLATION DATA RELEASE.

In the last week of the month in the Oceanic Session, the volatility expected will come from the Inflation (QoQ) data release. The analysts expect that the CPI (QoQ) will be 0.8% and (YoY) 2.0%. Under this context, the RBA (Reserve bank of Australia) could hike the Interest Rate in the next Monetary Policy Meeting scheduled on February 6.

As has been forecasted previously, our primary vision remains bullish for the Aussie, where the long-term target is 0.8433 level from where the price could find sellers to begin to develop a major degree connector.

AUD-USD Daily Chart ( click on the image to enlarge)